Site Search

271 results for Buy fc 26 coins Buyfc26coins.com Their customer service is very responsive..6gfc

- [pdf] Non-Resident Transactions

-

EAMG Market Commentary July 2023

Posted July 27, 2023

July 17, 2023

Rates & Credit - The rates market was volatile in Q2 as investors focused on inflation, central bank interest rate decisions, and recession probabilities. Persistent strength in U.S. consumer spending and labour markets have surprised investors and prompted further interest rate tightening from central banks. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a total return of 0.2%, versus a loss of 1.0% for government bonds and 0.7% for the overall Index. The corporate bond outperformance was driven by a broad risk-on tone to the market, most notably in April as the market recovered from the banking sector liquidity crisis that developed during March. That said, the market tone remained cautious, with the improved risk premium on corporate bonds tempered by lingering concerns around sticky inflation, high interest rates, and the potential for slower economic growth into the latter half of the year.

Dominance of U.S. Equities – U.S. equity markets posted another strong quarter with the S&P 500 returning 8.7%, outperforming Canada and other major international equity markets. The S&P/TSX Composite, returned 1.2% in CAD. Major developed economies from Europe, Australasia, and Far East (EAFE) returned 3.2% in local currency terms. The highly anticipated re-opening of the Chinese economy has failed to materialize with economic data indicating less strength than previously forecasted. Amid sluggish Chinese growth, closely interconnected economic partners such as the European Union, as well as commodity-driven markets like Canada, have all underperformed the U.S. on a relative basis.

U.S. Fundamentals – Earnings continued to contract versus prior year, albeit at a slower pace than forecasted. Forward earnings guidance improved quarter-over-quarter with corporate sentiment returning to neutral levels. Based on our analysis, we observed that 31% of major companies expect deteriorating financial performance, while 33% expect improved performance, with the remaining expecting no material change. Overall, major U.S. companies remain well capitalized with strong operating margins. However, company guidance indicates a prioritization of cost controls amid increased consumer indebtedness and concerns about the health of the consumer.

Artificial Intelligence (AI) Mania – Despite concerns that the U.S. economy is at a late stage in its economic cycle, that monetary tightening by central banks could go too far, and the fact that earnings contracted on a year-over-year basis, equity markets became more expensive during the quarter with price-to-earnings multiples expanding. This expansion was driven by investors crowding into AI focused technology companies, with the seven largest AI/technology themed companies averaging a 26% return while the other 493 members gained only 3%. Investors rewarded businesses with contributions to AI development (hardware and software components), as well as those with the ability to implement synergies from leveraging the technology. A crowded market surge is not uncommon at this point in the economic cycle, where positive economic surprises, in this instance, strong employment and consumer spending can lead to an upswelling in investor confidence.

U.S. Quant Factors – Using our investment framework, we currently favour exposures to large cash-rich companies with innovative product offerings, which we believe offer the strongest risk-adjusted returns in the current market environment. While the valuation of AI companies seems to defy traditional rationales, the momentum has continued to push the group higher. Consequently, the Quality factor (companies with higher return-on-equity, strong operating performance, and healthy leverage levels) participated in the AI trend and consistently outperformed throughout the quarter. The Low Volatility factor (stocks with lower sensitivity to broad market movement, and lower price volatility) underperformed through the quarter. While the Low Volatility factor typically performs well at this stage of the economic cycle, the fact that a small number of stocks were responsible for much of the market’s return hurt this factor. Lastly, the Momentum factor (stocks with a recent history of price appreciation) initially underperformed during the quarter before rebounding in June. This factor’s recent outperformance suggests that the market is becoming complacent and possibly signals that rotations within the market are slowing as current trends remain in favour.

Canadian Fundamentals – Top line revenue missed forecasts while bottom line earnings were consistent with expectations. Softer-than-expected results out of Canadian financials, as well as underwhelming results from the materials sector, dragged on the aggregate index performance. Earnings forecasts for the rest of the year have been revised downward with analyst expecting index aggregate earnings to detract 2% to 3%. Meanwhile, the Bank of Canada raised its overnight interest rate by 25 basis points, bringing it to 4.75% on the backdrop of robust economic data releases including Q1 GDP and April CPI.

Canadian Quant Factors – The most notable dislocation in Canada was the convergence of the dividend yield of High-Dividend ETFs and Equal-Weight Bank ETFs. We believe that the drag from Canadian banks following the U.S. regional banking concerns in March resulted in a discount of the Quality factor as the performance of the group is sensitive to the movements of banks. While banks did recover around 35% of their SVB-induced underperformance, the nature of banking has attracted investor scrutiny given the view that we are in the late-stage of the economic cycle. That said, this environment is an attractive environment to add variants of the Quality factor, which would gain exposure to a rebounding industry that offers a similar dividend yield to the high dividend stocks.

Views From the Frontline

Rates – On an outright basis, bond yields across the curve continue to look attractive. Economic data remains strong however we are beginning to see the first signs of weakness in spending, jobs and inflation. Slower growth, a more balanced labour market, declining inflation, and tighter credit conditions will likely drive interest rates lower throughout 2023. Market participants remain focused on the extent of interest rate hikes and the duration of a pause required to bring inflation back to the 2% target. With inflation remaining more persistent than previously expected forecasts around the timing, pace and extent of the removal of monetary policy have been pushed into 2024.

Credit – The uncertain economic outlook and risks around slower economic growth later this year merit caution about corporate bonds and a bias towards higher-quality, shorter-dated credit where we think the risk / reward dynamic are more favourable. That said, the “soft-landing” narrative, now more pervasive in the market, could continue to provide support to risk assets, which we view as an opportunity to further pare down higher beta exposure.

Equities – Given the direction of the current economic and company fundamental data, we continue to favour high quality growth segments of the market with strong operating margins. As such, the late cycle conditions in the market reinforce our preference for large cap stocks over smaller, more U.S. domestically focused businesses. The U.S. Low Volatility factor’s underperformance is unlikely to reverse in the short term given the resilience of the U.S. economy. Furthermore, after a steep decline last quarter, we expect that cyclical value will find support in the near term, echoing the increased chance of slowing inflation without stalling economic growth. In Canada, equities are typically more cyclical in nature, which coupled with the potential for an earnings contraction, makes us view the Low Volatility factor as more likely to outperform. Like the U.S., we prefer Canadian high-quality companies to navigate through the late cycle environment. On the heels of poor Chinese economic data and underwhelming stimulus, we are maintaining our overweight to the U.S. relative to Canada and EAFE.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. - [pdf] Pivotal Select Estate Class Client Brochure

-

Two options for supporting plan members during the pandemic

We know these are difficult times. In addition to concerns about their health and the health of their family, working Canadians are worried about their jobs and their finances. Fortunately, through our partnership with Homewood Health®, we have two options for employers to support their employees through this crisis.

Below is an overview to refer to when you're meeting with your clients. Or you can download this PDF version.

Homewood Online (Homeweb)

All Equitable Life® clients and their plan members have access to Homeweb, a personalized online mental health and wellness portal. Accessible via the web or mobile app, Homeweb includes an online library of interactive tools, assessments, e-courses and resources to support plan members through the pandemic.

Homewood Health Employee and Family Assistance Program (EFAP)

Employers can provide additional support by adding the Homewood Health EFAP. In addition to full access to Homeweb, it offers confidential short-term counselling through a national network of mental health professionals, plus other resources and tools.

To make it easier to understand the options, here’s a detailed summary of what’s included with each:

Service Description Homeweb EFAP Homeweb.ca A secure and personalized online portal that includes hundreds of articles and resources, including e-books, toolkits, self-assessments, podcasts and more.

Homeweb Mobile App One of Canada’s newest EFAP mobile apps that allows users to access every one of Homewood’s online tools and resources wherever they are.

i-Volve Cognitive Behavioural Therapy Tool An online self-directed treatment tool that helps coach plan members to identify, challenge and overcome anxious thoughts, behaviours and emotions.

Online Health Risk Assessment An online tool that helps plan members identify and address their health and wellness risks and barriers.

Short-Term Counselling Short-term counselling provided face-to-face, by phone, email, chat or video through a national network of counsellors and clinical professionals.

Life Smart Coaching A suite of telephonic and online services including coaching and resources to help employees manage their life balance, finances, health and career. Online resources only.

Trauma response Prompt, compassionate and effective response to traumatic events, consisting of one three-hour block with one counsellor at one location per year.

Legal Resources One-on-one consultation with a lawyer for guidance on issues such as family law, civil litigation, real estate and immigration. Online resources only.

Key Person Advice Line (KPAL) Designed for HR, managers and supervisors, this service provides Online Management Resources and Workplace Situation Professional Support.

Resource Locator Online childcare and eldercare resources locators.

For more information, please contact your Group Account Executive or myFlex Sales Manager.

- [pdf] CAREpath

- About

-

Tools to manage mental health

As we all continue to manage the impacts of the COVID-19 pandemic, it’s important to remind your clients of the valuable supports available to help their plan members cope through this challenging time.

Free trusted information and COVID-19 resources

Our partner FeelingBetterNow® is responding to the pandemic by providing trusted public resources that offer mental health support. They are available to anyone 24 hours a day, seven days a week, and include:

- What to do if you’re anxious or worried about COVID-19;

- Resources for parents and caregivers; and

- National and Provincial Public Health resources.

Access COVID-19 resources from FeelingBetterNow.

FeelingBetterNow Mental Health Assessment

In addition to these public resources, Equitable Life clients with FeelingBetterNow as part of their group benefits plan have access to online mental health resources. FeelingBetterNow can help plan members identify their risk for mental health concerns and work with their doctor on diagnosis and treatment. It’s an anonymous tool developed by mental health experts which provides:

- Emotional and mental health assessments;

- Practical, evidence-based tools employees and their doctor can use to assess, treat, and follow-up on emotional and mental health concerns; and

- Convenient online access to information and effective resources.

FeelingBetterNow is easy to use and completely anonymous. It takes less than 20 minutes to complete the assessment and view your results.

Learn more about FeelingBetterNow, then contact your Group Account Executive or myFlex Sales Manager to discuss how your clients can add this service to their plan.

-

Welcome EZtransact from Equitable Life

On July 28, 2021, Savings & Retirement is launching online transactions for segregated funds. A new way to make managing your client’s policies quick and convenient. With a growing need for digital solutions, Equitable Life’s new EZtransact eliminates the hassle of filling out forms, facilitating signatures yourself, submitting copies to your MGA and being tied down to business hours for submitting transactions.

Available on EquiNet's secure website, EZtransact’s first service will allow advisors to setup a one-time or recurring deposit or edit an existing pre-authorized debit already in place. In just five simple steps, EZtransact:- Collects the deposit details,

- Pre-populates pre-existing relevant details,

- Alerts you to any missing information,

- Facilitates the signing process and

- Sends a copy of the transaction to your MGA, eliminating any need for duplicate copies, or additional steps.

“We are excited to be able to launch a new digital solution for our advisors”, said Vice-President, Savings and Retirement, Judy Williams. “We feel this new application complements our existing highly rated EZcomplete® online application process. With both solutions available to advisors, we are making it even easier to do business with Equitable Life”.

If you are already registered with EquiNet, go online today, and give EZtransact a try. If you are not registered, contact your local Regional Investment Sales Manager or, call our Advisor Services Team to have a Regional Investment Sales Manager in your area contact you.

To learn more, click here.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada

-

Step Up Your Wealth Sales with Equitable Life

Step up your wealth sales with Equitable Life® and you’ll be rewarded with a growth bonus for doing more business in 2022. Make this year your best year ever with Equitable Life!

The program rewards advisors who promote Equitable Life’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account (GIA) contracts

+ 25% of payout annuity sales

― Segregated fund redemptions

― GIA redemptions

= 2022 Net Deposits

All eligible deposits, sales, and redemptions occurring between January 1 and December 31, 2022, will be used to calculate an advisor’s 2022 net deposits.

* The bonus amount will be calculated at the end of 2022 based on net deposits. The bonus will be paid within 90 days following December 31, 2022. Maximum bonus payable is $75,000.

For more information, download our flyer or contact your Equitable Life Regional Investment Sales Manager.

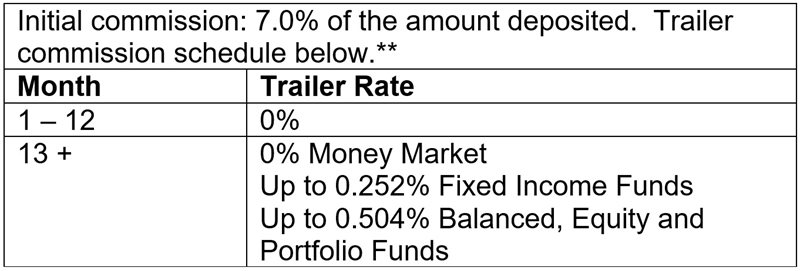

And as a reminder, we increased the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.** Learn more.

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

** Equitable Life reserves the right to end the campaign, at any time and without notice.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada. -

7% No Load CB5 Initial Commission – Limited time offer extended to December 31, 2022 for Investment

We are pleased to announce the temporary increase to the CB5 sales option initial commission from 5.6% to 7.0% has been extended to December 31, 2022 on Pivotal Select™ Investment Class (75/75) only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Equitable Life reserves the right to end the campaign, at any time and without notice. Prior temporary increase to CB5 sales option initial commission for Pivotal Select Protection Class 100/100 and Pivotal Select Estate Class 75/100 ends August 31, 2022.

** Applies to FundSERV trades occurring between September 1 and December 31, 2022. Initial commission on non-FundSERV trades occurring between September 1 to December 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™ or ® denote trademarks of The Equitable Life Insurance Company of Canada.