Market Commentary October 2025

• Market sentiment improved significantly in Q3 as economic uncertainties eased.

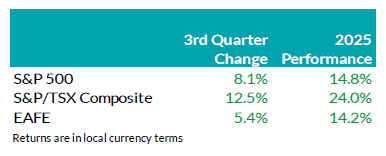

• Both U.S. and Canadian stock markets posted strong gains. The rally was supported by sector-specific earnings strength and structural growth drivers in AI and digital infrastructure. Equity valuations remain elevated, which could become a potential headwind for future performance.

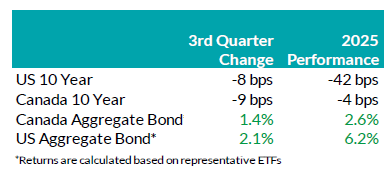

• Canadian bond markets delivered positive returns in Q3. Returns were largely from underlying interest income, supported by modestly lower interest rates and continued strong performance from tighter credit spreads.

• Both the Bank of Canada and the U.S. Federal Reserve restarted easing in Q3. Each central bank cut rates by 25 basis points in September, responding to rising risks to labour markets.

Economic and Market Update

Economic Summary: In the U.S., economic activity has remained relatively steady through 2025. However, while business investment remained robust, the pace of hiring slowed. Inflation has increased in recent months, but overall price pressures appear contained. Trade uncertainty eased in the third quarter as the U.S. reached agreements on tariffs with several key trading partners. Countries such as Japan, South Korea, and Indonesia, as well as the European Union, negotiated compromise deals. These deals typically involved U.S. tariffs in the range of 15% to 20% in exchange for market access or investment commitments. However, other nations faced higher tariffs of 30-50% following failed negotiations. Mexico and China are currently in a 90-day pause on tariff hikes, which will expire on October 29 and November 10, respectively. At its September meeting, the U.S. Federal Reserve (the “Fed”) lowered its policy rate by 25 basis points to a range of 4.00%– 4.25%. The Fed also signaled that additional interest rate cuts will likely be required to support the economy. Chair Jerome Powell highlighted increasing risks to the labour market and decreasing risks to inflation. He emphasized that the Fed remains data dependent and that interest rate decisions will be made “meeting-by-meeting”. The October 1 shutdown of the U.S. government added further uncertainty to the economic outlook. Key data releases are expected to be delayed, and the White House has warned of mass layoffs of federal workers.

The Canadian economy experienced a modest rebound in July following weak growth in the second quarter. However, U.S. tariffs and ongoing trade policy uncertainty continue to present risks to the economy. The labour market continues to weaken while inflationary pressures have eased in recent months. On July 31, the U.S. increased tariffs on Canadian imports from 25% to 35% for those products not exempted under USMCA. In addition, the U.S. has expanded its list of sector-specific tariffs. This is expected to place further strain on Canadian exporters. In response to these developments, the Bank of Canada cut its policy rate by 25 basis points to 2.50% during its September meeting. Governor Tiff Macklem indicated that the Bank is prepared to take further action if the balance of risks shifts to weaker growth.

Bond Markets: During Q3, the FTSE Canada Universe Bond Index returned 1.5%. Yields on Canadian bonds with maturities of 10 years or less declined. That reflected increased expectations for interest rate cuts by the Bank of Canada. Yields on bonds with maturities of greater than 10 years increased moderately, as investors continued to demand a higher risk premium for long-term debt.

Overall, corporate bonds saw a positive return for the quarter and outperformed government bonds. This outperformance was due to the higher interest rate on corporate bonds relative to government bonds, with an assist from modestly tighter credit spreads. Corporate issuance was robust during the quarter with strong investor demand, as investors were willing to look past U.S. tariffs and their potential impact to global growth. There were 99 corporate bond issuances during Q3 that combined to raise $45 billion for issuers, a new record. Indeed, the new issuance market is tracking ahead of last year, the previous high-water mark for issuance.

Notwithstanding the continued strong performance from corporate bonds, we have maintained a bias towards shorter corporate bonds where the risk and reward are better balanced. We remain ready to invest in longer corporate bonds as valuations become attractive.

Stock Markets: Equity markets posted strong gains in Q3. The S&P 500 returned 8.1% for the quarter, led by Information Technology and Communication Services. Investors focused on the expansion of AI infrastructure and a more favourable regulatory environment for blockchain technology. These themes supported risk appetite despite valuations remaining high relative to historical averages. The Canadian market returned 12.5% in Q3, outperforming the U.S. by more than 4%. This was driven mainly by strong returns in the Materials sector. Meanwhile, the Europe, Australasia, and Far East Index (EAFE) returned 5.4%, as international investors re-evaluated the “Sell America” trade trend.

U.S. Equities: In Q3, U.S. equities rose on strong momentum in AI infrastructure investment and growing interest in blockchain innovation. Mega-cap tech stocks led the rally. Major announcements such as NVIDIA’s $100 billion investment in OpenAI and Oracle’s $300 billion multi-year cloud deal highlighted the rapid growth of hyperscale data centers and the deepening commitment to AI development. A more supportive regulatory environment for blockchain technology also boosted investor interest in digital assets. This was reflected in robust IPO activity from crypto-focused companies such as Figure Technology and Gemini. Both stocks saw sharp gains following their public market debuts. That said, the S&P 500 continues to trade at nearly 23 times its forward earnings, roughly 20% above its 10-year average.

Canadian Equities: Canadian equities rose on better-than-expected economic data and sector-driven earnings, outperforming the U.S. by more than 4% in Q3. The Materials sector drove the rally, contributing nearly half of the gain for the TSX in Q3, as the price of gold surged past US$3850/oz (+45% YTD). The Technology sector also posted solid results, highlighted by Shopify’s continued strong performance. Shopify’s AI-driven product expansion and scalable digital commerce growth pushed the stock to trade around 85 times its forward earnings over the next twelve months. Positive sentiment extended to the Financials sector, where better-than-expected provisions for credit losses helped support a revaluation of bank stocks.

Overall, Q3 marked a risk-on environment across North American equities, underpinned by sector-specific earnings strength and structural growth drivers. In the U.S., enthusiasm around AI and digital infrastructure continued to dominate. In Canada, the rally was driven by surging gold prices and better-than-expected bank earnings. These catalysts helped sustain broad-based market strength across both markets.

Bottom line: Overall market sentiment improved in the third quarter following the volatility earlier in the year caused by tariffs. Investors benefited from resilient performance in North American equities and positive performance in fixed income. In the U.S., the Federal Reserve resumed its rate-cutting cycle, while strong consumer demand and continued capex-spending acted as key drivers for the market strength. In Canada, gold prices continued to surge amid persistent safe-haven demand driven by geopolitical risks. Looking ahead, we will continue to closely monitor valuation levels and underlying economic data for signals of inflection as the cycle progresses.

Downloadable Copy

| Mark Warywoda, CFA VP, Public Investments |

Ian Whiteside, CFA, MBA AVP, Public Investments |

Johanna Shaw, CFA Director, Public Investments |

Jin Li Director, Equity Investments |

||

| Wanyi Chen, CFA, FRM Sr. Quantitative Analyst |

Andrew Vermeer, CFA Senior Analyst, Credit |

Elizabeth Ayodele Analyst, Credit |

Edward Ng Cheng Hin Analyst, Credit |

Kate (Huyen) Vinh Analyst, Equity |

Francie Chen Analyst, Rates |

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.