Market Comments - October 2024

Key Takeaways for Q3

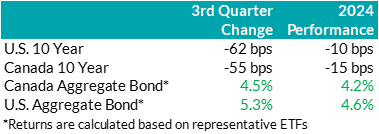

· Central banks eased monetary policy by reducing their target interest rates.· Bond markets performed very well during the quarter as interest rates fell.

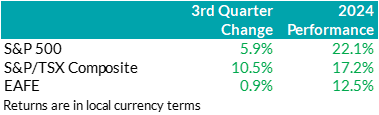

· Risk markets experienced some volatility, but stock markets had robust returns.

· Canadian stocks outperformed U.S. stocks in Q3, while the sources of returns in the U.S. market were more balanced and diversified than in the first half of the year.

Views From the Frontline

Bond Markets: During the third quarter, interest rates in both Canada and the U.S. moved significantly lower as markets anticipated that the Bank of Canada would continue – and the Federal Reserve would start – cutting rates. Additionally, the expectation became that the central banks would end up lowering rates more aggressively than previously assumed. That’s because inflation data has softened sufficiently to give the central banks the scope to ease policy, and other economic data, especially from the labour market, indicated the need for them to ease policy in order to prevent economic activity from cooling too much. For instance, in Canada, inflation slowed to the Bank of Canada’s 2% target, while the labour market showed warning signs with the unemployment rate rising to 6.6%. The Bank of Canada cut its target interest rate by 0.25% at each of its July and September meetings. Governor Macklem indicated that if growth does not materialize as expected, “it could be appropriate to move faster on interest rates”. In the U.S., the Federal Reserve kicked off its easing cycle by cutting its target rate by 0.50% in September. The growing signs of a cooling labour market amidst slowing inflation motivated the larger-than-typical move. That said, consumer spending in the U.S. continued to be strong, and GDP is still tracking a healthy growth rate.

While interest rates fell, bonds returns were also boosted by solid behaviour of corporate bonds. Credit spreads (i.e. the risk premium for corporate bonds versus government bonds) continued to grind lower over the quarter. Tightening credit spreads reflected the generally positive risk-on tone to the market, despite some volatility. Lower-rated BBB bonds performed better than higher-quality A-rated bonds. Credit spreads have now generally fallen back to levels that are largely consistent with the tight post-pandemic levels experienced in 2021. The on-going appetite of investors for the extra yield offered by corporate bonds over government bonds is indicated not just by falling credit spreads, but also by investors’ enthusiasm to support the primary issuance market. Corporate bond supply continues to be very robust, with $29B (billion) in new issuance during the quarter, resulting in an impressive $119B issued year-to-date, a new record. Nonetheless, on balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward trade-off as being more favourable.

Stock Markets: In the U.S., we continue to caution against heavily concentrated sources of market returns and emphasize a diversified portfolio. Last quarter, diversification proved essential as a multitude of factors heightened market volatility. These factors – which included the unwind of the yen carry trade, investor reactions to mixed mega-cap earnings, and concerns of a slowing labour market – drove investors away from mega-cap technology names and into defensive areas of the market. Following the Federal Reserve’s decision to reduce interest rates by 0.5%, sources of investment returns continued to broaden as investors rotated into economically-sensitive baskets. Underpinned by decelerating inflation and easing monetary policy, we believe the rotation away from the mega-cap tech names is likely to persist and we continue to emphasize portfolio diversification. In Canada, high-quality, high-yielding businesses – composed of the financial sector and non-financial dividend payers – outperformed over the quarter as investors rewarded companies that demonstrated a strong ability to sustain dividends, as well as greater efficiency generating profits. While we continue to favour these businesses, we have taken profit on our financial sector dividend exposure after a sharp reversion in the premium between value creation and current yield. In addition, Chinese officials introduced a wave of stimulus to revitalize growth, bringing life back to the metals and luxury goods sectors. Accordingly, Canadian and European equities have benefitted recently.

Market Update

Rates & Credit: In Q3, interest rates in both Canada and the U.S. decreased significantly, with front-end interest rates declining faster than long-end interest rates amid cooling inflation and a weakening labour market. As a result, the FTSE Canada Universe Index posted a positive return of 4.7%. Coincidentally, Canadian corporate bonds and government bonds each also generated returns of 4.7%, totally in-line with the Universe index. On the other hand, despite short-term interest rates falling much more than long-term interest rates, the higher price sensitivity of long-dated bonds had them outperform shorter-dated bonds, with the Long-Term bond index up 5.8% while the Short-Term bond index gained 3.4%. Similarly, within corporate bonds, industries that have longer-dated debt (e.g. energy and infrastructure) outperformed those that tend to have shorter-dated debt (e.g. real estate and financials).

Rates & Credit: In Q3, interest rates in both Canada and the U.S. decreased significantly, with front-end interest rates declining faster than long-end interest rates amid cooling inflation and a weakening labour market. As a result, the FTSE Canada Universe Index posted a positive return of 4.7%. Coincidentally, Canadian corporate bonds and government bonds each also generated returns of 4.7%, totally in-line with the Universe index. On the other hand, despite short-term interest rates falling much more than long-term interest rates, the higher price sensitivity of long-dated bonds had them outperform shorter-dated bonds, with the Long-Term bond index up 5.8% while the Short-Term bond index gained 3.4%. Similarly, within corporate bonds, industries that have longer-dated debt (e.g. energy and infrastructure) outperformed those that tend to have shorter-dated debt (e.g. real estate and financials). Equity Overview: Underpinned by decelerating inflation data and easing monetary policy – including the outsize 50-basis cut from the Federal Reserve – prospects for an economic soft landing increased over the quarter. That favourable outlook spurred global equity markets to all-time highs, with previously lagging areas of the market narrowing the performance gap compared to the U.S. mega-cap technology names that had led returns in the first half of the year. Canadian equities outperformed their U.S. counterpart last quarter, rising 10.5% as strength in the banking and materials sectors pushed the index higher. Major developed markets from Europe, Australasia, and the Far East (EAFE) were more subdued, gaining 0.9% (in local currency terms) last quarter. That said, grand expectations for further interest rate cuts in the U.S. pushed the greenback to its lowest level in over a year, boosting EAFE returns to over 7% in U.S. dollar terms. Within the U.S., sources of market returns broadened as well, with investors rotating out of concentrated AI companies and into more economically sensitive businesses.

Equity Overview: Underpinned by decelerating inflation data and easing monetary policy – including the outsize 50-basis cut from the Federal Reserve – prospects for an economic soft landing increased over the quarter. That favourable outlook spurred global equity markets to all-time highs, with previously lagging areas of the market narrowing the performance gap compared to the U.S. mega-cap technology names that had led returns in the first half of the year. Canadian equities outperformed their U.S. counterpart last quarter, rising 10.5% as strength in the banking and materials sectors pushed the index higher. Major developed markets from Europe, Australasia, and the Far East (EAFE) were more subdued, gaining 0.9% (in local currency terms) last quarter. That said, grand expectations for further interest rate cuts in the U.S. pushed the greenback to its lowest level in over a year, boosting EAFE returns to over 7% in U.S. dollar terms. Within the U.S., sources of market returns broadened as well, with investors rotating out of concentrated AI companies and into more economically sensitive businesses. U.S. Fundamentals: Outside of the Magnificent 7, investors are interpreting downside earnings surprises as a normalization of financial performance rather than a deterioration. For example, McDonald’s share price rallied over 17% into quarter-end following its earnings release despite announcing declining sales and contracting earnings per share. Within the AI-ecosystem, investors are beginning to look for opportunities beyond chip manufacturers, such as nuclear energy providers. At an index level, our work shows that members of the Russell 1000 index, excluding the Mag-7, posted a median earnings growth of nearly 9% year-over-year, expanding from the ~6% witnessed in Q2. Furthermore, the number of companies from this group reporting positive earnings growth grew to approximately 67%, up from 60% in the prior quarter. In our view, the ongoing broadening of earnings strength outside of the Mag-7 can provide tailwinds to current market rotations into previously left-behind companies. Within the mega-cap tech space, investors have become more discriminant than in prior quarters, rewarding businesses with greater success monetizing their AI-investments. This trend was evident through the divergence of returns from IBM and Alphabet (Google’s parent company) following their quarterly earnings.

U.S. Quant Factors: Decelerating U.S. inflation data prompted a rotation out of highly concentrated areas of the market (growth) and into more economically-sensitive companies (value). Then, concerns of a slowing U.S. labour market and the unwind of the yen carry trade increased market volatility, leading investors to shelter their positions by reallocating to low volatility. As the quarter progressed, expectations of easing monetary policy and stabilizing employment data helped calm return to the market and the rotation from mega-cap tech sector resumed, albeit at a lesser pace. Notably, this “catch-up” trade also benefitted dividend-paying companies, particularly those with a lengthy and established history of increasing dividends, as investors favoured those more mature operations.

Canadian Fundamentals: Investors returned to the Canadian market after Canadian companies showed signs of recovery last quarter with earnings expanding by more than expected. With inflation showing clearer signs of deceleration and the outlook regarding the path of monetary policy increasingly implying lower interest rates going forward, investors are allocating toward high-quality, dividend-paying companies. From a sector level, surging gold prices provided a tailwind for Canadian miners, helping the materials sector outperform over the quarter. More recently, the materials sector has benefitted from elevated base metal prices following the arrival of Chinese stimulus. In contrast, oil prices declined over 16% last quarter as fears of an oversupplied market swelled following speculation that OPEC+ would look to dial back production cuts. As a result, investors looked past lingering geopolitical risks and the energy sector underperformed.

Canadian Quant Factors: Amid an improving Canadian macroeconomic backdrop and clearer outlook on the trajectory of monetary policy, dividend-yielding businesses became sought after. More specifically, investors continued to emphasize dividend sustainability last quarter, rewarding dividend-paying businesses that demonstrated strong financial performance and the ability to support future payouts. For example, the major Canadian banks sharply outperformed in Q3 after reporting earnings growth that mostly exceeded expectations. In essence, investors have become more constructive on this high-yielding group as their ability to create value relative to financing costs improves.

Downloadable Copy

| Mark Warywoda, CFA VP, Public Portfolio Management |

Ian Whiteside, CFA, MBA AVP, Public Portfolio Management |

Johanna Shaw, CFA Director, Portfolio Management |

Jin Li Director, Equity Portfolio Management |

| Tyler Farrow, CFA Senior Analyst, Equity |

Andrew Vermeer Senior Analyst, Credit |

Elizabeth Ayodele Analyst, Credit |

Francie Chen Analyst, Rates |