Site Search

1362 results for if

-

Submit transfer forms automatically with EZcomplete!

Save time, effort and the hassles of transfer forms with EZcomplete®!

With EZcomplete you can now automatically submit transfer forms to the relinquishing institution online quickly and easily.*

1. Pick the name of the relinquishing institution

2. Choose the e-signature option

3. Save the transfer form for your records

Easy as 1-2-3!

Want to take EZcomplete for a test drive?

Play around in the sandbox with a demo client account.Ready to start with the real thing?

Submit your transfer form request today.

Take me to the sandbox Take me to EZcomplete

* Available for e-signatures only

® denotes a trademark of The Equitable Life Insurance Company of Canada.

December 6, 2022

-

December 2022 eNews

Update: EI Sickness Benefit Extension confirmed for Dec. 18, 2022*

The federal government confirmed on Nov. 25, 2022, that it is extending the Employment Insurance (EI) Sickness Benefits period permanently from 15 weeks to 26 weeks. The change takes effect on Dec. 18, 2022.

Equitable Life will not require or implement any changes to our disability plan designs based on this extension. However, plan sponsors may wish to amend their short-term disability (STD) and long-term disability (LTD) plans and policies to align with the new 26-week EI period.

If your clients choose to amend their plan design in response to this extension, we have created an overview of how amendments may affect common plan design scenarios. Click here to learn more.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

QDIPC updates terms and conditions for 2023*

Every year, the Quebec Drug Insurance Pooling Corporation (QDIPC) reviews the terms and conditions for the high-cost pooling system in the province.

Based on its latest review, QDIPC is revising its pooling levels and fees for 2023 to reflect trends in the volume of claims submitted to the pool, particularly catastrophic claims:

We will apply the new pooling levels and fees to future renewal calculations that involve Quebec plan members.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

*Indicates content that will be shared with your clients

-

Important notice: Funds with Deferred Sales Charges

The Canadian Council of Insurance Regulators (CCIR) is requiring all insurance companies to discontinue the sale of segregated funds with deferred sales charges (DSC) effective June 1, 2023. This also impacts ongoing or new deposits to some existing segregated fund accounts. Please contact any Equitable Life clients who may be impacted.

How this impacts clients:

In response to the insurance regulator’s recommendation, Equitable Life® will be making changes to the administration of certain segregated fund products, which may impact clients. The details are outlined below:

Pivotal Select™ segregated fund product

On or about May 29, 2023:- Funds with DSC or Low Load (LL) sales charge options will be closed to additional deposits. Future deposits must be allocated to the No Load (NL) sales charge option of the funds available within the policy.

- Any existing amounts held in DSC or LL funds are not impacted and will retain the existing deferred sales charge schedule outlined in a client’s contract. The annual 10% available (20% for RIF policies) for withdrawal without fees continues to apply through to the expiry of the fee schedule.

- If the default deposit instructions that a client previously provided include funds with DSC or LL sales charge options, these instructions will be automatically updated to the NL sales charge option of the same fund for all future deposits.

- If a client has pre-authorized scheduled deposits into funds with the DSC or LL sales charge options, these instructions will be automatically updated to the NL sales charge option of the same funds for all future deposits.

- In alignment with our current administrative rules, if a client has DSC or LL funds, they will not be able to make deposits into No Load Chargeback funds (NLCB and NLCB5) within the same policy.

Legacy segregated fund products

Ongoing deposits to DSC funds are permitted when a segregated fund product does not have an alternative sales charge option available within the contract. This applies to the following products:- Personal Investment Portfolio

- Pivotal Solutions II

- Pivotal Solutions DSC

If a client plans on making additional deposits, they may be interested in alternative sales charge options that do not include DSC. For example, Equitable Life offers “No Load” (NL) and “No Load Chargeback” (NLCB and NLCB5) sales charge options within the Pivotal Select segregated fund contract. In these situations, a new application would need to be completed and submitted.

Please note that draft regulation in Quebec is currently under review which may impact Equitable Life’s approach for Quebec clients with legacy segregated fund products.

Equitable Life will continue to monitor provincial regulatory developments and adjust our approach as needed.

Client communication

We will be sending clients a letter within their December 31, 2022, statement describing their options, and the impacts to their policy (if applicable). We recommend that you contact clients to discuss the contents of Equitable Life’s letter and provide any advice that they may need regarding ongoing deposits to their segregated funds. You can access a copy of the client letter here:If you have any questions, please reach out to our Advisor Services Team at 1.866.884.7427.

December 23, 2022

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada. -

Kickoff to 2023 with Equitable Life and Robert Gignac

Equitable Life® is pleased to present Robert Gignac, author of the book ““Rich is a State of Mind”. Robert will deliver his new “Stop Playing Chess in a PokerStars World” presentation. Robert’s engaging presentation offers examples of what clients (and prospects) are struggling with today and how advisors can take a leadership role by changing from a one-dimensional game (chess) to a multi-dimensional one (poker).

Your hosts, Cam Crosbie, Vice President, Savings & Retirement and Joseph Trozzo, Investment Sales Vice President, MGA, will highlight some of the ways Equitable Life can help make 2023 a great year.

Learn More

Posted: December 23, 2022

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® denote a registered trademark of The Equitable Life Insurance Company of Canada

-

2023 is here and we are here for you!

Equitable Life® would like to wish everyone a Happy New Year and we are looking forward to doing more business together in 2023!

Just a reminder, we made some changes in 2022 to make doing business with Equitable Life easier. Some of the most recent enhancements include:

Opt in for text messages on new applications

● Upon submission of an application, you can opt-in to receive text message updates for your new business applications. That’s a text message when the application is received, when a decision is made, when it’s ready for delivery and when the commissions have been triggered.

Cloning pages on EZcomplete®

● You now have the ability to clone an application on EZcomplete. A whole family or a spouse can have a lot of duplicate information and the ability to clone an application can save tremendous amounts of time and make for a much more pleasant client experience.

Jump around on EZcomplete

● Jump from one part of the application to another and back again. You no longer have to complete the application one section after another in order. This will allow a lot more flexibility when submitting a policy application.

To learn more about these great enhancements contact your local wholesaler.

Continue watching for news from Equitable Life for more great launches and enhancements in 2023!

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

-

Are your clients looking for more Tax-Free Savings Account contribution room?

Good news! With the start of the new year comes new additional contribution room. And to make it even better the Government of Canada increased the annual contribution limit. Effective January 1, 2023, the annual limit goes from $6,000.00 to $6,500.00.

A Tax-Free Savings Account is a great option for clients to grow their savings with the flexibility to access their money when they need it, before or during retirement. Encourage your clients to start saving today!

For more information on the options available, please click here.

Posted: January 3, 2023 -

Updated Temporary Resident Guidelines – Student Permit Requirements

We are pleased to announce that we have clarified the student permit requirements of our Temporary Resident Guidelines.

● The guidelines for Student Visa holders attending elementary and secondary school students have been outlined in further detail.

● The guidelines for Student Visa holders attending post secondary educational institutions have been enhanced with additional details regarding professional programs, as well as post-secondary programs not included in the professional program category.

Read more about the details of the changes in the updated Residency Guidelines form 1530.

We have also added an additional note to the 1343 Evidence of Insurability to specify the following:

● If in Canada for less than 1 year, Paramedical, Blood Profile with Hepatitis screens and Urinalysis tests are required for applicants of attained age 17 or over.

Read more about the details of the change in the updated Evidence of Insurability 1343.

Please contact your local wholesaler for more information.

-

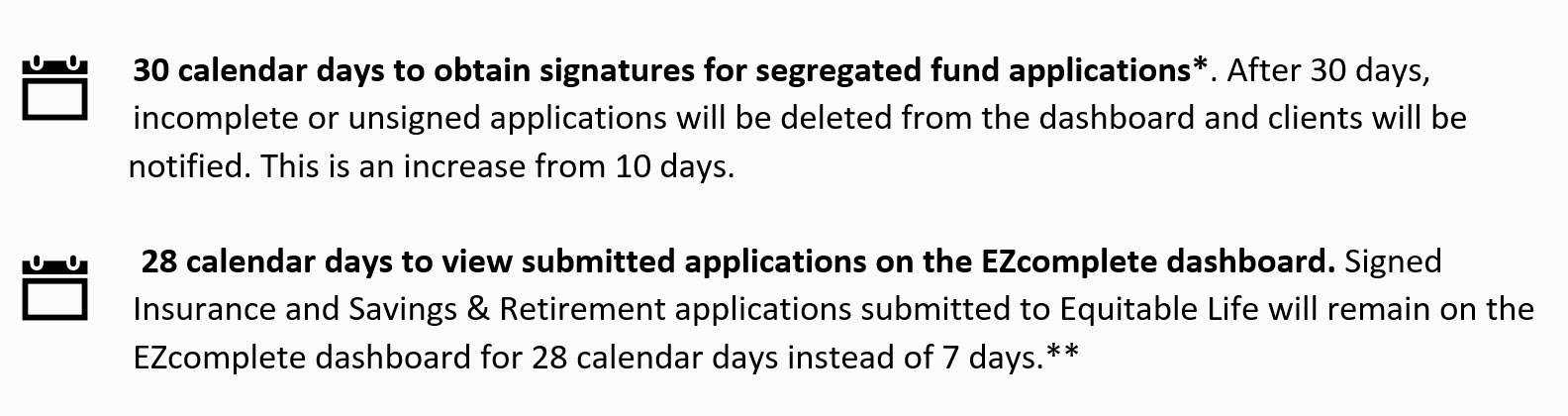

More time to complete and view applications on EZcomplete

You asked for more time, we listened!

Effective January 14, 2023, you will have more time to complete and view in-flight and completed applications on the EZcomplete® dashboard.

You will now have,

.jpg?width=900&height=238)

There are no changes to EZcomplete’s Sandbox. Applications in the Practice Site will continue to be deleted after 10 calendar days.Take me to the Sandbox

Take me to EZcomplete

Play around in the Sandbox with a demo client account.

Submit your applications today.

If you have any questions, contact your Regional Investment Sales Manager or Advisor Services Team Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427, or email savingsretirement@equitable.ca.

*Insurance applications currently offer 30 calendar days

** In-flight applications created prior to January 14, 2023, will maintain the existing 10-day submission timeline.

® denote a trademark of The Equitable Life Insurance Company of Canada.

Posted: January 14, 2023 -

Step Up Your Wealth Sales with Equitable Life!

Welcome to the Step Up Your Wealth Sales program with Equitable Life® . You will be rewarded with a growth bonus for doing more business with Equitable Life in 2023!

The program rewards advisors who promote Equitable Life’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account (GIA) contracts

+ 25% of payout annuity sales

- Segregated fund redemptions

- GIA redemptions

= 2023 Net Deposits

All deposits, sales, and redemptions occurring between January 1 and December 31, 2023, will be used to calculate an advisor’s 2023 net deposits.

Tier 2023 Net Deposits Bonus Rate* 1 Less than $250,000 $0 2 $250,000 - 499,999 .25% 3 $500,000 – 749,999 .50% 4 $750,000+ .75% 5 Elite Advisor re-qualifiers1 1.00%

* The bonus amount will be calculated at the end of 2023 based on net deposits. The bonus will be paid within 90 days following December 31, 2023. Maximum bonus payable is $100,000 for Elite Advisor re-qualifiers; $75,000 otherwise.

For more information, download our flyer or contact your Equitable Life Regional Investment Sales Manager.

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with clients’ unique needs.Posted:June 26, 2023

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

1 Elite Advisor re-qualifiers are advisors who attained Elite status as of end of 2022 and maintain Elite status at the end of 2023. To attain 2023 Elite Advisor status, an advisor must have $1,250,000 in gross deposits in at least 5 policies or $10,000,000 in assets. -

January 2023 eNews

Responding to Saskatchewan’s biosimilar switch initiative*

We are changing coverage for some biologic drugs in Saskatchewan in response to the province’s biosimilar initiative. These changes will help protect your clients’ plans from additional drug costs that may result from this new government policy while providing access to equally safe and effective lower-cost biosimilars.

Saskatchewan’s provincial biosimilar initiative

Announced in October 2022, the Saskatchewan Biosimilars Initiative ends coverage of ten biologic drugs beginning on April 30, 2023.

Patients in the province who are using these drugs will be required to switch to biosimilar versions of these drugs by April 30, 2023, in order to maintain their Saskatchewan Drug Plan coverage.

Equitable Life’s response

To ensure this provincial change doesn’t result in your clients’ plans paying additional and avoidable drug costs, we are changing coverage in Saskatchewan for most biologic drugs included in the provincial initiative.

Beginning April 30, 2023, plan members in the province will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower cost biosimilar version of the drug.** These plan members will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable Life plan.

Communicating this change to plan members

We will inform any affected plan members in early February of the need to switch their medications so that they have ample time to change their prescriptions and avoid any interruptions in treatment or coverage.

What is the difference between biologics and biosimilars?

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is known as the “originator” biologic. Biosimilars are highly similar to the drugs they are based on and Health Canada considers them to be equally safe and effective for approved conditions.

Questions?

If you have any questions about this change, please contact your Group Account Executive or myFlex Sales Manager.

**The list of affected drugs is dynamic and will change as Saskatchewan includes more biologic drugs in its biosimilar initiative, as new biosimilars come onto the market, and as we make changes in drug eligibility.

Ontario announces 2023 biosimilar switch program*

The government of Ontario recently announced the launch of a biosimilar initiative to switch patients from eight originator biologic drugs to biosimilar versions of the drugs.

Patients in Ontario using affected originator biologic drugs will have until December 29, 2023 to switch to a biosimilar version of their medications in order to maintain coverage under the province’s public drug plans.

We are actively monitoring and investigating the impact of this new policy on private drug plans in Ontario. We plan to implement changes to coverage of biologic drugs in the province in 2023 to help prevent this change from resulting in additional costs for our clients’ drug plans. We will provide more details in the coming months.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

Dental fee guide updates*

Each year, Provincial and Territorial Dental Associations publish fee guides. Equitable Life® uses these guides to help determine the reimbursement limits for dental procedures. For your reference, below is the list of the average dental fee increases for general practitioners that will be used by Equitable Life for 2023.***Dental fee guide increases over 2022***

***Data for all provinces and territories was not available at the time of publication. This chart will be updated on EquitableHealth.ca as more information becomes available.

Equitable Life ranks high with Canadian group advisors*

Equitable Life ranked second nationally and first in Ontario among major insurers in a recent survey of Canadian group benefits advisors.

NMG Consulting, a leading global consulting firm, conducted in-depth interviews with 130 leading group consultants, brokers and third-party administrators across the country between May and August 2022 for its annual Canadian Group Benefits Study. Based on these interviews, NMG ranked group insurers in six categories, ranging from operational management to technology.

Nationally, Equitable Life ranked either first or second in four of the six main categories:

Advisors in Ontario, in particular, scored Equitable Life very favourably. We ranked #1 overall in the province, finishing first in four of the six overall categories, including: Relationship Management, Operational Management, Underwriting and Claims Management and Technology.

“The fact that advisors regard us so highly in so many categories is a testament to our mutual status and our ability to focus exclusively on our clients and advisors,” said Marc Avaria, Senior Vice President of Group. “We are truly working together to build strong, enduring and aligned partnerships.”

“While we are happy with these results, we won’t rest on our laurels,” added Avaria. “We will continue to dedicate ourselves to providing our clients and advisors with a better benefits experience.”

Here are more of the highlights from this year’s results:

Nationally, we ranked first in all 10 subcategories in Operational Management, including:- Overall service to intermediaries,

- Overall service to plan sponsors,

- New quote process,

- Plan implementation,

- Renewal process,

- Information shared at renewal,

- Accuracy and timeliness of reporting and billing,

- Administration quality and responsiveness,

- Taking ownership and

- Management information quality and availability.

- Company relationship management,

- Ease of doing business,

- Account executive capability,

- Market knowledge,

- Visit/call quality,

- Effective coordination and

- Advice.

- Fairness and timeliness of disability claims (1st)

- Fairness and timeliness of health claims (2nd)

- Fraud management (2nd)

- Competitiveness of pooling charges (2nd)

- Group underwriting flexibility (3rd)

- Health and dental TLR competitiveness (3rd)

- Overall technology – Intermediary (2nd)

- Member experience (2nd)