EAMG - Macro Tear Sheet – Recent Market Volatility Summary

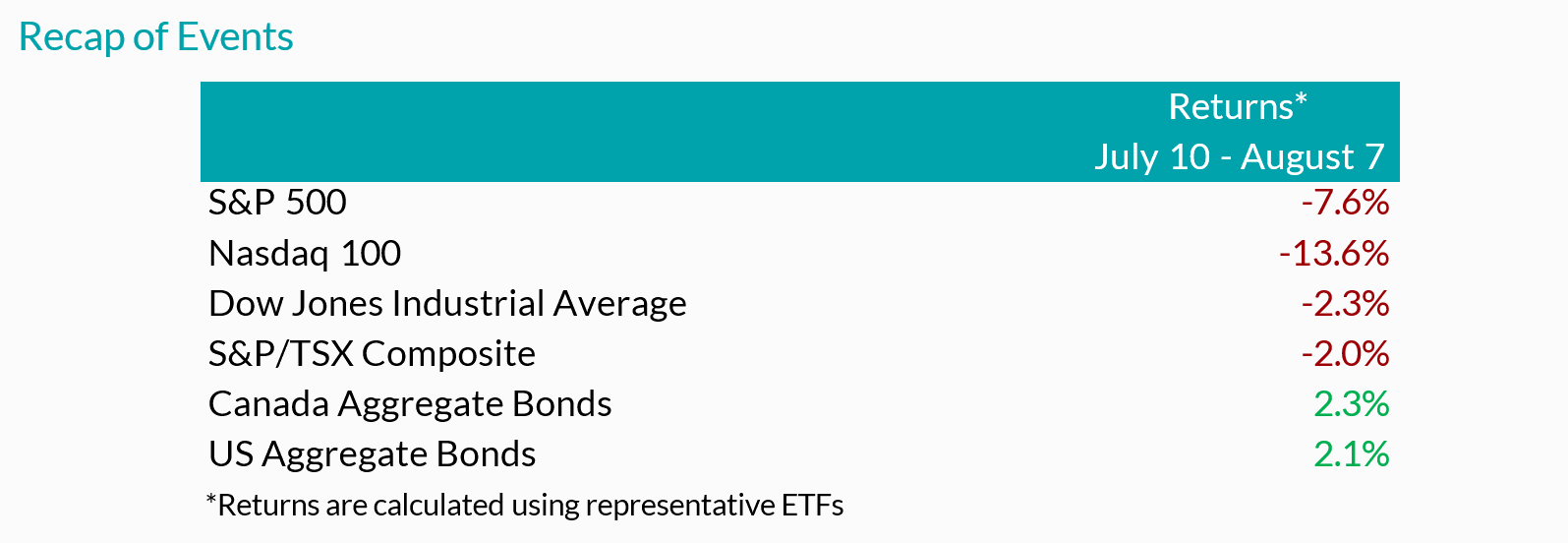

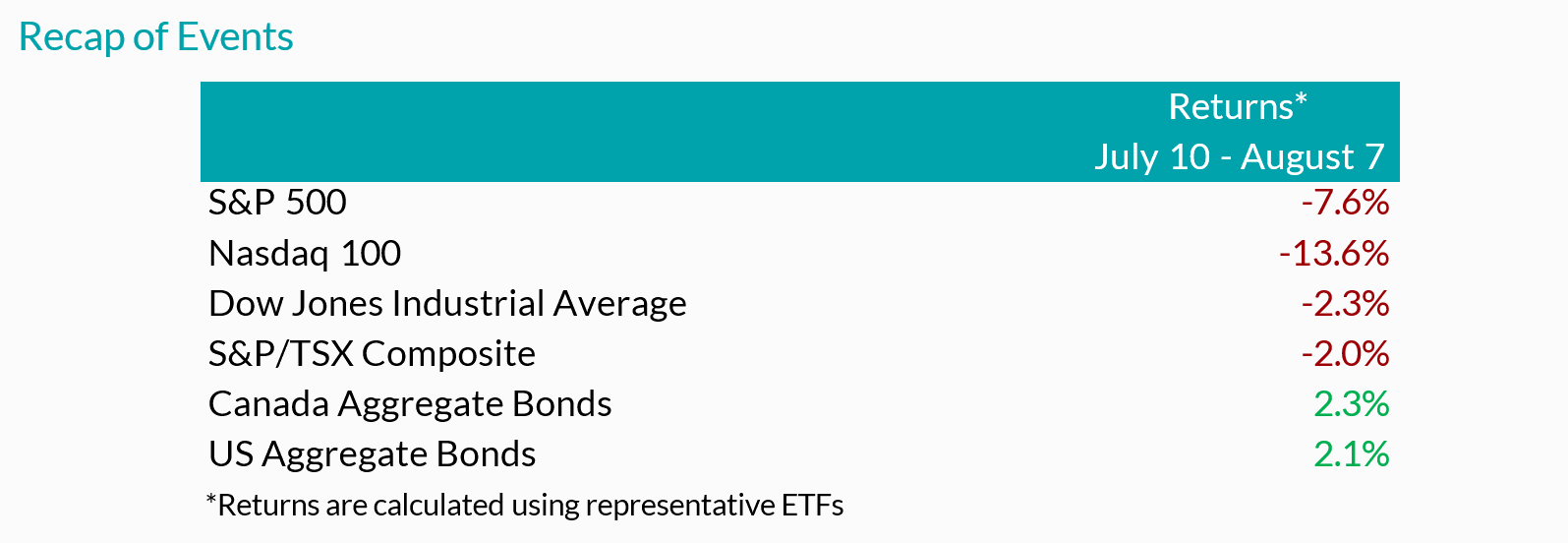

By separating the noise from the signals, we believe the rotation away from the mega-cap technology names is likely to continue. Recent market volatility, triggered by a multitude of factors that include the unwind of the carry trade, investor reactions to mixed mega-cap earnings, and U.S. economic data, may present more investment opportunities for long-term outperformance. Recall over the past year that the majority of U.S. stock market performance came from a limited number of mega-cap technology companies and, in our view, moving forward it will be prudent to analyze the source of returns as rapid market rotations may punish overly-concentrated portfolios.

Inflation Slows (July 11) – Headline U.S. inflation readings increased 3.0% year-over-year in June, decelerating from May (3.3%). With prices slowing ahead of forecasts but economic growth remaining strong, investors became more confident regarding the prospects of an economic soft landing.

Outcome: market strength broadened with traders rotating out of highly concentrated areas of the market (“Fabulous 5”) and into more economically sensitive stocks that had been left behind.

• Big Tech Earnings (July 23 – Aug 1) – High profile mega-cap technology companies – including many members of the Magnificent 7 – reported earnings growth that generally surpassed expectations as margins remained healthy. That said, investors were more focused on spending towards AI-initiatives, rewarding businesses with greater success translating their AI investments into higher sales.

Outcome: this trend is evident through the divergence of returns from IBM and Alphabet (Google’s parent company) after releasing their quarterly earnings. The limited number of companies that contributed to the returns of the S&P 500 failed to impress investors, extending the rotation into other areas of the market.

• Caution is Brewing – Following a strong rally of economically sensitive pockets of the market, notably a breakout of returns from U.S. small cap companies, the low volatility factor, which tends to outperform during times of stress, moved in sync with the small caps’ strength.

Outcome: with a lack of fundamental justification supporting small cap performance, markets showed signs of caution.

• Central Bank Decisions (July 31)– The Federal Reserve held interest rates unchanged during its July meeting, in line with market expectations, reiterating committee members’ need for greater confidence that inflation would continue to subside. That said, policymakers signaled a reduction in policy rates could be a possibility in the coming meetings. In contrast, the Bank of Japan (BoJ) increased its key interest rate while also announcing plans to scale back bond purchases – restrictive monetary policy maneuvers aimed at backstopping the depreciating Japanese currency.

Outcome: the bifurcation between the BoJ and most other major central banks sparked a sharp appreciation of the yen and a rapid unwind of the yen carry trade (see below for explanation).

• Growth Scare (August 2)– In early August, a downside surprise in U.S. nonfarm payrolls (114k actual versus 175k expected) and an increase in the unemployment rate to 4.3%, higher than the 4.1% that was expected and up from 3.5% a year ago triggered concerns of a cooling labor market.

Outcome: speculation swelled surrounding the pace of rate cuts with market participants expecting the Federal Reserve to cut rates as much as 125bps over the next 3 policy meetings, up from 50-75bps as of the end of July. Against this backdrop, the ongoing unwind of the yen carry trade accelerated.

Yen Carry Trade Explained

• Simply put, investors have been borrowing Japanese yen – a low yielding currency – to invest in higher-yielding foreign assets. The primary risks in a carry trade can include the uncertainty of foreign exchange rates (if unhedged), as well as changes to expectations of the underlying yields, among other risks. Over the last 2 decades, the BoJ has implemented an ultra-low interest rate monetary policy to combat deflation and stimulate growth. Furthermore, investors were emboldened by the Japanese yen’s ~53% depreciation versus the U.S. dollar over the last 10 years. With the BoJ hiking its key interest rate while also announcing plans to scale back bond purchases, the yen rallied abruptly. Consequently, highly leveraged investors have had to exit their long positions in riskier assets to repay their borrowed yen exposure.

Peak Carry Trade Unwind – Buying Opportunity

• Peak carry trade unwind, which implies heightened panic levels, has historically created an attractive buying environment. That said, we are focused on companies that have demonstrated robust earnings growth and healthy leverage. Given the unprecedented level of market concentration over the last year, we view the unwind of the carry trade as another catalyst for investors to rotate out of the “Fabulous 5”.

Our Findings:

We found that the peak unwind of the carry trade may be a buying opportunity. At present, the current level of the unwind is similar to many notable market bottoms, including the Great Financial Crisis (2008), the European debt crisis (2010), the oil crash (2014), the subsequent emerging market crisis (2015), the Covid-19 crash (2020), and the collapse of Silicon Valley Bank (2023). We assessed the degree of the unwind by looking at the one-month implied volatility between three currency pairs, U.S. Dollar/Yen, Australian Dollar/Yen, and Euro/Yen. Implied volatility is a measure of the expected future volatility of the underlying assets over a given time period. Amid strong earnings growth and steady margins from quality businesses within the U.S. market, the fundamental backdrop suggests that businesses outside the concentrated AI-darlings may drive the next leg of market returns.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

Inflation Slows (July 11) – Headline U.S. inflation readings increased 3.0% year-over-year in June, decelerating from May (3.3%). With prices slowing ahead of forecasts but economic growth remaining strong, investors became more confident regarding the prospects of an economic soft landing.

Outcome: market strength broadened with traders rotating out of highly concentrated areas of the market (“Fabulous 5”) and into more economically sensitive stocks that had been left behind.

• Big Tech Earnings (July 23 – Aug 1) – High profile mega-cap technology companies – including many members of the Magnificent 7 – reported earnings growth that generally surpassed expectations as margins remained healthy. That said, investors were more focused on spending towards AI-initiatives, rewarding businesses with greater success translating their AI investments into higher sales.

Outcome: this trend is evident through the divergence of returns from IBM and Alphabet (Google’s parent company) after releasing their quarterly earnings. The limited number of companies that contributed to the returns of the S&P 500 failed to impress investors, extending the rotation into other areas of the market.

• Caution is Brewing – Following a strong rally of economically sensitive pockets of the market, notably a breakout of returns from U.S. small cap companies, the low volatility factor, which tends to outperform during times of stress, moved in sync with the small caps’ strength.

Outcome: with a lack of fundamental justification supporting small cap performance, markets showed signs of caution.

• Central Bank Decisions (July 31)– The Federal Reserve held interest rates unchanged during its July meeting, in line with market expectations, reiterating committee members’ need for greater confidence that inflation would continue to subside. That said, policymakers signaled a reduction in policy rates could be a possibility in the coming meetings. In contrast, the Bank of Japan (BoJ) increased its key interest rate while also announcing plans to scale back bond purchases – restrictive monetary policy maneuvers aimed at backstopping the depreciating Japanese currency.

Outcome: the bifurcation between the BoJ and most other major central banks sparked a sharp appreciation of the yen and a rapid unwind of the yen carry trade (see below for explanation).

• Growth Scare (August 2)– In early August, a downside surprise in U.S. nonfarm payrolls (114k actual versus 175k expected) and an increase in the unemployment rate to 4.3%, higher than the 4.1% that was expected and up from 3.5% a year ago triggered concerns of a cooling labor market.

Outcome: speculation swelled surrounding the pace of rate cuts with market participants expecting the Federal Reserve to cut rates as much as 125bps over the next 3 policy meetings, up from 50-75bps as of the end of July. Against this backdrop, the ongoing unwind of the yen carry trade accelerated.

Yen Carry Trade Explained

• Simply put, investors have been borrowing Japanese yen – a low yielding currency – to invest in higher-yielding foreign assets. The primary risks in a carry trade can include the uncertainty of foreign exchange rates (if unhedged), as well as changes to expectations of the underlying yields, among other risks. Over the last 2 decades, the BoJ has implemented an ultra-low interest rate monetary policy to combat deflation and stimulate growth. Furthermore, investors were emboldened by the Japanese yen’s ~53% depreciation versus the U.S. dollar over the last 10 years. With the BoJ hiking its key interest rate while also announcing plans to scale back bond purchases, the yen rallied abruptly. Consequently, highly leveraged investors have had to exit their long positions in riskier assets to repay their borrowed yen exposure.

Peak Carry Trade Unwind – Buying Opportunity

• Peak carry trade unwind, which implies heightened panic levels, has historically created an attractive buying environment. That said, we are focused on companies that have demonstrated robust earnings growth and healthy leverage. Given the unprecedented level of market concentration over the last year, we view the unwind of the carry trade as another catalyst for investors to rotate out of the “Fabulous 5”.

Our Findings:

We found that the peak unwind of the carry trade may be a buying opportunity. At present, the current level of the unwind is similar to many notable market bottoms, including the Great Financial Crisis (2008), the European debt crisis (2010), the oil crash (2014), the subsequent emerging market crisis (2015), the Covid-19 crash (2020), and the collapse of Silicon Valley Bank (2023). We assessed the degree of the unwind by looking at the one-month implied volatility between three currency pairs, U.S. Dollar/Yen, Australian Dollar/Yen, and Euro/Yen. Implied volatility is a measure of the expected future volatility of the underlying assets over a given time period. Amid strong earnings growth and steady margins from quality businesses within the U.S. market, the fundamental backdrop suggests that businesses outside the concentrated AI-darlings may drive the next leg of market returns.

Downloadable Copy

| Mark Warywoda, CFA VP, Public Portfolio Management |

Ian Whiteside, CFA, MBA AVP, Public Portfolio Management |

Johanna Shaw, CFA Director, Portfolio Management |

Jin Li Director, Equity Portfolio Management |

| Tyler Farrow, CFA Senior Analyst, Equity |

Andrew Vermeer Senior Analyst, Credit |

Elizabeth Ayodele Analyst, Credit |

Francie Chen Analyst, Rates |

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.