Site Search

961 results for life policy 300109556

-

The right tools to seize the RSP Season

Fast. Easy. Accurate. With the EZ Suite of services from Equitable Life®, you won’t just get on top of the wave this RSP season, you’ll enjoy the ride.

Learn more.

-

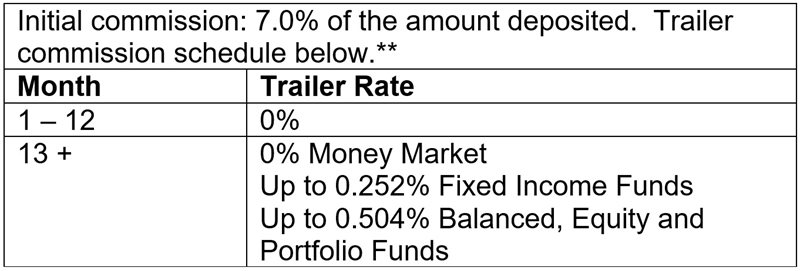

7% No Load CB5 Initial Commission – Limited time offer extended to December 31, 2022 for Investment

We are pleased to announce the temporary increase to the CB5 sales option initial commission from 5.6% to 7.0% has been extended to December 31, 2022 on Pivotal Select™ Investment Class (75/75) only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Equitable Life reserves the right to end the campaign, at any time and without notice. Prior temporary increase to CB5 sales option initial commission for Pivotal Select Protection Class 100/100 and Pivotal Select Estate Class 75/100 ends August 31, 2022.

** Applies to FundSERV trades occurring between September 1 and December 31, 2022. Initial commission on non-FundSERV trades occurring between September 1 to December 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™ or ® denote trademarks of The Equitable Life Insurance Company of Canada. -

Colaiacovo to lead Equitable’s Eastern Group Sales Team

We are pleased to announce that Sofia Colaiacovo has been appointed our new Group Sales Vice President, Eastern Canada.

In her role, Colaiacovo will lead the Eastern sales team. She will focus on working with distribution partners to grow our business together while continuing to provide clients and their plan members with a better benefits experience.

Colaiacovo brings to her role 18 years of experience with Equitable Life, building strong distribution partnerships and delivering exceptional client service.

She joined Equitable Life in 2005 and has held roles of increasing responsibility in our Group distribution organization.

Since 2011, she has served as our Group Account Executive for the Ottawa territory. In that role, she quadrupled the size of our client base in the region and established strong and lasting relationships with key distribution partners. She was recognized as Equitable Life’s Group Account Executive of the Year three consecutive times – in 2019, 2020 and 2021.

“Sofia will further strengthen our Group Leadership Team and reinforce our ongoing commitment to building enduring distribution partnerships and delivering great service,” says Marc Avaria, Equitable Life’s Senior Vice-President, Group.

“Sofia’s success has come from taking the time to understand the needs of her partner advisors and their clients,” he adds. “By asking the right questions and listening, she has been able to provide valuable and practical solutions to meet their needs.”

Colaiacovo graduated from Carleton University with a Degree in Psychology. She holds the Group Benefits Associate (GBA) designation through the International Foundation of Employee Benefits Plans. -

Making it easier to do business with Equitable

We wanted to share some exciting updates with you that focus on enhancing your experience with Equitable®. Improving your journey with us is a top priority, and we continually seek ways to make doing business simpler and more convenient.

The following are our latest enhancements designed specifically to benefit you.

New annual premium payment options for Life and Critical Illness plans

● Great news! We recently introduced new additional payment methods for clients making their first and subsequent annual insurance premium payments.

● And - we're thrilled to introduce a new lower annual premium requirement of $2,500 for clients who wish to pay their annual premiums by Pre-Authorized Debit (PAD)!

● Learn more about these changes here.

Improved forms for requesting in-force illustrations

● We understand the importance of efficient workflows, and that's why we have recently updated and improved the following forms to make requesting inforce illustrations even easier:

● Term, CI & Whole Life Illustration and Quote for inforce policies

● Universal Life Illustration and Quote for inforce policies

For these and other Equitable forms, navigate to EquiNet® -> Individual Insurance -> Forms.

We trust that these improvements will be met with enthusiasm! And this is just the beginning – stay tuned for more enhancements in the new year!

Questions? Please reach out to your local wholesaler or our customer service team.

® or TM denote trademarks of The Equitable Life Insurance Company of Canada

-

Join us for an Equitable Life Master Class webcast featuring Dr. Ryan Murphy, Morningstar

You’re invited to our next Equitable® Master Class webcast offering compelling topics and unique ideas from leading experts to help you manage and grow your business.

Just asking clients what their goals are may not be enough. Clients may respond in ways that seem reasonable but might not represent the goals that are truly important to them.

In the Behavioural world, this is known as ‘thinking blind spots’ and stems from behavioural biases we all have. The blind spots can prevent clients from expressing their true goals to you and lead to a plan that doesn’t accurately represent their preferences and motivations.

Join us for an informative discussion led by Dr. Ryan Murphy, head of Morningstar’s global Behavioural insights in how you can get clients past their thinking blind spots.

Learn more

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® or ™ denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Posted February 1, 2024 - [pdf] Cloud DX Client Guide

- [pdf] Equation Generation IV Advisor Guide

- [pdf] Financial Critical Illness Underwriting Guidelines

- [pdf] The Power of Paying a Little Bit More - Equitable Generations

- [pdf] Protect your Retirement Assets