Site Search

348 results for mode change request

-

Paramedicals are Re-opening Shortly

We are pleased to announce that face-to-face insurance testing paramedical services, including the collection of vitals & fluids, are resuming shortly. Our service providers, Dynacare and ExamOne, have been monitoring the public health standards and have established standards they will operate under to protect the health of both the applicant and health professionals.

Our commitment to your client’s safety

It is Equitable Life's commitment that both clients and advisors will be provided clear and thoughtful communication before initiating any testing. Clients should fully understand the potential risks associated with having a paramedical test taken at this time and are always able to choose not to attend the appointment if they do not feel comfortable or safe.

How will paramedical services be conducted?

Dynacare is conducting appointments at fixed site facilities where clients will travel to the health professional for their appointment. The paramedical questions will be covered by video or telephone to minimize the time spent in the fixed site facility. For more information, see Dynacare’s COVID-19 client guide that will be provided to the client directly.

ExamOne examiners will travel to the client’s home for their appointment and the entire paramedical will be conducted at that time. Information about ExamOne’s COVID-19 processes and their Preparing for my exam client guide will also be provided to the client directy.

When are paramedical services re-opening?

In person paramedical services for Equitable Life cases will begin opening gradually. We have worked closely with our service providers, the CLHIA & provincial governments and believe it is prudent to begin re-opening services in the provinces that have a lower incidence of COVID-19. We will expand the schedule as the incidence of COVID-19 lowers or is expected to lower in specific regions.

Please note if you had an order in process prior to services shutting down, the provider will be looking to re-open and complete those orders. If requirements are no longer needed given the non-med limit changes, the order will remain closed.

Schedule for re-opening paramedical services:Province Start Date Saskatchewan June 1-Dynacare, June 11-ExamOne New Brunswick June 8-Dynacare, June 11-ExamOne PEI and Newfoundland June 15, Dynacare and ExamOne Manitoba June 15, Dynacare and ExamOne Alberta June 18, Dynacare and ExamOne British Columbia June 22, Dynacare and ExamOne Nova Scotia June 22, Dynacare and ExamOne Ontario* By June 30, Dynacare and ExamOne Quebec * By June 30, Dynacare and ExamOne

Note: Start dates are subject to change based on the progress of COVID-19.

*Ontario & Quebec to re-open regionally (starting with areas with lower incidence of COVID-19). Specifics for Ontario and Quebec will be communicated closer to the implementation dates for these provinces. Further details can be found in this communication. -

Extending premium relief for Dental and Extended Health Care benefits

We know this continues to be a challenging time for Canadian employers and we remain committed to looking for ways to help your clients manage while still supporting their employees.

Although many health practitioners have re-opened as pandemic restrictions are lifted, plan member use of dental benefits and some health benefits still remains lower than normal in June.

We are pleased to announce that we are extending premium relief for all Traditional and myFlex insured non-refund customers for Health and Dental benefits for the month of June, as follows:

- A 25% reduction on Dental premiums; and

- A 5% reduction on Extended Health Care premiums.

These reductions are effective for June 2020 and will appear as a credit on the July bill, or against the next available billing. We will assess the situation monthly and will continue with monthly refunds for as long as the current crisis period continues. The size of the credit may change over time as dentists and other health practitioners gradually reopen their offices. We will confirm premium credits for July (if any) at a later date. Credits for subsequent months will be communicated on a month-by-month basis.

In order to be eligible for the monthly credit calculation and payout, a policy must be in force on the first of the month and remain in force thereafter. The monthly credit calculation is based on employees in force on the June bill. If employees experienced layoffs during the month, that would not affect eligibility for a premium credit as long as the benefit itself is not terminated.

We expect that claims experience and premiums will return to normal once the current pandemic restrictions are lifted.

In the meantime, plan members will continue to have full access to their benefits coverage throughout the pandemic. In many cases, dental offices have remained open for emergency services, and a variety of healthcare providers are available virtually.

Commissions

We know the pandemic has put financial strain on your business as well, so we will continue to pay full compensation. Although your overall commission will be unaffected by these premium reduction adjustments, you may see a temporary reduction in your commission payments if you are on a pay-as-earned basis.

Communication

We will be communicating this premium relief program to your clients later this week.

Questions?

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. You can also refer to our online COVID-19 Group Benefits FAQ.

-

Celebrating our most popular Pivotal Select funds

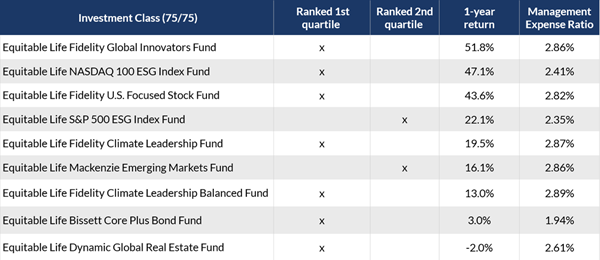

In August 2022, Equitable® launched 12 new segregated funds in Pivotal Select’s Investment Class (75/75). We wanted to bring some new innovative solutions to the product, including six sustainable investment funds. To say the launch of these funds was successful would be an understatement.

The funds are quickly becoming some of the most popular funds in Pivotal Select™, and their performance in 2023 was impressive. Equitable wants to celebrate these funds and encourage clients to consider them for their portfolios.

As of February 29, 2024, nine out of the 12 funds received a 1st quartile ranking for their 1-year return and two more were 2nd quartile. The table below shows the new funds that ranked in the top two quartiles for their 1-year returns.

Access additional fund performance information

If you haven’t looked at these funds yet, now is the time. Speak to clients about their investment options and see if these funds fit within their investment portfolio.

Talk to your Director, Investment Sales today for more information.Disclaimer

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value. Segregated fund values change frequently, and past performance does not guarantee future results. Investors do not purchase an interest in underlying securities or funds, but rather, an individual variable insurance contract issued by The Equitable Life Insurance Company of Canada. There are risks involved with investing in segregated funds. Please read the Contract and Information Folder before investing for a description of risks relevant to each segregated fund and for a complete description of product features and guarantees. Copies of the Contract and Information Folder are available on equitable.ca.

Management Expense Ratios (MERs) are based on figures as of February 29, 2024, and are unaudited. MERs may vary at any time. The MER is the combination of the management fee, insurance fee, operating expenses, HST, and any other applicable non-income tax for the fund and for the underlying fund. For clients with larger contract values, a Management Fee Reduction may be available through the Preferred Pricing Program. For details, please see the Pivotal Select Contract and Information Folder.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

Posted April 18, 2024

- RRSP Loan Calculator

-

How to Stay Grounded in a Changing World: Supporting Financial & Mental Well-Being

Are clients feeling the strain of global uncertainty? Join our Master Class webcast, "How to Stay Grounded in a Changing World: Supporting Financial & Mental Well-Being," to gain insights on managing financial and mental well-being.

We will explore how economic instability, geopolitical conflict, and climate change impact mental health and financial behaviours.

Join Shannon Labby, Vice President, National Investment Sales, Equitable as she welcomes Homewood Health’s clinical expert, Gabrielle Provencher who will provide tools to help advisors recognize signs of mental strain and support clients in maintaining financial focus.

Why Attend?- Understand the psychological impacts of global crises and media exposure.

- Learn how financial stress can affect mental health and decision-making.

- Enhance media literacy to help navigate misinformation and stay focused.

- Develop coping strategies to help manage anxiety and promote resilience.

- Gain techniques to help clients form self-care habits for long-term financial security.

Learn more

Continuing Education Credits

This webcast has been submitted for continuing education (CE) approval for all provinces excluding Quebec via the Insurance Council of Manitoba and Alberta Insurance Council. Upon approval, you will be sent an email notification to come back to the webcast presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full, and complete a short quiz. It is the advisor's responsibility to ensure Continuing Education credits being offered are accepted by their licensing body. Alberta Insurance Council (AIC) credits are valid in Yukon, British Columbia, Alberta, Saskatchewan, Ontario, New Brunswick, Prince Edward Island and Nova Scotia. Insurance Council of Manitoba (ICM) credits are valid in Manitoba only.

This webcast is available in English only.

Date posted: June 5, 2025 -

January 2024 eNews

In this issue:

- Equitable scores high marks with group advisors*

- REMINDER: Equitable's National Biosimilar Program starts in March*

- 2024 dental fee guide updates*

- Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable scores high marks with group advisors*

Equitable ranked first for operational service among major group insurers in a recent study of Canadian group benefits advisors.

NMG Consulting, a leading global consulting firm, conducted in-depth interviews with 146 Canadian group benefits brokers, consultants, MGAs and third-party administrators between May and August 2023 for its annual Canadian Group Benefits Study. Based on these interviews, NMG ranked group insurers in six categories, ranging from operational management to technology.

Nationally, Equitable ranked among the top three in five of the six main categories, including number one for Operational Management:Category Ranking Operational management 1st Initiatives (including seminars & training) 2nd Technology 3rd Underwriting & claims management 3rd Relationship management 3rd

“Advisors regard us highly in many categories. That’s a testament to our mutual status and ability to focus exclusively on our clients and advisor partnerships,” said Marc Avaria, Executive Vice President, Group Insurance Division. “We are truly working together to build strong, enduring and aligned partnerships with our clients and advisors.”

“We’re delighted with these results and are committed to continuously advancing our delivery of a better benefits experience for our clients and advisors,” added Avaria.More highlights from the latest NMG survey

Nationally, we ranked first in seven subcategories in Operational Management, including:- Overall service to intermediaries,

- Overall service to plan sponsors,

- New quote process,

- Plan implementation,

- Renewal process,

- Accuracy and timeliness of reporting and billing, and

- Administration quality and responsiveness

And we were rated strongly in Technology, finishing in the top three for:- Overall technology for Intermediary (2nd)

- Member experience (3rd)

- Quality of technology for the plan sponsor (2nd)

- Quality of mobile application (2nd)

REMINDER: Equitable's National Biosimilar Program starts in March*

In October 2023 we announced the upcoming launch of our national biosimilar program. Starting March 1, 2024, we are expanding our biosimilar switch initiatives to provide a single, nationwide** program.

Why we’re making the switch

Over the past few years, most provinces have introduced policies to delist some originator biologic drugs. They require most patients to switch to biosimilar versions of those drugs to be eligible for coverage under their public drug plans. Soon, it is expected that all provincial drug plans will cover only biosimilars.

Equitable’s National Biosimilar Program simplifies drug plan coverage by replacing our provincial programs. It also protects clients from additional drug costs while offering access to lower-cost biosimilars deemed equally safe and effective by Health Canada.

How will this affect clients' drug plans?

Because we have already introduced biosimilar switch initiatives in most provinces, the impact of this change will be minimal. It will primarily affect plan members in provinces or territories where we haven’t already required the switch to biosimilars. It will also affect plan members who are taking biosimilars that were not originally included in the switch initiative for their province.

Regardless of where they live, plan members across Canada will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower-cost biosimilar version of the drug. Plan members already taking the originator biologic will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable plan. We will support their transition with education, personalized communication, and resources.

Advance notice for plan members

We contacted affected claimants in early December to give them enough time to change their prescriptions and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Account Executive.

** Excludes plan members in Quebec who participate in a separate provincial program.

2024 dental fee guide updates*

Each year, Provincial and Territorial Dental Associations publish fee guides. Equitable uses these guides to help determine the reimbursement limits for dental procedures.

For your reference, you may wish to refer to the 2024 list of the average dental fee increases for general practitioners.

Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable is proud to congratulate our Employee and Family Assistance Plan (EFAP) partner, Homewood Health®, for winning the Canadian HR Reporter 2023 Reader’s Choice Award in Employee Assistance Plan services. Homewood’s EFAP provides confidential support for a range of health, family, money, and work issues through face-to-face, phone, email, chat, or video counselling. The award recognizes their high standards in counselling and mental health support services.

The annual Reader’s Choice Awards identify organizations that provide outstanding expertise and services for HR professionals and employers across Canada. Those organizations provide valuable information on useful, innovative HR and employee benefits products and programs, in categories such as recruitment, mental health services, employee engagement programs, and more.

Sharing Homewood Health with your clients

Since 2019, we have worked with Homewood to provide mental health services for Equitable benefits plan members.

Your clients can access Homewood Health’s award-winning EFAP for an additional fee by adding it to their benefits plan. Services are available 24/7, 365 days a year.

All Equitable clients also have free access to Homewood Health Online in their benefits plan. Homewood Online provides a variety of helpful wellness resources, including:

- Homeweb, an online and mobile health and wellness portal,

- Health Risk Assessment, a group of assessment tools to help plan members identify and overcome health and wellness barriers, and

- Online Internet-based cognitive behavioural therapy (iCBT) through Sentio to manage symptoms of anxiety and/or depression.

Questions

To learn more about Homewood Health’s services, contact your Group Account Executive or myFlex Account Executive.

-

All about the changes to the capital gains inclusion rate

Disclaimer: The following content is provided by and is the opinion of Invesco Canada Ltd. Equitable does not guarantee the adequacy, accuracy, timeliness, or completeness of the information. Equitable shall not be liable for any errors or omissions in the information provided by Invesco.

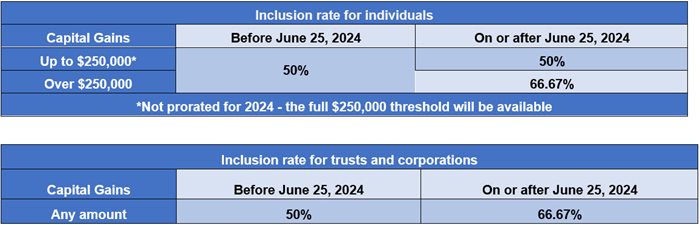

What has changed?

One noteworthy measure to come from Budget 2024 is the proposed change to the capital gains inclusion rate, which was previously held steady at 50% since 2001.

For individuals, capital gains more than $250,000 annually will be subject to an increased 66.67% inclusion rate as of June 25, 2024, while the capital gains up to $250,000 will continue to be subject to the existing 50% inclusion rate. As a transitional measure for 2024, only the capital gains realized by individuals on or after the effective date of June 25 that are above the $250,000 threshold will be subject to the increased inclusion rate.

For trusts and corporations, the inclusion rate on all capital gains will increase from 50% to 66.67% starting on June 25, 2024.

Who is affected?

Impact to individuals

Budget 2024 proposed to add transitional rules which would specifically identify capital gains and losses realized before the effective date (Period 1) and those realized on or after the effective date (Period 2). The effective date is June 25, 2024. Capital gains realized on or after that date will have an inclusion rate of 50% on the amount up to $250,000, and an inclusion rate of 66.67% on the amount above $250,000. All capital gains realized prior to the effective date will have an inclusion rate of 50%.

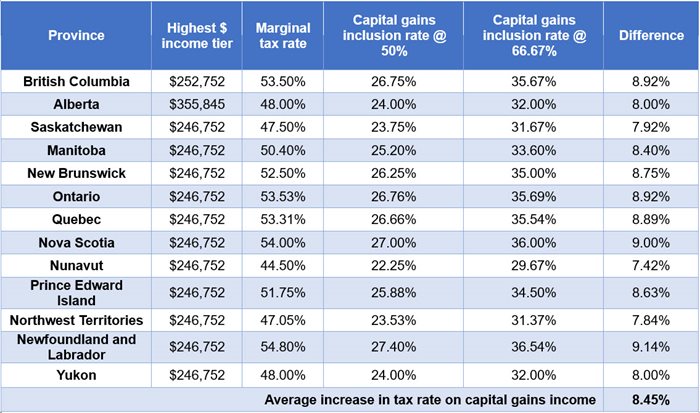

Take Ontario as an example, the proposed higher inclusion rate on capital gains would effectively increase the average federal-provincial marginal tax rate for Ontario residents on capital gains above $250,000 at the top marginal tax rate from 26.76% to 35.69%. A more detailed analysis on the impact of these changes to an individual’s tax rate is discussed below.

For net capital gains realized in Period 2, the annual $250,000 threshold would be fully available in 2024 (i.e., it would not be prorated) and it would apply only in respect of net capital gains realized in Period 2.

The $250,000 threshold would effectively apply to capital gains realized by an individual, either directly or indirectly via a partnership or trust, net of any: current-year capital losses, capital losses of other years applied to reduce current-year capital gains, and capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed employee Ownership Trust Exemption or the proposed Canadian Entrepreneurs’ Incentive claimed.

Two common scenarios of reaching the $250,000 capital gain threshold are the deemed disposition of capital property at death, and the emigration from Canada (i.e., becoming a non-resident for income tax purposes). We have provided additional details on these topics below.

Deemed disposition upon death

When an individual passes away, they are deemed to have sold their capital property (e.g., units or shares of mutual funds, shares of corporations, and real property) at its fair market value (FMV) immediately before their death. If a capital gain arises because of this deemed disposition, that capital gain is reportable on the deceased’s final (terminal) tax return and the taxes owing as a result, if any, would be payable by the estate of the deceased. However, there are provisions that allow taxes to be deferred when the property is transferred to a spouse. For example, if a capital property is transferred to a surviving spouse or common-law partner, subsection 70(6) of the Income Tax Act (Canada) automatically deems the deceased to have disposed of that property and the spouse or common-law partner immediately acquires the same property at the deceased transferor’s adjusted cost base (ACB). This is commonly referred to as the “spousal rollover”. Another potential strategy to manage potential large capital gains taxes at death is life insurance, since the death benefit is typically paid out tax-free.

Without careful planning, the estate value could be substantially reduced by the changes to the capital gains inclusion rate. Furthermore, it would be prudent to ensure there are liquid assets or cash available in the estate to cover the associated tax liabilities.

Non-resident of Canada – Departure tax

Residency in Canada for income tax purposes is a question of fact, which primarily depends on the individual’s residential and social ties in Canada. When an individual becomes a non-resident of Canada, they are deemed to have disposed of and immediately reacquired certain types of property at FMV. The tax incurred because of this deemed disposition and reacquisition is also known as the departure tax. Some examples of properties subject to departure tax include securities inside a non-registered investment portfolio, shares of Canadian private corporations, and real estate situated outside of Canada. Note that there are some properties that are exempted from the departure tax, including: pensions and similar rights (including registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), and tax-free savings accounts (TFSAs)) and Canadian real property.

The departure tax rules coupled with the increased capital gain inclusion rate above the $250,000 threshold may incur additional tax payable for emigrants. However, there is an option to defer the payment of departure tax on income associated with the deemed disposition upon emigration. By making an election, the individual would pay the tax later, without interest, when the property is disposed of. This election can be done by completing CRA Form T1244, “Election Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property," on or before April 30 of the year following their departure from Canada.

Impact to Entities

Corporations and trusts will also be impacted by the increased inclusion rate as of June 25, 2024. Unlike individuals, corporations and trusts will not have access to the old inclusion rate on the first $250,000 of capital gains: they will be subject to the new 66.67% inclusion rate from the very first dollar.

With the above in mind, there will be options available to shelter corporate and trust capital gains from the new inclusion rate.

For corporations:

The lifetime capital gains exemption (LCGE) can be used to eliminate capital gains taxes on the sale of qualified small business corporation shares (generally, these are shares of a Canadian-controlled private corporation that carries on an active business). The LCGE is also available on the sale of qualified farm or fishing property. The current lifetime limit for the LCGE is $1,016,836. Budget 2024 proposed to increase that limit to $1,250,000 starting on June 25, 2024, so certain business owners will be able to reduce or eliminate their exposure to the new inclusion rate if they are able to make use of the increased LCGE limit.

For trusts:

Budget 2024 suggests that capital gains allocated by a trust to its beneficiaries on or after June 25, 2024, will be included in the beneficiaries’ income at the old 50% rate up to the beneficiaries’ first $250,000 of capital gains for the year. While the specifics are not yet available, this opportunity will likely create further planning considerations surrounding the allocation of capital gains from a trust to its beneficiaries to reduce taxes. Capital gains can generally be allocated to a beneficiary for tax purposes when they are actually paid to the beneficiary, or when they are payable to a beneficiary (i.e., the beneficiary hasn’t received it, but has a right to demand payment of the capital gain). The option of making income paid (or payable) to its beneficiaries and allocating such income to be taxed in their hands will largely depend on the trust terms.

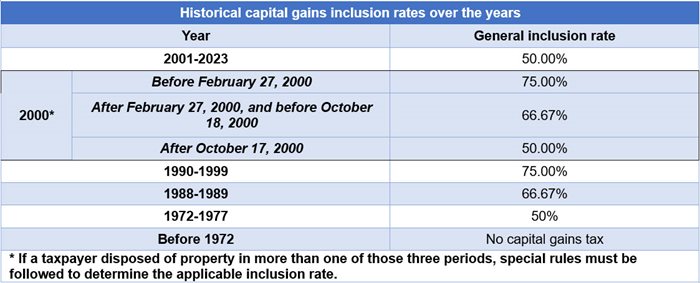

Historical reference: capital gains inclusion rate

Those of us around long enough, understand that this recent change was not the only time the capital gains inclusion rate has deviated from the 50% inclusion rate. Over the years, capital gains tax rate has ranged from nil to as high as 75% as indicated in the table below. In fact, the first instance of capital gain tax was introduced in 1972!

Excluding the 2024 tax year, we have given a rough estimate on the percentage of time spent at each of the various capital gains inclusion rates over the last 42 years. As we can see, for most of the time, the capital gains inclusion rate has remained at the 50 % inclusion rate. In fact, for the last 23 consecutive years, the inclusion rate has remained untouched with the last change being back in tax year 2000 with various changes introduced that year.

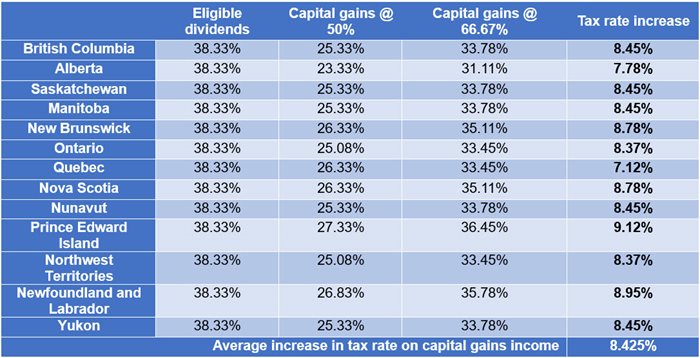

Tax impact by province/jurisdiction

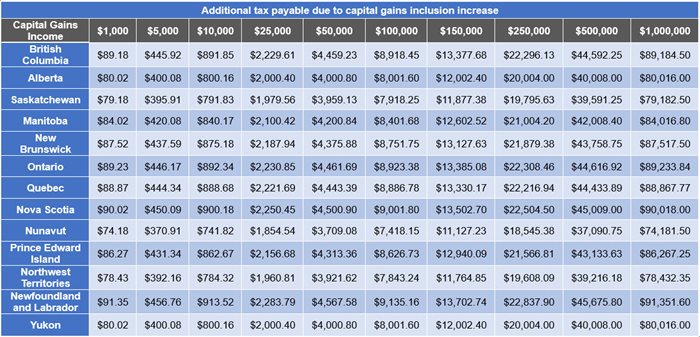

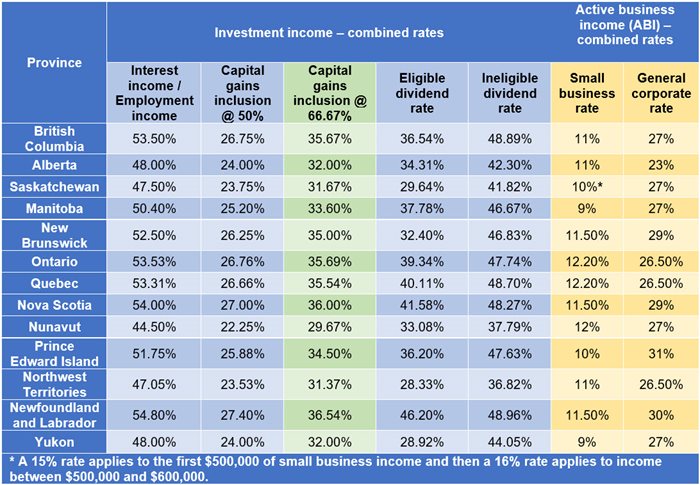

With the increase in the capital gains inclusion rate, we want to demonstrate the potential tax impact of those changes across jurisdictions in Canada. The table below shows the 2024 marginal tax rate for the highest individual income earners in each jurisdiction at both the 50% and 66.67% capital gains inclusion rate, respectively. The average difference is an increase in taxes payable by 8.45%.

Next, we look at the additional taxes payable because of the inclusion increase, assuming varying capital gains income levels. Of course, this assumes that the capital gains do not otherwise benefit from a reduced inclusion rate or an outright exemption such as eligible in-kind donations of securities to registered charities, or shares that qualify for the lifetime capital gains exemption, to name a few.

Understanding the tax implications of investing is an essential part of financial planning and reinforces the importance of working with a knowledgeable financial advisor to understand the long-term impact of these changes as it applies to personal situations. No doubt, tax rates influence capital allocation decisions. Canadians who take more inherent risk with their capital have traditionally been afforded preferred taxation rates promoting innovation through capital investment, something the government can do with good tax policy to encourage business growth and spur economic expansion. This is evident in the breakdown of the tax rates depending on the characterization of the income as noted in the table below.

Clearly the tax rates reflect the added capital risk investors and business owners take. We can clearly see the preferred taxation rates afforded on small business income and at the general corporate tax rates on income over the small business limit, compared to the tax rate on interest income or that of employment income. That tax-preference also extends to investors of “riskier” allocations of capital in marketable securities such as stocks, bonds, mutual funds, and exchange traded funds, to name a few. The tax rates of less-risky investments (such as money market instruments) do not benefit from the capital gains tax-preferred inclusion rates. With the latest move, there is not much difference in earning eligible dividend income from Canadian resident corporations and from dispositions resulting in capital gains.

Some pundits have declared the move as a disincentive to capital and business investment and may encourage businesses to move into more tax-favoured jurisdictions outside Canada. The Federal government has promoted the change as impacting a very small overall percentage of investors, estimated at 0.13% of Canadian individuals and 12.6% of corporations. Further, the move has been argued by the Liberals as necessary to work towards “intergenerational fairness”.

How to prepare for the changes?

For now, advisors may want to start educating their clients about the basics of the changes, which starts with comparing the current inclusion rates with the new inclusion rates.

Individual investors with large unrealized capital gains will also likely ask if they should crystallize their capital gains before June 25th to save money on taxes in the long run. The assumption that selling now will result in overall savings will not be correct in all cases, however. There is an opportunity cost to paying taxes upfront, rather than deferring those taxes to a later year.

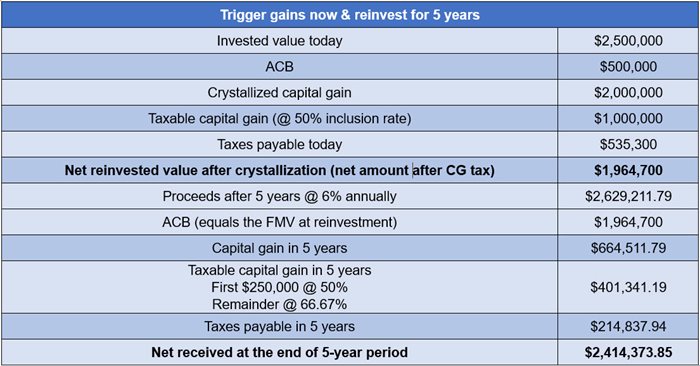

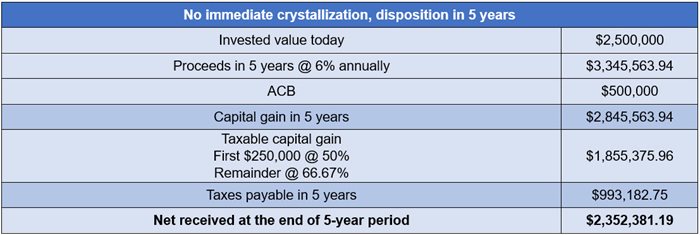

For example, let’s assume an Ontario client owns a $2.5 million non-registered equity portfolio with $2,000,000 in unrealized capital gains. They had no intention of selling those investments for another 5 yeas, but in light of the upcoming changes, they are considering selling immediately, paying the capital gains taxes now, then reinvesting the net amount after taxes back into those same investments for the 5-year investment period. They are currently in the top marginal tax bracket in Ontario (53.53%) and expect to continue to be in 5 years’ time. The assumed average rate of return on their investments is 6% annually over the next 5 years.

As can be seen in this example, at 6% annual compound growth rate, the option to realize much of the capital gains now resulted in a higher overall return in the amount of $61,992.66 over the 5-year period due to the lower inclusion rate. Alternatively stated, if the investor does not crystallize the gains today, the equivalent rate of return needed to have the exact net after tax amount at the end of the 5-year period (the “breakeven return”) would be a 6.60% compound annual return. While this certainly will not be true in all cases, this is the sort of analysis that will have to be conducted when assessing whether it makes sense to realize capital gains in 2024. The rate of return on investment and the investment horizon, among other things, are important determining factors.

Although we used securities investment in our example, a similar analysis can be done for other kinds of property held, such as a vacation property that is unlikely to benefit from the principal residence exemption. In addition, taxes often take a back seat to other planning considerations. These conversations should be had with the primary goals of the client in mind, which may supersede tax planning considerations.

For corporate investors, it will be important to emphasize the impact the capital gains inclusion increase will have on small business owners. As a refresher, a corporation is a separate legal entity from the shareholders who own it and is subject to tax on the income it generates. Income is first taxed within the corporation before it can be passed to the shareholders in the form of dividends out of its retained earnings. To avoid double tax on income that passes through a corporation to shareholders (and to prevent any unintended tax advantages), a dividend gross-up and tax credit model is applied at the individual level, along with a tax refund mechanism to the corporation on passive investment income. This is designed to integrate the tax system between the two entities: individual and corporation. Ideally, perfect integration is achieved when after-tax income is equal, whether it is earned individually or through a corporation. In reality, depending on the province and type of income earned, there could be a tax cost in earning passive investment income through a corporation, including earning passive investment capital gains income. Currently there is a tax cost of earning capital gains income through a corporation across all Canadian provinces/jurisdictions.

The latest change further increases the cost of earning passive investment income inside a corporation, though we do not yet know what changes will be made to the corporate tax refund mechanisms. As noted in the table below, the increase averages approximately 8.43% and closely equates the rate on eligible dividends. This rate reflects the initial tax rate on passive investment income earned within an active business.

For many small businesses, and perhaps to long-term individual investors, this increase in the tax rate will feel unfair as the accumulation of earning a pool of assets for retirement is often done within their small business corporation, and in many cases the sole source of retirement funds.

If an immediate crystallization of accumulated capital gains is not desired, what should investors consider in the longer run? Although many details of the new proposed rules are yet to be clarified, here are some general considerations.

For individuals, it may be helpful to plan the timing of future dispositions to stay below the annual $250,000 threshold. Also, it may seem obvious but maximizing investments within registered plans, including the new first home savings plan (FHSA) where eligible, can reduce exposure to future capital gains tax. Moreover, estate planning becomes even more important as the potential tax payable on the deemed disposition of capital property at death rises. On that front, strategies to reduce capital gains at death could be considered, such as inter-vivos gifting, charitable donation, spousal rollover, and acquiring life insurance to provide sufficient liquidity to the estate.

For business owners, some strategies to limit future capital gain exposure may include contributing to an individual pension plan (IPP), conducting an estate freeze to pass on future capital gains to succession owners, and ensuring the small business shares qualify for the LCGE. The suitable strategies are highly dependent on the business needs and personal situation of the business owner.

Acting too soon or not fast enough?

Finally, there is what many in the industry have been calling a “change of law” risk. That is, within the next year and a half, a federal election is scheduled, and this capital gains inclusion tax policy will surely be a primary election issue. As part of that election platform, parties may promise to repeal it outright or alter its scope and application. Consider also that any changes in the capital gains inclusion rate could be retroactive or simply not apply in all cases.

The information provided is general in nature and may not be relied upon nor considered to be the rendering of tax, legal, accounting or professional advice. Invesco Canada is not providing advice. Readers should consult with their own accountants, lawyers and/or other professionals for advice on their specific circumstances before taking any action. The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the simplified prospectus before investing. Copies are available from your advisor or from Invesco Canada Ltd

Date posted: May 23, 2024 - [pdf] B2B Loan application process for Equitable Life of Canada

-

EAMG Market Commentary July 2023

Posted July 27, 2023

July 17, 2023

Rates & Credit - The rates market was volatile in Q2 as investors focused on inflation, central bank interest rate decisions, and recession probabilities. Persistent strength in U.S. consumer spending and labour markets have surprised investors and prompted further interest rate tightening from central banks. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a total return of 0.2%, versus a loss of 1.0% for government bonds and 0.7% for the overall Index. The corporate bond outperformance was driven by a broad risk-on tone to the market, most notably in April as the market recovered from the banking sector liquidity crisis that developed during March. That said, the market tone remained cautious, with the improved risk premium on corporate bonds tempered by lingering concerns around sticky inflation, high interest rates, and the potential for slower economic growth into the latter half of the year.

Dominance of U.S. Equities – U.S. equity markets posted another strong quarter with the S&P 500 returning 8.7%, outperforming Canada and other major international equity markets. The S&P/TSX Composite, returned 1.2% in CAD. Major developed economies from Europe, Australasia, and Far East (EAFE) returned 3.2% in local currency terms. The highly anticipated re-opening of the Chinese economy has failed to materialize with economic data indicating less strength than previously forecasted. Amid sluggish Chinese growth, closely interconnected economic partners such as the European Union, as well as commodity-driven markets like Canada, have all underperformed the U.S. on a relative basis.

U.S. Fundamentals – Earnings continued to contract versus prior year, albeit at a slower pace than forecasted. Forward earnings guidance improved quarter-over-quarter with corporate sentiment returning to neutral levels. Based on our analysis, we observed that 31% of major companies expect deteriorating financial performance, while 33% expect improved performance, with the remaining expecting no material change. Overall, major U.S. companies remain well capitalized with strong operating margins. However, company guidance indicates a prioritization of cost controls amid increased consumer indebtedness and concerns about the health of the consumer.

Artificial Intelligence (AI) Mania – Despite concerns that the U.S. economy is at a late stage in its economic cycle, that monetary tightening by central banks could go too far, and the fact that earnings contracted on a year-over-year basis, equity markets became more expensive during the quarter with price-to-earnings multiples expanding. This expansion was driven by investors crowding into AI focused technology companies, with the seven largest AI/technology themed companies averaging a 26% return while the other 493 members gained only 3%. Investors rewarded businesses with contributions to AI development (hardware and software components), as well as those with the ability to implement synergies from leveraging the technology. A crowded market surge is not uncommon at this point in the economic cycle, where positive economic surprises, in this instance, strong employment and consumer spending can lead to an upswelling in investor confidence.

U.S. Quant Factors – Using our investment framework, we currently favour exposures to large cash-rich companies with innovative product offerings, which we believe offer the strongest risk-adjusted returns in the current market environment. While the valuation of AI companies seems to defy traditional rationales, the momentum has continued to push the group higher. Consequently, the Quality factor (companies with higher return-on-equity, strong operating performance, and healthy leverage levels) participated in the AI trend and consistently outperformed throughout the quarter. The Low Volatility factor (stocks with lower sensitivity to broad market movement, and lower price volatility) underperformed through the quarter. While the Low Volatility factor typically performs well at this stage of the economic cycle, the fact that a small number of stocks were responsible for much of the market’s return hurt this factor. Lastly, the Momentum factor (stocks with a recent history of price appreciation) initially underperformed during the quarter before rebounding in June. This factor’s recent outperformance suggests that the market is becoming complacent and possibly signals that rotations within the market are slowing as current trends remain in favour.

Canadian Fundamentals – Top line revenue missed forecasts while bottom line earnings were consistent with expectations. Softer-than-expected results out of Canadian financials, as well as underwhelming results from the materials sector, dragged on the aggregate index performance. Earnings forecasts for the rest of the year have been revised downward with analyst expecting index aggregate earnings to detract 2% to 3%. Meanwhile, the Bank of Canada raised its overnight interest rate by 25 basis points, bringing it to 4.75% on the backdrop of robust economic data releases including Q1 GDP and April CPI.

Canadian Quant Factors – The most notable dislocation in Canada was the convergence of the dividend yield of High-Dividend ETFs and Equal-Weight Bank ETFs. We believe that the drag from Canadian banks following the U.S. regional banking concerns in March resulted in a discount of the Quality factor as the performance of the group is sensitive to the movements of banks. While banks did recover around 35% of their SVB-induced underperformance, the nature of banking has attracted investor scrutiny given the view that we are in the late-stage of the economic cycle. That said, this environment is an attractive environment to add variants of the Quality factor, which would gain exposure to a rebounding industry that offers a similar dividend yield to the high dividend stocks.

Views From the Frontline

Rates – On an outright basis, bond yields across the curve continue to look attractive. Economic data remains strong however we are beginning to see the first signs of weakness in spending, jobs and inflation. Slower growth, a more balanced labour market, declining inflation, and tighter credit conditions will likely drive interest rates lower throughout 2023. Market participants remain focused on the extent of interest rate hikes and the duration of a pause required to bring inflation back to the 2% target. With inflation remaining more persistent than previously expected forecasts around the timing, pace and extent of the removal of monetary policy have been pushed into 2024.

Credit – The uncertain economic outlook and risks around slower economic growth later this year merit caution about corporate bonds and a bias towards higher-quality, shorter-dated credit where we think the risk / reward dynamic are more favourable. That said, the “soft-landing” narrative, now more pervasive in the market, could continue to provide support to risk assets, which we view as an opportunity to further pare down higher beta exposure.

Equities – Given the direction of the current economic and company fundamental data, we continue to favour high quality growth segments of the market with strong operating margins. As such, the late cycle conditions in the market reinforce our preference for large cap stocks over smaller, more U.S. domestically focused businesses. The U.S. Low Volatility factor’s underperformance is unlikely to reverse in the short term given the resilience of the U.S. economy. Furthermore, after a steep decline last quarter, we expect that cyclical value will find support in the near term, echoing the increased chance of slowing inflation without stalling economic growth. In Canada, equities are typically more cyclical in nature, which coupled with the potential for an earnings contraction, makes us view the Low Volatility factor as more likely to outperform. Like the U.S., we prefer Canadian high-quality companies to navigate through the late cycle environment. On the heels of poor Chinese economic data and underwhelming stimulus, we are maintaining our overweight to the U.S. relative to Canada and EAFE.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. -

EAMG Market Commentary January 2024

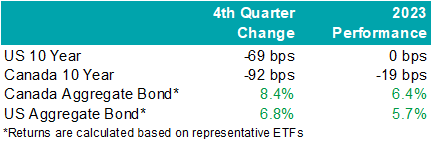

Rates & Credit – Interest rates decreased sharply in Q4 as the market priced in aggressive interest rate cuts by central banks in 2024. The prospect of lower interest rates also drove a strong risk-on tone to the market, with the risk premium on corporate bonds grinding tighter as prospects for a “soft landing” improved. The rally in interest rates resulted in the best quarter for bonds over the past 15 years, with the FTSE Canada Universe Index returning 8.3%. Corporate bonds modestly underperformed the Universe Index with a return of 7.3%. The lower return for corporate bonds was primarily driven by the fact that the corporate bond index is less sensitive to interest rate movements (as compared to the government index), partially offset by the risk-on tone to the market. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds. Industries with higher interest rate exposure such as infrastructure, energy, and communications outperformed those with less exposure (notably financials and securitization), consistent with the overall shift in the yield curve.

.png)

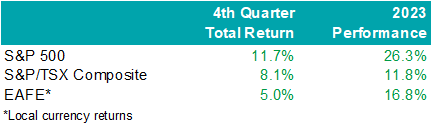

Santa Came to Town – Moving in sync with bonds, global equities jolted higher into the end of the year with cooling inflation data and dovish comments from central bankers. The U.S. market outperformed most regions last quarter with the S&P 500 returning 11.7% in USD terms, bringing the total return in 2023 to 26.3%. The TSX added 8.1% in Q4, boosting the total annual return to 11.8%. Meanwhile, major developed economies from Europe, Australasia, and the Far East (EAFE) gained 5.0% in local currency terms over the quarter, helping the region produce a 16.8% return from the year prior. Prospects of interest rate cuts by the Federal Reserve saw the Loonie rally into year-end and resultantly, investors of Canadian dollar securities witnessed enhanced returns. Strong domestic U.S. economic data helped value pockets of the market outperform. That said, this was not a synchronized trend as China’s economic disappointment weighed on the performance of EAFE.

U.S. Fundamentals – Our work shows that investors are shifting their focus away from operating margins and towards the ability to sustain debt levels ahead of renewing debt obligations. Corporate earnings beat modest expectations last quarter, contracting by less-than-expected on a year-over-year basis. Resilient operating margins continue to attract investors into equities. After three consecutive quarters of improving forward earnings guidance, we observed that the number of major companies expecting deteriorating financial performance grew to ~35%. We note that this is a sharp contrast relative to the optimistic run-up in equity valuations. In general, corporate pessimism has been underpinned by concerns for the health of the consumer, increasing wage pressures, and inflation.

U.S. Quant Factors – While mega-cap technology stocks gave back some ground in the second half, crowding into the magnificent 7 remains noticeable with the cap weighted S&P 500 outperforming the equal weighted index by 12.5% last year. That said, value areas of the market – which underperformed through the first three quarters of the year – were top performing companies last quarter as the prospects for an economic “soft-landing” improved with U.S. inflation continuing to ease without substantial deteriorations of employment or output data. Quality-growth businesses initially outperformed as the higher-for-longer narrative continued to drive investors toward large cash-rich companies with stable margins. That said, this basket of companies gave back relative returns into quarter-end as weakness in operating margins persisted, making fundamentals appear stretched. Low volatility stocks (i.e. stocks with lower sensitivity to broad market movement and lower price volatility) rallied to start the quarter before dovish comments from central bankers improved risk-sentiment and ultimately pushed this basket lower on a relative basis. Lastly, dividend growth companies, which include businesses with a lengthy and established history of increasing dividends, underperformed the broader index as market participants punished businesses that slowed capital growth projects during the rising interest rate environment. While operating margins have declined, the basket’s strong cash flow and low debt burden may be advantageous if the market’s anticipation of impending interest rate cuts proves to be incorrect or mistimed.

Canadian Fundamentals – Although Canadian companies exceeded bleak forecasts last quarter, earnings continue to contract on a year-over-year basis. Return on equity (ROE) – a gauge of how efficiently a corporation generates profits – continued to decline last quarter while corporate costs of capital remain elevated. In essence, Canadian companies are generating less value relative to their financing cost. Value creation underpins the sustainability of dividend payments, which are a unique and desirable attribute of the Canadian market. Meanwhile, the Bank of Canada held its overnight interest rate unchanged with market participants forecasting a higher probability of interest rate cuts in 2024. On the expectations of easing monetary conditions, dividend yields compressed while earnings forecasts improved with analysts predicting that index aggregate earnings will grow 6% to 8% in 2024. At a sector level, the energy industry’s financial performance normalized – in line with expectations – as weakening oil demand expectations overshadowed geopolitical conflict in the Middle East, ultimately pushing crude prices ~21% lower last quarter. The industrials and financials sectors beat expectations, helping offset softer-than-expected results from the consumer staples and technology sectors.

Canadian Quant Factors – The Canadian banks underperformed for most of the year as they reported increasing provisions for nonperforming loans, reflecting forecasts of worsening economic conditions. That said, expectations of interest rate cuts in 2024 helped tame recession fears and eased concerns of slowing loan growth, propelling banks higher in the fourth quarter as they appeared more stable and therefore favourable than prior estimates. The high-quality basket underperformed last quarter as improving risk sentiment in the market reduced the attractiveness of secure companies with lower earnings variability. Furthermore, high dividend payers with solid growth prospects outperformed in the fourth quarter as market participants rewarded companies that demonstrated a strong ability to support future dividends and punished high yielding businesses with less certain financial capabilities.

Views From the Frontline Rates – Interest rates declined sharply in Q4 as inflation continued to trend lower, fears of excess bond supply declined, and the Federal Open Market Committee signaled that the next change to their overnight policy interest rate would likely be lower. Labour market and consumer spending data remain resilient however businesses have indicated slowing across industries, more price-sensitive consumers, rising delinquencies, and concerns about the high cost of debt. Central banks remain committed to achieving their 2% inflation target and most acknowledge that interest rates have likely peaked.

Credit – The risk premium for corporate bonds (versus government bonds) tightened materially over the quarter, with a strong risk on tone to the market as investors priced in lower interest rates in 2024 and a “soft-landing” to economic concerns. Corporate bond supply was well received by the market. On the balance, we do not think the current risk premium adequately compensates for downside risk, and as such, we remain cautious on corporate bonds and have a bias towards higher-quality, shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – In the U.S., we allocated exposure to value names which outperformed over the quarter as the macroeconomic outlook improved on the backdrop of rate cut expectations. Looking forward, we expect that margins will continue to normalize as Covid-induced pent up demand fades. While we do not forecast margins to compress at an alarming rate, we believe sticky wage and input costs will continue to pressure businesses while consumers exhibit further exhaustion. As such, we are shifting our focus toward the balance between company reinvestment in capital projects and upcoming debt refinancing requirements. In line with this view, we favour businesses with stable cash flows and decreased debt loads as we believe they present an attractive contrarian opportunity if soft-landing projections prove to be overstated. Within Canada, we remain attentive to the inverse movements of ROE relative to financing costs over 2023. With the excess between ROE and financing costs compressing, businesses’ ability to create value appears more stretched than earlier in 2023. Therefore, we continue to favour high quality companies in Canada, which is typically defined by high ROE, stable earnings variability, and low financial leverage. Geographically, the U.S. economy appears to be in healthier condition with inflation easing while employment and output data remain stable and hence, our focus will be on capital expenditures. EAFE – which is generally more economically linked to China than North America – contains a large bucket of stable, high-quality businesses that may benefit from any upside economic surprises out of China. Lastly, through the lens of a Canadian investor, the Loonie’s relative value versus other major currencies presents another resource in our investment mandate to derive excess return.Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.