Site Search

756 results for form to restart a pac on insurance

- [pdf] Change of Sales Charge Option (Pivotal Select)

- [pdf] TFSA Third Party Contribution

- [pdf] Agency Application For Contract

- [pdf] Get started online

-

Equitable Life Group Benefits Bulletin – May 2020

In this issue:

- Digital options for your clients and their plan members*

- Alberta delaying biosimilar initiative*

- Yukon increasing insurance premium tax*

- Manitoba and New Brunswick relaxing drug limits*

- Free guide to accessing virtual healthcare*

- Homeweb for plan members who are losing coverage*

*Indicates content that will be shared with your clients

Easy and convenient digital resources for your clients and their plan membersDuring this time of physical distancing, people are looking for ways to interact with their providers virtually. We have several convenient digital tools available to make it easier for your clients and their plan members.

For plan administrators:

Plan administrator portal (EquitableHealth.ca)Our secure portal allows plan administrators to easily manage their plan anytime and anywhere. Instead of printing and mailing forms, they can make real-time updates at their convenience. The site also makes it easy to:

- View or upload forms and other important documents;

- Retrieve billing information;

- Estimate monthly premium costs; and

- View announcements, tips and reminders.

Plan administrators can visit www.equitablehealth.ca to activate their account.

Digital Welcome Kits

Instead of paper kits that can easily get lost or quickly become outdated, plan members receive personalized welcome kits via an interactive email, including instructions on how to:

- Activate their online group benefits account;

- Download their digital benefits card;

- Submit claims from their computer or mobile device;

- Review their coverage details; and

- Explore health and wellness resources.

Easy automated payments

Automated payments are a convenient way to avoid missed payments, suspended claims and disruption. Plan administrators simply complete the pre-authorized debit form and send to GroupCollections@equitable.ca. Or contact Group Collections about online banking and electronic funds transfer (EFT).

We can help

For assistance, plan administrators can contact their Client Relationship Specialist or our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

For plan members:

Plan member portal (EquitableHealth.ca)By logging into EquitableHealth.ca, plan members have secure 24/7 access to their personalized Group Benefits account. They can:

- View and submit claims;

- Review their coverage details; and

- Access health and wellness resources.

Electronic claims payment and notifications

Once plan members have activated their Group Benefits account on EquitableHealth.ca, they can easily set up receiving their claim payments via direct deposit, and their claim notifications via email.

EZClaim Mobile App

Submitting claims is fast, easy and secure with the Equitable EZClaim® mobile app for iOS and Android devices. Plan members can view and submit health and dental claims and review their coverage details.

Digital Benefits Cards

Instead of digging through their wallets, plan members can download a digital version of their benefits card to their mobile device.

We can help

We’ve created a video guide to help plan members access and use their digital resources. For further assistance, plan members can contact our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

Alberta government delaying biosimilar initiativeAs we announced in the February 2020 issue of eNews, the Alberta Biosimilar Initiative will require patients using several originator biologic drugs to switch to a biosimilar in order to maintain coverage through their Alberta government sponsored drug plan.

Due to the increased demands the COVID-19 pandemic is placing on healthcare providers, the Alberta government has postponed the switching requirement. Affected patients will now have until January 15, 2021 to switch to the biosimilar version of their drug in order to maintain provincial coverage.

We continue to investigate appropriate options to help ensure this provincial change does not unreasonably impact Equitable Life groups and patients and will keep you informed.

For more information about the Alberta Biosimilars Initiative, consult the Alberta government website.

Yukon increasing Insurance Premium TaxThe Yukon Government has announced that it plans to increase its Insurance Premium Tax rates effective January 1, 2021. The premium tax rates for group life and accident and sickness insurance are expected to increase from 2% to 4%. The new tax rates will be applied to premiums paid on or after January 1, 2021.

Manitoba and New Brunswick relaxing drug limitsIn order to protect the drug supply during the COVID-19 crisis, residents of most provinces were temporarily limited to receiving a 30-day supply of drugs when filling a prescription. Normally, doctors prescribe a 90-day supply for most maintenance-type drugs.

The Government of Manitoba and the Government of New Brunswick are now relaxing this 30-day limit for prescription drugs where shortages do not exist. They will address potential shortages of specific drugs if necessary.

As the situation continues to evolve, there may continue to be changes to provincial legislation and prescription limits. Plan members should speak to their pharmacist for the most up to date information.

Free guide to accessing virtual healthcareWith many health clinics closed and the healthcare system under strain, people are looking to access a doctor and other health providers virtually.

As we announced previously, we’ve made it easier for plan members to find the information they need using our Guide to Accessing Virtual Healthcare. This online resource provides information about and links to a range of virtual health services they need to take care of their health and the health of their family during these challenging times.

The Guide also indicates which services are covered by public health plan, so there’s no cost to the patient to access them if they provide their valid provincial health card.

We will continue to update the Guide as more virtual healthcare providers and services become available.The Guide is available on both EquitableHealth.ca and Equitable.ca.

Homeweb for plan members who are losing coverageWe know these are difficult times for Canadian employers and their employees. As businesses temporarily suspend operations, some employers have had to make the difficult decision to temporarily lay off employees or put their benefits coverage on hold.

That’s why we were pleased to announce that Homewood Health® and Equitable Life will extend access to Homeweb, a personalized online mental health and wellness portal, for up to 120 days for plan members who have temporarily lost their benefits coverage due to COVID-19.

Employees and their family members will continue to have access to the Homeweb website and mobile app, including:

- iVolve, online self-directed Cognitive Behavioural Therapy;

- Resources to support themselves and their family members through the COVID-19 pandemic;

- An interactive online Health Risk Assessment; and

- An online library of tools, assessments and e-courses.

This will allow businesses undergoing financial hardship to provide some support to employees who are temporarily without benefits coverage.

- [pdf] Aviation Questionnaire

-

THREE new ways to help make your Savings & Retirement business run smoother

As of August 20, 2022, EZcomplete® will include several new features that allow applications to be completed faster and easier:

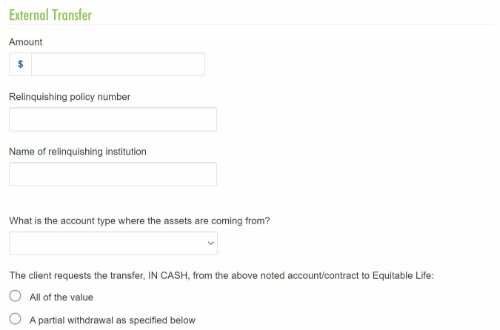

1. Prefilled Fund Transfer Form

The transfer form will be generated with the information from EZcomplete and included in the EZcomplete signing package, saving you time.

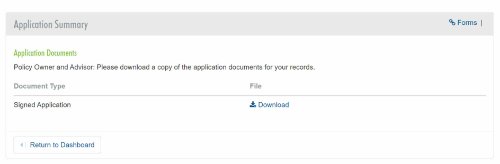

2. Client eSignature Audit History and Document Download

If you choose the e-signature option for the client, you’ll be able to download a copy of the e-signed transfer forms and the signature audit history.

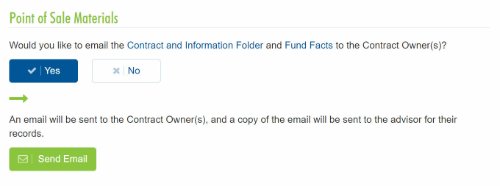

3. Email the Client Contract Info and Fund Facts Before Signing

You'll now be able to email Point of Sale materials (Contract & Info Folder and Fund Facts) to clients before they provide their e-signature.

Log in to EZcomplete today!

Speak to your Regional Investment Sales Manager to learn more!

- Surrender charges

- Practical approach to selling segregated funds in a TFSA

-

Equitable Life Group Benefits Bulletin - November 2022

The importance of timely plan member eligibility updates*

Effective Dec. 1, 2022, we are implementing a revised process for managing plan member and dependent health and dental claims that have been incurred and paid after coverage has been terminated. This new process is consistent with industry practices.

If health or dental claims have been incurred and paid after a plan member’s termination date but before we received notice of the termination, we will align the plan member’s or dependent’s termination date with the service date of the last paid claim, retaining premiums up until that date.

If no claims have been incurred and paid after the termination date, Equitable Life will process the termination as requested and refund any excess premium, subject to a maximum premium refund credit of three months.

Currently, we process the termination as requested and attempt to recover any claim overpayments directly from the plan member. We then refund any excess premiums that have been paid, subject to the maximum refund credit amount.

To avoid claims being incurred and paid after a plan member’s termination date, it is important for your clients to update plan member and dependent eligibility dates on or before the effective date of the change.

If you have any questions about the process your clients should follow for updating plan member eligibility, please contact your Group Account Executive or myFlex Sales Manager.QuickAssess®: Absence and accommodation request review services*

It can be difficult to navigate chronic or complex cases of absenteeism or accommodation requests. That’s where QuickAssess® can help.

QuickAssess is an optional, fee-per-use service that can provide your clients with an unbiased, timely assessment of complex plan member absences and workplace accommodation requests. Our disability experts can provide recommendations to help your clients manage:- Workplace absences

- Chronic or patterned absenteeism

- Requests to modify workplaces or duties

- Return-to-work coordination

- Employee Insurance sick leaves

For more information on using QuickAssess, including eligibility requirements, please contact your Group Account Executive or myFlex Sales Manager.

**Within two business days of receiving a completed QuickAssess Absence and Accommodation Review Referral Form and all required information. For more complex referrals, more time will be required.Finding a health care provider with TELUS eClaims direct billing*

By visiting TELUS’s Find a Provider page, your clients’ plan members can now easily search for paramedical and vision providers who are registered on the TELUS Health eClaims network and who can submit claims directly to us on behalf of their patients. Searches can be filtered by postal code to help plan members find the most convenient provider options.

As our direct billing provider for pharmacy, vision and paramedical claims, TELUS Health has an extensive network of 70,000 health care providers that provide direct billing to streamline the claims process.

Please note, plan members should always check Equitable Life’s list of de-listed providers before selecting a health care provider. The list is available for your clients and their plan members on EquitableHealth.ca, and is updated regularly.

For more information about TELUS eClaims, please contact your Group Account Executive or myFlex Sales Manager.First phase of the Canada Dental Benefit proposed for Dec. 1, 2022*

The federal government’s new Canada Dental Benefit is proposed to take effect on Dec. 1, 2022, subject to Parliamentary approval. The program will cover eligible expenses retroactive to Oct. 1, 2022, and this first phase would apply to Canadians under 12 years of age.

If implemented, the Canada Dental Benefit will provide dental care to Canadian families with under $90,000 adjusted net income annually. By 2025, the federal government expects to extend the benefit to children under 18, senior citizens and Canadians with disabilities.

Parents or guardians will be required to apply for this coverage through the Canada Revenue Agency (CRA) and must not have private dental coverage for the child(ren).

This new program will have no impact on your clients’ dental coverage and no action is required on their part.

* Indicates content that will be shared with your clients.