Site Search

367 results for pre-authorized debit plan

-

Equitable Life Group Benefits Bulletin - October 2022

Introducing new Gender Affirmation Coverage for group benefits plans

Providing an inclusive benefits plan can play a critical role in fostering a workplace culture that welcomes diversity and helps employees thrive. While most provinces cover the cost of gender-affirming surgery, each person has unique needs. Some may require procedures that are not publicly covered.

That’s why we’re pleased to introduce a new coverage option for gender affirmation surgical procedures that are not covered by provincial health plans. Gender Affirmation Coverage helps plan sponsors to close the gap where provincial health coverage ends.Coverage details and eligibility

Gender Affirmation Coverage can be added to any Equitable Life plan with an in-force Extended Health Care plan. It provides coverage for gender-affirming procedures that are not covered by provincial health plans. This might include tracheal (Adam’s apple) shaving and voice surgery. It will also cover some additional procedures to further align the plan member’s features to the transitioned gender, such as facial bone reduction and cheek augmentation. This makes a wider variety of gender-affirming surgeries accessible to plan members and helps minimize their out-of-pocket costs.

Plan members are eligible for coverage with a diagnosis of gender dysphoria from a qualified health care professional.Offering a more inclusive benefits plan

The coverage provides one more way for your clients to offer more inclusive coverage and to offer holistic support to their plan members undergoing a gender transition. We have developed this coverage as a complement to our existing coverage options, including Health Care Spending Accounts (HCSAs), Taxable Spending Accounts (TSAs), Extended Health Care and drug coverage, and Employee and Family Assistance Programs, all of which can provide support to plan members undergoing gender affirmation.

We regularly review our products to ensure that they’re meeting your clients’ needs, and we’re committed to offering products that support diversity, equity and inclusion.

We also continue to review our forms, documents and processes to make them more inclusive. This includes reviewing our online plan member enrolment (OPME) tool to allow for more flexibility with the way plan members identify their gender.Gender affirmation and mental well-being

Gender affirmation procedures can lead to improved mental health outcomes for those with gender dysphoria, as most report an improvement in their quality of life following the procedures. Gender dysphoria may occur when a person’s assigned sex at birth does not match their identity, and people experiencing gender dysphoria typically report psychological and emotional distress, including symptoms of depression or anxiety. By offering coverage where provincial health coverage ends, your clients can support plan members as they seek procedures that align their body presentation with their self-identified gender.

Advantages at a glance

Advantages for plan members include:- Reimbursement for some procedures and expenses, leading to fewer out-of-pocket costs

- May experience improved mental health outcomes after surgery

- A benefits plan that promotes a culture of diversity, equity and inclusion, which may build employee loyalty

- Support for plan member mental health to help those with gender dysphoria thrive

The Benefits Canada 2022 Health Care Survey results are in!

Equitable Life is proud to be a Platinum sponsor for The Benefits Canada 2022 Health Care Survey, Canada’s leading survey on workplace benefits plans. This year’s survey report highlights many fascinating insights across a wide variety of benefits topics, including:- A focus on mental health for both plan sponsors and plan members

- The repercussions of the "shadow" pandemic due to health care delays

- Trends in plan members' overall perceptions of their health benefits plans

- The types of benefits getting more attention from plan members

- The role of remote work in plan member satisfaction

We’re committed to helping you and your clients navigate the evolving landscape of employee benefits in Canada by contributing to this vibrant industry community. To read the full report, visit Benefits Canada.

HCSA and TSA manual allocation reminder

If your clients’ Health Care Spending Account (HCSA) and/or Taxable Spending Account (TSA) have manual allocations, they need to allocate these amounts to plan members each year. Clients should review their plan members’ profiles on EquitableHealth.ca to ensure they have received their allocation(s) for the current benefit year. Your clients may also order HCSA and TSA forfeiture reports on EquitableHealth.ca.

If your clients have Plan Administrator update access on EquitableHealth.ca, they can update these amounts online by doing the following:- Select View certificate

- Select Health Care Spending Account or Taxable Spending Account

- Select Update Allocation in Task Center

- Enter amount in Revised Allocation Amount

- Override Reason – Plan Administrator Request

- Select Save

- Select Reports

- Select New

- Select Next

- Select HCSA or TSA Totals by Plan Member

- Select Next

- Enter end date of 12/31/2022

- Select Next

- Select Finish

- View Report

-

Equitable Life Group Benefits Bulletin – September 2021

In this issue:

- Right drug, right dose*

- Responding to New Brunswick’s Biosimilar Initiative*

- Helping plan members access our convenient digital options*

- Reminder: Please access forms on EquitableHealth.ca*

- Over-age dependents losing coverage?*

Right drug, right dose

Equitable Life partners with Personalized Prescribing Inc. to help plan members avoid treatment trial and error

Patients suffering from mental health conditions often need to try several medications before they find one that works for them. This is frustrating and can result in negative side-effects, a longer recovery, lost productivity, or a delayed return to work.

To help plan members avoid this treatment trial and error, we have partnered with Personalized Prescribing Inc. to provide easier access to pharmacogenomic testing for plan members with mental health conditions.

Pharmacogenomics 101

Pharmacogenomics is the study of how an individual’s genes influence their response to medications. Pharmacogenomic testing can help determine how compatible a patient’s body may be to a particular drug, and helps their physician prescribe the most appropriate medication. The goal is to ensure the right drug is prescribed to deliver the most positive outcome with the fewest side effects.

Easier access to pharmacogenomic testing

Through our partnership with Personalized Prescribing Inc., any Equitable Life plan member diagnosed with a mental health condition can purchase a pharmacogenomic test for a discounted price of $399 plus HST – a 20% savings.

We are also introducing the option for plan sponsors to add coverage of pharmacogenomic tests provided by Personalized Prescribing Inc. for mental health conditions.

With this coverage, plan members are eligible for pharmacogenomic testing if:- They have been diagnosed with a mental health condition;

- They are currently taking or have stopped taking a medication for a mental health condition that does not work or has side effects; and

- The pharmacogenomic test is conducted by Personalized Prescribing Inc.

Getting a test is easy. The plan member starts by visiting www.personalizedprescribing.com/equitablelife to request a test kit.

Once they receive their test kit from Personalized Prescribing Inc., they simply provide a saliva sample and send it back (postage is pre-paid). Within 7-10 business days, they receive an Rx Report™ that they can share with their doctor. This report includes details to help their doctor prescribe the right drug and the right dose for them.

Benefits for plan members:- The plan member and their physician receive a full report that is easy to understand;

- The report identifies the most compatible medications for the plan member’s condition and the medications to avoid;

- The physician is able to prescribe the most appropriate medication with the fewest side effects; and

- The plan member avoids medication trial and error.

- Pharmacogenomic testing can be an effective prevention strategy to help employees stay healthy and potentially avoid a mental health-related work absence; and

- Employees suffering from mental health conditions may be more productive when they are on the right medication for them.

Responding to New Brunswick’s Biosimilar Initiative

We are changing coverage for some biologic drugs in New Brunswick in response to the province’s Biosimilar Initiative. These changes will help protect your clients from additional drug costs while still providing access to equally safe and effective biosimilars.

What is New Brunswick’s Biosimilar Initiative?

New Brunswick’s Biosimilar Initiative will end provincial coverage of several originator biologic drugs for some or all conditions beginning on December 1, 2021. Patients who are using these drugs for the affected conditions will be required to switch to biosimilar versions of the drugs to maintain coverage under the province’s government drug plan.

What is the impact on private drug plans?

The most significant risk to plan sponsors who maintain coverage of originator biologics is coordination of benefits (CoB) risk. If other insurance carriers follow suit with the province and delist the originator biologics, it could expose a plan that doesn’t delist them to significant coordination of benefits risk.

For example, consider a patient who is covered under two private plans – their employer plan and a spousal plan. If their employer plan was the first payer for the originator biologic but delists the drug, the spousal plan now becomes the first payor. If the spousal plan continues to cover the cost of the originator, it now pays most or all of the cost of the drug.

How is Equitable Life responding?

To protect your clients’ plans from paying additional and avoidable drug costs, we are changing coverage in New Brunswick for most biologic drugs included in the provincial initiative.

Beginning Feb. 1, 2022, plan members in New Brunswick will no longer be eligible for coverage of Humira, Lantus, Humalog and Copaxone if they have a condition for which Health Canada has approved a lower cost biosimilar version of the drug. These plan members will be required to switch to a biosimilar version of those drugs to maintain coverage under their Equitable Life plan.

How will Equitable Life communicate this change to plan members?

We will be communicating with affected claimants in early-December 2021 to allow them ample time to change their prescriptions and avoid any interruptions in their treatment or their coverage.

Can my client maintain coverage of these biologic drugs?

All groups, except myFlex clients, who wish to opt out of this change and maintain coverage of these originator biologics for New Brunswick plan members can submit a policy amendment. Amendments must be submitted no later than Nov. 30, 2021.

Advisors with myFlex Benefits clients who wish to maintain coverage of these originator biologics for New Brunswick plan members should speak to their myFlex Sales Manager to confirm their eligibility to opt out of this change.

Groups that opt out of this change are also opting out of any future changes to our New Brunswick biosimilar initiative. Their drug plans will continue to cover any additional originator biologics that we subsequently add to the program.

Will this change impact my clients’ rates?

The rate impact of this change and any cost savings associated with the change will be factored in at renewal.

If plan sponsors opt out of these changes and maintain coverage for the originator biologics, it may result in a rate increase. Any rate adjustment will be applied at renewal.

What is the difference between biologics and biosimilars?

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is also known as the “originator” biologic. Biosimilars are also biologics. They are highly similar to the originator drug they are based on and have been shown to have no clinically meaningful differences in safety or efficacy.

Questions?

If you have any questions about this change, please contact your Group Account Executive or myFlex Sales Manager.

Helping plan members access our convenient digital options

Some of your clients’ plan members aren’t benefitting from our secure and convenient digital options to access and use their Group Benefits. They can sign up to submit claims electronically for faster claim payments, get claim payments deposited directly to their bank accounts, easily review their coverage details, quickly access their Group Benefits plan booklet, benefits card and more. We’ve made it easier than ever to sign up, with more resources all conveniently located at Equitable.ca/go/digital.

Your clients’ plan members can visit this link to view:- A brochure with all the high-level instructions they need to get started on EquitableHealth.ca and the EZClaim mobile app

- A full video guide on how to access and navigate EquitableHealth.ca

Reminder: Please access forms on EquitableHealth.ca*

We routinely update our Plan Administrator forms on EquitableHealth.ca based on their feedback and to stay compliant with legal and/or regulatory requirements. If your clients need a form, they should always pull the most recent version from EquitableHealth.ca instead of reusing forms they have saved on their computer. Using an old or outdated form may result in processing delays.

Your clients can access the Plan Administrator forms by following these steps:- Login to EquitableHealth.ca

- Select “Documents”

- Toggle between English and French forms

- Click on the document name to download a PDF copy

Over-age dependents losing coverage?*

Some of your clients’ plan members may have dependents who are reaching the maximum age for eligibility under their group benefits plan.

If they are attending school full-time or are disabled, they may be eligible for continued coverage. Plan members with over-age dependents can simply complete the Application for Coverage of Dependent Child Over Age 21 (Form #441) and submit it through our online document submission tool. They can access the tool by logging into their Group Benefits account at www.equitablehealth.ca and clicking My Resources.

If they are not attending school full-time or disabled, they will no longer be covered under the plan. However, they may be eligible for Coverage2go®. It allows individuals who are losing their group coverage to purchase personal month-to-month health and dental coverage that is affordable, reliable and works like their previous group benefits plan. They can choose the level of coverage and protection that suits their personal situation.

There are no medical questions – they simply need to apply within 60 days of losing their health coverage under their group benefits plan.*

Help your clients’ plan members and their dependents who are losing coverage by letting them know about Coverage2go. They can visit our website to learn more about Coverage2go and to get a quote.

*Quebec residents are not eligible for Coverage2go -

Faster claims processing on Equitable EZClaim Mobile

Equitable Life now provides real-time processing of massage therapy, physiotherapy and chiropractor claims submitted via the EZClaim® Mobile app.

That means plan members will be able to find out the status of their claim almost instantaneously. And, for approved claims, they will receive payment even sooner – often in as little as 24 hours.

Equitable Life plan members can submit all types of health and dental claims via EZClaim Mobile, including co-ordination of benefits and Health Care Spending Account claims. Currently, 43% of all claims are submitted through the user-friendly app.

“We know plan members love the speed and convenience of EZClaim Mobile,” says Norma Crouse, Assistant Vice-President of Claims and Administration at Equitable Life. “With these enhancements, some claims submitted through the app will be processed and paid even faster.”

We’re also adding biometric login functionality to allow plan members to sign in to the app using their face or fingerprint. And we’ve redesigned our landing page on the mobile app to make it easier for plan members to navigate the various features of the app.

- Exchanges

-

Equitable Life Group Benefits Bulletin – January 2022

Short-term disability coverage for plan members with COVID-19*

Please note: This announcement applies only to groups with short-term disability coverage through Equitable Life

As the COVID-19 pandemic continues, and the situation evolves, we continue to adjust our practices to ensure ongoing support for our plan members.

PCR tests no longer required for COVID-related STD claims

Some provinces have recently restricted access to COVID-19 PCR testing to only high-risk individuals. To ensure your clients' eligible plan members receive their short-term disability benefits in a timely manner, we no longer require a positive PCR test for plan members submitting COVID-19-related STD claims.

Plan members who are experiencing symptoms of COVID-19 or who have tested positive for the virus (either with a PCR test or with an at-home rapid test) and are unable to work from home should complete the Short Term Disability Plan Member COVID-19 Claim Form (#421A).

They should indicate the date of the onset of symptoms or date of their positive test result. Where applicable, they should also indicate the date they have been cleared by public health to end their self-isolation. The form includes an attestation that the information they have provided is accurate.

The employer needs to complete the Short Term Disability Employer COVID-19 Claim Form (#421B). They should indicate the expected return-to-work date according to their provincial health guidelines, or using the date provided by a public health official.

Waiting periods for COVID-related STD claims

To support your clients' plan members during the initial stages of the pandemic, we waived the STD waiting period if a plan member’s absence was due to symptoms or a diagnosis of COVID-19. Now that COVID-19 has become the “new normal,” we are returning to our standard practices and treating the virus as we would any other illness.

Effective Jan. 1, 2022, standard waiting periods will apply for COVID-related STD claims, according to the terms of the Group policy. This ensures that all plan members submitting a STD claim are treated fairly, no matter what the cause of the claim.

Eligible plan members will receive STD benefits up to a maximum of 10 days from the date of the onset of symptoms or a positive COVID-19 test result, minus the waiting period.

For example, if the plan has a five-day waiting period, and the plan member returns to work nine days after a positive test result, they would be eligible for four days of benefits payments.

If the claimant is still unwell after 10 days, then the standard Short Term Disability Claim Form (#421) needs to be completed.

If a plan member is admitted to hospital, benefits will be paid following the waiting period applicable to hospital claims. -

Responding to Alberta's Biosimilar Initiative

Beginning March 15, 2021, we are changing coverage for some biologic drugs in Alberta in response to the province’s Biosimilar Initiative. These changes will help protect your clients from additional drug costs that may result from this new government policy while still providing access to equally safe and effective biosimilars.

What is Alberta’s Biosimilar Initiative?

Alberta’s Biosimilar Initiative will end provincial coverage of several originator biologic drugs for some or all conditions beginning on Jan. 15, 2021. Patients 18 and over who are using these drugs for the affected conditions will be required to switch to biosimilar versions of the drugs to maintain coverage under the province’s government drug plan.

What is the impact on private drug plans?

Industry response to Alberta’s Biosimilar Initiative has the potential to significantly impact your clients’ drug plan costs. If other insurance carriers follow suit with the province and delist the originator biologics, it could expose a plan that doesn’t delist them to significant coordination of benefits risk. (See Case Study below.)

How is Equitable Life responding?

To protect your clients’ plans from paying additional and avoidable drug costs, we are changing coverage in Alberta for most biologic drugs included in the provincial initiative.

As of March 15, 2021, several originator biologic drugs will no longer be covered for plan members of all ages in Alberta. Plan members taking these biologics will be required to switch to the biosimilar versions of these drugs to maintain eligibility under their Equitable Life plan.

What drugs and conditions are affected?

The following table outlines the drugs and conditions that will be affected by this change. The list of affected drugs or conditions is dynamic and will change as Alberta includes more biologic drugs in its Biosimilar Initiative, as new biosimilars come onto the market, and as we make changes in drug eligibility.

Drug name Originator biologic

These drugs will no longer be covered in Alberta for the conditions listed in this table.Biosimilar

Plan members will need to switch to these medications to maintain coverage under their Equitable Life plan.

Affected health conditions

The changes in coverage apply to these conditions.Etanercept Enbrel Brenzys

ErelziAnkylosing Spondylitis

Rheumatoid Arthritis

Polyarticular juvenile idiopathic arthritis (JIA)

Psoriatic Arthritis

Plaque Psoriasis (adults and children)Infliximab Remicade Inflectra

Renflexis

AvsolaAnkylosing Spondylitis

Plaque Psoriasis

Psoriatic Arthritis

Rheumatoid Arthritis

Crohn's Disease (adults and children)

Ulcerative Colitis (adults and children)Insulin glargine Lantus Basaglar Diabetes (Type 1 and 2) Filgrastim Neupogen Grastofil

NivestymNeutropenia Pegfilgrastim Neulasta Lapelga

Fulphila

ZiextenzoNeutropenia Glatiramer* Copaxone Glatect

TEVA-Glatiramer AcetateMultiple Sclerosis *Glatiramer is a non-biologic complex drug.

How will Equitable Life communicate this change to plan members?

We will be communicating with affected claimants in January 2021 to allow them ample time to change their prescriptions and avoid any interruptions in their treatment or their coverage.

Can my client maintain coverage of these biologic drugs?

Traditional groups who wish to opt out of this change and maintain coverage of these originator biologics for Alberta plan members can submit a policy amendment. Amendments must be submitted no later than January 15, 2021. Advisors with myFlex Benefits clients who wish to maintain coverage of these originator biologics for Alberta plan members should speak to their myFlex Sales Manager to confirm their eligibility to opt out of this change.

Will this change impact my clients’ rates?

The rate impact of this change in coverage will be relatively insignificant. Any cost savings associated with the change will be factored in at renewal.

If plan sponsors opt out of these changes and maintain coverage for the originator biologics, it may result in a rate increase. Any rate adjustment will be applied at renewal.

What is the difference between biologics and biosimilars?

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is also known as the “originator” biologic. Biosimilars are also biologics. They are highly similar to the originator drug they are based on and have been shown to have no clinically meaningful differences in safety or efficacy.

Questions?

If you have any questions about this change, please contact your Group Account Executive or myFlex Sales Manager.

CASE STUDY: The Alberta Biosimilar Initiative and Coordination of Benefits (CoB) risk

CoB risk is real and can be significant, even if a pharmaceutical savings program exists.

The industry response to Alberta’s Biosimilar Initiative has the potential to significantly impact your clients’ drug plan costs. Some insurers may follow the province’s lead and delist these originator biologics. Others may cut back coverage to the cost of the biosimilars or maintain coverage of the originators. These differences could expose a plan that doesn’t delist the originator biologics to significant coordination of benefits risk. Here’s how:

Let’s assume there are two private drug plans – Plan A and Plan B. Both plans are open plans with no deductible. Plan A has 80% co-insurance and Plan B has 100% co-insurance.

BEFORE Alberta’s Biosimilar Initiative

Before Alberta’s Biosimilar Initiative, both plans cover the originator biologics listed above.

Plan A is the first private payer for an Alberta plan member taking an originator biologic drug for Rheumatoid Arthritis. Plan B is the second private payer. The cost of the originator biologic for the plan member is $30,000 annually. Here’s how the coordination of benefits would look before Alberta’s Biosimilar Initiative.

AFTER Alberta’s Biosimilar InitiativeIn response to Alberta’s Biosimilar Initiative, the insurer for Plan A delists the originator biologic and requires plan members to switch to the biosimilar. The insurer for Plan B maintains coverage of the originator biologic. Under this scenario, if the plan member doesn’t switch, Plan B essentially becomes the first payer and sees their annual cost increase by 400% (from $6,000 to $30,000).

Even if the insurer for Plan B cuts back coverage to the cost of the biosimilar or adjusts the paid amount because they have a savings program in place with the drug manufacturer, the impact could be significant. For example, if the insurer cuts back coverage to 50% (or $15,000 annually), Plan B would see a 150% annual cost increase (from $6,000 to $15,000):

-

Supporting you and your group clients during the COVID-19 pandemic

We know these are challenging times.

As COVID-19 continues to spread, we want to reassure you that we remain ready and committed to support you, your group clients and their plan members.

We have a robust and well-tested business continuity plan in place and have taken the necessary steps to maintain the high level of service you have come to expect from us. Our business is near 100% digital, so the vast majority of our employees are now working remotely from home and are fully functional. Our Customer Care Centre remains open to support plan members and can be reached at 1.800.265.4556. And our Client Relationship Specialists are available for Plan Administrator questions and support.

As the situation continues to develop, we know you will have questions about what it means for your clients and their plan members. We have already issued announcements related to Travel Assist coverage for plan members who are outside of the country, and about short-term disability coverage for plan members who are in quarantine or self-isolation. We will continue to provide timely updates as developments unfold.

All of us are facing an unprecedented number of urgent situations where there is no established protocol. Our commitment to you and your clients is to respond quickly, and to be flexible where we can, tailoring solutions to specific needs. The global situation is evolving rapidly; we ask for your patience as our solutions also evolve quickly and accordingly. Your Group Account Executive and myFlex Sales Manager are well equipped to navigate Equitable Life’s experts and to resolve difficulties.

These are extraordinary times and history is in the making. Rest assured that Equitable Life is unwavering in our support, and we will be here to help you when it matters most.

-

Insights from a pandemic: Long-term COVID-19 drug risks

For the remainder of 2020 and beyond, COVID-19 will continue to add to the existing pressures driving up drug costs. Examples of contributing factors include:

- Claims for acute drugs will likely increase as elective surgeries resume and plan members address non-emergency health issues that were left unattended during COVID-19.

- Plan members whose employers are facing financial strain due to COVID-19 may stock up on their prescriptions in anticipation of losing their job and/or their benefits.

- An ongoing increase in the prevalence and severity of mental health issues and chronic conditions. In May and June, we saw a dramatic increase in the number of claimants for depression, ulcers, blood pressure and diabetes, and depression was associated with 1 in 5 claimants.

All trends thus far suggest we can expect about a 10% increase in average paid amounts per certificate in 2020 compared with 2019. But the impact won’t be the same for all groups. There will be significant variations, particularly for smaller groups, and some may see much larger cost increases.

Unknown COVID-19-related risks

Another risk exposure may come from the costs associated with drugs used to treat or prevent COVID-19. There are currently numerous vaccines in development, and more than 300 clinical trials are underway for both new and existing drugs to determine their effectiveness in treating the virus.

The cost of any vaccine or whether government or private plans will pay for it is unknown. Regardless, there will likely be other drugs indicated for the treatment or prevention of COVID-19 that private plans will be expected to cover. The cost of this impact for private payers is unknown, but potentially high.

Another unknown is what will happen with dispensing fees. While most provinces have lifted their 30-day prescription refill limits, it remains to be seen whether pharmacies will resume dispensing 60- and 90-day refills at pre-COVID levels for private plans. If not, this would mean the dispensing fees will continue to drive up drug costs.

Advisor opportunity

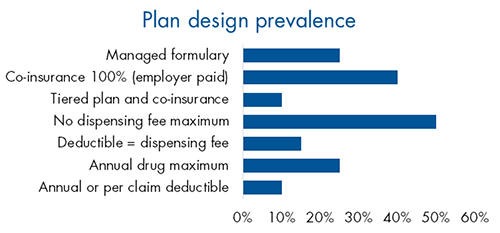

Despite the increase in drug plan risk in recent years, little has changed in plan design trends. Very few plan sponsors have adopted managed plans or other plan design options that could help manage risk.

This presents an opportunity for advisors to educate their clients about the risks their drug plan may be exposed to and the options available to manage that risk.

A practical starting point for those conversations is our Drug Plan Design Tool. With two simple questions, it can help confirm your client’s objectives and identify some best-fit solutions for their plan. Ask your Group Account Executive or myFlex Sales Manager for a copy of the tool.

-

Equitable Life Coronavirus Update – March 13, 2020

As the coronavirus (COVID-19) continues to spread, it’s important that you, your clients and their plan members have the most up-to-date information. We are providing timely updates on any developments that impact your clients and their plan members or their benefits coverage.

Please share this information with your clients. You can direct them to EquitableHealth.ca, where we have posted a version of these updates.

Coronavirus travel coverage*

For groups with Travel Assist coverage

The Public Health Agency of Canada has issued several Travel Health Notices advising Canadians to avoid travel to countries and regions where there have been outbreaks of coronavirus (COVID-19).

A good resource to help your clients and their plan members understand how the spread of the coronavirus may impact their travel plans is the Public Health Agency of Canada’s Coronavirus Travel Advice site. The levels of risk by country and region are regularly updated.

If your clients’ plan members cannot avoid travelling, Public Health recommends they take steps to prevent illness and seek medical attention if they become sick.

Where to find the latest information

The list and level of travel advisories can change at any time. Please check the Government of Canada’s Travel Advisor and Advisory page for the most current information.

If your clients’ plan members have coronavirus symptoms while travelling, please advise them to contact Travel Assist at the numbers listed below for assistance.

Advise plan members to call before they travel

If a plan member is travelling anywhere outside of the province or country and their benefits plan includes Travel Assist, plan administrators should advise them to make sure they’re prepared for a medical emergency by following these steps.

- Check the Government of Canada’s Travel Advisor and Advisory page. Note that it is important to click on the country to check whether any specific regions of that country have travel advisories.

- If they have questions, they should call Travel Assist before they travel for assistance and benefit information.

- Pack their Equitable Life benefits card and provincial health card.

- In a medical emergency, call the Travel Assist 24-Hour Hotline:

- Toll-free Canada/USA: 1.800.321/9998

- Global call collect: 519.742.3287

- Allianz Global Assistance ID #9089

Allianz Global Assistance administers Equitable Life’s Travel Assist benefits. Allianz has an international network of medical facilities, transportation providers, medical correspondents and multilingual administrative agents who aid with medical, legal and most travel-related emergencies 24-hours a day, seven days a week.

Early prescription refills and drug shortages*

In response to concerns about COVID-19 TELUS Health, our pharmacy benefits manager, has announced it is maintaining its standard rules for refills of medication. Plan members can refill their medications when at least two-thirds of the last dispensed supply has been used.

If plan members need more than the maximum supply allowed on their plan, they must pay out-of-pocket for the excess amount. They can then submit a claim to ask for an exception request.

TELUS is taking this position to help maintain access to medication for all patients. They continue to monitor the situation. We will provide an update if it changes.

Drug shortages

TELUS Health monitors for drug shortages and updates their system for any unavailable drugs. This helps to ensure accurate claims payment. If a referenced lowest-cost generic drug is unavailable, claims for drugs in the class will be paid at the next lowest-cost generic alternative available.

*Indicates content that will be shared with your clients

-

Equitable Life Group Benefits Bulletin - July 2021

In this issue:

- Fabien Jeudy takes over as President and CEO*

- Reminder: Equitable Life’s Guide to Accessing Virtual Healthcare*

- Mental health resources for plan members*

- Recall of Philips CPAP machines*

Fabien Jeudy takes over as President and CEO*

In March, we announced that Fabien Jeudy was appointed as Equitable Life’s next President and CEO. Jeudy officially took over on July 5th, succeeding Ronald Beettam, who is retiring after 16 years with the company.

Jeudy is a collaborative leader with more than 30 years of experience in the insurance industry, leading actuarial, finance, risk management, distribution, marketing teams and operational teams in the Life & Health Insurance, Wealth Management and Group Benefits markets in Canada, the US, and Asia.

Reminder: Equitable Life’s Guide to Accessing Virtual Healthcare*

The demand for virtual healthcare services has increased as the pandemic is driving more people to access their health care providers from home.

Thankfully, many virtual healthcare services are available for free to Canadians with provincial health care coverage. We have created a Guide to Accessing Virtual Healthcare for plan members to easily access a variety of virtual healthcare services. Our guide includes information and links to both free and paid virtual medical care options, including video appointments, health advice over the phone, emergency dental services, and more.

You can find the guide on our website. It’s also available on our plan member website at EquitableHealth.ca.Mental health resources for plan members*

Many Canadians have been experiencing increased levels of stress, anxiety, and depression since the beginning of the COVID-19 pandemic. Through our partnership with Homewood Health®, all of our clients and their plan members have access to a number of health and wellness resources designed to provide guidance and support.

Homewood’s Online Cognitive Behavioural Therapy tool, i-Volve, can help plan members identify, challenge and overcome anxious thoughts, behaviours and emotions. Learn more about Online CBT or access i-Volve at Homeweb.ca/Equitable.

As well, Homewood has a number of resources available to help support plan members dealing with increased anxiety during these uncertain times:- Quelling COVID-19 Anxiety

- Managing stress and anxiety

- How to speak to children

- How to stay productive and motivated when working from home

- The COVID-19 Pandemic: Managing the Impact

- Support for First Responders, Front Line Workers and Public Facing Employees

- Financial tips for your financial health

- Increases in Domestic Violence

- Those with family members in long-term care facilities

- COVID-19: Employee Fatigue, Isolation and Loneliness

Recall of Philips CPAP machines*

Last month, electronics company, Philips, issued a recall with Health Canada of some of its Continuous Positive Airway Pressure (CPAP), BiLevel Positive Airway Pressure (BiLevel PAP) devices and Mechanical Ventilators. The recall was issued due to a foam abatement within the machines that can become loose and cause potential health risks.

To qualify for repair or replacement of these devices, users must register their machine on the Philips website.

CPAP, BiLevel PAP devices and Mechanical Ventilators are eligible for coverage under an HCSA and under some Extended Health Care plans. Plan administrators may want to inform plan members of this recall if the devices are eligible for coverage under their plan.