Insights from a pandemic: STD claims during COVID-19

The spread of COVID-19 has had a significant impact on short-term disability (STD) claims. We’re providing an update on what we’ve seen so far in terms of STD experience on our block.

Claim volumes

Initially, as COVID-19 started to spread, STD claims ramped up quickly as plan members tested positive for or developed symptoms associated with the virus and were unable to work. Overall, we saw a 34% increase in the volume of claims on our block in Q1, compared with the first quarter of 2019, primarily due to COVID-19-related claims.

Since then, we’ve seen the number of COVID-19-related STD claims slow. Claims levelled off to a 21% year-over-year increase by the end of May. We haven’t seen any meaningful increase in STD claims related to mental health.

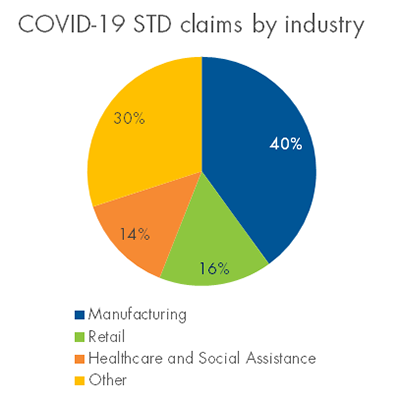

Most of the COVID-19-related STD claims so far have been in the manufacturing, retail and healthcare and social assistance sectors where physical distancing can be challenging.

Somewhat surprisingly, Alberta had for the largest share of STD claims on our block, accounting for 40% of claims, followed by BC with 28% and Ontario with 21%.

Claim durations

While STD claim volumes have increased, we’ve seen a notable decrease in claim durations so far this year. As of the end of May, 59% of closed claims resolved in the first two weeks, compared with only 20% the previous year. This is expected given the nature of COVID-19 and that, for most people, symptoms dissipate within about two weeks./p>

Of the STD claims we’ve approved, approximately 25% were paid for the full 14 days. In most cases, this meant the plan member had tested positive for COVID-19.The remaining 75% of paid claims were paid based on the elimination period in the contract, with the most common elimination period of 7 days accounting for 35% of paid claims.

We will continue to provide timely updates on any development/p>