Site Search

422 results for beneficiary change form

- Exchanges

- Conversions

-

New “Update Payment” feature for banking changes has launched!

Great news! Equitable® has launched a new self-serve "Update Payment" feature in Client Access and on EquiNet®. This new online process enables clients and advisors to easily submit key banking change requests for eligible insurance policies*, with no need to complete a physical form.

What’s new?

A new "Update Payment" feature is now available on Client Access and on EquiNet under Policy Inquiry. It allows clients (and advisors) to easily submit requests for the following three transactions online:

1. STOP pre-authorized payments.

2. RESUME pre-authorized payments on overdue accounts.

3. CHANGE which bank we withdraw money from.

The new "Update Payment" feature replaces the previous "Edit" button in Client Access. The old banking change options are still available in the client’s Profile section. They can be used to request a change to the payment withdrawal date, as that option is not yet available with the new Update Payment feature.

How it works!

When a change is requested using the new Update Payment feature, our Operations team receives it online. They will review and process the changes within three business days, as per Equitable’s current service standards.

The Update Payment feature in Client Access is a self-serve process. However, if a client prefers, their advisor or an Equitable Customer Service associate can assist them by submitting the request on their behalf. Clients will be asked to sign to approve any such requests that are submitted by someone other than the owner of the policy.

*The Update Payment transactions are only available for eligible policies: those that have not lapsed, are not on Automatic Premium Loan, and are not owned by a corporation or other entity.

We trust that these digital enhancements will help make the client and advisor experience even simpler and more efficient.

Need more information? Please contact your Equitable wholesaler.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada. - [pdf] Health Information Form

- [pdf] Capacity Reserve Form

-

Enhancing the Transfer Process: Equitable's New Signature Guarantee Service

Equitable® is making transfers even easier with EZcomplete®.

This enhancement will help advisors and clients by reducing the number of rejections from other institutions that need a signature guarantee. Reducing transfer rejections means less time and effort for advisors, and faster transfers from other institutions.

Signature Guarantees

Equitable will now offer signature guarantees on most transfers requested through EZcomplete.

When is a signature guarantee not available?

• For entity owned accounts

• If a Power of Attorney is signing on behalf of an owner

• If the transferring account has an irrevocable beneficiary

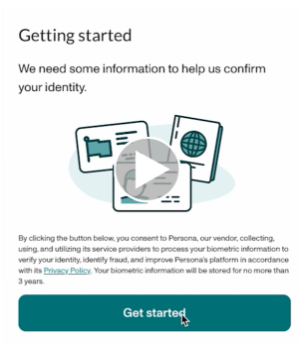

Watch the quick Identity Check with Persona video or read through instructions below.

To offer a signature guarantee, Equitable first needs to check the identity of all owners using Persona, a third-party service provider.

The advisor starts by selecting a signature guarantee in EZcomplete. An email link is sent to all proposed owners.

Clients can click the link within the email to Persona's verification process.

They will be prompted to take a picture of their photo ID and a selfie, turning their head slightly left and right by following the prompts.

Their identity can then be confirmed in seconds.

Sending Transfer Forms:

• If all owners' identities are verified, Equitable will send the transfer form with a signature guarantee stamp and the e-signature audit log to the transferring institution.

• If ID verification fails, clients will be prompted to try up to three times. If still unsuccessful, the transfer form and e-signature audit log is sent to the transferring institution without the signature guarantee stamp.

Handling Issues:

• Advisors’ obligations to verify ID is not affected by this process; ID verification is still required.

• If the client times out or loses the email to access Persona, the advisor can resend the link.

• If the client’s name or email changes after ID verification, the advisor will need to redo the ID verification with the updated information to get a signature guarantee.

This update strives to make processes smoother and more efficient for everyone. Just another reason to do business with Equitable. When we work together, success is mutual.

For more information or assistance, please contact your Director, Investment Sales.

Date published: May 7, 2025 - [pdf] Reallocation and Transfer of Funds Form -Universal Life (Guide)

- [pdf] Claimant Statement for Entities - S&R

- [pdf] Pivotal Select Application - TFSA