Market Commentary January 2025

Key Takeaways

Full year 2024:

-

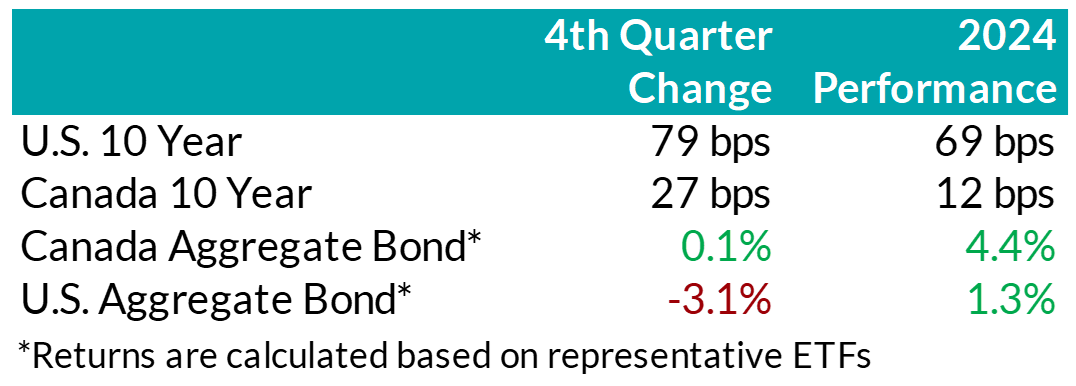

Despite reductions of policy-setting interest rates by central banks, yields on longer-term bonds finished the year higher than they started the year.

-

Positive risk appetite helped corporate bonds perform well, led by lower-quality issuers.

-

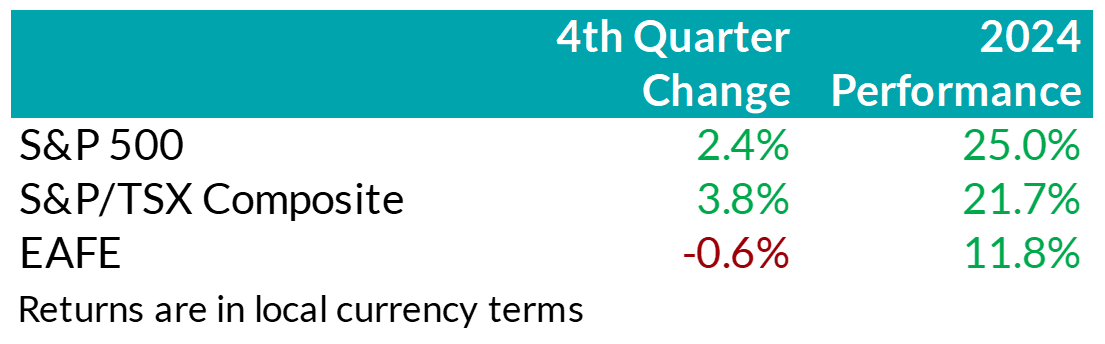

Global equity markets posted robust returns, with U.S. equities outperforming other developed markets, driven by heavy concentration into the ‘Magnificent 7’ stocks.

Fourth Quarter:

-

Central banks continued to ease monetary policy in Q4, with the Bank of Canada cutting its policy interest rate more aggressively than did the U.S. Federal Reserve.

-

The Republican victory across both the executive and legislative branches in the U.S. ignited expectations of economic growth, pushing bond yields and stock prices higher.

-

Risk sentiment helped corporate bonds continue to outperform government bonds.

-

Markets remained volatile: while North American stock markets continued to outperform most international indices, Canadian stocks managed to outperform U.S. stocks in Q4, as sources of returns in the U.S. narrowed into year-end.

Economic and Market Update

Economic Summary: In the U.S., economic activity continued to expand at a solid pace in Q4. The rate of inflation continued to slow but remained above the central bank’s 2% objective. The labour market in the U.S. remained resilient, as the unemployment rate has remained low compared to historical norms. A decisive victory for Donald Trump and the Republican Party further boosted expectations for continued growth. The return of the President-elect’s old tactics of threatening tariffs to influence trade, security, and drug control re-introduced some economic uncertainty, particularly regarding the potential return of inflationary pressures. Those concerns prompted the Federal Reserve to slow the pace of its policy easing, as it lowered rates by just 0.25% at each of its two meetings in Q4, following the 0.50% cut in September. Throughout 2024, the Fed reduced rates by a total of 100 basis points, from 5.50% to 4.50%. Nonetheless, bond yields were significantly higher for most maturity terms during the fourth quarter as the market priced in not just a stronger economy than had been the expectation during Q3, implying less interest rate cuts by the Fed, but also growing concerns about the government deficit.

In Canada, growth remained positive during 2024 and improved a bit to close the year, but continued to fall short of the Bank of Canada’s expectations. Similarly, inflation came in lower than expected and below the Bank’s 2% target. The labour market continued to soften for much of the year, with employment growth falling short of labour force growth. The weakness in the labour market and economy, along with tamed inflation, prompted the Central Bank to cut rates at the pace of 50 basis points at each of its two meetings in Q4. For the full year, the Bank of Canada ended up lowering its policy rate by a total of 175 basis points, from 5% to 3.25%. The market has been expecting the Bank of Canada to need to continue cutting rates due to slower economic growth in Canada, but the fear of a possible trade war with the U.S. has made the economic outlook somewhat murkier.

.png)

Bond Markets: During the quarter, yields on mid- to long-term bonds in Canada rose in sympathy with rising bond yields in the U.S. However, bond yields in Canada rose to a lesser extent, and yields on shorter-term bonds were actually little changed over the quarter. The FTSE Canada Universe Bond Index was basically flat during Q4 and posted a return of 4.2% for the full year. Although interest rates rose, credit spreads (i.e. the extra yield on corporate bonds versus government bonds to compensate for their extra risk) continued to grind lower, helping corporate bonds post positive overall returns in the quarter. Tightening credit spreads reflected the generally positive risk-on tone to the market, despite some volatility. Lower-rated BBB bonds generally performed better than higher-quality A-rated bonds. Credit spreads have now generally fallen back to levels similar to those experienced in 2021, when markets did quite well after the pandemic. The on-going appetite of investors for the extra yield offered by corporate bonds over government bonds is indicated not just by falling credit spreads, but also by investors’ enthusiasm to support the primary issuance market. Corporate bond supply continued to be very robust in the quarter, with $30 billion in new issuance, resulting in a record-breaking year with $141 billion of new issuance in 2024. Nonetheless, on balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward trade-off as being more favourable.

.png) Stock Markets – Overview: Trump’s presidential victory and the Republican party’s ‘red sweep’ in the Senate and House of Representatives sparked optimism surrounding economic growth and a new era of U.S. exceptionalism. As a result, North American equity markets extended their rally in Q4, capping off a year of robust returns. The S&P 500 returned 2.4%, bringing its year-to-date return to 25%. Within the U.S., the broadening of returns paused during the quarter as the chase for growth intensified, with mega-cap growth names like Tesla driving performance. Canadian equities surprisingly outperformed the U.S. market over the quarter, returning 3.8% in Q4, despite threats of widespread tariff negotiations looming on the horizon that could negatively impact Canadian corporate fundamentals. At a sector level, strength in the technology, financials, and energy sectors more than offset weakness in telecommunication companies as well as in the materials sector. Elsewhere, major developed markets from Europe and Asia (EAFE) underperformed last quarter as deteriorating Chinese growth prospects and weak economic growth in the Eurozone weighed on equities. Notably, foreign investors of U.S. denominated securities benefitted from a rebounding U.S. dollar with the dollar index adding over 7.6% in Q4.

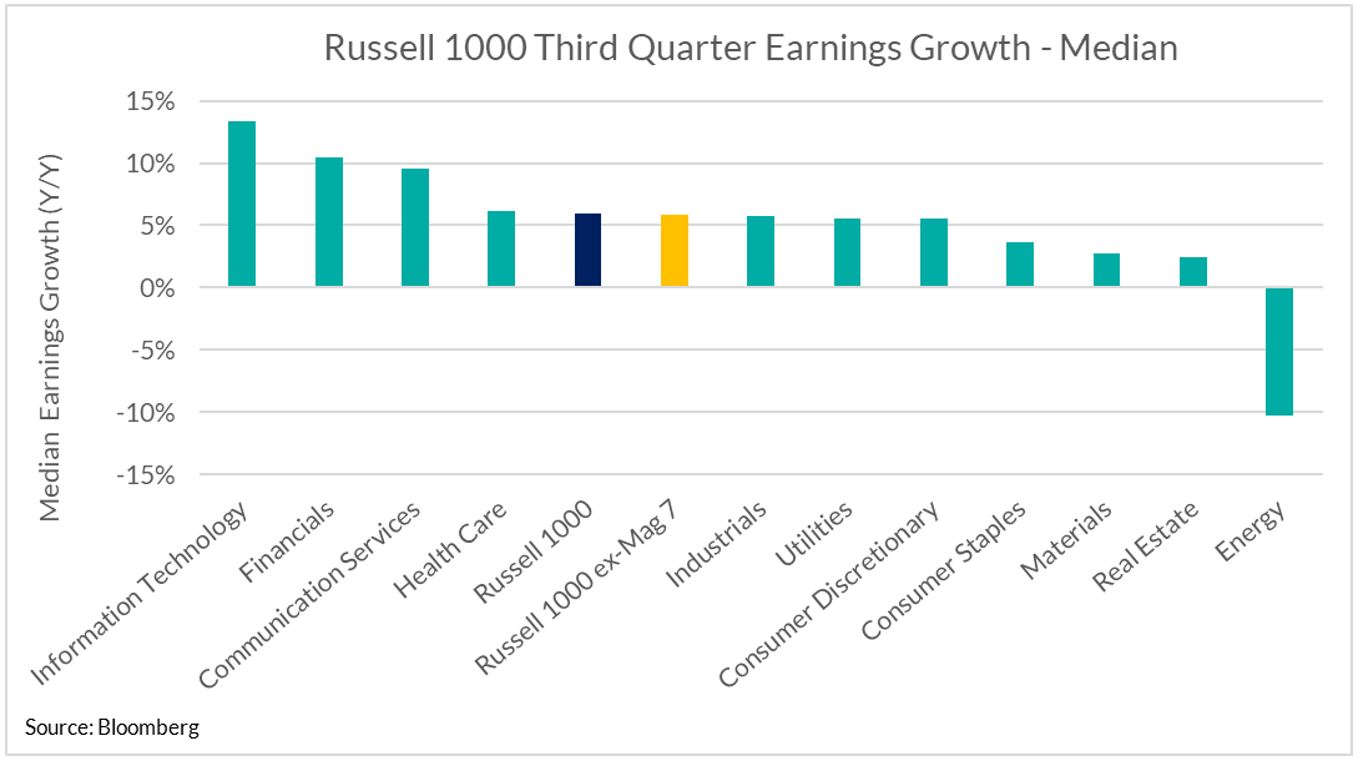

Stock Markets – Overview: Trump’s presidential victory and the Republican party’s ‘red sweep’ in the Senate and House of Representatives sparked optimism surrounding economic growth and a new era of U.S. exceptionalism. As a result, North American equity markets extended their rally in Q4, capping off a year of robust returns. The S&P 500 returned 2.4%, bringing its year-to-date return to 25%. Within the U.S., the broadening of returns paused during the quarter as the chase for growth intensified, with mega-cap growth names like Tesla driving performance. Canadian equities surprisingly outperformed the U.S. market over the quarter, returning 3.8% in Q4, despite threats of widespread tariff negotiations looming on the horizon that could negatively impact Canadian corporate fundamentals. At a sector level, strength in the technology, financials, and energy sectors more than offset weakness in telecommunication companies as well as in the materials sector. Elsewhere, major developed markets from Europe and Asia (EAFE) underperformed last quarter as deteriorating Chinese growth prospects and weak economic growth in the Eurozone weighed on equities. Notably, foreign investors of U.S. denominated securities benefitted from a rebounding U.S. dollar with the dollar index adding over 7.6% in Q4. .png) U.S. Equities: U.S. equities remain supported by resilient margins and strong corporate earnings growth with over 70% of businesses surpassing bottom-line expectations last quarter. We remain attentive to the broadening of earnings performance and note that this trend has continued, albeit at a normalized pace versus prior quarters. More specifically, our work shows that members of the Russell 1000, excluding the Magnificent 7, posted median earnings growth of 6% last quarter, down from nearly 9% in Q3 but comparable to Q2 (6%). Looking forward to 2025, analysts continue to forecast U.S. exceptionalism, with forecasts of ~12% earnings growth.

U.S. Equities: U.S. equities remain supported by resilient margins and strong corporate earnings growth with over 70% of businesses surpassing bottom-line expectations last quarter. We remain attentive to the broadening of earnings performance and note that this trend has continued, albeit at a normalized pace versus prior quarters. More specifically, our work shows that members of the Russell 1000, excluding the Magnificent 7, posted median earnings growth of 6% last quarter, down from nearly 9% in Q3 but comparable to Q2 (6%). Looking forward to 2025, analysts continue to forecast U.S. exceptionalism, with forecasts of ~12% earnings growth.Following Trump’s presidential victory, stocks with greater sensitivity to the U.S. economy, such as small cap businesses, benefitted from expectations of domestically focused growth initiatives. However, stubborn inflation and expectations of fewer interest rate cuts by the Federal Reserve saw the trend of broadening sources of returns pause into the end of the year. Instead, market concentration reaccelerated with investors rushing back towards mega-cap growth stocks. In fact, Tesla – which is approximately 2% of the S&P 500 Index by market cap – contributed approximately one-third of the total index return in Q4, while the Mag 7 as a group contributed over 100% of total returns. In other words, U.S. large cap companies excluding the Magnificent 7 declined in aggregate last quarter.

Canadian Equities: Against the backdrop of cooling inflation and below-trend growth, the Bank of Canada continued to loosen monetary policy. As a result, Canadian companies

showed signs of improving efficiency with return on equity – a gauge of corporate profitability – improving versus prior quarters. Under these conditions, investors remained focused on higher quality, high-dividend paying companies – particularly within the financial sector. Relative to prior quarters, this group witnessed greater contribution out of non-bank financials (such as asset managers and insurance companies), as the premium investors were willing to pay for Canadian banks remained elevated. Across other sectors, the energy sector had a positive quarter as the price of oil stabilized, but falling prices for raw industrials pushed the materials sector lower.

Bottom line: U.S. political developments and subsequent growth expectations dominated market sentiment last quarter. As a result, investors dialed back rate cut expectations and bond yields moved higher. In equity markets, the potential for an era of higher-for-longer rates prompted a resumption of investors crowding into growth stocks. Going forward, we remain cautious of elevated valuations and continue to prioritize diversified sources of returns with a long-term outlook. Nonetheless, despite rich valuations, our base case remains that investors’ enthusiasm for equities will persist in the near-term and stocks should continue to outperform bonds.

Downloadable Copy

| Mark Warywoda, CFA VP, Public Portfolio Management |

Ian Whiteside, CFA, MBA AVP, Public Portfolio Management |

Johanna Shaw, CFA Director, Portfolio Management |

Jin Li Director, Equity Portfolio Management |

| Tyler Farrow, CFA Senior Analyst, Equity |

Andrew Vermeer Senior Analyst, Credit |

Elizabeth Ayodele Analyst, Credit |

Francie Chen Analyst, Rates |