Payout Annuities

Payout Annuities

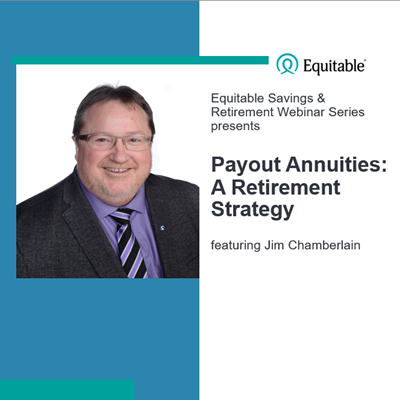

A payout annuity can be used as a guaranteed income. It can be used for short or long-term income needs. It can also cover fixed expenses in retirement or give guaranteed income that is not affected by interest rates or market fluctuations. Payout annuities can also be used for converting registered savings to income.

Notable Features

- Registered, non-registered, pension and locked-in monies

- Indexed payments

- Prescribed and non-prescribed tax treatment (non-registered annuities)

- Guarantee periods

- Potential for creditor protection

- Flexibility

Payout Annuity Options

There are lots of payout annuity options available. Each gives the opportunity to build a retirement income solution based on personalized financial goals.

- Life Annuity

- Annuity Certain (non-registered only)

- Annuity Certain to age 90

- Joint and Survivor

- Joint and Survivor (with reducing payments)

If you would like to order paper copies, click here for the Savings and Retirement Supply Order Form.

| Form Number | Cover | Marketing Material Name | Available Languages | Product |

|---|---|---|---|---|

| 0455 | Annuity Settlement Option File | FR | ||

| 0355 | Payout Annuity Application File | FR | ||

| 0687 | Custom Quote - Payout Annuity File | FR |

If you would like to order paper copies, click here for the Savings and Retirement Supply Order Form.

| Form Number | Cover | Marketing Material Name | Available Languages | Product |

|---|---|---|---|---|

| 1244 |

|

Payout Annuities Client Brochure

File

Equitable payout annuities offer a simple, yet effective solution that will work to meet your individual needs. |

FR | |

| 1369 |

|

Payout Annuities Product at a Glance

File

A Payout Annuity is a lump sum investment that provides guaranteed income. (Available in PDF only) |

FR | |

| 1947 |

|

Payout Annuity Interest Rate Guarantees (Advisor)

File

When you request a rate guarantee, you are guaranteeing the interest rate, not the dollar amount of the annuity payment. (Available in PDF only) |

FR | |

| 1507 |

|

Payout Annuity Rate Guarantees

File

A rate guarantee locks in the interest rate that will be used to calculate the income payment. (Available in PDF only) |

FR | |

| 1511 |

|

Prescribed Annuities: Tax-Efficient Retirement Income

File

Taxation is an important consideration when planning your retirement income, and using a prescribed life annuity is one of the best ways to generate tax-efficient income. |

FR | |

| 1514 |

|

Gradual Inheritance Strategy

File

When electing this option, you are requesting that the death benefit proceeds payable at your death are used to purchase an annuity for your beneficiary(ies). |

FR |

Share articles using your Facebook, Twitter or LinkedIn account.

| Article | |||

| Does a payout annuity fit your retirement plan? When you reach retirement, your focus shifts from saving money to spending money. Now before you get too excited, what I mean by spending money is that you are pulling the money out of your account for living expenses. Let me see if I can be clearer. |

.png?width=30&height=31) |

.png?width=30&height=30) |

.png?width=30&height=29) |

If you would like to order paper copies, click here for the Savings and Retirement Supply Order Form.

| Form Number | Cover | Marketing Material Name | Available Languages | Product |

|---|---|---|---|---|

| 1638 |

|

Equitable's Competitive Advantage

File

When it comes to simple and straightforward investment products and resources for clients, advisors look to Equitable® to help build and support their business. |

FR | |

| 1947 |

|

Payout Annuity Interest Rate Guarantees (Advisor)

File

When you request a rate guarantee, you are guaranteeing the interest rate, not the dollar amount of the annuity payment. (Available in PDF only) |

FR | |

| SS2 |

Equimax & Term Certain Annuity Package

File

This sales track shows you how to use a Term Certain Annuity to prearrange funding for an Equimax policy. |

FR |

Participating Whole Life Term |

|

| 2046 |

|

WL & Annuity - Child's 10 Pay File | FR | Participating Whole Life |

| 0610 |

|

WL Annuity & Checklist File | FR | Participating Whole Life |

| 0613 |

|

WL Annuity 20 Pay File | FR | Participating Whole Life |

| 0612 |

|

WL Annuity Child's 20 Pay File | FR | Participating Whole Life |

| 0614 |

|

WL Annuity Create a Legacy File | FR | Participating Whole Life |

|

.jpg?width=400&height=309) |

.png)