Site Search

271 results for Buy fc 26 coins Buyfc26coins.com Their customer service is very responsive..6gfc

- [pdf] Insights into Non-registered taxation

- About

-

Equitable Life Group Benefits Bulletin - November 2022

The importance of timely plan member eligibility updates*

Effective Dec. 1, 2022, we are implementing a revised process for managing plan member and dependent health and dental claims that have been incurred and paid after coverage has been terminated. This new process is consistent with industry practices.

If health or dental claims have been incurred and paid after a plan member’s termination date but before we received notice of the termination, we will align the plan member’s or dependent’s termination date with the service date of the last paid claim, retaining premiums up until that date.

If no claims have been incurred and paid after the termination date, Equitable Life will process the termination as requested and refund any excess premium, subject to a maximum premium refund credit of three months.

Currently, we process the termination as requested and attempt to recover any claim overpayments directly from the plan member. We then refund any excess premiums that have been paid, subject to the maximum refund credit amount.

To avoid claims being incurred and paid after a plan member’s termination date, it is important for your clients to update plan member and dependent eligibility dates on or before the effective date of the change.

If you have any questions about the process your clients should follow for updating plan member eligibility, please contact your Group Account Executive or myFlex Sales Manager.QuickAssess®: Absence and accommodation request review services*

It can be difficult to navigate chronic or complex cases of absenteeism or accommodation requests. That’s where QuickAssess® can help.

QuickAssess is an optional, fee-per-use service that can provide your clients with an unbiased, timely assessment of complex plan member absences and workplace accommodation requests. Our disability experts can provide recommendations to help your clients manage:- Workplace absences

- Chronic or patterned absenteeism

- Requests to modify workplaces or duties

- Return-to-work coordination

- Employee Insurance sick leaves

For more information on using QuickAssess, including eligibility requirements, please contact your Group Account Executive or myFlex Sales Manager.

**Within two business days of receiving a completed QuickAssess Absence and Accommodation Review Referral Form and all required information. For more complex referrals, more time will be required.Finding a health care provider with TELUS eClaims direct billing*

By visiting TELUS’s Find a Provider page, your clients’ plan members can now easily search for paramedical and vision providers who are registered on the TELUS Health eClaims network and who can submit claims directly to us on behalf of their patients. Searches can be filtered by postal code to help plan members find the most convenient provider options.

As our direct billing provider for pharmacy, vision and paramedical claims, TELUS Health has an extensive network of 70,000 health care providers that provide direct billing to streamline the claims process.

Please note, plan members should always check Equitable Life’s list of de-listed providers before selecting a health care provider. The list is available for your clients and their plan members on EquitableHealth.ca, and is updated regularly.

For more information about TELUS eClaims, please contact your Group Account Executive or myFlex Sales Manager.First phase of the Canada Dental Benefit proposed for Dec. 1, 2022*

The federal government’s new Canada Dental Benefit is proposed to take effect on Dec. 1, 2022, subject to Parliamentary approval. The program will cover eligible expenses retroactive to Oct. 1, 2022, and this first phase would apply to Canadians under 12 years of age.

If implemented, the Canada Dental Benefit will provide dental care to Canadian families with under $90,000 adjusted net income annually. By 2025, the federal government expects to extend the benefit to children under 18, senior citizens and Canadians with disabilities.

Parents or guardians will be required to apply for this coverage through the Canada Revenue Agency (CRA) and must not have private dental coverage for the child(ren).

This new program will have no impact on your clients’ dental coverage and no action is required on their part.

* Indicates content that will be shared with your clients.

- [pdf] Equitable's Competitive Advantage

- [pdf] Pivotal Select Protection Class (Client brochure)

-

Short-term disability coverage for plan members in quarantine or self-isolation*

Please note: This announcement applies only to groups with short-term disability coverage through Equitable Life

With the spread of COVID-19, many people have been instructed to self-isolate or quarantine themselves or are doing so voluntarily. We realize this is a stressful situation for people and they may be wondering if they are eligible for disability benefits. Short-term disability is designed to replace a plan member’s earnings if they are unable to work due to illness and injury. As a result, only plan members who meet the following criteria are eligible for benefits:

- Plan members who have tested positive for COVID-19 and are unable to work from home are eligible for coverage from Day 1 of their self-isolation period.

- Plan members who have not been tested but have symptoms consistent with COVID-19 and are unable to work from home, are eligible for coverage. Claims will be assessed according to the terms of the plan.

Plan members who are in quarantine for any other reason, but do not have symptoms consistent with COVID-19, are not eligible for coverage. These plan members should consider applying for Employment Insurance (EI) benefits, if they do not have an option to work from home.

Submitting COVID-19-related STD claims

To make things easier for plan members who need to submit claims related to COVID-19, we will not require a physician’s statement. Instead plan members should submit our simplified Short Term Disability Plan Member COVID-19 Claim Form.

Plan Administrators need to complete their portion of the regular Short Term Disability Form (Form #421).

This is a temporary process that will remain in effect through the current coronavirus situation. We will update on changes and share them on EquitableHealth.ca.

Applying for the Employment Insurance sickness benefit

Canadians quarantined due to COVID-19, who are not receiving Short Term Disability benefits, can apply for Employment Insurance (EI) sickness benefits. The one-week waiting period for EI sickness benefits has been waived. Service Canada’s dedicated toll-free support number is 1-833-381-2725 or (TTY) 1-800-529-3742.

*Indicates content that will be shared with your clients

-

This year’s RSP contribution deadline is March 1, 2022

Does your client want to contribute or open a new policy this Retirement Savings Plan (RSP) season? Whether using paper or our recent EZtransact online platform, here are some important things to remember.

Issuing New Policy with EZcomplete®

-

All online applications must be digitally signed and submitted and have a date stamp no later than March 1, 2022.

Issuing New Policy using Paper Application-

For contributions to qualify for the first 60 days, all paperwork must be completed and signed by March 1, 2022. Equitable Life must receive all paperwork by March 7, 2022.

Deposits to Existing Policy

-

Advisors can setup a one-time or recurring deposit or edit an existing pre-authorized debit already in place using EZtransact. Online deposits must be made and have a date stamp by March 1, 2022, to qualify for a 2021 tax receipt. New to EZtransact? Try our EZtransact Practice Site to see how EZ it is to use.

-

Clients can make online deposits to Equitable Life® through their financial institution’s online banking service. Online deposits must be made and have a date stamp by March 1, 2022, to qualify for a 2021 tax receipt.

-

Clients can also make a new deposit to an existing policy by cheque. The cheque must be dated and signed by March 1, 2022. Equitable Life must receive the cheque no later than March 7, 2022.

If online banking is being used to fund the policy – either topping up an existing policy or opening a new policy – the online banking transaction must be completed by March 1, 2022, to receive a 2021 tax receipt.

Do not miss your opportunity to have your contributions count for 2021!

Please note that cheques and other paperwork cannot be backdated. They must be completed and signed by March 1, 2022, to qualify for a 2021 tax receipt.

® denotes a trademark of The Equitable Life Insurance Company of Canada.

-

-

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

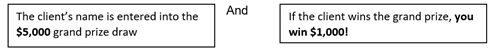

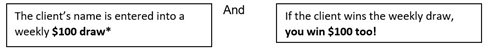

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy

See full contest details. Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

* Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Grow Your Future RSP Contestt: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 20232, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules. -

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy*

Full contest details.

Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

*Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Equitable Life® 2023 RRSP Season Contest: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 2023, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules.

Posted December 1, 2022

-

Dialogue Virtual Healthcare now available to add to Equitable Life benefits plans

We’re pleased to announce we are partnering with Dialogue, Canada’s leading virtual health provider, to offer unlimited and on-demand virtual access to primary healthcare practitioners.

Virtual Healthcare is the latest addition to our HealthConnector suite of health and wellness services. It is available to add to all Equitable Life benefits plans for an additional cost as of July 1, 2023.Features of Dialogue Virtual Healthcare

Available 24/7, 365 days a year, Dialogue Virtual Healthcare provides access to unlimited non-urgent medical care for a wide range of health concerns. Plan members get fast access to the largest, most experienced and bilingual medical team in Canada for non-urgent medical issues. They also benefit from in-app prescription renewals and refills, personalized follow-ups after every consultation, and concierge-level navigation support for all referrals to in-person specialists when needed.

Dialogue’s industry-leading platform provides an all-in-one patient journey to address health issues, reducing long wait times and time away for doctor appointments. Plan members and their families can access Dialogue Virtual Healthcare through the secure web portal or mobile app. The Dialogue medical team includes doctors, nurse practitioners and nurses. Plan members can use the service even if they’re already receiving care from a family doctor.

For your clients

Benefits of Virtual Healthcare

By providing access to Virtual Healthcare, plan sponsors can help to:-

Drive employee engagement;

-

Reduce absenteeism related to in-person medical appointments;

-

Manage chronic health issues;

-

Attract and retain top talent; and

-

Build a healthier workforce.

By providing easier access to primary healthcare practitioners, Virtual Healthcare can offer extra health and wellness support for plan members. It also supports members that may experience barriers to accessing in-person healthcare, such as:-

Living in a remote location;

-

Work or family obligations during standard medical clinic hours;

-

Mobility challenges related to a disability; and

-

Transportation challenges.

Click the link to learn more about Dialogue Virtual Healthcare : Welcome to Dialogue!Questions?

To learn more about how your clients can add Virtual Healthcare to their benefits plan, please contact your Group Account Executive or myFlex Sales Manager. -