Preferred life insurance solutions - corporations

A business owner’s net worth is tied up in their company. That creates some unique challenges for them:

Equitable has the solutions to help your corporate clients meet these goals.

- How do they get their shares out of the corporation and into the hands of their heirs as tax-efficiently as possible?

- How can they structure the corporate investments to minimize tax?

- How do they access the value of their business to supplement their retirement?

Equitable has the solutions to help your corporate clients meet these goals.

|

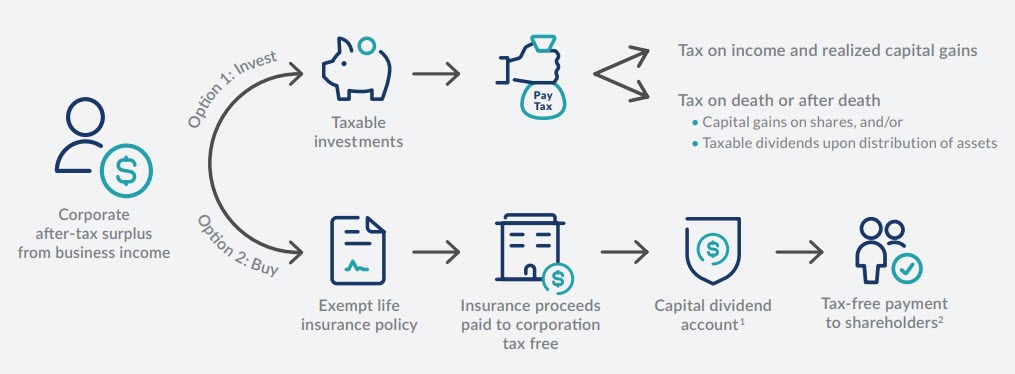

Corporate Preferred Estate Transfer By redirecting some of their after-tax surplus from business income into a corporately-owned life insurance policy rather than taxable investments, corporate clients can reduce the fair market value of the corporation thereby reducing capital gains tax and increase the value of their estate. |

.jpg) |

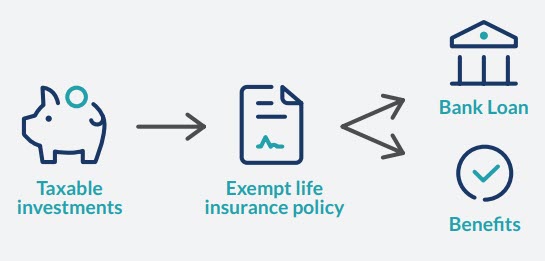

| Corporate Preferred Retirement Solution This concept is an extension of the Corporate Preferred Estate Transfer. Either the shareholder or the corporation may be able to access the cash surrender value by applying for a bank loan using the corporately-owned life insurance policy as collateral. Life policy collateral loans. Find out more. |

|

Advisor Guide

Marketing Materials

Interested in ordering marketing materials? Complete our Life & Health supply order form| Form Number | Cover | Marketing Material Name | Available Languages | Product |

|---|---|---|---|---|

| 1562 |

|

Corporate Preferred Estate Transfer (generic flyer)

File

Provides a generic overview of the Corporate Preferred Estate Transfer concept without a specific reference to Equimax participating whole life or Equation Generation IV universal life. |

FR | Sales Strategies |

| 1570 |

|

Corporate Preferred Estate Transfer using Equimax

File

Are your clients looking for the most tax-efficient way to get the value of their shares out of their company and into the hands of their estate? Choose the Corporate Preferred Estate Transfer. |

FR | Sales Strategies |

| 1688 |

|

Corporate Preferred Estate Transfer using universal life

File

The Corporate Preferred Estate Transfer is the most tax-efficient way for clients to get the value of their shares out of their company and into the hands of their estate. |

FR |

Critical illness Insurance Sales Strategies |

| 2011 |

|

Corporate Preferred Estate Transfer® using whole life

File

If clients are looking for the most tax-efficient way to get the value of their shares out of their company and into the hands of their estate, consider the Corporate Preferred Estate Transfer using a participating whole life insurance policy. |

FR |

Participating Whole Life Sales Strategies |

| N/A | Tips for illustrating concepts using WL CORPORATE (Preferred Retirement Solutions using Equimax) File | FR | Participating Whole Life | |

| 1816 |

|

Corporate Preferred Retirement Solution (corporate borrowing) (generic flyer)

File

Provides a generic overview of the Corporate Preferred Retirement Solution concept without a specific reference to Equimax participating whole life or Equation Generation IV universal life. |

FR | Sales Strategies |

| 1815 |

|

Corporate Preferred Retirement Solution (corporate borrowing) Checklist

File

Review this checklist with your clients to ensure they understand the Corporate Preferred Retirement Solution (corporate borrowing) and how it can impact them and their business. |

FR | Sales Strategies |

| 1840 |

|

Corporate Preferred Retirement Solution (corporate borrowing) using Equimax

File

Corporate Preferred Retirement Solution (corporate borrowing) using Equimax whole life insurance. |

FR | Participating Whole Life |

| 1563 |

|

Corporate Preferred Retirement Solution (shareholder borrowing) (generic flyer)

File

Provides a generic overview of the Corporate Preferred Retirement Solution concept without a specific reference to Equimax participating whole life or Equation Generation IV universal life. |

FR |

Participating Whole Life Universal Life |

| 1556 |

|

Corporate Preferred Retirement Solution (shareholder borrowing) Checklist

File

Review this checklist with your clients to ensure they understand the Corporate Preferred Retirement Solution (shareholder borrowing) and how it can impact them and their business. |

FR |

Participating Whole Life Universal Life |

| 1571 |

|

Corporate Preferred Retirement Solution (shareholder borrowing) using Equimax

File

Corporate Preferred Retirement Solution (shareholder borrowing) using Equimax whole life insurance. |

FR | Participating Whole Life |

| 1569 |

|

Tax and estate planners' guide to corporate life insurance

File

This guide is a support piece for tax and estate planners who want a high-level review of two unique planning opportunities using corporately-owned life insurance to help meet estate & retirement needs. |

FR | Sales Strategies |