Site Search

103 results for 31

- Make It EZ2 EZtransact Contest – Twice As Nice!

-

The Equitable Gives Back Contest – Start spreading the word!

Equitable Life of Canada is celebrating our 100th Anniversary in 2020, and we’re busy planning a year of events and activities so we can celebrate this significant milestone with our employees, clients, wholesalers and advisors across Canada.

A big part of who we are as a company is our commitment to help strengthen the communities where we operate by supporting a variety of charitable initiatives that help to improve the quality of life for the people living there. We are proud to launch the Equitable Gives Back Contest. Our goal is to give $10,000 to five registered charities operating in Canada.

All it takes to enter is an original essay (not less than 100 words, not more than 500) describing the way in which a charitable organization could use $10,000 to help further their charitable purpose and improve life for Canadians.

Reach out to your clients, tell them about the contest, and encourage them to visit www.equitable100.ca to see if they are eligible! All entries must be submitted by March 31, 2020.

-

Retirement Income Options from Equitable Life

If you have clients who are reaching retirement age and have a Retirement Savings Plan or locked-in funds from a previous employer, the government requires them to convert these plans by December 31 of the year they turn 71.

If your client is converting a plan, ask them about other existing assets. This is a great opportunity for your client to consolidate assets from other providers; and for you to discuss a lower management fee through Equitable Life’s Pivotal Select Preferred Pricing Program.

For more information on the options available for clients who are reaching retirement age and the advantages of each, check out the following materials.

- When it is time to convert your RSP to a RIF

- Converting your savings into retirement income

- Retirement Income Fund Understanding minimum withdrawal percentages

To learn more about Equitable’s Preferred Pricing Program, please click here. -

Anytime. Anywhere! Equitable Client Access

At Equitable Life®, we know that managing your clients’ requests can keep you busy. We also know providing the opportunity for your clients to self-serve can allow you to focus on their future. That’s why our online client site, Equitable Client Access ensures your clients have all the information about their individual investment and insurance policy information that they need, right at their fingertips.

Our secure client site gives your clients access to:

- Tax Slips *NEW*

- Coverage and guarantees

- Investment allocation, performance, and market values

- Pre-authorized payment information

- Transaction history

- Beneficiary information

- Statements and letters

- Advisor’s contact information

- Banking or payment information

Sign up by December 31, 2021.

Encourage your clients to login or register today!

client.equitable.ca

If you have any questions about Equitable Client Access, we are here to help. Contact us Monday to Friday from 8:30 a.m. to 7:30 p.m. at 1.866.884.7427.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada -

Help your clients this tax season with Equitable Life

It is tax time, and your clients should be receiving tax slips and deposit receipts by now. Check out the Tax Slips: A Quick Reference Guide which gives a taxation breakdown by product. Review Insights into Non-Registered Taxation that offers a detailed explanation on investment income, and why T3 tax slips generate on non-registered segregated funds. Does your client have questions about contribution limits? Retirement Income Fund minimums? or Canada pension maximums? Check out Equitable’s handy 2022 Facts & Figures guide.

Did your clients sign up for tax slips on Equitable Client Access before December 31, 2021?

If so, your clients can download or print their tax slips quickly and easily from their Equitable Client Access Inbox.

For questions, contact Equitable's Advisor Services Team Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or by email at savingsretirement@equitable.ca. or your Regional Investment Sales Manager. -

Important information regarding use of the form 350 Application for Life and/or Critical Illness Ins

As of February 12, 2022 the new version of the form 350 (2022/02/12) was available on EquiNet® (Individual Insurance>Forms), and can be ordered from our Supply department using form 1390 Supply Order Form (Life and Health)

To apply for the new 10 pay premium option on Equimax Estate Builder, or the new EquiLiving plans or riders, the new version of the form 350 (2022/02/12) Application for Life and/or Critical Illness Insurance must be used. The new version of the 350 will include the option to select the new features.

We will not accept the 350 (2021/04/02) version of the application with a hand-written note indicating the new 10 pay premium option, or the new EquiLiving plans or riders.

After March 31, 2022, we will no longer accept the 2021/04/02 or earlier version of the 350 application for any life or critical illness products. -

Tax Slips – What you need to know

It is tax time, and clients should be receiving tax slips and deposit receipts by now. Check out the Tax Slips: A Quick Reference Guide for a taxation breakdown by product and Insights into Non-Registered Taxation for a detailed explanation on investment income, and why T3 tax slips are generated on non-registered segregated funds.

Clients who registered for tax slips on Equitable Client Access before December 31, 2022, can download or print tax slips quickly and easily from their Equitable® Client Access Inbox. Advisors can download tax receipts on Document Lookup on EquiNet®.

For questions about contribution limits, Retirement Income Fund minimums and Canada pension maximums check out Equitable Life®’s helpful 2023 Facts & Figures guide.

Equitable's Advisor Services Team is available Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or by email at savingsretirement@equitable.ca. You can also contact your Regional Investment Sales Manager.

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted: February 15, 2023 -

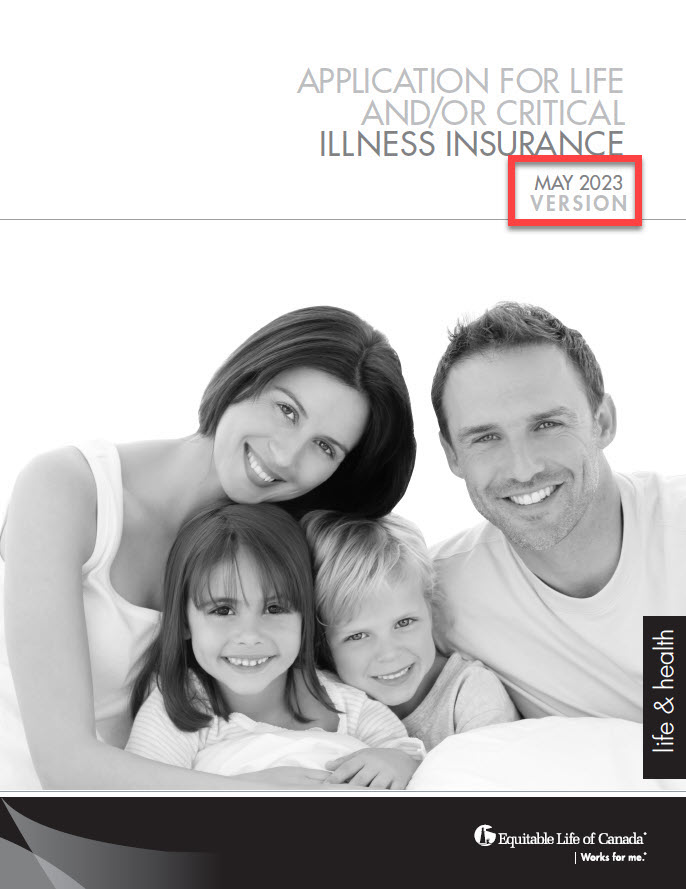

Reminder: New 350 Life and CI Applications

In early August, Equitable® updated the privacy and legal sections on some forms. This included the 350 Paper Application for Life and/or Critical Illness Insurance. This change was also applied on our websites and our online application EZComplete®. These changes are part of Bill 64. The Bill is about the protection of personal and private information in Quebec and took effect on September 1st, 2023.

Due to this change, we ask that all advisors use the latest version, dated May 2023, of the paper application.

For applications in Quebec, the latest version must be used.

For all regions outside Quebec, we are supporting a transition period from ‘old’ to ‘new’ applications until December 31st, 2023. After this date, we will no longer accept older versions of our Life and Critical Illness applications.

To make sure you are using the latest version of the application, check the date on the title page. It should say May 2023. See the image below:

.jpg?width=200&height=259)

To order paper copies, click here.

To learn more about Bill 64, please visit Assemblee nationale du Quebec - Bill 64. You may also contact your wholesaler.

® denote a registered trademark of The Equitable Life Insurance Company of Canada. - Retirement Nestegg Calculator

- RRIF Payment Calculator