Site Search

70 results for investor profile

-

Elevate your business with industry best practices and needs-based selling

Keeping your business aligned with industry best practices is vital for your success. It not only supports the fair treatment of clients – it also helps you meet certain market conduct requirements and Equitable’s expectations for needs-based selling.

The Financial Services Regulatory Authority of Ontario (FSRA) has a program that checks how well advisors follow the Insurance Act and its conduct rules. FSRA looks at how well advisors follow industry best practices and fair treatment of clients guidance (see CLHIA’s guidance document, “The Approach”). Their focus is on key areas such as giving sound advice, managing conflicts of interest, and putting clients’ needs first. FSRA selects advisors’ client files and looks for documentation that indicates needs-based selling.

In December 2024, FSRA released its latest Market Conduct Supervision Report. It highlights the need for advisors to follow certain rules and industry best practices. The report found five key areas where improvement is needed:

1. Missing notes from client meetings and calls

2. Inadequate advisor disclosure

3. Missing sales illustrations for different product options

4. Missing insurance needs analysis

5. Missing policy delivery receipts

By following industry best practices and keeping thorough records, you show your commitment to providing clients with the solutions they need. For example, taking notes during client meetings helps you track all discussions that support your recommendations. Having an insurance needs analysis shows you are providing clients with suitable advice to buy the solutions that best meet their needs.

Resources: Equitable® has resources that can help improve your business practices and help you treat clients fairly. We encourage you to check these out:

1. PPT: “Ensuring a Compliant, Needs-based Insurance Sale”. The steps to follow in needs-based selling and the records to keep.

Get CE credits! We offer the above as a self-study course that qualifies for 1 Continuing Education (CE) credit. Access it here: https://equitable-life-education.teachable.com/. (Use your contracted email to log in).

2. Client File Reference: The records to keep when selling investments, life insurance, or critical illness insurance, including key documents insurers and regulators look for during compliance audits.

3. Investor Profile Questionnaires: These will help you document your sales recommendations for:

● Universal Life (UL) sales: 1190.pdf, and

● Pivotal Select (Segregated Fund) sales: 1165.pdf

Questions? Contact your Equitable wholesaler. They are ready to support your success!

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada. - Savings & Retirement Marketing Materials

-

EAMG - Macro Tear Sheet – Recent Market Volatility Summary

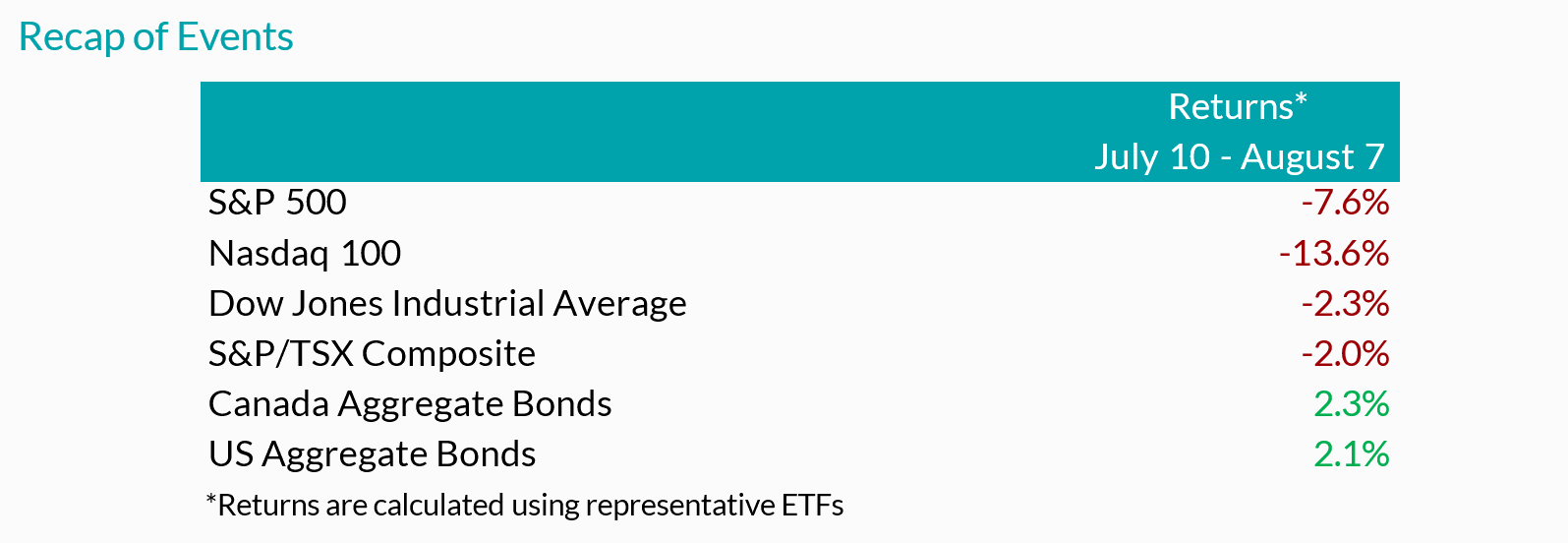

By separating the noise from the signals, we believe the rotation away from the mega-cap technology names is likely to continue. Recent market volatility, triggered by a multitude of factors that include the unwind of the carry trade, investor reactions to mixed mega-cap earnings, and U.S. economic data, may present more investment opportunities for long-term outperformance. Recall over the past year that the majority of U.S. stock market performance came from a limited number of mega-cap technology companies and, in our view, moving forward it will be prudent to analyze the source of returns as rapid market rotations may punish overly-concentrated portfolios.

Inflation Slows (July 11) – Headline U.S. inflation readings increased 3.0% year-over-year in June, decelerating from May (3.3%). With prices slowing ahead of forecasts but economic growth remaining strong, investors became more confident regarding the prospects of an economic soft landing.

Outcome: market strength broadened with traders rotating out of highly concentrated areas of the market (“Fabulous 5”) and into more economically sensitive stocks that had been left behind.

• Big Tech Earnings (July 23 – Aug 1) – High profile mega-cap technology companies – including many members of the Magnificent 7 – reported earnings growth that generally surpassed expectations as margins remained healthy. That said, investors were more focused on spending towards AI-initiatives, rewarding businesses with greater success translating their AI investments into higher sales.

Outcome: this trend is evident through the divergence of returns from IBM and Alphabet (Google’s parent company) after releasing their quarterly earnings. The limited number of companies that contributed to the returns of the S&P 500 failed to impress investors, extending the rotation into other areas of the market.

• Caution is Brewing – Following a strong rally of economically sensitive pockets of the market, notably a breakout of returns from U.S. small cap companies, the low volatility factor, which tends to outperform during times of stress, moved in sync with the small caps’ strength.

Outcome: with a lack of fundamental justification supporting small cap performance, markets showed signs of caution.

• Central Bank Decisions (July 31)– The Federal Reserve held interest rates unchanged during its July meeting, in line with market expectations, reiterating committee members’ need for greater confidence that inflation would continue to subside. That said, policymakers signaled a reduction in policy rates could be a possibility in the coming meetings. In contrast, the Bank of Japan (BoJ) increased its key interest rate while also announcing plans to scale back bond purchases – restrictive monetary policy maneuvers aimed at backstopping the depreciating Japanese currency.

Outcome: the bifurcation between the BoJ and most other major central banks sparked a sharp appreciation of the yen and a rapid unwind of the yen carry trade (see below for explanation).

• Growth Scare (August 2)– In early August, a downside surprise in U.S. nonfarm payrolls (114k actual versus 175k expected) and an increase in the unemployment rate to 4.3%, higher than the 4.1% that was expected and up from 3.5% a year ago triggered concerns of a cooling labor market.

Outcome: speculation swelled surrounding the pace of rate cuts with market participants expecting the Federal Reserve to cut rates as much as 125bps over the next 3 policy meetings, up from 50-75bps as of the end of July. Against this backdrop, the ongoing unwind of the yen carry trade accelerated.

Yen Carry Trade Explained

• Simply put, investors have been borrowing Japanese yen – a low yielding currency – to invest in higher-yielding foreign assets. The primary risks in a carry trade can include the uncertainty of foreign exchange rates (if unhedged), as well as changes to expectations of the underlying yields, among other risks. Over the last 2 decades, the BoJ has implemented an ultra-low interest rate monetary policy to combat deflation and stimulate growth. Furthermore, investors were emboldened by the Japanese yen’s ~53% depreciation versus the U.S. dollar over the last 10 years. With the BoJ hiking its key interest rate while also announcing plans to scale back bond purchases, the yen rallied abruptly. Consequently, highly leveraged investors have had to exit their long positions in riskier assets to repay their borrowed yen exposure.

Peak Carry Trade Unwind – Buying Opportunity

• Peak carry trade unwind, which implies heightened panic levels, has historically created an attractive buying environment. That said, we are focused on companies that have demonstrated robust earnings growth and healthy leverage. Given the unprecedented level of market concentration over the last year, we view the unwind of the carry trade as another catalyst for investors to rotate out of the “Fabulous 5”.

Our Findings:

We found that the peak unwind of the carry trade may be a buying opportunity. At present, the current level of the unwind is similar to many notable market bottoms, including the Great Financial Crisis (2008), the European debt crisis (2010), the oil crash (2014), the subsequent emerging market crisis (2015), the Covid-19 crash (2020), and the collapse of Silicon Valley Bank (2023). We assessed the degree of the unwind by looking at the one-month implied volatility between three currency pairs, U.S. Dollar/Yen, Australian Dollar/Yen, and Euro/Yen. Implied volatility is a measure of the expected future volatility of the underlying assets over a given time period. Amid strong earnings growth and steady margins from quality businesses within the U.S. market, the fundamental backdrop suggests that businesses outside the concentrated AI-darlings may drive the next leg of market returns.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. - [pdf] S&R Supply Order Form

-

Delegation Requests Now Available on EquiNet

We are excited to announce a new feature that will help make it easier for you to do business with Equitable Life.

This new feature allows you, to submit a delegation request through the “Access” tab under your EquiNet profile.

Once the delegation request has been completed, the specified people will be able to view and manage the policies of the Advisor who submitted the request, as long as they have codes of their own within the system.

Please contact the customer service team at customerservice@equitable.ca for more information. - [pdf] Product Portfolio Comparison Guide

-

EAMG Market Commentary July 2024

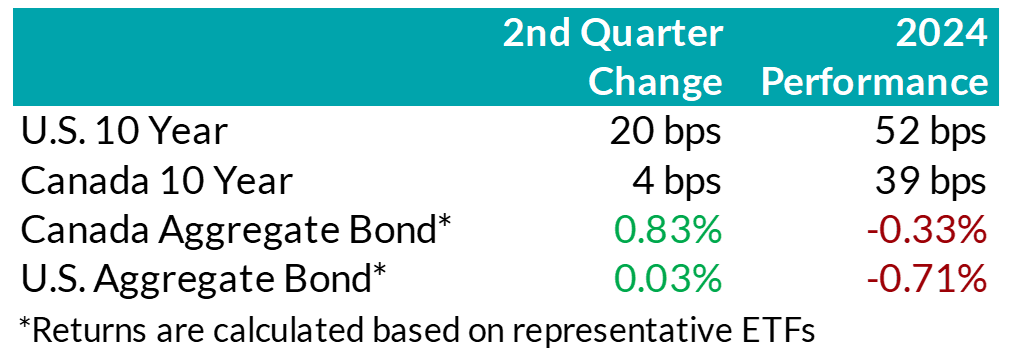

.png) Rates & Credit – In Q2 2024, U.S. inflation and economic growth data was mixed, leading to moderately higher interest rates in the U.S. Meanwhile, in Canada, long-end interest rates were little changed during the quarter, but short-term interest rates fell. That was due to the weaker economic outlook, as well as the Bank of Canada’s decision to reduce its overnight interest rate in June, with anticipation of further monetary policy easing to come. Canadian corporate bonds returned 1.1%, outperforming the 0.8% return of government bonds as well as the 0.9% return for the overall FTSE Canada Universe Bond index. Shorter-dated bonds outperformed longer-dated bonds. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries that have shorter-dated debt (e.g. real estate and financials) outperformed those that tend to have longer-dated debt (e.g. communications and infrastructure).

Rates & Credit – In Q2 2024, U.S. inflation and economic growth data was mixed, leading to moderately higher interest rates in the U.S. Meanwhile, in Canada, long-end interest rates were little changed during the quarter, but short-term interest rates fell. That was due to the weaker economic outlook, as well as the Bank of Canada’s decision to reduce its overnight interest rate in June, with anticipation of further monetary policy easing to come. Canadian corporate bonds returned 1.1%, outperforming the 0.8% return of government bonds as well as the 0.9% return for the overall FTSE Canada Universe Bond index. Shorter-dated bonds outperformed longer-dated bonds. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries that have shorter-dated debt (e.g. real estate and financials) outperformed those that tend to have longer-dated debt (e.g. communications and infrastructure).

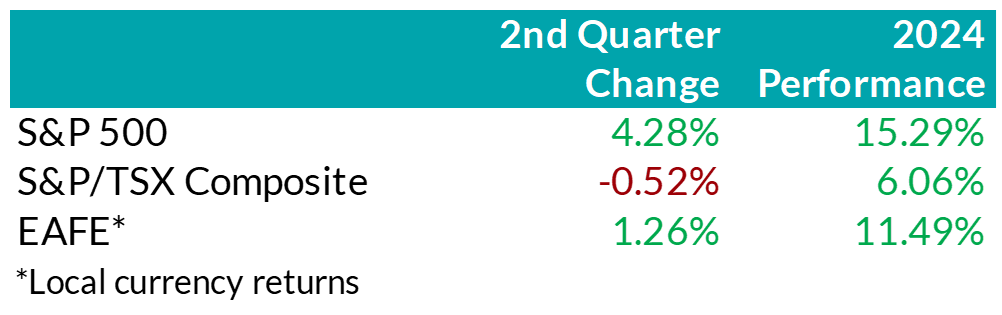

.png) Equity Overview – Against the backdrop of volatile inflation data and a lack of indication from the Federal Reserve that it was prepared to start cutting interest rates yet, U.S. equity markets decoupled from other regions. Crowding into AI-focused, mega-cap names accelerated in Q2. More specifically, investors defaulted toward the Magnificent 7 to navigate the current period, overlooking broadening earnings breadth and less expensive valuations from the remaining S&P 493. Outside the U.S., equity returns were generally mundane in dollar terms. That said, emerging markets proved to be a bright spot for investors seeking value, as the rebound in heavily discounted Chinese equities helped push frontier markets higher.

Equity Overview – Against the backdrop of volatile inflation data and a lack of indication from the Federal Reserve that it was prepared to start cutting interest rates yet, U.S. equity markets decoupled from other regions. Crowding into AI-focused, mega-cap names accelerated in Q2. More specifically, investors defaulted toward the Magnificent 7 to navigate the current period, overlooking broadening earnings breadth and less expensive valuations from the remaining S&P 493. Outside the U.S., equity returns were generally mundane in dollar terms. That said, emerging markets proved to be a bright spot for investors seeking value, as the rebound in heavily discounted Chinese equities helped push frontier markets higher.

U.S. Fundamentals – Corporate earnings continued to surpass expectations last quarter with stable operating margins helping businesses report better-than-expected bottom line results. Investors remain focused on the ability of companies to sustain debt levels ahead of renewing debt obligations, rewarding businesses with a strong ability to generate stable cash flows. Moreover, while prior quarters have witnessed earnings growth that was largely driven by highly profitable mega-cap technology stocks, U.S. markets are witnessing a broadening trend in earnings strength, with previously stunted segments of the market recovering. Our work shows that members of the Russell 1000 index, excluding the Magnificent 7, posted a median earnings growth of about 6% last quarter, with nearly 60% of companies increasing earnings versus the year prior. Furthermore, we observed an increase in the number of major companies that expect improving financial performance to approximately 27%, suggesting that the recovery in earnings breadth may persist.

U.S. Quant Factors – As mentioned, concentration in the equity market drove a surge in valuations as investors continued to chase specific mega-cap technology stocks. In fact, within the Russell 1000 growth factor – which screens for companies whose earnings are expected to grow at an above-average rate relative to the market – the Magnificent 7 totaled nearly 55% of the entire index by quarter-end. In addition, the Nasdaq 100 – which is generally viewed as a technology-biased index – saw the weight of the Magnificent 7 rise to almost 43% of the entire index by the end of the quarter. Furthermore, the equal-weighted S&P 500 underperformed the cap-weighted index by nearly 7% last quarter, bringing the year-to-date divergence to about 10%. With concentration accelerating, the cap-weighted index outperformance has soared past Covid-era levels, a period that saw investors rapidly crowd into profitable technology names due to panic and economic uncertainty. We remain cautious of a severely crowded market that trades near all-time highs as strong performance from 5-7 names distorts the overall stature of market conditions.

Canadian Fundamentals – Although Canadian companies exceeded bleak forecasts, earnings continue to contract on a year-over-year basis. Furthermore, earnings revisions have grinded lower with easing monetary conditions unable to offset concerns of a slowing economic environment. We note the sharp contrast versus the U.S. as the bifurcation of earnings performance widens. The CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges as metals rallied higher despite a stronger U.S. dollar and elevated interest rates. The mining industry benefited from a sustained elevation in prices, helping the materials sector outperform over the quarter. Returns from the heavily-weighted Canadian banks were constrained last quarter with company-specific drivers – including regulatory challenges from TD, and underwhelming U.S. results from BMO – limiting performance. More broadly, the banks continue to build prudent credit provisions to mitigate uncertain economic forecasts and remain well capitalized.

Canadian Quant Factors – With investors remaining attentive to businesses’ ability to create value relative to financing costs, we see value in high quality, dividend-paying companies with strong earnings sustainability and a healthy degree of leverage. Based on our work, investors of the Canadian banks appear well compensated, with the current premium between value creation and current yield remaining compressed. In our opinion, the market has modest expectations regarding prospects for value generation from the banks and, therefore, we believe the industry stands to benefit if the premium reverts closer to historical norms. We also continue to see sources of quality dividend opportunities within certain areas of the energy sector. More specifically, we believe companies that have taken steps to improve their balance sheets through deleveraging efforts, and with improved operating leverage, offer attractive prospects given their stable and high-yielding composition.

Views From the Frontline

Rates – During the first half of the second quarter, interest rates in both Canada and the U.S. increased, continuing the upward momentum from Q1. Higher-than-expected inflation data in the U.S. along with mixed economic growth data caused investors to push out expectations for when the U.S. Federal Reserve would start lowering its interest rate. This trend shifted in the second half of Q2, as positive economic momentum slowed in the U.S. economy and inflation data began to soften. Interest rates in Canada declined more rapidly than in the U.S. due to more benign inflation, a weaker job market, and economic growth remaining below population growth. This economic weakening provided the confidence required for the Bank of Canada to cut rates by 25 basis points in June to 4.75%. The Bank also signaled that if inflation continues to ease and the Bank’s confidence grows that inflation would continue to trend toward its 2% inflation target, it is reasonable to expect further cuts. The second quarter marked a pivotal point for the global policy easing cycle. Sweden, Canada, and the European Central Bank all began lowering their policy rates, and Switzerland made a second rate cut, following one in Q1. The market continues to speculate on the timing of the U.S. Federal Reserve’s first rate cut. Interest rate cut expectations are largely unchanged in Canada since last quarter, with a total of three rate cuts expected throughout 2024. Expectations for the rate cuts by the U.S. Federal Reserve declined slightly, however, to two cuts in 2024.

Credit – The risk premium for corporate bonds (versus government bonds) was largely flat over the quarter, with spreads approaching the tight post-pandemic levels experienced in 2021. Corporate bond supply continues to be very robust, with $41bn in new issuance. Year-to-date, corporate issuance has set a new record, with an impressive $80bn in issuance. On balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward trade-off as being more favourable.

Equity – On the backdrop of a heavily concentrated U.S. market rally, we remain cautious of the distortion to market returns from high-flying technology stocks. As a result, we continue to favour a combination of the Dow Jones Industrial Average and the S&P 500 for our broad U.S. market exposure. The Dow provides a more diversified exposure to 30 prominent large-cap companies and less concentration in technology relative to the S&P. Broadening earnings strength presents an opportunity for previously out-of-favour names to “catch-up”. In our view, companies outside the Magnificent 7 that have demonstrated robust earnings growth, strong cash flow generation, along with decreased debt loads, are well-positioned to benefit from internal market rotations. As such, we gain exposure to these companies through the quality factor – companies with higher return-on-equity, strong operating performance, and healthy leverage levels – and the dividend growth factor – businesses with a lengthy and established history of increasing dividends.

In Canada, we remain attentive to how efficiently corporations are generating profits relative to financing costs. Looking forward, we continue to monitor the ability of businesses to generate profits given a decline in capital spending. More specifically, we are focused on businesses’ ability to grow and sustain dividends amid the lag between easing monetary conditions and consumption. Due to this, we observe value in higher yielding companies that are higher on the spectrum of quality. Geographically, we maintain our overweight U.S. exposure, underpinned by encouraging U.S. inflation data trends, broadening corporate earnings growth, and normalizing consumption. In addition, sluggish Chinese data and the lack of positive earnings revisions from EAFE tilt the risk-adjusted return profile in favour of the U.S. Lastly, as a Canadian investor, fluctuations in the Loonie’s relative value versus other major currencies continues to present tactical trading opportunities within our investment mandate.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

- [pdf] Pivotal Select Estate Class Client Brochure

-

Updated Temporary Resident Guidelines – Student Permit Requirements

We are pleased to announce that we have clarified the student permit requirements of our Temporary Resident Guidelines.

● The guidelines for Student Visa holders attending elementary and secondary school students have been outlined in further detail.

● The guidelines for Student Visa holders attending post secondary educational institutions have been enhanced with additional details regarding professional programs, as well as post-secondary programs not included in the professional program category.

Read more about the details of the changes in the updated Residency Guidelines form 1530.

We have also added an additional note to the 1343 Evidence of Insurability to specify the following:

● If in Canada for less than 1 year, Paramedical, Blood Profile with Hepatitis screens and Urinalysis tests are required for applicants of attained age 17 or over.

Read more about the details of the change in the updated Evidence of Insurability 1343.

Please contact your local wholesaler for more information.

-

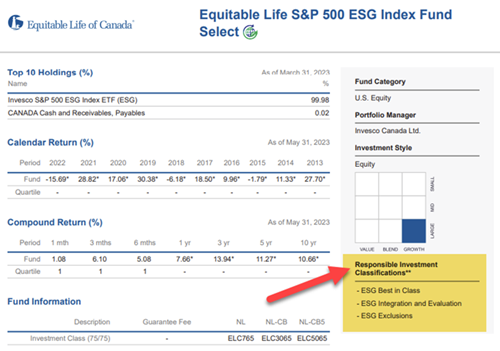

Responsible investing classification on Equitable Life Pivotal Select funds

Recently, the Canadian Investment Funds Standards Committee (CIFSC) classified responsible investing funds under its RI identification framework. The goal of the framework is to help investors and advisors identify and compare responsible investing funds.

We’re pleased to share that the following funds have been assigned multiple responsible investment classifications:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life S&P 500 ESG Index Fund Select

• Equitable Life S&P/TSX Composite ESG Index Fund Select

• Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Climate Leadership Fund Select

You can find the new responsible investment classifications for our funds by visiting our Fund Information webpage. After selecting a fund with the “Sustainable Investment” icon, the classifications can be found on the right side of the webpage or fund profile PDF:

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted: June 26, 2023