Site Search

66 results for dividend scale

- Par Whole Life Summary

- [pdf] Building a Stronger Investment Portfolio

- Navigating the current market

- PAR whole life Highlights

-

Market Commentary April 2025

Key Takeaways for Q1

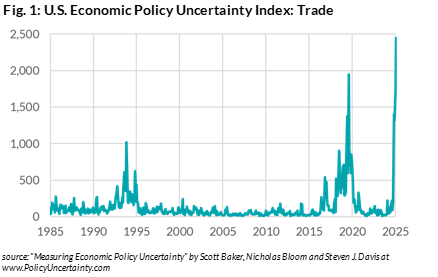

- Economic policy became more uncertain with fluctuating tariff announcements from the U.S. and its trading partners.

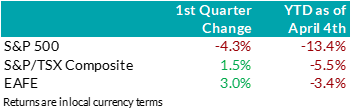

- Global stocks markets experienced heightened volatility year-to-date, reflecting the negative repercussions of tariffs for highly integrated global economies.

- Within U.S. markets, investors rotated out of growth stocks into value and defensive areas of the market.

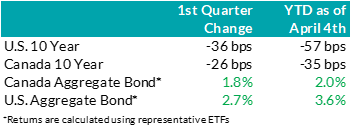

- Bond markets performed well during the quarter as interest rates moved lower.

- Most central banks continued to ease monetary policy by reducing their target interest rates. The U.S. Federal Reserve was a notable exception, electing to wait for greater clarity before lowering rates further.

Economic and Market UpdateEconomic Summary: In the U.S., the latest GDP data confirmed solid economic growth in 2024. However, as President Trump pushes forward his economic agenda, uncertainty surrounding fiscal policy and global trade have dampened market sentiment. Inflation pressures persisted, with the rate of inflation remaining above the central bank’s 2% objective. The labour market in the U.S. remained resilient, with unemployment rate staying low compared to historical norms. The Federal Reserve shifted to a more cautious approach, holding the policy rate steady through Q1 at the range 4.25% - 4.5%. The central bank raised its inflation forecast, lowered growth projections, and warned that “uncertainty around the economic outlook has increased.” U.S. bond yields were lower for most maturity dates during the first quarter, as the market priced in more growth concerns and anticipated more rate cuts from the Federal Reserve.

In Canada, recent GDP data showed stronger-than-expected growth. The inflation rate remained close to the 2% target but rose more than expected in February, and the labour market showed signs of improvement. U.S. tariffs continued to be a significant concern, and it is prompting businesses and consumers to become more cautious and slow their spending. The Bank of Canada warned that the economic impact of the tariffs could be “severe” and expected weaker growth in the coming quarters. For those reasons the Bank of Canada continued its easing cycle, cutting rates by 25 basis points at each of the January and March meetings, bringing the policy rate to 2.75%. Bond yields in Canada were also lower, with short-term interest rates decreasing faster than long-term interest rates as the Bank of Canada’s rate cuts outpaced market expectations.

Bond Markets: During Q1 2025, the FTSE Canada Universe Bond Index returned 2.0% as interest rates declined across all tenors. Although interest rates fell, this was partially offset by higher credit spreads (i.e. the extra yield on corporate bonds versus government bonds to compensate for their extra risk). Consequently, while corporate bonds still generated a positive return on the quarter, they underperformed government bonds. Widening credit spreads reflected the risk-off tone to the market, with on-off-on-off-on(?) tariffs contributing to the uncertainty. Lower-rated BBB bonds generally performed worse than higher-quality A-rated bonds. While credit spreads are higher than they were in December and January, they are still expensive compared to longer term averages. Corporate bond issuance remained robust up until the last week of March, as investor demand kept deals well supported. Overall, the market took in $40 billion in new issuance, the second highest on record, spread over 82 bonds. While corporate bonds are more attractive than in January 2025, we believe the more likely path is towards higher credit spreads as U.S. tariffs impact global growth. We have maintained our conservative view with a bias towards shorter-dated credit but remain ready to invest in longer dated corporate bonds as valuations become more attractive.

Stock Markets – Overview:

Uncertainty surrounding the scope and severity of new tariffs led investors to reassess global economic growth prospects and weighed on risk sentiment. As a result, the S&P 500 declined 4.3% over the quarter, underperforming Canadian and international markets. Within the U.S., investors rotated out of previously favoured growth stocks with loftier valuations – including members of the Magnificent 7 – into less volatile and value-cyclical companies. Meanwhile, Canadian equities returned 1.5% in Q1 despite ongoing trade negotiations and uncertain economic growth forecasts. Surging commodity prices helped the materials and energy sectors outperform, offsetting weakness in the technology and industrials sectors. Elsewhere, major developed markets from Europe and Asia (EAFE) were supported over the quarter by the introduction of a new German fiscal stimulus package and signs of improving Chinese economic growth. Following the quarter end, President Trump announced global tariffs on April 2nd, prompting some trading partners to hit back with retaliatory tariffs. The S&P 500 lost a record $5.2 trillion over two trading sessions and re-entered correction territory, with other global equity markets moving in tandem.

U.S. Equities: While the impact of tariffs has made investors more apprehensive, we have yet to witness a deterioration in financial performance. In fact, U.S. earnings continued to exceed forecasts last quarter, with approximately 70% of companies beating expectations. Furthermore, our bottom-up analysis shows that the skew of corporate earnings surprises continues to tilt positive. That said, we note that companies are providing more cautious guidance amid the increased economic uncertainty and that these earnings largely reflect conditions in 2024, not 2025. Notably, consumer stocks like Walmart have lowered growth forecasts for 2025, citing concerns surrounding consumer confidence and macroeconomic conditions. In addition to clouding the outlook, geopolitical shocks like sweeping tariffs may risk changing how companies choose to operate, including the structure of supply chains and sources of revenue. At this stage, it is still unclear how long these trade tensions will last, as that depends on how other countries choose to respond. If the tariffs are rolled back quickly, many companies may be able to absorb the temporary extra costs without serious damage to profits, and the broader economy could avoid lasting harm. But if the tariffs remain in place for a long time, the consequences could be much more serious; companies might have to change how they operate, restructure supply chains, and raise prices to deal with long-term pressure on profits.

Canadian Equities: Against the backdrop of worrisome trade developments, the Bank of Canada continued to ease monetary policy. While lower rates have helped Canadian companies report better-than-expected profit growth, consensus earnings expectations for 2025 have been revised 2% lower since the beginning of the year, reflecting the expectations for tariff headwinds. Falling bond yields made high quality, high dividend paying companies more attractive, helping this group outperform. Furthermore, the price of raw industrials – a basket of commodities – surged higher over the quarter and as a result, commodity-oriented companies benefitted. More specifically, the materials sector performed strongly with gold prices reaching new all-time highs throughout the quarter. However, if trade frictions continue to escalate and weaker growth projections materialize into a real economic slowdown, the Canadian market, given its cyclical nature and heavy reliance on commodity-driven businesses, remains particularly vulnerable to external headwinds. Moreover, given Canada’s weaker fundamental backdrop, we caution that the recent outperformance of Canadian equities relative to the U.S. may prove short-lived, particularly if trade tension persists.

Bottom line:

Heightened uncertainty surrounding global trade policies, coupled with deteriorating economic growth projections, continued to weigh on investor sentiment. Bond prices benefited from the flight to less-risky assets, with lower interest rates in anticipation of weaker economic conditions. In equity markets, the introduction of broad-based tariffs increased market volatility and drove major indices sharply lower year-to-date. Looking forward, we remain cautious of the recent outperformance of Canadian and international markets relative to the U.S. While tariffs began as a U.S. policy move, the ripple effects extend far beyond American borders, reflecting the systemic fragility that underpins global trade. If trade barriers persist, businesses may be forced to make structural shifts in their operations and review their current business models. Until markets achieve greater clarity on global trade policies, we continue to prioritize exposure to diversified large-cap stocks in the U.S., over defensive or growth-heavy positions. Within Canada, we continue to favour high quality, high dividend paying names with less sensitivity to downgrades in global growth.

Downloadable Copy

ADVISOR USE ONLYMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

EAMG Market Commentary July 2024

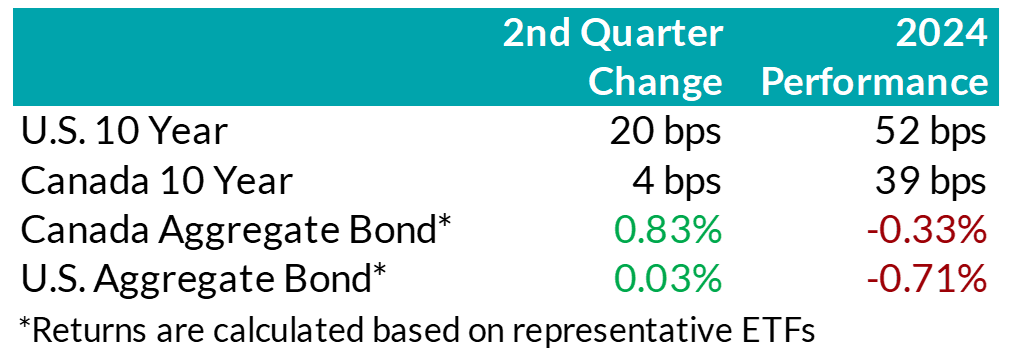

.png) Rates & Credit – In Q2 2024, U.S. inflation and economic growth data was mixed, leading to moderately higher interest rates in the U.S. Meanwhile, in Canada, long-end interest rates were little changed during the quarter, but short-term interest rates fell. That was due to the weaker economic outlook, as well as the Bank of Canada’s decision to reduce its overnight interest rate in June, with anticipation of further monetary policy easing to come. Canadian corporate bonds returned 1.1%, outperforming the 0.8% return of government bonds as well as the 0.9% return for the overall FTSE Canada Universe Bond index. Shorter-dated bonds outperformed longer-dated bonds. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries that have shorter-dated debt (e.g. real estate and financials) outperformed those that tend to have longer-dated debt (e.g. communications and infrastructure).

Rates & Credit – In Q2 2024, U.S. inflation and economic growth data was mixed, leading to moderately higher interest rates in the U.S. Meanwhile, in Canada, long-end interest rates were little changed during the quarter, but short-term interest rates fell. That was due to the weaker economic outlook, as well as the Bank of Canada’s decision to reduce its overnight interest rate in June, with anticipation of further monetary policy easing to come. Canadian corporate bonds returned 1.1%, outperforming the 0.8% return of government bonds as well as the 0.9% return for the overall FTSE Canada Universe Bond index. Shorter-dated bonds outperformed longer-dated bonds. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries that have shorter-dated debt (e.g. real estate and financials) outperformed those that tend to have longer-dated debt (e.g. communications and infrastructure).

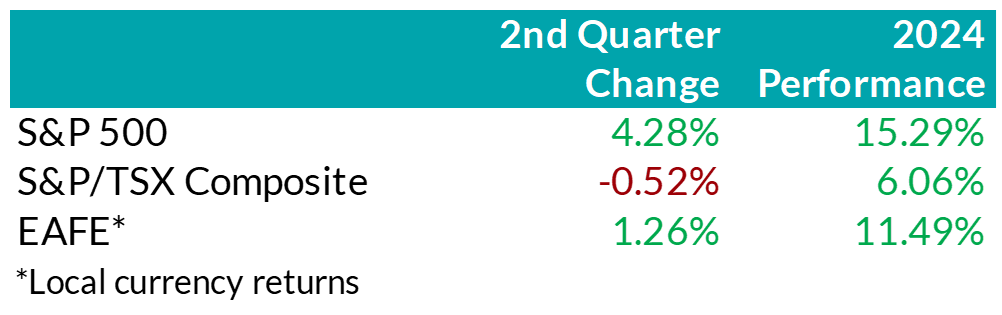

.png) Equity Overview – Against the backdrop of volatile inflation data and a lack of indication from the Federal Reserve that it was prepared to start cutting interest rates yet, U.S. equity markets decoupled from other regions. Crowding into AI-focused, mega-cap names accelerated in Q2. More specifically, investors defaulted toward the Magnificent 7 to navigate the current period, overlooking broadening earnings breadth and less expensive valuations from the remaining S&P 493. Outside the U.S., equity returns were generally mundane in dollar terms. That said, emerging markets proved to be a bright spot for investors seeking value, as the rebound in heavily discounted Chinese equities helped push frontier markets higher.

Equity Overview – Against the backdrop of volatile inflation data and a lack of indication from the Federal Reserve that it was prepared to start cutting interest rates yet, U.S. equity markets decoupled from other regions. Crowding into AI-focused, mega-cap names accelerated in Q2. More specifically, investors defaulted toward the Magnificent 7 to navigate the current period, overlooking broadening earnings breadth and less expensive valuations from the remaining S&P 493. Outside the U.S., equity returns were generally mundane in dollar terms. That said, emerging markets proved to be a bright spot for investors seeking value, as the rebound in heavily discounted Chinese equities helped push frontier markets higher.

U.S. Fundamentals – Corporate earnings continued to surpass expectations last quarter with stable operating margins helping businesses report better-than-expected bottom line results. Investors remain focused on the ability of companies to sustain debt levels ahead of renewing debt obligations, rewarding businesses with a strong ability to generate stable cash flows. Moreover, while prior quarters have witnessed earnings growth that was largely driven by highly profitable mega-cap technology stocks, U.S. markets are witnessing a broadening trend in earnings strength, with previously stunted segments of the market recovering. Our work shows that members of the Russell 1000 index, excluding the Magnificent 7, posted a median earnings growth of about 6% last quarter, with nearly 60% of companies increasing earnings versus the year prior. Furthermore, we observed an increase in the number of major companies that expect improving financial performance to approximately 27%, suggesting that the recovery in earnings breadth may persist.

U.S. Quant Factors – As mentioned, concentration in the equity market drove a surge in valuations as investors continued to chase specific mega-cap technology stocks. In fact, within the Russell 1000 growth factor – which screens for companies whose earnings are expected to grow at an above-average rate relative to the market – the Magnificent 7 totaled nearly 55% of the entire index by quarter-end. In addition, the Nasdaq 100 – which is generally viewed as a technology-biased index – saw the weight of the Magnificent 7 rise to almost 43% of the entire index by the end of the quarter. Furthermore, the equal-weighted S&P 500 underperformed the cap-weighted index by nearly 7% last quarter, bringing the year-to-date divergence to about 10%. With concentration accelerating, the cap-weighted index outperformance has soared past Covid-era levels, a period that saw investors rapidly crowd into profitable technology names due to panic and economic uncertainty. We remain cautious of a severely crowded market that trades near all-time highs as strong performance from 5-7 names distorts the overall stature of market conditions.

Canadian Fundamentals – Although Canadian companies exceeded bleak forecasts, earnings continue to contract on a year-over-year basis. Furthermore, earnings revisions have grinded lower with easing monetary conditions unable to offset concerns of a slowing economic environment. We note the sharp contrast versus the U.S. as the bifurcation of earnings performance widens. The CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges as metals rallied higher despite a stronger U.S. dollar and elevated interest rates. The mining industry benefited from a sustained elevation in prices, helping the materials sector outperform over the quarter. Returns from the heavily-weighted Canadian banks were constrained last quarter with company-specific drivers – including regulatory challenges from TD, and underwhelming U.S. results from BMO – limiting performance. More broadly, the banks continue to build prudent credit provisions to mitigate uncertain economic forecasts and remain well capitalized.

Canadian Quant Factors – With investors remaining attentive to businesses’ ability to create value relative to financing costs, we see value in high quality, dividend-paying companies with strong earnings sustainability and a healthy degree of leverage. Based on our work, investors of the Canadian banks appear well compensated, with the current premium between value creation and current yield remaining compressed. In our opinion, the market has modest expectations regarding prospects for value generation from the banks and, therefore, we believe the industry stands to benefit if the premium reverts closer to historical norms. We also continue to see sources of quality dividend opportunities within certain areas of the energy sector. More specifically, we believe companies that have taken steps to improve their balance sheets through deleveraging efforts, and with improved operating leverage, offer attractive prospects given their stable and high-yielding composition.

Views From the Frontline

Rates – During the first half of the second quarter, interest rates in both Canada and the U.S. increased, continuing the upward momentum from Q1. Higher-than-expected inflation data in the U.S. along with mixed economic growth data caused investors to push out expectations for when the U.S. Federal Reserve would start lowering its interest rate. This trend shifted in the second half of Q2, as positive economic momentum slowed in the U.S. economy and inflation data began to soften. Interest rates in Canada declined more rapidly than in the U.S. due to more benign inflation, a weaker job market, and economic growth remaining below population growth. This economic weakening provided the confidence required for the Bank of Canada to cut rates by 25 basis points in June to 4.75%. The Bank also signaled that if inflation continues to ease and the Bank’s confidence grows that inflation would continue to trend toward its 2% inflation target, it is reasonable to expect further cuts. The second quarter marked a pivotal point for the global policy easing cycle. Sweden, Canada, and the European Central Bank all began lowering their policy rates, and Switzerland made a second rate cut, following one in Q1. The market continues to speculate on the timing of the U.S. Federal Reserve’s first rate cut. Interest rate cut expectations are largely unchanged in Canada since last quarter, with a total of three rate cuts expected throughout 2024. Expectations for the rate cuts by the U.S. Federal Reserve declined slightly, however, to two cuts in 2024.

Credit – The risk premium for corporate bonds (versus government bonds) was largely flat over the quarter, with spreads approaching the tight post-pandemic levels experienced in 2021. Corporate bond supply continues to be very robust, with $41bn in new issuance. Year-to-date, corporate issuance has set a new record, with an impressive $80bn in issuance. On balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward trade-off as being more favourable.

Equity – On the backdrop of a heavily concentrated U.S. market rally, we remain cautious of the distortion to market returns from high-flying technology stocks. As a result, we continue to favour a combination of the Dow Jones Industrial Average and the S&P 500 for our broad U.S. market exposure. The Dow provides a more diversified exposure to 30 prominent large-cap companies and less concentration in technology relative to the S&P. Broadening earnings strength presents an opportunity for previously out-of-favour names to “catch-up”. In our view, companies outside the Magnificent 7 that have demonstrated robust earnings growth, strong cash flow generation, along with decreased debt loads, are well-positioned to benefit from internal market rotations. As such, we gain exposure to these companies through the quality factor – companies with higher return-on-equity, strong operating performance, and healthy leverage levels – and the dividend growth factor – businesses with a lengthy and established history of increasing dividends.

In Canada, we remain attentive to how efficiently corporations are generating profits relative to financing costs. Looking forward, we continue to monitor the ability of businesses to generate profits given a decline in capital spending. More specifically, we are focused on businesses’ ability to grow and sustain dividends amid the lag between easing monetary conditions and consumption. Due to this, we observe value in higher yielding companies that are higher on the spectrum of quality. Geographically, we maintain our overweight U.S. exposure, underpinned by encouraging U.S. inflation data trends, broadening corporate earnings growth, and normalizing consumption. In addition, sluggish Chinese data and the lack of positive earnings revisions from EAFE tilt the risk-adjusted return profile in favour of the U.S. Lastly, as a Canadian investor, fluctuations in the Loonie’s relative value versus other major currencies continues to present tactical trading opportunities within our investment mandate.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

- [pdf] Shareholder Borrowing Checklist

-

EAMG Market Commentary August 2022

August 2022

The S&P 500 fell into bear market territory over the first half of 2022 with the index down -20.6%. This represented a top 10 ranking amongst the most dismal back-to-back quarterly performances going back to 1928. While comparisons have been made to the inflation driven bear market of 1973-74, the economic backdrop today has some significant differences including greater production capacity (factory utilization rates are running about 20% lower vs the 70’s) and a meaningful decline in raw industrial prices which have fallen -11% over the quarter. While these economic anecdotes are potential positives for the future, it’s important to remain cognizant that prices remain elevated.

As such, the US Federal Reserve seems to be taking every opportunity to telegraph their intentions of raising interest rates at the expense of both market and economic performance, so long as inflation remains a threat. Given this hawkish tone, the market narrative has morphed from fears of inflation to a fed driven recession. As a result, the move in the bond market has been swift with the 10-year treasury yield peaking at approximately 3.5% in June to today’s level of 2.7% (lower rates = higher bond prices). This positive bond performance reflects the consensus view that inflation is temporary (2023 CPI forecasts are approximately 3.6% vs the second quarter’s 8.7% CPI reading) and could allow the Fed to adjust their higher interest rate trajectory downward. The Fed also remains confident that a soft landing is achievable, and a recession avoidable.

Investors seem less convinced however, given the Fed has never been able to engineer a soft landing before, and so it’s no surprise equity markets entered a bear market over the quarter, and currently remain in a technical correction (defined as losses greater than -10%). To better assess future performance, we closely monitor earnings results to understand how companies are navigating these economic trends. With nearly 80% of the S&P 500 reported, the results have been better than expected, but still the EPS beat rate and magnitude of beats (actual vs expectation) remain below 5-year averages. This tells us companies are finding today’s economic conditions more challenging than the recent past. Consumer sectors including marketing, retail, autos and textiles posted the 2nd worst performance vs other sectors while the Financials sector saw the greatest challenges with aggregate EPS falling by -15% year-over-year. Wall Street analysts have started to revise S&P 500 forward growth estimates lower, a trend which we expect will continue for several quarters ahead. The forward (12-month blended) P/E ratio of 17.5 times remains 1.5 multiple points above the long-term average which potentially suggests risks may not be fully priced in.

In terms of the S&P/TSX Composite, after declining nearly -14% in Q2 as recession fears around the world jeopardized the global demand outlook, its’ since rebounded over 4.0%. Still, valuation remains below longer-term averages at 11.8x forward earnings with the heavier weighted Financials and Energy sectors trading at 9.5x and 7.9x, respectively. TSX earnings expectations have stalled as of late but downward revisions are lagging US and European counterparts. Additionally, the domestic labour market remains tight which has allowed the Bank of Canada to continue its aggressive rate hike path to curb soaring inflation. For most of 2022 the TSX has benefitted from surging commodity prices but an economic slowdown in China resulting from its commitment to a zero-Covid policy and a potential global recession could prove to be a challenge for the Canadian market.

Equity markets on average lose 30% of their value in recession led bear markets. If we use this as a potential road map, it suggests the S&P 500 could have further to fall. Using past performance as a forward-looking tool however is an imperfect technique and used in isolation of what’s happening today can often mislead.

Accounting for today’s backdrop, we come up with three scenarios of varying probabilities. The first is the most optimistic and includes an engineered soft landing by the Fed, meaning no recession and inflation cools. A less optimistic view is the fed tames inflation with higher interest rates but tips the economy into a mild-to-moderate recession. The outcome would be consumer spending and corporate hiring slow as a result of tighter financial conditions, and therefore financial results are negatively impacted. The least optimistic scenario is one where stagflationary conditions emerge as inflation continues to accelerate at the expense of growth despite higher interest rates, in other words the Fed loses control. The net result would be similar to our second scenario but with much more dire results in terms of unemployment, household spending and impacts to corporate profitability. While we don’t rule out any of the above scenarios completely, we assign the highest probability to the second one where macro economic issues get resolved at some point in the future, but the full effects of inflation and a possible recession have yet to be priced into the market. Currently, this view translates into a slight underweight equity position versus our benchmark with a tilt towards low volatility and defensive strategies along with an overlay of value and dividend paying securities. In other words, we’ve de-risked the portfolios relative to our benchmark to manage potential downside risks but remain meaningfully invested an on absolute basis. As always, time in the market tends to overcome trying to time the market, and so employing a strategic and diversified strategy is often the most prudent approach.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. - [pdf] Equitable’s Legacy Products: Segregated Fund Codes

- Continuing Education