Site Search

756 results for form to restart a pac on insurance

-

We hear you. Equitable Life was ranked #1 for overall segregated funds service performance*.

Each year, Life Ops Consulting Group conducts an independent survey of financial advisors to find out

how satisfied advisors are with the service they receive from life insurance companies in Canada. Since 2015, Equitable Life® has received top marks in overall segregated funds service performance, new business processing, fund/policy statements and post-sales service.

Equitable Life was ranked #1 for overall segregated funds service performance*

We would like to take this opportunity to thank each of you that took the time to participate in this survey. We are proud of the service that we provide and are committed to listening to what advisors want and need to run their business. We work hard to earn your trust and will do what it takes to keep it.

Thank you.

* Life Ops Consulting Group Distribution Service Satisfaction Survey 2019

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

Equitable Life presents Invesco Canada – Global perspectives in a highly uncertain time

The COVID-19 pandemic has shaken the global economy. Uncertainty in the market is leaving investors unsure of what is next and asking where do we go from here? Please join Michael Hatcher, Head of Global Equities and Director of Research for Invesco Canada as he shares his insight in the global equity space.

Equitable Life® is pleased to highlight access to Invesco Global Companies Fund, Invesco International Companies Fund, and Invesco Europlus Fund in the Pivotal Select™ segregated fund line-up.

Register now

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. In order to be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

-

DBRS Morningstar reaffirms Equitable Life’s Financial Strength Rating and Issuer Rating

DBRS Morningstar confirms Equitable Life’s Financial Strength Rating and Issuer Rating at A (high) with Stable Trends. Equitable Life of Canada is pleased to be able to maintain the confidence of the global credit rating agency DBRS Morningstar.

A Financial Strength Rating is DBRS Morningstar’s assessment of an insurance company’s ability to make timely and full payment of its obligations on policyholder claims and benefits as well as financial contract guarantees and benefit obligations. An Issuer Rating reflects DBRS Morningstar’s assessment of that issuer’s likelihood of default and considers the issuer’s fundamental creditworthiness and business and financial risks.

For more information, please see the DBRS Morningstar Media Release.

-

Equitable Life Savings & Retirement Webinar Series featuring Invesco Europlus

In 2021, Equitable Life’s S&R team will spotlight various aspects of our competitive fund line up and product offerings. Each webinar in the series will feature a new topic. The series will also give advisors an opportunity to:

-

learn more about various products and product features,

-

hear from industry professionals,

-

learn about investment strategies; and so much more.

This month, Equitable Life welcomes Invesco Canada to highlight Invesco’s Europlus Fund. Join your host, Joseph Trozzo, Investment Sales Vice President as he welcomes Matt Peden, Portfolio Manager, and Kimberley West, Client Portfolio Manager.

Learn More

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only. -

-

Anytime. Anywhere! Equitable Client Access

At Equitable Life®, we know that managing your clients’ requests can keep you busy. We also know providing the opportunity for your clients to self-serve can allow you to focus on their future. That’s why our online client site, Equitable Client Access ensures your clients have all the information about their individual investment and insurance policy information that they need, right at their fingertips.

Our secure client site gives your clients access to:

- Tax Slips *NEW*

- Coverage and guarantees

- Investment allocation, performance, and market values

- Pre-authorized payment information

- Transaction history

- Beneficiary information

- Statements and letters

- Advisor’s contact information

- Banking or payment information

Sign up by December 31, 2021.

Encourage your clients to login or register today!

client.equitable.ca

If you have any questions about Equitable Client Access, we are here to help. Contact us Monday to Friday from 8:30 a.m. to 7:30 p.m. at 1.866.884.7427.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada -

An Exciting Fund Lineup Offered with Equitable Generations

Equitable Generations™ is a Universal Life product that offers investment options that resonate with today’s 21st century client while reducing every fee possible. It also reduces the cost of insurance to help clients maximize their opportunity to purchase coverage and build tax-advantaged wealth.

Fund Features of Equitable Generations:

● 34 fund options, including 18 new investment options, tracking funds managed by Fidelity™, Dynamic™, Invesco™ and more.

● 3 sustainable investment “ESG” (Environmental, Social & Governance) options – because today’s buyer cares as much about impact as they do about returns.

● Target date funds that auto-rebalance over time so that as a client approaches retirement, the fund adjusts its risk automatically.

Learn more about our new funds:

● American Equity Index (ESG)

● Canadian Equity Index (ESG)

● Special Situations fund (Fidelity)

● Sustainable Equity, Balanced, and Bond Funds (Fidelity)

● Target Date funds (Fidelity)

● Details on funds available

● Get all your ESG questions answered with Margaret Dorn, S&P

-

Equitable Life Savings & Retirement Webinar Series featuring Payout Annuities.

This month, Equitable Life is featuring a discussion on Payout Annuities. Hear why payout annuities provide a guaranteed income that is worry-free and receive insights into how a payout annuity can fit into a client’s retirement plan.

Join your host, Shannon Labby, Regional Vice President, National Investment Sales as she welcomes Nicole Lemon, Product Manager, Savings and Retirement, Equitable Life of Canada for a discussion on Equitable Life’s Payout Annuities.

Learn more

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only. -

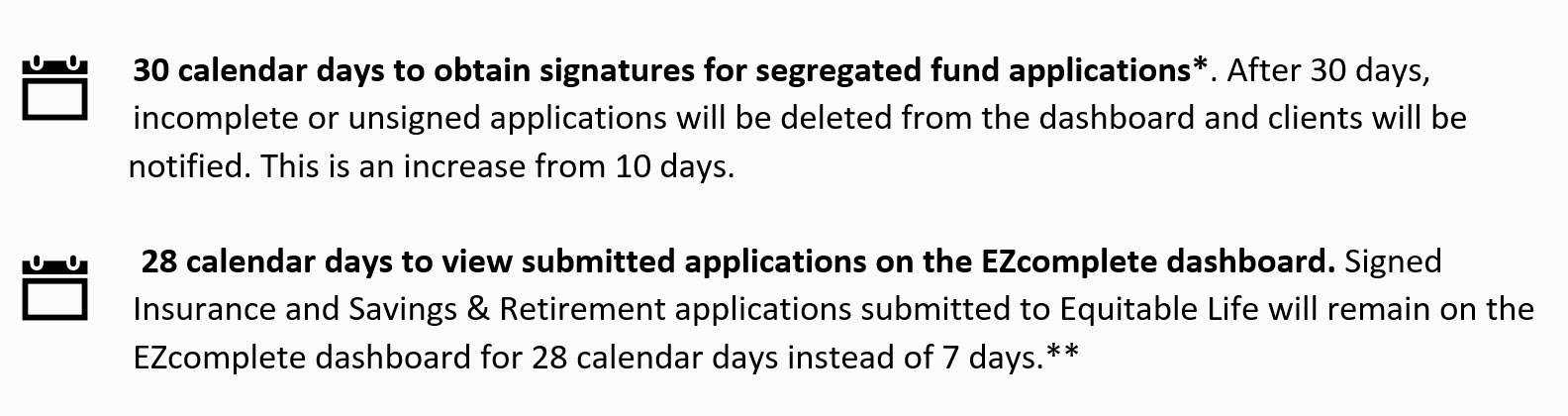

More time to complete and view applications on EZcomplete

You asked for more time, we listened!

Effective January 14, 2023, you will have more time to complete and view in-flight and completed applications on the EZcomplete® dashboard.

You will now have,

.jpg?width=900&height=238)

There are no changes to EZcomplete’s Sandbox. Applications in the Practice Site will continue to be deleted after 10 calendar days.Take me to the Sandbox

Take me to EZcomplete

Play around in the Sandbox with a demo client account.

Submit your applications today.

If you have any questions, contact your Regional Investment Sales Manager or Advisor Services Team Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427, or email savingsretirement@equitable.ca.

*Insurance applications currently offer 30 calendar days

** In-flight applications created prior to January 14, 2023, will maintain the existing 10-day submission timeline.

® denote a trademark of The Equitable Life Insurance Company of Canada.

Posted: January 14, 2023 -

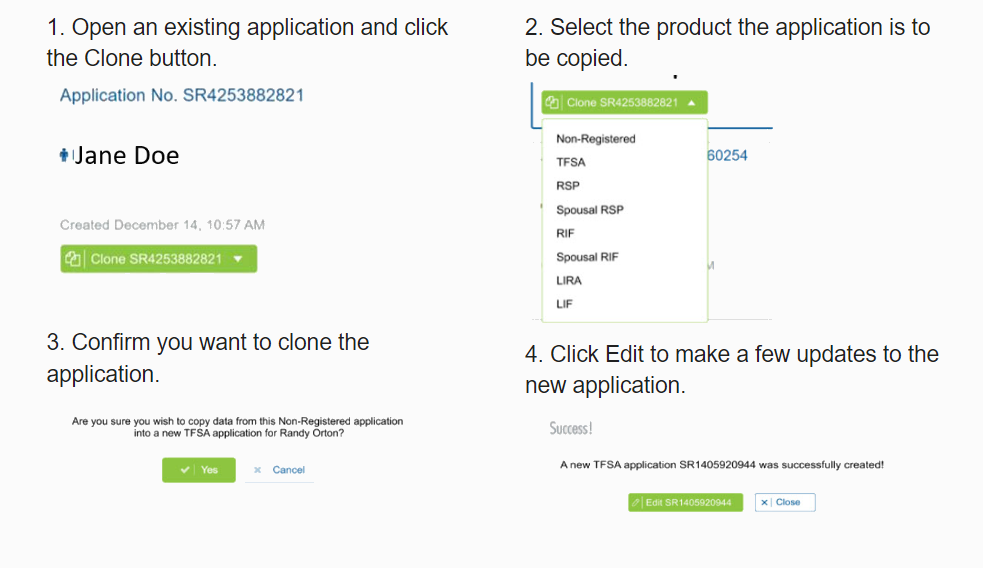

The new segregated fund EZcomplete cloning feature will save time and errors.

The new cloning feature for Savings & Retirement EZcomplete® applications means that advisors don’t need to enter the same client information when completing multiple applications for the same client.

Here's how easy it is to use.

.png)

Best of all, you can clone in progress and submitted applications.

This is just some of the information that will be automatically copied:-

Name

-

Date of birth

-

Gender

-

Occupation

-

Address

-

Phone numbers

-

Email address

-

Social Insurance Number

-

All beneficiary information

The new EZcomplete cloning feature will save advisors time and reduce errors.If you have any questions, contact your Regional Investment Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted April 6, 2023 -

-

Universal Life Savings and Investment Options Updates

The fund pages for our Universal Life products have been updated.

Full details on the Equitable Generations™ funds available, visit Equitable Generations Savings and Investment Options (2055 pdf).

Full details on the Equation Generation® IV funds available, visit Universal Life Savings and Investment Options (1193 pdf).

We launched our Universal Life product update in September 2022, when an exciting new fund lineup became available.

Learn more about the funds:- Details on funds available

- American Equity Index (ESG)

- Canadian Equity Index (ESG)

- Special Situations fund (Fidelity)

- Sustainable Equity, Balanced, and Bond Funds (Fidelity)

- Target Date funds (Fidelity)

- Get all your ESG questions answered with Margaret Dorn, S&P

- Rates and Performance page

® and ™ denote trademarks of The Equitable Life Insurance Company of Canada.

.png?width=500&height=92)

.png?width=500&height=92)

.png?width=300&height=82)

.png?width=300&height=39)