Site Search

756 results for form to restart a pac on insurance

- [pdf] A closer look at life insurance

-

In case you missed it… read our life insurance as an asset class article

Equitable in partnership Wayne Miller, BMATH, ASA

The concept of viewing life insurance as an asset class only became mainstream in Canada 12 years ago, after Wayne Miller, BMATH, ASA, made the case for it in an industry magazine article.

Has anything changed in the past decade? Does a mutual company vs. a stock company make a difference? Equitable has been collaborating with Wayne to provide an answer – which is provided in this follow-up article to his original piece.

-

Let’s talk about Critical Illness insurance, the Equitable way.

Having critical illness insurance benefits in an important time of need is so valuable. Get the right critical illness insurance coverage for your clients.

In 2022, we made some significant updates to our EquiLiving® Critical Illness insurance plans to provide better choices and features for clients.

These significant updates included:

● The addition of Acquired Brain Injury as a covered condition

● The addition of 20 pay options allowing more choice when choosing the right plan for your clients

● The removal of the age restriction for juveniles to claim for Loss of Independent Existence

Plus, a Canadian first, the addition of Cloud DX. Cloud DX is a value-added service that provides remote patient monitoring to claimants in addition to the full critical illness benefit paid by Equitable Life®. Cloud DX delivers medical grade hardware directly to the client so that Cloud DX can remotely monitor their vitals to help ensure they are on and stay on the road to recovery.

View our new Critical Illness video on YouTube or Vimeo!

With these updates and more, EquiLiving Critical Illness Insurance is there for clients, not only at time of their claim but also during their recovery. To learn more about Critical Illness insurance, the Equitable way, contact your local wholesaler.

*Cloud DX is a non-contractual benefit and may be withdrawn or changed by Equitable Life® at any time. To be eligible for the Cloud DX offering, a claimant must be age 12 or older and have received payment on or after February 12, 2022 for a covered critical condition benefit under an individual critical illness insurance policy issued by Equitable Life. An early detection benefit payment does not qualify. Equitable Life pays for 6 months of Cloud DX subscription fees. If the claimant wishes to continue the Cloud DX service after 6 months, they will be responsible for the cost.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

- [pdf] Your guide to Coverage2go

-

Transaction Authorization Requirements table for Savings & Retirement advisors

Equitable Life® is here to help. When it comes to getting certain transactions authorized in a non face-to-face environment, you might need some direction. We’ve got you covered.

Equitable has created a quick reference table on EquiNet™. The Transaction Authorization Requirements table provides details on how to get certain forms approved and the best way to get them to us. Each form listed gives the authorization type that is accepted. We’ve also provided details when we receive a document that is considered not-in-good-order.

As we navigate through COVID-19, we will continue to update this table. This means you have the most current information available at your fingertips, 24/7.

Have other questions about COVID-19? Check out our Savings & Retirement COVID-19 update page on EquiNet as well. This page provides the latest news and information for Savings & Retirement advisors.

Still have a question? Give our Advisor Services team a call Monday to Friday 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or email savingsretirement@equitable.ca, or your local Regional Investment Sales Manager.

-

Getting a tax refund is exciting, but should it be?

Do clients know that when a tax refund is issued, it means they are giving the government an interest-free loan? If a client receives a tax refund, it may mean the client’s employer is withholding too much tax. Here’s how to change that.

The client can complete and submit Canada Revenue Agency (CRA) form T1213 (Request to Reduce Tax Deductions at Source).

The client will indicate which regular deductions and non-refundable tax credits to qualify for. These would include things like regular Registered Retirement Savings Plans contributions, childcare expenses, etc. When approved by the CRA, the client will see more money on every pay. A client might even want to make this request to reduce the tax withheld if a large bonus or vacation pay is anticipated.

Encourage clients to use the additional cash flow to increase monthly contributions, support a Retirement Savings Plan or Tax-Free Savings Account or repay an investment loan. Increasing savings each year – even by a small amount – can have a substantial impact on retirement savings. For additional questions, contact your Regional Investment Sales Manager. -

Exciting update: External transfer now available on EZtransact!

We are thrilled to announce a new feature that will make your work easier and more efficient.

What’s new this quarter?

The External Transfer function was introduced to Equitable’s EZtransact® on May 14.

Benefits of this enhancement:

This feature is part of our strategic plan to help make transactions smoother for you. It was already available in EZcomplete®, and now it’s on EZtransact too. This means you won’t have to search for information about the relinquishing institution anymore. You can submit requests with ease.

External Transfer Functionality:If you have any questions, reach out to your Director, Investment Sales.

• You can digitally request a transfer of funds from other institutions to Equitable.

• Information about the relinquishing institution will be available on EZtransact, so you don’t have to search for it.

• Both full and partial transfer requests are available.

• It’s available for registration types that don’t need the RC720/RC721 form and for individual accounts.

When we work together, success is mutual.

Date posted: July 3, 2025 - [pdf] Daily/Guaranteed Interest Account Application - FHSA

-

Enhancing the Transfer Process: Equitable's New Signature Guarantee Service

Equitable® is making transfers even easier with EZcomplete®.

This enhancement will help advisors and clients by reducing the number of rejections from other institutions that need a signature guarantee. Reducing transfer rejections means less time and effort for advisors, and faster transfers from other institutions.

Signature Guarantees

Equitable will now offer signature guarantees on most transfers requested through EZcomplete.

When is a signature guarantee not available?

• For entity owned accounts

• If a Power of Attorney is signing on behalf of an owner

• If the transferring account has an irrevocable beneficiary

Watch the quick Identity Check with Persona video or read through instructions below.

To offer a signature guarantee, Equitable first needs to check the identity of all owners using Persona, a third-party service provider.

The advisor starts by selecting a signature guarantee in EZcomplete. An email link is sent to all proposed owners.

Clients can click the link within the email to Persona's verification process.

They will be prompted to take a picture of their photo ID and a selfie, turning their head slightly left and right by following the prompts.

Their identity can then be confirmed in seconds.

Sending Transfer Forms:

• If all owners' identities are verified, Equitable will send the transfer form with a signature guarantee stamp and the e-signature audit log to the transferring institution.

• If ID verification fails, clients will be prompted to try up to three times. If still unsuccessful, the transfer form and e-signature audit log is sent to the transferring institution without the signature guarantee stamp.

Handling Issues:

• Advisors’ obligations to verify ID is not affected by this process; ID verification is still required.

• If the client times out or loses the email to access Persona, the advisor can resend the link.

• If the client’s name or email changes after ID verification, the advisor will need to redo the ID verification with the updated information to get a signature guarantee.

This update strives to make processes smoother and more efficient for everyone. Just another reason to do business with Equitable. When we work together, success is mutual.

For more information or assistance, please contact your Director, Investment Sales.

Date published: May 7, 2025 -

All about the changes to the capital gains inclusion rate

Disclaimer: The following content is provided by and is the opinion of Invesco Canada Ltd. Equitable does not guarantee the adequacy, accuracy, timeliness, or completeness of the information. Equitable shall not be liable for any errors or omissions in the information provided by Invesco.

What has changed?

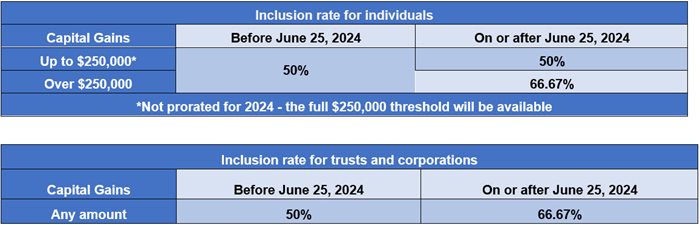

One noteworthy measure to come from Budget 2024 is the proposed change to the capital gains inclusion rate, which was previously held steady at 50% since 2001.

For individuals, capital gains more than $250,000 annually will be subject to an increased 66.67% inclusion rate as of June 25, 2024, while the capital gains up to $250,000 will continue to be subject to the existing 50% inclusion rate. As a transitional measure for 2024, only the capital gains realized by individuals on or after the effective date of June 25 that are above the $250,000 threshold will be subject to the increased inclusion rate.

For trusts and corporations, the inclusion rate on all capital gains will increase from 50% to 66.67% starting on June 25, 2024.

Who is affected?

Impact to individuals

Budget 2024 proposed to add transitional rules which would specifically identify capital gains and losses realized before the effective date (Period 1) and those realized on or after the effective date (Period 2). The effective date is June 25, 2024. Capital gains realized on or after that date will have an inclusion rate of 50% on the amount up to $250,000, and an inclusion rate of 66.67% on the amount above $250,000. All capital gains realized prior to the effective date will have an inclusion rate of 50%.

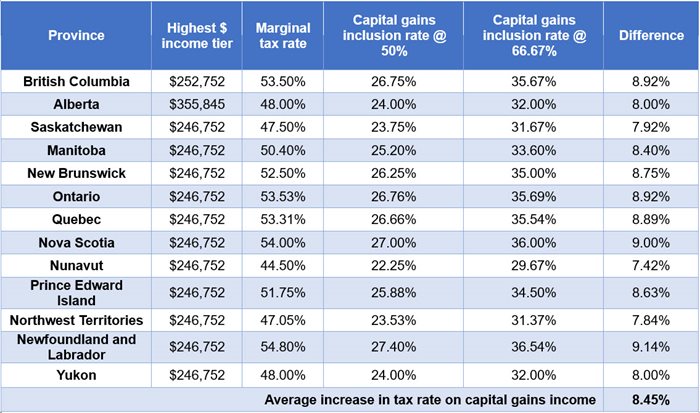

Take Ontario as an example, the proposed higher inclusion rate on capital gains would effectively increase the average federal-provincial marginal tax rate for Ontario residents on capital gains above $250,000 at the top marginal tax rate from 26.76% to 35.69%. A more detailed analysis on the impact of these changes to an individual’s tax rate is discussed below.

For net capital gains realized in Period 2, the annual $250,000 threshold would be fully available in 2024 (i.e., it would not be prorated) and it would apply only in respect of net capital gains realized in Period 2.

The $250,000 threshold would effectively apply to capital gains realized by an individual, either directly or indirectly via a partnership or trust, net of any: current-year capital losses, capital losses of other years applied to reduce current-year capital gains, and capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed employee Ownership Trust Exemption or the proposed Canadian Entrepreneurs’ Incentive claimed.

Two common scenarios of reaching the $250,000 capital gain threshold are the deemed disposition of capital property at death, and the emigration from Canada (i.e., becoming a non-resident for income tax purposes). We have provided additional details on these topics below.

Deemed disposition upon death

When an individual passes away, they are deemed to have sold their capital property (e.g., units or shares of mutual funds, shares of corporations, and real property) at its fair market value (FMV) immediately before their death. If a capital gain arises because of this deemed disposition, that capital gain is reportable on the deceased’s final (terminal) tax return and the taxes owing as a result, if any, would be payable by the estate of the deceased. However, there are provisions that allow taxes to be deferred when the property is transferred to a spouse. For example, if a capital property is transferred to a surviving spouse or common-law partner, subsection 70(6) of the Income Tax Act (Canada) automatically deems the deceased to have disposed of that property and the spouse or common-law partner immediately acquires the same property at the deceased transferor’s adjusted cost base (ACB). This is commonly referred to as the “spousal rollover”. Another potential strategy to manage potential large capital gains taxes at death is life insurance, since the death benefit is typically paid out tax-free.

Without careful planning, the estate value could be substantially reduced by the changes to the capital gains inclusion rate. Furthermore, it would be prudent to ensure there are liquid assets or cash available in the estate to cover the associated tax liabilities.

Non-resident of Canada – Departure tax

Residency in Canada for income tax purposes is a question of fact, which primarily depends on the individual’s residential and social ties in Canada. When an individual becomes a non-resident of Canada, they are deemed to have disposed of and immediately reacquired certain types of property at FMV. The tax incurred because of this deemed disposition and reacquisition is also known as the departure tax. Some examples of properties subject to departure tax include securities inside a non-registered investment portfolio, shares of Canadian private corporations, and real estate situated outside of Canada. Note that there are some properties that are exempted from the departure tax, including: pensions and similar rights (including registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), and tax-free savings accounts (TFSAs)) and Canadian real property.

The departure tax rules coupled with the increased capital gain inclusion rate above the $250,000 threshold may incur additional tax payable for emigrants. However, there is an option to defer the payment of departure tax on income associated with the deemed disposition upon emigration. By making an election, the individual would pay the tax later, without interest, when the property is disposed of. This election can be done by completing CRA Form T1244, “Election Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property," on or before April 30 of the year following their departure from Canada.

Impact to Entities

Corporations and trusts will also be impacted by the increased inclusion rate as of June 25, 2024. Unlike individuals, corporations and trusts will not have access to the old inclusion rate on the first $250,000 of capital gains: they will be subject to the new 66.67% inclusion rate from the very first dollar.

With the above in mind, there will be options available to shelter corporate and trust capital gains from the new inclusion rate.

For corporations:

The lifetime capital gains exemption (LCGE) can be used to eliminate capital gains taxes on the sale of qualified small business corporation shares (generally, these are shares of a Canadian-controlled private corporation that carries on an active business). The LCGE is also available on the sale of qualified farm or fishing property. The current lifetime limit for the LCGE is $1,016,836. Budget 2024 proposed to increase that limit to $1,250,000 starting on June 25, 2024, so certain business owners will be able to reduce or eliminate their exposure to the new inclusion rate if they are able to make use of the increased LCGE limit.

For trusts:

Budget 2024 suggests that capital gains allocated by a trust to its beneficiaries on or after June 25, 2024, will be included in the beneficiaries’ income at the old 50% rate up to the beneficiaries’ first $250,000 of capital gains for the year. While the specifics are not yet available, this opportunity will likely create further planning considerations surrounding the allocation of capital gains from a trust to its beneficiaries to reduce taxes. Capital gains can generally be allocated to a beneficiary for tax purposes when they are actually paid to the beneficiary, or when they are payable to a beneficiary (i.e., the beneficiary hasn’t received it, but has a right to demand payment of the capital gain). The option of making income paid (or payable) to its beneficiaries and allocating such income to be taxed in their hands will largely depend on the trust terms.

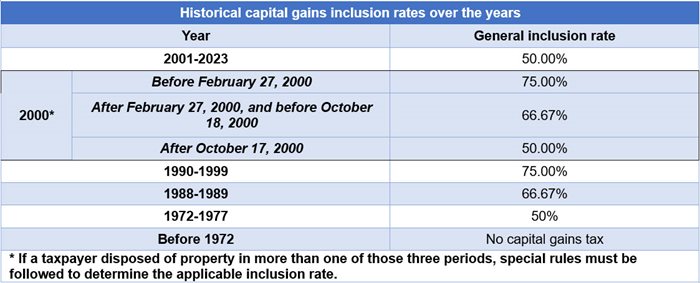

Historical reference: capital gains inclusion rate

Those of us around long enough, understand that this recent change was not the only time the capital gains inclusion rate has deviated from the 50% inclusion rate. Over the years, capital gains tax rate has ranged from nil to as high as 75% as indicated in the table below. In fact, the first instance of capital gain tax was introduced in 1972!

Excluding the 2024 tax year, we have given a rough estimate on the percentage of time spent at each of the various capital gains inclusion rates over the last 42 years. As we can see, for most of the time, the capital gains inclusion rate has remained at the 50 % inclusion rate. In fact, for the last 23 consecutive years, the inclusion rate has remained untouched with the last change being back in tax year 2000 with various changes introduced that year.

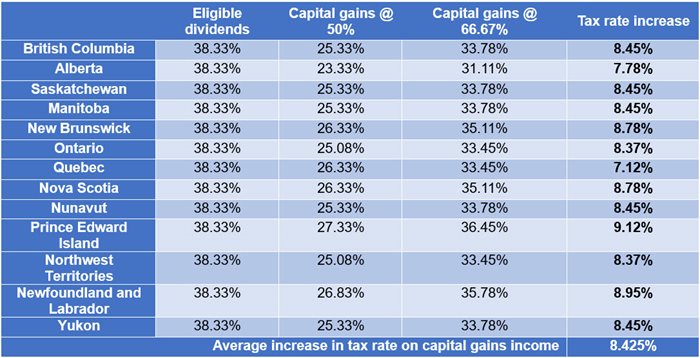

Tax impact by province/jurisdiction

With the increase in the capital gains inclusion rate, we want to demonstrate the potential tax impact of those changes across jurisdictions in Canada. The table below shows the 2024 marginal tax rate for the highest individual income earners in each jurisdiction at both the 50% and 66.67% capital gains inclusion rate, respectively. The average difference is an increase in taxes payable by 8.45%.

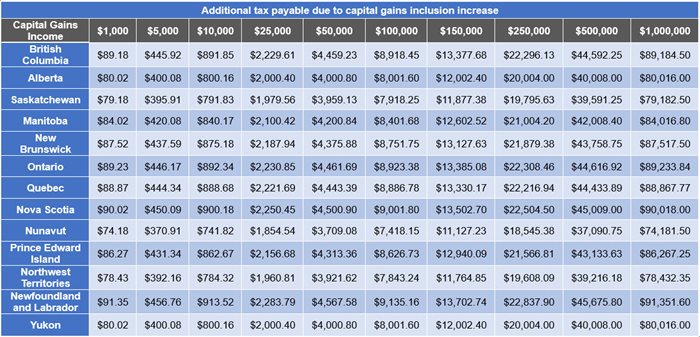

Next, we look at the additional taxes payable because of the inclusion increase, assuming varying capital gains income levels. Of course, this assumes that the capital gains do not otherwise benefit from a reduced inclusion rate or an outright exemption such as eligible in-kind donations of securities to registered charities, or shares that qualify for the lifetime capital gains exemption, to name a few.

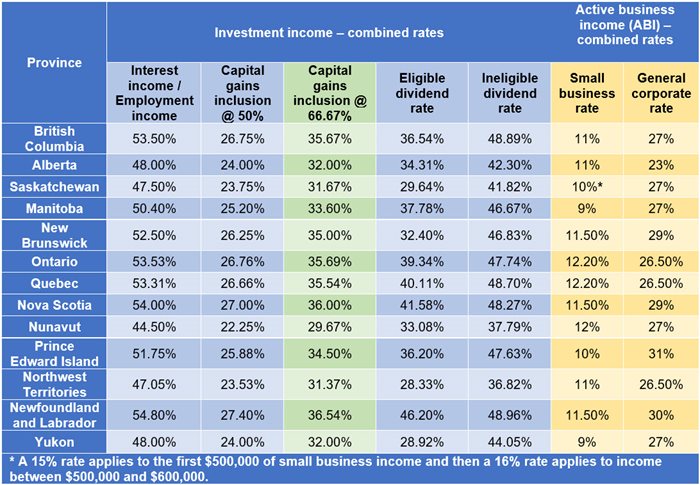

Understanding the tax implications of investing is an essential part of financial planning and reinforces the importance of working with a knowledgeable financial advisor to understand the long-term impact of these changes as it applies to personal situations. No doubt, tax rates influence capital allocation decisions. Canadians who take more inherent risk with their capital have traditionally been afforded preferred taxation rates promoting innovation through capital investment, something the government can do with good tax policy to encourage business growth and spur economic expansion. This is evident in the breakdown of the tax rates depending on the characterization of the income as noted in the table below.

Clearly the tax rates reflect the added capital risk investors and business owners take. We can clearly see the preferred taxation rates afforded on small business income and at the general corporate tax rates on income over the small business limit, compared to the tax rate on interest income or that of employment income. That tax-preference also extends to investors of “riskier” allocations of capital in marketable securities such as stocks, bonds, mutual funds, and exchange traded funds, to name a few. The tax rates of less-risky investments (such as money market instruments) do not benefit from the capital gains tax-preferred inclusion rates. With the latest move, there is not much difference in earning eligible dividend income from Canadian resident corporations and from dispositions resulting in capital gains.

Some pundits have declared the move as a disincentive to capital and business investment and may encourage businesses to move into more tax-favoured jurisdictions outside Canada. The Federal government has promoted the change as impacting a very small overall percentage of investors, estimated at 0.13% of Canadian individuals and 12.6% of corporations. Further, the move has been argued by the Liberals as necessary to work towards “intergenerational fairness”.

How to prepare for the changes?

For now, advisors may want to start educating their clients about the basics of the changes, which starts with comparing the current inclusion rates with the new inclusion rates.

Individual investors with large unrealized capital gains will also likely ask if they should crystallize their capital gains before June 25th to save money on taxes in the long run. The assumption that selling now will result in overall savings will not be correct in all cases, however. There is an opportunity cost to paying taxes upfront, rather than deferring those taxes to a later year.

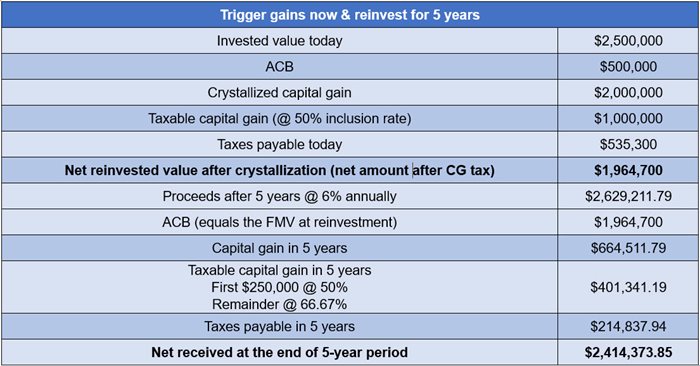

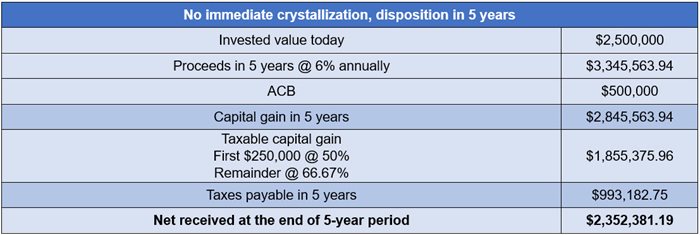

For example, let’s assume an Ontario client owns a $2.5 million non-registered equity portfolio with $2,000,000 in unrealized capital gains. They had no intention of selling those investments for another 5 yeas, but in light of the upcoming changes, they are considering selling immediately, paying the capital gains taxes now, then reinvesting the net amount after taxes back into those same investments for the 5-year investment period. They are currently in the top marginal tax bracket in Ontario (53.53%) and expect to continue to be in 5 years’ time. The assumed average rate of return on their investments is 6% annually over the next 5 years.

As can be seen in this example, at 6% annual compound growth rate, the option to realize much of the capital gains now resulted in a higher overall return in the amount of $61,992.66 over the 5-year period due to the lower inclusion rate. Alternatively stated, if the investor does not crystallize the gains today, the equivalent rate of return needed to have the exact net after tax amount at the end of the 5-year period (the “breakeven return”) would be a 6.60% compound annual return. While this certainly will not be true in all cases, this is the sort of analysis that will have to be conducted when assessing whether it makes sense to realize capital gains in 2024. The rate of return on investment and the investment horizon, among other things, are important determining factors.

Although we used securities investment in our example, a similar analysis can be done for other kinds of property held, such as a vacation property that is unlikely to benefit from the principal residence exemption. In addition, taxes often take a back seat to other planning considerations. These conversations should be had with the primary goals of the client in mind, which may supersede tax planning considerations.

For corporate investors, it will be important to emphasize the impact the capital gains inclusion increase will have on small business owners. As a refresher, a corporation is a separate legal entity from the shareholders who own it and is subject to tax on the income it generates. Income is first taxed within the corporation before it can be passed to the shareholders in the form of dividends out of its retained earnings. To avoid double tax on income that passes through a corporation to shareholders (and to prevent any unintended tax advantages), a dividend gross-up and tax credit model is applied at the individual level, along with a tax refund mechanism to the corporation on passive investment income. This is designed to integrate the tax system between the two entities: individual and corporation. Ideally, perfect integration is achieved when after-tax income is equal, whether it is earned individually or through a corporation. In reality, depending on the province and type of income earned, there could be a tax cost in earning passive investment income through a corporation, including earning passive investment capital gains income. Currently there is a tax cost of earning capital gains income through a corporation across all Canadian provinces/jurisdictions.

The latest change further increases the cost of earning passive investment income inside a corporation, though we do not yet know what changes will be made to the corporate tax refund mechanisms. As noted in the table below, the increase averages approximately 8.43% and closely equates the rate on eligible dividends. This rate reflects the initial tax rate on passive investment income earned within an active business.

For many small businesses, and perhaps to long-term individual investors, this increase in the tax rate will feel unfair as the accumulation of earning a pool of assets for retirement is often done within their small business corporation, and in many cases the sole source of retirement funds.

If an immediate crystallization of accumulated capital gains is not desired, what should investors consider in the longer run? Although many details of the new proposed rules are yet to be clarified, here are some general considerations.

For individuals, it may be helpful to plan the timing of future dispositions to stay below the annual $250,000 threshold. Also, it may seem obvious but maximizing investments within registered plans, including the new first home savings plan (FHSA) where eligible, can reduce exposure to future capital gains tax. Moreover, estate planning becomes even more important as the potential tax payable on the deemed disposition of capital property at death rises. On that front, strategies to reduce capital gains at death could be considered, such as inter-vivos gifting, charitable donation, spousal rollover, and acquiring life insurance to provide sufficient liquidity to the estate.

For business owners, some strategies to limit future capital gain exposure may include contributing to an individual pension plan (IPP), conducting an estate freeze to pass on future capital gains to succession owners, and ensuring the small business shares qualify for the LCGE. The suitable strategies are highly dependent on the business needs and personal situation of the business owner.

Acting too soon or not fast enough?

Finally, there is what many in the industry have been calling a “change of law” risk. That is, within the next year and a half, a federal election is scheduled, and this capital gains inclusion tax policy will surely be a primary election issue. As part of that election platform, parties may promise to repeal it outright or alter its scope and application. Consider also that any changes in the capital gains inclusion rate could be retroactive or simply not apply in all cases.

The information provided is general in nature and may not be relied upon nor considered to be the rendering of tax, legal, accounting or professional advice. Invesco Canada is not providing advice. Readers should consult with their own accountants, lawyers and/or other professionals for advice on their specific circumstances before taking any action. The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the simplified prospectus before investing. Copies are available from your advisor or from Invesco Canada Ltd

Date posted: May 23, 2024