Site Search

370 results for pre-authorized debit plan

-

Temporary change for certain Savings & Retirement withdrawal requests

We’re making improvements to Equitable’s EZtransact® automation system. Unfortunately, withdrawal requests under the Home Buyer’s Plan or Lifelong Learning Plan are currently being processed incorrectly as taxable withdrawals, with taxes withheld in error. We are working hard to fix this issue.

What to do:

Please submit these specific withdrawal requests using paper forms for manual processing until further notice.

We appreciate your understanding and support as we enhance the system. If you have any questions, feel free to reach out to your Director, Investment Sales.

Date posted: June 26, 2025 -

August 2019 Advisor eNews

Coming soon:

Tech updates for plan members

Technology doesn’t stand still, and neither does your clients' businesses. That’s why we continually invest in technology to make things easier for your clients and their employees.

Faster claims processing on Equitable EZClaim® Mobile

Equitable Life now provides real-time processing of massage therapy, physiotherapy and chiropractor claims submitted via the EZClaim Mobile app.

That means plan members are able to find out the status of their claim almost instantaneously. And, for approved claims, they will receive payment even sooner - often in as little as 24 hours.

In order to allow for instantaneous processing and faster payment, plan members will be prompted to enter some additional information including the practitioner’s name, the date of the expense, and the type and amount of the expense, when submitting their claims for these services.

Equitable Life plan members can submit all types of health and dental claims via EZClaim Mobile, including co-ordination of benefits and Health Care Spending Account claims. Currently, 43% of all claims are submitted through the user-friendly app.

AS part of our ongoing efforts to improve the mobile claims experience for plan members, we've also added biometric login functionality to allow plan members to sign in to the app using their face or fingerprint. And we've redesigned our landing page on the mobile app to make it easier for plan members to navigate the various features of the app.

We will be announcing this enhancement to plan members on EquitableHealth.ca

Introducing InpatProtect:

Health coverage for employees who are new to Canada

For a new employee starting to work in Canada, looking after basic health needs can be difficult.

There’s a waiting period for provincial health coverage, and group benefits plans don’t cover the physician, hospital or emergency services that they or their eligible dependents may need during their initial months in the country. They could end up incurring significant unexpected health expenses.

That’s why Equitable Life has launched InpatProtectTM. InpatProtect provides temporary coverage to look after the basic health needs of employees and their eligible dependents during their transition to Canada. Your clients can recruit from outside the country knowing that their employees will have some protection in the event of a medical need, including an emergency.

For up to 90 days, InpatProtect will cover employees and their eligible dependents for basic services that would normally be reimbursed under provincial health plans, such as:

- Physician services

- Prescriptions for medications

- Diagnosis and treatment for illness or injury

- Hospital services

- In-patient services

- Drugs prescribed and delivered as an inpatient in-hospital

- Out-patient services

- Emergency services

- Ambulance services

- Emergency dental services

Contact your Group Marketing Manager or myFlex Sales Manager for more information about this new product from Equitable Life.

De-listed service providers

As part of our ongoing initiative to have Group Benefits plans only reimburse eligible claims, we conduct reviews of the billing and administrative practices of service providers, including clinics, facilities and medical suppliers.

As a result of these reviews we may de-list certain providers. We will no longer accept, or process claims for services and/or supplies obtained from those providers. The plan member can still choose to obtain services or supplies from these providers, but Equitable Life will not provide reimbursement for the claims.

Review Equitable Life’s de-listed service providers

The delisted service provider list is also posted on EquitableHealth.ca for plan members to review to determine if their claim(s) are eligible for reimbursement under their Group Benefits plan.

For more information about protecting group benefits plans from abuse, check out our articles.

1 Based on Equitable Life health and dental claims submitted between January 2019 – March 2019

Google Home and Google Assistant are registered trademarks of Google LLC.

® denotes a trademark of The Equitable Life Insurance Company of Canada unless otherwise indicated. - Physician services

-

January 2024 eNews

In this issue:

- Equitable scores high marks with group advisors*

- REMINDER: Equitable's National Biosimilar Program starts in March*

- 2024 dental fee guide updates*

- Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable scores high marks with group advisors*

Equitable ranked first for operational service among major group insurers in a recent study of Canadian group benefits advisors.

NMG Consulting, a leading global consulting firm, conducted in-depth interviews with 146 Canadian group benefits brokers, consultants, MGAs and third-party administrators between May and August 2023 for its annual Canadian Group Benefits Study. Based on these interviews, NMG ranked group insurers in six categories, ranging from operational management to technology.

Nationally, Equitable ranked among the top three in five of the six main categories, including number one for Operational Management:Category Ranking Operational management 1st Initiatives (including seminars & training) 2nd Technology 3rd Underwriting & claims management 3rd Relationship management 3rd

“Advisors regard us highly in many categories. That’s a testament to our mutual status and ability to focus exclusively on our clients and advisor partnerships,” said Marc Avaria, Executive Vice President, Group Insurance Division. “We are truly working together to build strong, enduring and aligned partnerships with our clients and advisors.”

“We’re delighted with these results and are committed to continuously advancing our delivery of a better benefits experience for our clients and advisors,” added Avaria.More highlights from the latest NMG survey

Nationally, we ranked first in seven subcategories in Operational Management, including:- Overall service to intermediaries,

- Overall service to plan sponsors,

- New quote process,

- Plan implementation,

- Renewal process,

- Accuracy and timeliness of reporting and billing, and

- Administration quality and responsiveness

And we were rated strongly in Technology, finishing in the top three for:- Overall technology for Intermediary (2nd)

- Member experience (3rd)

- Quality of technology for the plan sponsor (2nd)

- Quality of mobile application (2nd)

REMINDER: Equitable's National Biosimilar Program starts in March*

In October 2023 we announced the upcoming launch of our national biosimilar program. Starting March 1, 2024, we are expanding our biosimilar switch initiatives to provide a single, nationwide** program.

Why we’re making the switch

Over the past few years, most provinces have introduced policies to delist some originator biologic drugs. They require most patients to switch to biosimilar versions of those drugs to be eligible for coverage under their public drug plans. Soon, it is expected that all provincial drug plans will cover only biosimilars.

Equitable’s National Biosimilar Program simplifies drug plan coverage by replacing our provincial programs. It also protects clients from additional drug costs while offering access to lower-cost biosimilars deemed equally safe and effective by Health Canada.

How will this affect clients' drug plans?

Because we have already introduced biosimilar switch initiatives in most provinces, the impact of this change will be minimal. It will primarily affect plan members in provinces or territories where we haven’t already required the switch to biosimilars. It will also affect plan members who are taking biosimilars that were not originally included in the switch initiative for their province.

Regardless of where they live, plan members across Canada will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower-cost biosimilar version of the drug. Plan members already taking the originator biologic will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable plan. We will support their transition with education, personalized communication, and resources.

Advance notice for plan members

We contacted affected claimants in early December to give them enough time to change their prescriptions and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Account Executive.

** Excludes plan members in Quebec who participate in a separate provincial program.

2024 dental fee guide updates*

Each year, Provincial and Territorial Dental Associations publish fee guides. Equitable uses these guides to help determine the reimbursement limits for dental procedures.

For your reference, you may wish to refer to the 2024 list of the average dental fee increases for general practitioners.

Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable is proud to congratulate our Employee and Family Assistance Plan (EFAP) partner, Homewood Health®, for winning the Canadian HR Reporter 2023 Reader’s Choice Award in Employee Assistance Plan services. Homewood’s EFAP provides confidential support for a range of health, family, money, and work issues through face-to-face, phone, email, chat, or video counselling. The award recognizes their high standards in counselling and mental health support services.

The annual Reader’s Choice Awards identify organizations that provide outstanding expertise and services for HR professionals and employers across Canada. Those organizations provide valuable information on useful, innovative HR and employee benefits products and programs, in categories such as recruitment, mental health services, employee engagement programs, and more.

Sharing Homewood Health with your clients

Since 2019, we have worked with Homewood to provide mental health services for Equitable benefits plan members.

Your clients can access Homewood Health’s award-winning EFAP for an additional fee by adding it to their benefits plan. Services are available 24/7, 365 days a year.

All Equitable clients also have free access to Homewood Health Online in their benefits plan. Homewood Online provides a variety of helpful wellness resources, including:

- Homeweb, an online and mobile health and wellness portal,

- Health Risk Assessment, a group of assessment tools to help plan members identify and overcome health and wellness barriers, and

- Online Internet-based cognitive behavioural therapy (iCBT) through Sentio to manage symptoms of anxiety and/or depression.

Questions

To learn more about Homewood Health’s services, contact your Group Account Executive or myFlex Account Executive.

- [pdf] Protecting your plan

- [pdf] Supplementary Advisor Contracting Application

- Equitable Blog

-

Most employers staying the course on benefits during COVID-19

With businesses suffering hardship due to COVID-19, employers are turning to you for advice on their benefits plans during these difficult times. We’ve received numerous questions from advisors about changes our clients are making to their plans during this crisis.

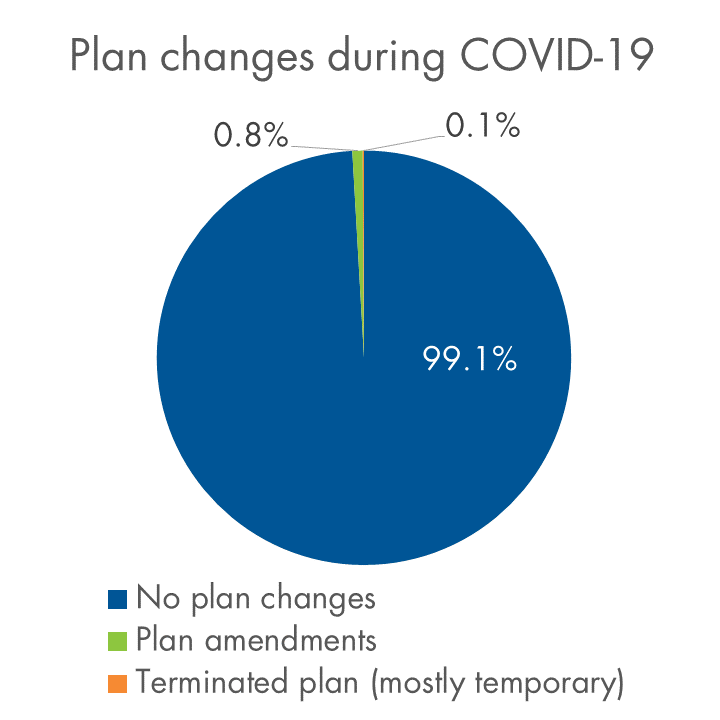

So far, the vast majority of clients are standing pat and taking a wait-and-see approach. Plan amendments have been the exception – fewer than 1% of our clients have made COVID-19-related amendments as of mid-April. Almost all are clients with fewer than 50 lives.

We know that many of our clients have experienced layoffs, but hardly any have cancelled benefits. Fewer than 0.1% have terminated benefits to date.

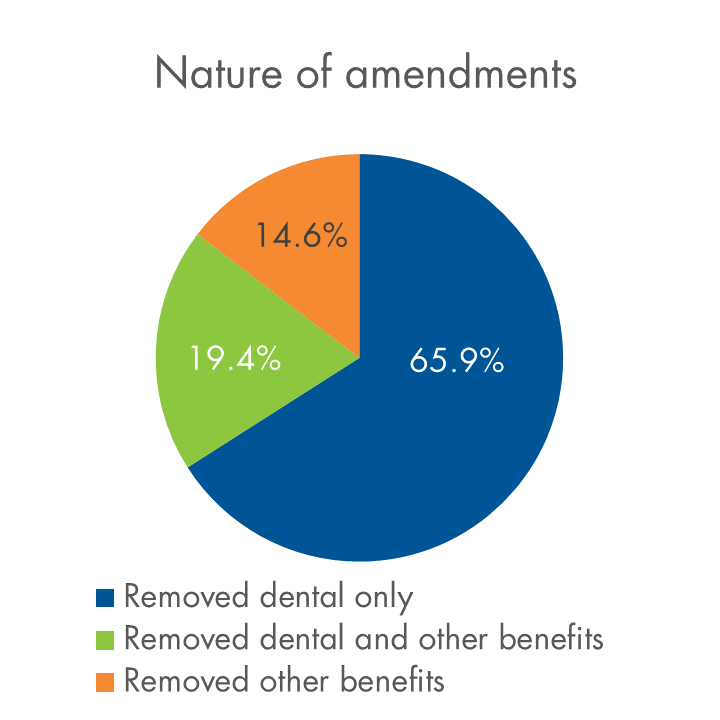

Below is a snapshot of plan amendments and terminations relative to our overall block, and an overview of the types of amendments we’re seeing.

COVID-19-related plan changes on Equitable Life’s block of businessAs of April 15, 2020

Have clients who need to make a change?

We know this is a difficult time for Canadian employers. If you have a client who needs to make a change to their plan, please contact your Group Account Executive or myFlex Sales Manager. We have a range of options to help them manage, and changes can be made quickly. The average turnaround time for COVID-19-related amendments is currently about four days.

We’re happy to work with each employer to understand the options that suit their specific situation best.

-

Update on our service levels during the COVID-19 pandemic

Supporting your clients and their plan members is more important than ever during the ongoing COVID-19 pandemic

So, we’re providing an update on our service levels.

We acted quickly to ensure there were no disruptions in service – most of our staff were working remotely from home and fully functional within a few days. We’ve reallocated resources from functions where volumes are down, such as dental claims, to those experiencing higher volumes. We also created a separate queue for COVID-19-related STD claims.

As a result, we’ve been able to maintain the industry-leading service levels you have come to expect from us, and our turnaround times continue to be well within our targets.

Here’s a summary of what you and your clients can currently expect in terms of average turnaround times:

Service category Average Turnaround Time

(as of April 26th)Customer Care Centre wait times 89% of calls answered within 20 seconds Responses to emails to our Service Team Within 24 hours Health claims 2 days Dental claims 2 days Life claims 1 day STD claims 4 days LTD claims 4 days Plan member updates 2 days New customer implementations 16 days COVID-19-related plan amendments 4 days Other plan amendments 8 days Quotes 2 days ahead of deadline We will closely monitor the situation and continue to adapt to ensure we maintain our service levels. And we will do our best to resolve any service issues that arise as quickly as possible.

Please feel free to contact your Group Account Executive or myFlex Sales Manager and let us know how we’re doing.

-

Tools to manage mental health

As we all continue to manage the impacts of the COVID-19 pandemic, it’s important to remind your clients of the valuable supports available to help their plan members cope through this challenging time.

Free trusted information and COVID-19 resources

Our partner FeelingBetterNow® is responding to the pandemic by providing trusted public resources that offer mental health support. They are available to anyone 24 hours a day, seven days a week, and include:

- What to do if you’re anxious or worried about COVID-19;

- Resources for parents and caregivers; and

- National and Provincial Public Health resources.

Access COVID-19 resources from FeelingBetterNow.

FeelingBetterNow Mental Health Assessment

In addition to these public resources, Equitable Life clients with FeelingBetterNow as part of their group benefits plan have access to online mental health resources. FeelingBetterNow can help plan members identify their risk for mental health concerns and work with their doctor on diagnosis and treatment. It’s an anonymous tool developed by mental health experts which provides:

- Emotional and mental health assessments;

- Practical, evidence-based tools employees and their doctor can use to assess, treat, and follow-up on emotional and mental health concerns; and

- Convenient online access to information and effective resources.

FeelingBetterNow is easy to use and completely anonymous. It takes less than 20 minutes to complete the assessment and view your results.

Learn more about FeelingBetterNow, then contact your Group Account Executive or myFlex Sales Manager to discuss how your clients can add this service to their plan.

- Online Banking