EAMG Market Commentary April 2024

April 2024

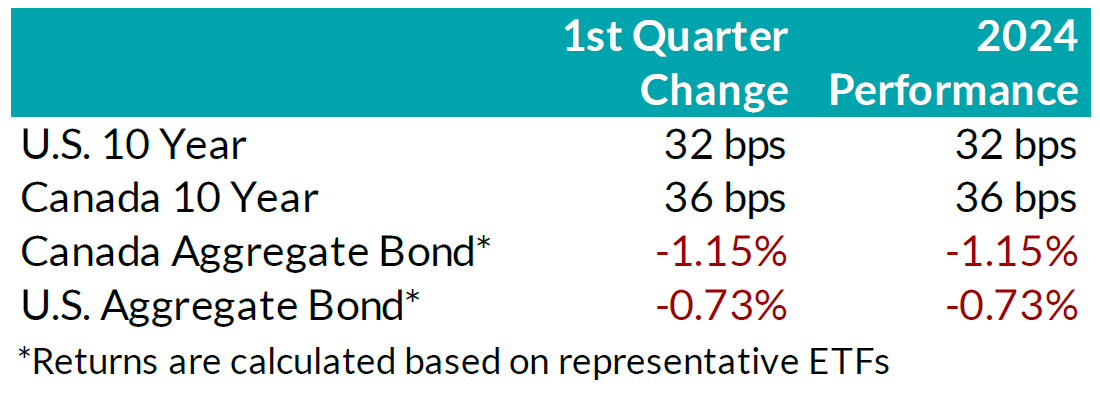

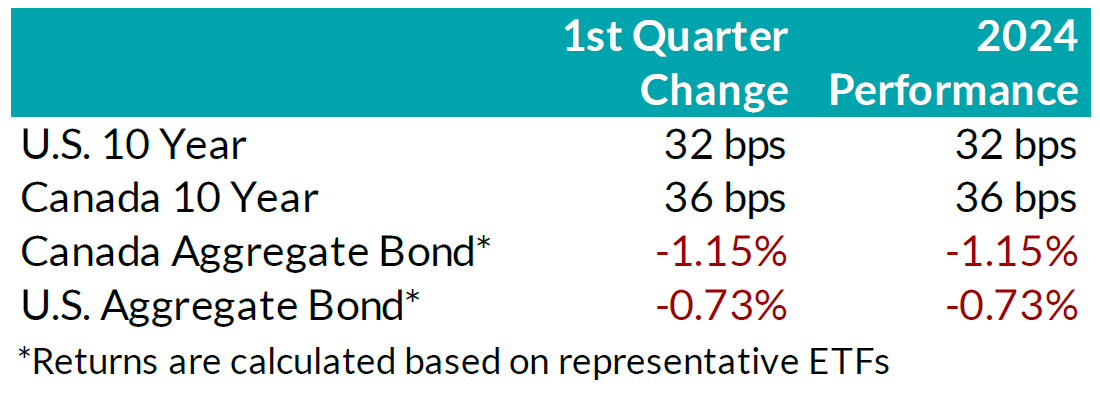

Rates & Credit – Interest rates increased in Q1 2024, giving back half of the decline experienced in Q4 2023 amid consistently positive surprises in U.S. economic data. The positive economic news also drove a strong risk-on tone to the market, with the risk premium on corporate bonds tightening as economic prospects improved. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index (FTSE) with a slightly positive 0.07% return, verses a loss of 1.66% in government bonds and a loss of 1.22% for the overall index. More interest rate sensitive long-term bonds experienced the largest decline, which was partially offset in corporate bonds by the risk-on tone to corporate bond spreads. On a 6-month and 1-year basis, the FTSE remained positive at 6.94% and 2.10%, respectively. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less exposure (notably financials and securitization).

.png?width=850&height=303)

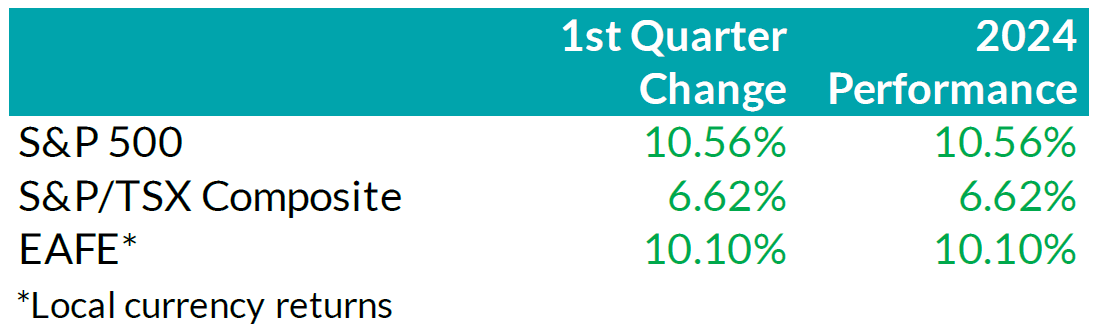

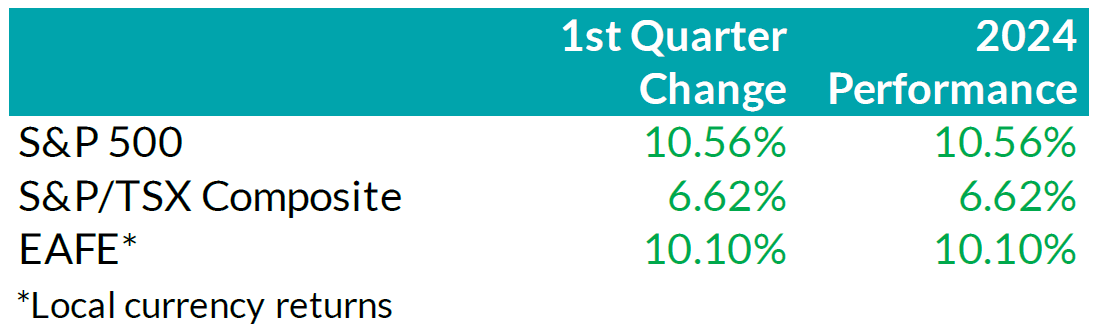

Equity Overview – Throughout Q1 2024, concerns about a recession gradually eased as central bankers adopted a more accommodative outlook on monetary policy. Their growing dovishness reflected confidence that the restrictive monetary measures were effectively curbing inflation as anticipated. Underpinned by prospects of an economic soft-landing, global equity markets rallied to start the year with most major North American indices soaring to new all-time highs during the quarter. U.S. equities continued to outperform other major international markets with the S&P 500 returning 10.6% in USD terms. Major developed economies from Europe, Australasia, and the Far East (EAFE) gained 10.1% in local currency terms, while the TSX added 6.6%. Furthermore, the U.S. economy continued to prove more resilient than most major developed economies, with strong employment and robust output data. As such, foreign investors of U.S. denominated securities achieved enhanced returns, benefitting from a stronger Greenback.

.png?width=850&height=260)

U.S. Fundamentals – Corporate earnings beat expectations in Q4 2023, triggering a wave of upward earnings revision. Stable operating margins, cash flows and debt loads continue to attract investors into equities. Investors appear focused on the company’s ability to sustain debt levels ahead of renewing debt obligations. We observed that the number of major companies that expect improving financial performance shrunk to ~19%. This suggests that concentration risks are likely brewing in the equity market, yet again.

U.S. Quant Factors

Optimistic run-up in equity valuations were mostly driven by the momentum factor. A basket of companies with positive price trends intensified concentration risk in the equity market. We note that momentum factor’ performance sharply contrasted fundamental factors, making us cautious on the market’s complacency. For context, high quality companies, which is typically defined by high Return on Equity (ROE), stable earnings variability, and low financial leverage, placed second in our risk-adjusted performance rankings, and is dwarfed by the ~ 17.9% return observed from the momentum factor.

Canadian Fundamentals – Against the backdrop of underwhelming financial results, ROE – a gauge of how efficiently a corporation generates profits – rebounded in Q4, 2023, after declining throughout most of the year. The improved efficiency metric provided a positive catalyst for dividend investors as the inverse movements of ROE relative to financing costs over 2023 kept investors on the sidelines. In addition, the CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges, providing a tailwind for Canada’s energy and materials sector. Concerns with earnings contraction and macro-economic conditions have subsided.

Canadian Quant Factors – Crude prices soared higher in Q1 2024, with ongoing production cuts from OPEC+ and ramifications of geopolitical conflicts keeping oil markets undersupplied. As such, energy companies benefitted, surging higher and outperforming the broader index, while the low volatility basket – with lower exposure to cyclically sensitive business – underperformed into quarter end. Furthermore, Canadian banks underperformed to start the quarter, giving back some of the sharp outperformance witnessed into the end of Q4 2023. That said, soft inflation data increased expectations of impending rate cuts from the Bank of Canada and, as such, banks performed in line with the broader market throughout most of the quarter. Underpinned by expectations of a dovish switch in monetary policy, investors rewarded dividend payers with a history of increasing dividends, boosting confidence in their ability to support future dividend growth. It is important to note that investors should not let dividend growth’s outperformance overshadow high dividend paying companies’ underperformance; more specifically, investors remain attentive to the businesses’ ability to create value relative to financing costs.

Views From the Frontline

Rates – Interest rates in both Canada and the U.S. increased across all bond tenors in Q1 2024. U.S. inflation data surprised to the upside, remaining stubbornly higher than hoped, while labour market and consumer indicators underscored the economy's continued strength. In Canada, inflation data fell below forecasts, but early 2024 GDP readings exceeded expectations. The market now anticipates a 'soft landing' for the U.S. economy; however, the Canadian economy continues to slow. North American central banks have signaled that we are at the peak for policy rates. The market is currently pricing in approximately two-to-three, 25 basis point interest rate cuts by the U.S. Federal Reserve in the second half of 2024, much fewer than the six-to-seven 25 basis point interest rate cuts that the market had been anticipating even just three months ago. As the Swiss central bank led the way with the first rate cut among developed countries, central banks in major developed economies will closely monitor upcoming data and market developments to determine the timing and pace for rate cuts.

Credit – The risk premium for corporate bonds (versus government bonds) continued to tighten over the quarter, with a strong risk-on tone to the market as investors priced in renewed economic growth in 2024 as compared to previous expectations. Corporate bond supply was robust, with $38.2bn in new issuance, the second strongest first quarter on record. On the balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – We favour a combination of the Dow Jones and the S&P500 for our broad market exposure. The Dow, a price-weighted index, should have some value and low volatility tilt as it tracks mature large companies. As explained above, concentration risks are brewing in the equity market, and during Q1 this risk was exacerbated by investors rushing into a basket of companies with positive price trends, thereby pushing valuation metrics further into the expensive territory. In our view, it is well-suited to use a combination of the Dow Jones Industrial Average and the S&P 500 for broad U.S. market exposure given the heightened concentration risk. Looking forward, we expect companies to exhibit stable operating margins and therefore, we are shifting our focus toward the balance between upcoming corporate debt refinancing requirements and reinvestment in projects intended to drive future growth. In plain words, we are tactically adding to companies with stable cash flows and decreased debt loads outside of the mega-cap group. In Canada, we expect a modest earnings growth and remain attentive to how efficiently a corporation generates profits relative to their financing cost. We caution against the overly optimistic, commodity driven, “catch-up” trade vs. our southern neighbour. Therefore, we tweaked our investment strategy by rotating out of the low volatility factor and adding to higher yielding quality companies in Canada.

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

Rates & Credit – Interest rates increased in Q1 2024, giving back half of the decline experienced in Q4 2023 amid consistently positive surprises in U.S. economic data. The positive economic news also drove a strong risk-on tone to the market, with the risk premium on corporate bonds tightening as economic prospects improved. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index (FTSE) with a slightly positive 0.07% return, verses a loss of 1.66% in government bonds and a loss of 1.22% for the overall index. More interest rate sensitive long-term bonds experienced the largest decline, which was partially offset in corporate bonds by the risk-on tone to corporate bond spreads. On a 6-month and 1-year basis, the FTSE remained positive at 6.94% and 2.10%, respectively. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less exposure (notably financials and securitization).

.png?width=850&height=303)

Equity Overview – Throughout Q1 2024, concerns about a recession gradually eased as central bankers adopted a more accommodative outlook on monetary policy. Their growing dovishness reflected confidence that the restrictive monetary measures were effectively curbing inflation as anticipated. Underpinned by prospects of an economic soft-landing, global equity markets rallied to start the year with most major North American indices soaring to new all-time highs during the quarter. U.S. equities continued to outperform other major international markets with the S&P 500 returning 10.6% in USD terms. Major developed economies from Europe, Australasia, and the Far East (EAFE) gained 10.1% in local currency terms, while the TSX added 6.6%. Furthermore, the U.S. economy continued to prove more resilient than most major developed economies, with strong employment and robust output data. As such, foreign investors of U.S. denominated securities achieved enhanced returns, benefitting from a stronger Greenback.

.png?width=850&height=260)

U.S. Fundamentals – Corporate earnings beat expectations in Q4 2023, triggering a wave of upward earnings revision. Stable operating margins, cash flows and debt loads continue to attract investors into equities. Investors appear focused on the company’s ability to sustain debt levels ahead of renewing debt obligations. We observed that the number of major companies that expect improving financial performance shrunk to ~19%. This suggests that concentration risks are likely brewing in the equity market, yet again.

U.S. Quant Factors

Optimistic run-up in equity valuations were mostly driven by the momentum factor. A basket of companies with positive price trends intensified concentration risk in the equity market. We note that momentum factor’ performance sharply contrasted fundamental factors, making us cautious on the market’s complacency. For context, high quality companies, which is typically defined by high Return on Equity (ROE), stable earnings variability, and low financial leverage, placed second in our risk-adjusted performance rankings, and is dwarfed by the ~ 17.9% return observed from the momentum factor.

Canadian Fundamentals – Against the backdrop of underwhelming financial results, ROE – a gauge of how efficiently a corporation generates profits – rebounded in Q4, 2023, after declining throughout most of the year. The improved efficiency metric provided a positive catalyst for dividend investors as the inverse movements of ROE relative to financing costs over 2023 kept investors on the sidelines. In addition, the CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges, providing a tailwind for Canada’s energy and materials sector. Concerns with earnings contraction and macro-economic conditions have subsided.

Canadian Quant Factors – Crude prices soared higher in Q1 2024, with ongoing production cuts from OPEC+ and ramifications of geopolitical conflicts keeping oil markets undersupplied. As such, energy companies benefitted, surging higher and outperforming the broader index, while the low volatility basket – with lower exposure to cyclically sensitive business – underperformed into quarter end. Furthermore, Canadian banks underperformed to start the quarter, giving back some of the sharp outperformance witnessed into the end of Q4 2023. That said, soft inflation data increased expectations of impending rate cuts from the Bank of Canada and, as such, banks performed in line with the broader market throughout most of the quarter. Underpinned by expectations of a dovish switch in monetary policy, investors rewarded dividend payers with a history of increasing dividends, boosting confidence in their ability to support future dividend growth. It is important to note that investors should not let dividend growth’s outperformance overshadow high dividend paying companies’ underperformance; more specifically, investors remain attentive to the businesses’ ability to create value relative to financing costs.

Views From the Frontline

Rates – Interest rates in both Canada and the U.S. increased across all bond tenors in Q1 2024. U.S. inflation data surprised to the upside, remaining stubbornly higher than hoped, while labour market and consumer indicators underscored the economy's continued strength. In Canada, inflation data fell below forecasts, but early 2024 GDP readings exceeded expectations. The market now anticipates a 'soft landing' for the U.S. economy; however, the Canadian economy continues to slow. North American central banks have signaled that we are at the peak for policy rates. The market is currently pricing in approximately two-to-three, 25 basis point interest rate cuts by the U.S. Federal Reserve in the second half of 2024, much fewer than the six-to-seven 25 basis point interest rate cuts that the market had been anticipating even just three months ago. As the Swiss central bank led the way with the first rate cut among developed countries, central banks in major developed economies will closely monitor upcoming data and market developments to determine the timing and pace for rate cuts.

Credit – The risk premium for corporate bonds (versus government bonds) continued to tighten over the quarter, with a strong risk-on tone to the market as investors priced in renewed economic growth in 2024 as compared to previous expectations. Corporate bond supply was robust, with $38.2bn in new issuance, the second strongest first quarter on record. On the balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – We favour a combination of the Dow Jones and the S&P500 for our broad market exposure. The Dow, a price-weighted index, should have some value and low volatility tilt as it tracks mature large companies. As explained above, concentration risks are brewing in the equity market, and during Q1 this risk was exacerbated by investors rushing into a basket of companies with positive price trends, thereby pushing valuation metrics further into the expensive territory. In our view, it is well-suited to use a combination of the Dow Jones Industrial Average and the S&P 500 for broad U.S. market exposure given the heightened concentration risk. Looking forward, we expect companies to exhibit stable operating margins and therefore, we are shifting our focus toward the balance between upcoming corporate debt refinancing requirements and reinvestment in projects intended to drive future growth. In plain words, we are tactically adding to companies with stable cash flows and decreased debt loads outside of the mega-cap group. In Canada, we expect a modest earnings growth and remain attentive to how efficiently a corporation generates profits relative to their financing cost. We caution against the overly optimistic, commodity driven, “catch-up” trade vs. our southern neighbour. Therefore, we tweaked our investment strategy by rotating out of the low volatility factor and adding to higher yielding quality companies in Canada.

Downloadable Copy

| Mark Warywoda, CFA VP, Public Portfolio Management | Ian Whiteside, CFA, MBA AVP, Public Portfolio Management | Johanna Shaw, CFA Director, Portfolio Management | Jin Li Director, Equity Portfolio Management |

| Tyler Farrow, CFA Senior Analyst, Equity |

Andrew Vermeer Senior Analyst, Credit |

Elizabeth Ayodele Analyst, Credit |

Francie Chen Analyst, Rates |

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.