Site Search

961 results for life policy 300109556

- [pdf] Charitable giving through life insurance

- [pdf] Make Equitable Life your first choice for insurance

-

New re-branded Application for Life and CI Insurance (Form 350)

We are excited to announce that as of December 7th, 2024, our new re-branded Application for Life and CI Insurance (Form 350) is available on EquiNet® Individual Insurance>Forms.

We will continue to accept the previous version of the Application for Life and CI Insurance (Form 350) dated May 2023.

Once your current supply is depleted, you can order the new application version dated November 2024 from our Supply department using form 1390 Supply Order Form (Life and Health). - [pdf] Individual Life & Health Products At-a-glance

-

All about the changes to the capital gains inclusion rate

Disclaimer: The following content is provided by and is the opinion of Invesco Canada Ltd. Equitable does not guarantee the adequacy, accuracy, timeliness, or completeness of the information. Equitable shall not be liable for any errors or omissions in the information provided by Invesco.

What has changed?

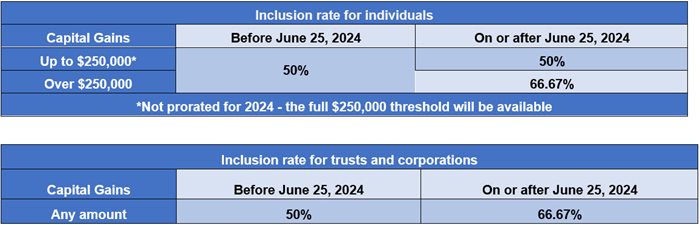

One noteworthy measure to come from Budget 2024 is the proposed change to the capital gains inclusion rate, which was previously held steady at 50% since 2001.

For individuals, capital gains more than $250,000 annually will be subject to an increased 66.67% inclusion rate as of June 25, 2024, while the capital gains up to $250,000 will continue to be subject to the existing 50% inclusion rate. As a transitional measure for 2024, only the capital gains realized by individuals on or after the effective date of June 25 that are above the $250,000 threshold will be subject to the increased inclusion rate.

For trusts and corporations, the inclusion rate on all capital gains will increase from 50% to 66.67% starting on June 25, 2024.

Who is affected?

Impact to individuals

Budget 2024 proposed to add transitional rules which would specifically identify capital gains and losses realized before the effective date (Period 1) and those realized on or after the effective date (Period 2). The effective date is June 25, 2024. Capital gains realized on or after that date will have an inclusion rate of 50% on the amount up to $250,000, and an inclusion rate of 66.67% on the amount above $250,000. All capital gains realized prior to the effective date will have an inclusion rate of 50%.

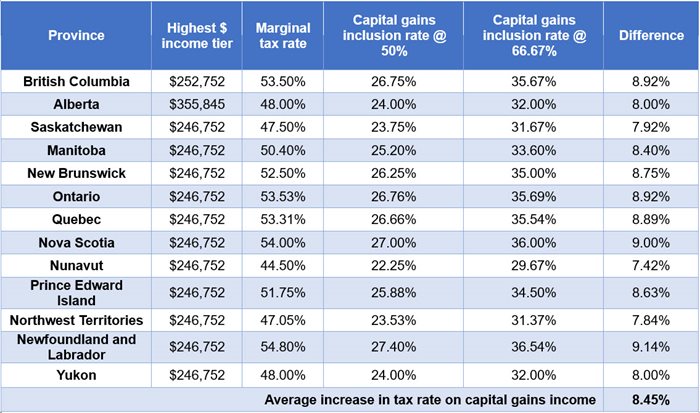

Take Ontario as an example, the proposed higher inclusion rate on capital gains would effectively increase the average federal-provincial marginal tax rate for Ontario residents on capital gains above $250,000 at the top marginal tax rate from 26.76% to 35.69%. A more detailed analysis on the impact of these changes to an individual’s tax rate is discussed below.

For net capital gains realized in Period 2, the annual $250,000 threshold would be fully available in 2024 (i.e., it would not be prorated) and it would apply only in respect of net capital gains realized in Period 2.

The $250,000 threshold would effectively apply to capital gains realized by an individual, either directly or indirectly via a partnership or trust, net of any: current-year capital losses, capital losses of other years applied to reduce current-year capital gains, and capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed employee Ownership Trust Exemption or the proposed Canadian Entrepreneurs’ Incentive claimed.

Two common scenarios of reaching the $250,000 capital gain threshold are the deemed disposition of capital property at death, and the emigration from Canada (i.e., becoming a non-resident for income tax purposes). We have provided additional details on these topics below.

Deemed disposition upon death

When an individual passes away, they are deemed to have sold their capital property (e.g., units or shares of mutual funds, shares of corporations, and real property) at its fair market value (FMV) immediately before their death. If a capital gain arises because of this deemed disposition, that capital gain is reportable on the deceased’s final (terminal) tax return and the taxes owing as a result, if any, would be payable by the estate of the deceased. However, there are provisions that allow taxes to be deferred when the property is transferred to a spouse. For example, if a capital property is transferred to a surviving spouse or common-law partner, subsection 70(6) of the Income Tax Act (Canada) automatically deems the deceased to have disposed of that property and the spouse or common-law partner immediately acquires the same property at the deceased transferor’s adjusted cost base (ACB). This is commonly referred to as the “spousal rollover”. Another potential strategy to manage potential large capital gains taxes at death is life insurance, since the death benefit is typically paid out tax-free.

Without careful planning, the estate value could be substantially reduced by the changes to the capital gains inclusion rate. Furthermore, it would be prudent to ensure there are liquid assets or cash available in the estate to cover the associated tax liabilities.

Non-resident of Canada – Departure tax

Residency in Canada for income tax purposes is a question of fact, which primarily depends on the individual’s residential and social ties in Canada. When an individual becomes a non-resident of Canada, they are deemed to have disposed of and immediately reacquired certain types of property at FMV. The tax incurred because of this deemed disposition and reacquisition is also known as the departure tax. Some examples of properties subject to departure tax include securities inside a non-registered investment portfolio, shares of Canadian private corporations, and real estate situated outside of Canada. Note that there are some properties that are exempted from the departure tax, including: pensions and similar rights (including registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), and tax-free savings accounts (TFSAs)) and Canadian real property.

The departure tax rules coupled with the increased capital gain inclusion rate above the $250,000 threshold may incur additional tax payable for emigrants. However, there is an option to defer the payment of departure tax on income associated with the deemed disposition upon emigration. By making an election, the individual would pay the tax later, without interest, when the property is disposed of. This election can be done by completing CRA Form T1244, “Election Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property," on or before April 30 of the year following their departure from Canada.

Impact to Entities

Corporations and trusts will also be impacted by the increased inclusion rate as of June 25, 2024. Unlike individuals, corporations and trusts will not have access to the old inclusion rate on the first $250,000 of capital gains: they will be subject to the new 66.67% inclusion rate from the very first dollar.

With the above in mind, there will be options available to shelter corporate and trust capital gains from the new inclusion rate.

For corporations:

The lifetime capital gains exemption (LCGE) can be used to eliminate capital gains taxes on the sale of qualified small business corporation shares (generally, these are shares of a Canadian-controlled private corporation that carries on an active business). The LCGE is also available on the sale of qualified farm or fishing property. The current lifetime limit for the LCGE is $1,016,836. Budget 2024 proposed to increase that limit to $1,250,000 starting on June 25, 2024, so certain business owners will be able to reduce or eliminate their exposure to the new inclusion rate if they are able to make use of the increased LCGE limit.

For trusts:

Budget 2024 suggests that capital gains allocated by a trust to its beneficiaries on or after June 25, 2024, will be included in the beneficiaries’ income at the old 50% rate up to the beneficiaries’ first $250,000 of capital gains for the year. While the specifics are not yet available, this opportunity will likely create further planning considerations surrounding the allocation of capital gains from a trust to its beneficiaries to reduce taxes. Capital gains can generally be allocated to a beneficiary for tax purposes when they are actually paid to the beneficiary, or when they are payable to a beneficiary (i.e., the beneficiary hasn’t received it, but has a right to demand payment of the capital gain). The option of making income paid (or payable) to its beneficiaries and allocating such income to be taxed in their hands will largely depend on the trust terms.

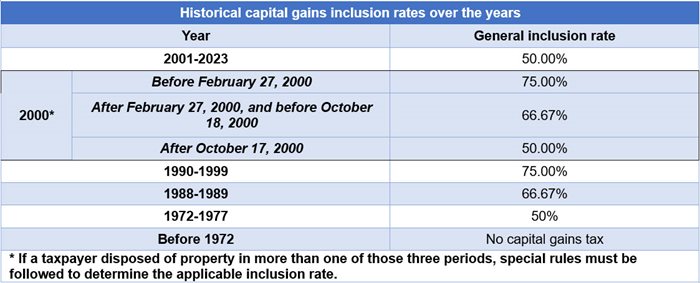

Historical reference: capital gains inclusion rate

Those of us around long enough, understand that this recent change was not the only time the capital gains inclusion rate has deviated from the 50% inclusion rate. Over the years, capital gains tax rate has ranged from nil to as high as 75% as indicated in the table below. In fact, the first instance of capital gain tax was introduced in 1972!

Excluding the 2024 tax year, we have given a rough estimate on the percentage of time spent at each of the various capital gains inclusion rates over the last 42 years. As we can see, for most of the time, the capital gains inclusion rate has remained at the 50 % inclusion rate. In fact, for the last 23 consecutive years, the inclusion rate has remained untouched with the last change being back in tax year 2000 with various changes introduced that year.

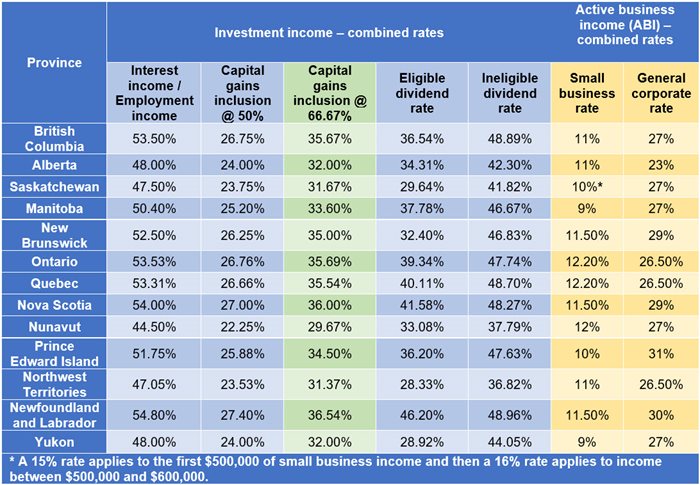

Tax impact by province/jurisdiction

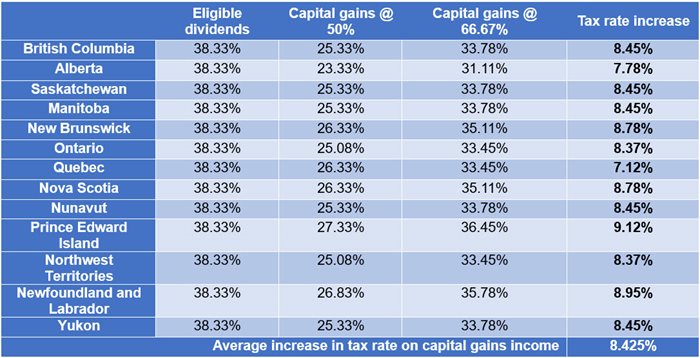

With the increase in the capital gains inclusion rate, we want to demonstrate the potential tax impact of those changes across jurisdictions in Canada. The table below shows the 2024 marginal tax rate for the highest individual income earners in each jurisdiction at both the 50% and 66.67% capital gains inclusion rate, respectively. The average difference is an increase in taxes payable by 8.45%.

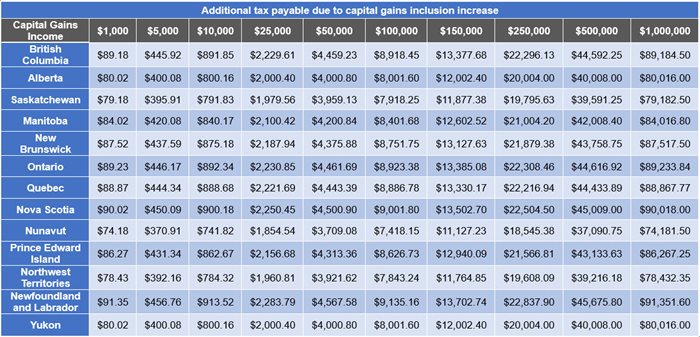

Next, we look at the additional taxes payable because of the inclusion increase, assuming varying capital gains income levels. Of course, this assumes that the capital gains do not otherwise benefit from a reduced inclusion rate or an outright exemption such as eligible in-kind donations of securities to registered charities, or shares that qualify for the lifetime capital gains exemption, to name a few.

Understanding the tax implications of investing is an essential part of financial planning and reinforces the importance of working with a knowledgeable financial advisor to understand the long-term impact of these changes as it applies to personal situations. No doubt, tax rates influence capital allocation decisions. Canadians who take more inherent risk with their capital have traditionally been afforded preferred taxation rates promoting innovation through capital investment, something the government can do with good tax policy to encourage business growth and spur economic expansion. This is evident in the breakdown of the tax rates depending on the characterization of the income as noted in the table below.

Clearly the tax rates reflect the added capital risk investors and business owners take. We can clearly see the preferred taxation rates afforded on small business income and at the general corporate tax rates on income over the small business limit, compared to the tax rate on interest income or that of employment income. That tax-preference also extends to investors of “riskier” allocations of capital in marketable securities such as stocks, bonds, mutual funds, and exchange traded funds, to name a few. The tax rates of less-risky investments (such as money market instruments) do not benefit from the capital gains tax-preferred inclusion rates. With the latest move, there is not much difference in earning eligible dividend income from Canadian resident corporations and from dispositions resulting in capital gains.

Some pundits have declared the move as a disincentive to capital and business investment and may encourage businesses to move into more tax-favoured jurisdictions outside Canada. The Federal government has promoted the change as impacting a very small overall percentage of investors, estimated at 0.13% of Canadian individuals and 12.6% of corporations. Further, the move has been argued by the Liberals as necessary to work towards “intergenerational fairness”.

How to prepare for the changes?

For now, advisors may want to start educating their clients about the basics of the changes, which starts with comparing the current inclusion rates with the new inclusion rates.

Individual investors with large unrealized capital gains will also likely ask if they should crystallize their capital gains before June 25th to save money on taxes in the long run. The assumption that selling now will result in overall savings will not be correct in all cases, however. There is an opportunity cost to paying taxes upfront, rather than deferring those taxes to a later year.

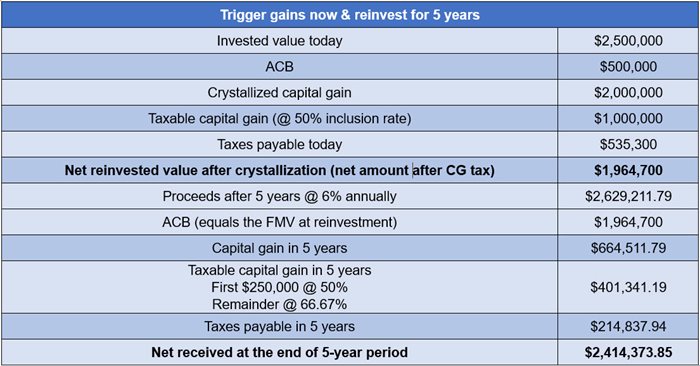

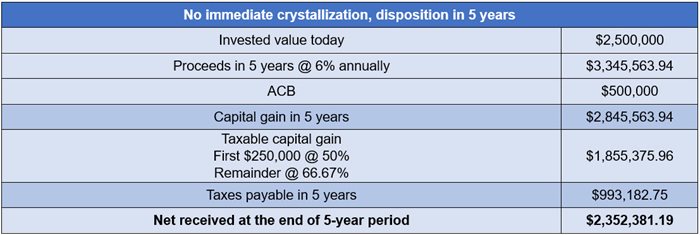

For example, let’s assume an Ontario client owns a $2.5 million non-registered equity portfolio with $2,000,000 in unrealized capital gains. They had no intention of selling those investments for another 5 yeas, but in light of the upcoming changes, they are considering selling immediately, paying the capital gains taxes now, then reinvesting the net amount after taxes back into those same investments for the 5-year investment period. They are currently in the top marginal tax bracket in Ontario (53.53%) and expect to continue to be in 5 years’ time. The assumed average rate of return on their investments is 6% annually over the next 5 years.

As can be seen in this example, at 6% annual compound growth rate, the option to realize much of the capital gains now resulted in a higher overall return in the amount of $61,992.66 over the 5-year period due to the lower inclusion rate. Alternatively stated, if the investor does not crystallize the gains today, the equivalent rate of return needed to have the exact net after tax amount at the end of the 5-year period (the “breakeven return”) would be a 6.60% compound annual return. While this certainly will not be true in all cases, this is the sort of analysis that will have to be conducted when assessing whether it makes sense to realize capital gains in 2024. The rate of return on investment and the investment horizon, among other things, are important determining factors.

Although we used securities investment in our example, a similar analysis can be done for other kinds of property held, such as a vacation property that is unlikely to benefit from the principal residence exemption. In addition, taxes often take a back seat to other planning considerations. These conversations should be had with the primary goals of the client in mind, which may supersede tax planning considerations.

For corporate investors, it will be important to emphasize the impact the capital gains inclusion increase will have on small business owners. As a refresher, a corporation is a separate legal entity from the shareholders who own it and is subject to tax on the income it generates. Income is first taxed within the corporation before it can be passed to the shareholders in the form of dividends out of its retained earnings. To avoid double tax on income that passes through a corporation to shareholders (and to prevent any unintended tax advantages), a dividend gross-up and tax credit model is applied at the individual level, along with a tax refund mechanism to the corporation on passive investment income. This is designed to integrate the tax system between the two entities: individual and corporation. Ideally, perfect integration is achieved when after-tax income is equal, whether it is earned individually or through a corporation. In reality, depending on the province and type of income earned, there could be a tax cost in earning passive investment income through a corporation, including earning passive investment capital gains income. Currently there is a tax cost of earning capital gains income through a corporation across all Canadian provinces/jurisdictions.

The latest change further increases the cost of earning passive investment income inside a corporation, though we do not yet know what changes will be made to the corporate tax refund mechanisms. As noted in the table below, the increase averages approximately 8.43% and closely equates the rate on eligible dividends. This rate reflects the initial tax rate on passive investment income earned within an active business.

For many small businesses, and perhaps to long-term individual investors, this increase in the tax rate will feel unfair as the accumulation of earning a pool of assets for retirement is often done within their small business corporation, and in many cases the sole source of retirement funds.

If an immediate crystallization of accumulated capital gains is not desired, what should investors consider in the longer run? Although many details of the new proposed rules are yet to be clarified, here are some general considerations.

For individuals, it may be helpful to plan the timing of future dispositions to stay below the annual $250,000 threshold. Also, it may seem obvious but maximizing investments within registered plans, including the new first home savings plan (FHSA) where eligible, can reduce exposure to future capital gains tax. Moreover, estate planning becomes even more important as the potential tax payable on the deemed disposition of capital property at death rises. On that front, strategies to reduce capital gains at death could be considered, such as inter-vivos gifting, charitable donation, spousal rollover, and acquiring life insurance to provide sufficient liquidity to the estate.

For business owners, some strategies to limit future capital gain exposure may include contributing to an individual pension plan (IPP), conducting an estate freeze to pass on future capital gains to succession owners, and ensuring the small business shares qualify for the LCGE. The suitable strategies are highly dependent on the business needs and personal situation of the business owner.

Acting too soon or not fast enough?

Finally, there is what many in the industry have been calling a “change of law” risk. That is, within the next year and a half, a federal election is scheduled, and this capital gains inclusion tax policy will surely be a primary election issue. As part of that election platform, parties may promise to repeal it outright or alter its scope and application. Consider also that any changes in the capital gains inclusion rate could be retroactive or simply not apply in all cases.

The information provided is general in nature and may not be relied upon nor considered to be the rendering of tax, legal, accounting or professional advice. Invesco Canada is not providing advice. Readers should consult with their own accountants, lawyers and/or other professionals for advice on their specific circumstances before taking any action. The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the simplified prospectus before investing. Copies are available from your advisor or from Invesco Canada Ltd

Date posted: May 23, 2024 -

Market Commentary April 2025

Key Takeaways for Q1

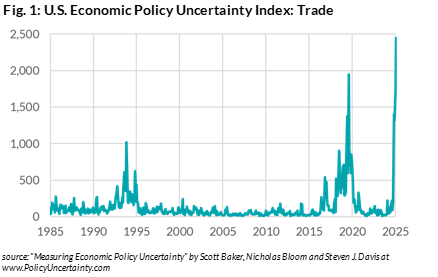

- Economic policy became more uncertain with fluctuating tariff announcements from the U.S. and its trading partners.

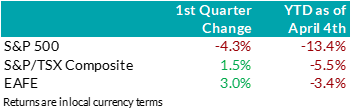

- Global stocks markets experienced heightened volatility year-to-date, reflecting the negative repercussions of tariffs for highly integrated global economies.

- Within U.S. markets, investors rotated out of growth stocks into value and defensive areas of the market.

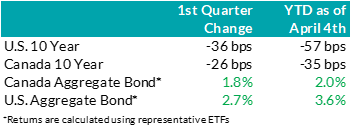

- Bond markets performed well during the quarter as interest rates moved lower.

- Most central banks continued to ease monetary policy by reducing their target interest rates. The U.S. Federal Reserve was a notable exception, electing to wait for greater clarity before lowering rates further.

Economic and Market UpdateEconomic Summary: In the U.S., the latest GDP data confirmed solid economic growth in 2024. However, as President Trump pushes forward his economic agenda, uncertainty surrounding fiscal policy and global trade have dampened market sentiment. Inflation pressures persisted, with the rate of inflation remaining above the central bank’s 2% objective. The labour market in the U.S. remained resilient, with unemployment rate staying low compared to historical norms. The Federal Reserve shifted to a more cautious approach, holding the policy rate steady through Q1 at the range 4.25% - 4.5%. The central bank raised its inflation forecast, lowered growth projections, and warned that “uncertainty around the economic outlook has increased.” U.S. bond yields were lower for most maturity dates during the first quarter, as the market priced in more growth concerns and anticipated more rate cuts from the Federal Reserve.

In Canada, recent GDP data showed stronger-than-expected growth. The inflation rate remained close to the 2% target but rose more than expected in February, and the labour market showed signs of improvement. U.S. tariffs continued to be a significant concern, and it is prompting businesses and consumers to become more cautious and slow their spending. The Bank of Canada warned that the economic impact of the tariffs could be “severe” and expected weaker growth in the coming quarters. For those reasons the Bank of Canada continued its easing cycle, cutting rates by 25 basis points at each of the January and March meetings, bringing the policy rate to 2.75%. Bond yields in Canada were also lower, with short-term interest rates decreasing faster than long-term interest rates as the Bank of Canada’s rate cuts outpaced market expectations.

Bond Markets: During Q1 2025, the FTSE Canada Universe Bond Index returned 2.0% as interest rates declined across all tenors. Although interest rates fell, this was partially offset by higher credit spreads (i.e. the extra yield on corporate bonds versus government bonds to compensate for their extra risk). Consequently, while corporate bonds still generated a positive return on the quarter, they underperformed government bonds. Widening credit spreads reflected the risk-off tone to the market, with on-off-on-off-on(?) tariffs contributing to the uncertainty. Lower-rated BBB bonds generally performed worse than higher-quality A-rated bonds. While credit spreads are higher than they were in December and January, they are still expensive compared to longer term averages. Corporate bond issuance remained robust up until the last week of March, as investor demand kept deals well supported. Overall, the market took in $40 billion in new issuance, the second highest on record, spread over 82 bonds. While corporate bonds are more attractive than in January 2025, we believe the more likely path is towards higher credit spreads as U.S. tariffs impact global growth. We have maintained our conservative view with a bias towards shorter-dated credit but remain ready to invest in longer dated corporate bonds as valuations become more attractive.

Stock Markets – Overview:

Uncertainty surrounding the scope and severity of new tariffs led investors to reassess global economic growth prospects and weighed on risk sentiment. As a result, the S&P 500 declined 4.3% over the quarter, underperforming Canadian and international markets. Within the U.S., investors rotated out of previously favoured growth stocks with loftier valuations – including members of the Magnificent 7 – into less volatile and value-cyclical companies. Meanwhile, Canadian equities returned 1.5% in Q1 despite ongoing trade negotiations and uncertain economic growth forecasts. Surging commodity prices helped the materials and energy sectors outperform, offsetting weakness in the technology and industrials sectors. Elsewhere, major developed markets from Europe and Asia (EAFE) were supported over the quarter by the introduction of a new German fiscal stimulus package and signs of improving Chinese economic growth. Following the quarter end, President Trump announced global tariffs on April 2nd, prompting some trading partners to hit back with retaliatory tariffs. The S&P 500 lost a record $5.2 trillion over two trading sessions and re-entered correction territory, with other global equity markets moving in tandem.

U.S. Equities: While the impact of tariffs has made investors more apprehensive, we have yet to witness a deterioration in financial performance. In fact, U.S. earnings continued to exceed forecasts last quarter, with approximately 70% of companies beating expectations. Furthermore, our bottom-up analysis shows that the skew of corporate earnings surprises continues to tilt positive. That said, we note that companies are providing more cautious guidance amid the increased economic uncertainty and that these earnings largely reflect conditions in 2024, not 2025. Notably, consumer stocks like Walmart have lowered growth forecasts for 2025, citing concerns surrounding consumer confidence and macroeconomic conditions. In addition to clouding the outlook, geopolitical shocks like sweeping tariffs may risk changing how companies choose to operate, including the structure of supply chains and sources of revenue. At this stage, it is still unclear how long these trade tensions will last, as that depends on how other countries choose to respond. If the tariffs are rolled back quickly, many companies may be able to absorb the temporary extra costs without serious damage to profits, and the broader economy could avoid lasting harm. But if the tariffs remain in place for a long time, the consequences could be much more serious; companies might have to change how they operate, restructure supply chains, and raise prices to deal with long-term pressure on profits.

Canadian Equities: Against the backdrop of worrisome trade developments, the Bank of Canada continued to ease monetary policy. While lower rates have helped Canadian companies report better-than-expected profit growth, consensus earnings expectations for 2025 have been revised 2% lower since the beginning of the year, reflecting the expectations for tariff headwinds. Falling bond yields made high quality, high dividend paying companies more attractive, helping this group outperform. Furthermore, the price of raw industrials – a basket of commodities – surged higher over the quarter and as a result, commodity-oriented companies benefitted. More specifically, the materials sector performed strongly with gold prices reaching new all-time highs throughout the quarter. However, if trade frictions continue to escalate and weaker growth projections materialize into a real economic slowdown, the Canadian market, given its cyclical nature and heavy reliance on commodity-driven businesses, remains particularly vulnerable to external headwinds. Moreover, given Canada’s weaker fundamental backdrop, we caution that the recent outperformance of Canadian equities relative to the U.S. may prove short-lived, particularly if trade tension persists.

Bottom line:

Heightened uncertainty surrounding global trade policies, coupled with deteriorating economic growth projections, continued to weigh on investor sentiment. Bond prices benefited from the flight to less-risky assets, with lower interest rates in anticipation of weaker economic conditions. In equity markets, the introduction of broad-based tariffs increased market volatility and drove major indices sharply lower year-to-date. Looking forward, we remain cautious of the recent outperformance of Canadian and international markets relative to the U.S. While tariffs began as a U.S. policy move, the ripple effects extend far beyond American borders, reflecting the systemic fragility that underpins global trade. If trade barriers persist, businesses may be forced to make structural shifts in their operations and review their current business models. Until markets achieve greater clarity on global trade policies, we continue to prioritize exposure to diversified large-cap stocks in the U.S., over defensive or growth-heavy positions. Within Canada, we continue to favour high quality, high dividend paying names with less sensitivity to downgrades in global growth.

Downloadable Copy

ADVISOR USE ONLYMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

EAMG Market Commentary July 2023

Posted July 27, 2023

July 17, 2023

Rates & Credit - The rates market was volatile in Q2 as investors focused on inflation, central bank interest rate decisions, and recession probabilities. Persistent strength in U.S. consumer spending and labour markets have surprised investors and prompted further interest rate tightening from central banks. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a total return of 0.2%, versus a loss of 1.0% for government bonds and 0.7% for the overall Index. The corporate bond outperformance was driven by a broad risk-on tone to the market, most notably in April as the market recovered from the banking sector liquidity crisis that developed during March. That said, the market tone remained cautious, with the improved risk premium on corporate bonds tempered by lingering concerns around sticky inflation, high interest rates, and the potential for slower economic growth into the latter half of the year.

Dominance of U.S. Equities – U.S. equity markets posted another strong quarter with the S&P 500 returning 8.7%, outperforming Canada and other major international equity markets. The S&P/TSX Composite, returned 1.2% in CAD. Major developed economies from Europe, Australasia, and Far East (EAFE) returned 3.2% in local currency terms. The highly anticipated re-opening of the Chinese economy has failed to materialize with economic data indicating less strength than previously forecasted. Amid sluggish Chinese growth, closely interconnected economic partners such as the European Union, as well as commodity-driven markets like Canada, have all underperformed the U.S. on a relative basis.

U.S. Fundamentals – Earnings continued to contract versus prior year, albeit at a slower pace than forecasted. Forward earnings guidance improved quarter-over-quarter with corporate sentiment returning to neutral levels. Based on our analysis, we observed that 31% of major companies expect deteriorating financial performance, while 33% expect improved performance, with the remaining expecting no material change. Overall, major U.S. companies remain well capitalized with strong operating margins. However, company guidance indicates a prioritization of cost controls amid increased consumer indebtedness and concerns about the health of the consumer.

Artificial Intelligence (AI) Mania – Despite concerns that the U.S. economy is at a late stage in its economic cycle, that monetary tightening by central banks could go too far, and the fact that earnings contracted on a year-over-year basis, equity markets became more expensive during the quarter with price-to-earnings multiples expanding. This expansion was driven by investors crowding into AI focused technology companies, with the seven largest AI/technology themed companies averaging a 26% return while the other 493 members gained only 3%. Investors rewarded businesses with contributions to AI development (hardware and software components), as well as those with the ability to implement synergies from leveraging the technology. A crowded market surge is not uncommon at this point in the economic cycle, where positive economic surprises, in this instance, strong employment and consumer spending can lead to an upswelling in investor confidence.

U.S. Quant Factors – Using our investment framework, we currently favour exposures to large cash-rich companies with innovative product offerings, which we believe offer the strongest risk-adjusted returns in the current market environment. While the valuation of AI companies seems to defy traditional rationales, the momentum has continued to push the group higher. Consequently, the Quality factor (companies with higher return-on-equity, strong operating performance, and healthy leverage levels) participated in the AI trend and consistently outperformed throughout the quarter. The Low Volatility factor (stocks with lower sensitivity to broad market movement, and lower price volatility) underperformed through the quarter. While the Low Volatility factor typically performs well at this stage of the economic cycle, the fact that a small number of stocks were responsible for much of the market’s return hurt this factor. Lastly, the Momentum factor (stocks with a recent history of price appreciation) initially underperformed during the quarter before rebounding in June. This factor’s recent outperformance suggests that the market is becoming complacent and possibly signals that rotations within the market are slowing as current trends remain in favour.

Canadian Fundamentals – Top line revenue missed forecasts while bottom line earnings were consistent with expectations. Softer-than-expected results out of Canadian financials, as well as underwhelming results from the materials sector, dragged on the aggregate index performance. Earnings forecasts for the rest of the year have been revised downward with analyst expecting index aggregate earnings to detract 2% to 3%. Meanwhile, the Bank of Canada raised its overnight interest rate by 25 basis points, bringing it to 4.75% on the backdrop of robust economic data releases including Q1 GDP and April CPI.

Canadian Quant Factors – The most notable dislocation in Canada was the convergence of the dividend yield of High-Dividend ETFs and Equal-Weight Bank ETFs. We believe that the drag from Canadian banks following the U.S. regional banking concerns in March resulted in a discount of the Quality factor as the performance of the group is sensitive to the movements of banks. While banks did recover around 35% of their SVB-induced underperformance, the nature of banking has attracted investor scrutiny given the view that we are in the late-stage of the economic cycle. That said, this environment is an attractive environment to add variants of the Quality factor, which would gain exposure to a rebounding industry that offers a similar dividend yield to the high dividend stocks.

Views From the Frontline

Rates – On an outright basis, bond yields across the curve continue to look attractive. Economic data remains strong however we are beginning to see the first signs of weakness in spending, jobs and inflation. Slower growth, a more balanced labour market, declining inflation, and tighter credit conditions will likely drive interest rates lower throughout 2023. Market participants remain focused on the extent of interest rate hikes and the duration of a pause required to bring inflation back to the 2% target. With inflation remaining more persistent than previously expected forecasts around the timing, pace and extent of the removal of monetary policy have been pushed into 2024.

Credit – The uncertain economic outlook and risks around slower economic growth later this year merit caution about corporate bonds and a bias towards higher-quality, shorter-dated credit where we think the risk / reward dynamic are more favourable. That said, the “soft-landing” narrative, now more pervasive in the market, could continue to provide support to risk assets, which we view as an opportunity to further pare down higher beta exposure.

Equities – Given the direction of the current economic and company fundamental data, we continue to favour high quality growth segments of the market with strong operating margins. As such, the late cycle conditions in the market reinforce our preference for large cap stocks over smaller, more U.S. domestically focused businesses. The U.S. Low Volatility factor’s underperformance is unlikely to reverse in the short term given the resilience of the U.S. economy. Furthermore, after a steep decline last quarter, we expect that cyclical value will find support in the near term, echoing the increased chance of slowing inflation without stalling economic growth. In Canada, equities are typically more cyclical in nature, which coupled with the potential for an earnings contraction, makes us view the Low Volatility factor as more likely to outperform. Like the U.S., we prefer Canadian high-quality companies to navigate through the late cycle environment. On the heels of poor Chinese economic data and underwhelming stimulus, we are maintaining our overweight to the U.S. relative to Canada and EAFE.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. - Frequently Asked Questions

- [pdf] Advanced market insurance solutions

- Forms