Site Search

348 results for mode change request

- [pdf] Retirement Realities

- [pdf] Homewood Health Online

- eDelivery of a Contract - New Business

-

Equitable Life Group Benefits Bulletin – November 2020

In this issue:

- Telemedicine now included in Travel Assist*

- Take advantage of our convenient digital options*

- 2021 changes to Maximum Insurable Earnings, Maximum Weekly Insurable Earnings and Short Term Disability Benefit*

*Indicates content that will be shared with your clients

Telemedicine now included in Travel Assist*

Medical emergencies can be particularly stressful while travelling. Making your way to a medical facility can be a struggle. And once you get there, you could face long wait times, language barriers or even the risk of COVID-19 infection.

That’s why Allianz Global Assistance®, our Travel Assist provider, is adding two new virtual care options to provide plan members with timely and appropriate medical support.

As always, when a travel medical emergency strikes, plan members call Allianz for assistance. During the intake process plan members will be guided through a series of questions to triage their unique medical situation. Options for care now include two different virtual care services:

- TeleConsultation – Video and chat consultation with a locally licensed physician. This physician can diagnose simple medical conditions and provide a prescription. Available across Canada and in some high travel states in the United States.

- TeleAdvice – Video and chat consultation for situations which are not likely to require a prescription. The physician can diagnose simple medical conditions and provide medical guidance.

Plan members who use virtual care may benefit from:

- Reduced wait times;

- Care from the comfort of their current location;

- Reduced language barriers;

- No need to arrange transportation to a medical facility;

- Reduced impact on travel itinerary; and

- Reduced risk of exposure.

Both TeleConsultation and TeleAdvice will be available for all Equitable Life plan members beginning January 1st, 2021. There is no additional cost, no changes required to your client’s plans, and no change to the way plan members contact Allianz in the event of a travel medical emergency.

This PDF plan member update will also be included in the eNews to plan administrators.

If you have any questions about these new features, please contact your Equitable Life Group Account Executive or myFlex Sales Manager.

Allianz Global Assistance is a registered business name of AZGA Service Canada Inc. and AZGA Insurance Agency Canada Ltd.

Help your clients take advantage of our convenient digital options*

During this time of physical distancing, people are looking for ways to interact with their providers virtually. We recently enhanced our Online Plan Member Enrolment tool, allowing all groups to add new plan members without the need for paper forms.

Did you know, we have several other digital options available to make it easier for your clients to do business with us and for their plan members to access and use their benefits plan? Over 71% of plan administrators are managing their plan online and 78% of plan members are already using our digital tools.

For plan administrators:

- Plan Administrator Portal (EquitableHealth.ca) – plan administrators can easily manage their plan anytime and anywhere

- Digital Welcome Kits – personalized welcome kits are delivered to plan members via email

- Easy automated payments – plan administrators can avoid missed payments by setting up pre-authorized debit or electronic funds transfer

For plan members:

- Plan Member Portal (EquitableHealth.ca) – plan members get secure, 24/7 access to their claims history, coverage details and health and wellness resources

- Electronic Claim Payments and Notifications – plan members can get claim updates sooner in their email inbox and payments right into their bank account

- EZClaim Mobile App – submitting claims from a mobile device is fast, easy and secure

- Digital Benefits Cards – plan members no longer have to dig through their wallet – they can download their benefits card on their mobile device

Learn more about how we’re making it easier for your clients to do business with us

2021 changes to Maximum Insurable Earnings, Maximum Weekly Insurable Earnings and Short Term Disability Benefit*

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2021 changes to Maximum Insurable Earnings, and premiums for employment insurance. These changes take effect January 1st, 2021.

Maximum Insurable Earnings (MIE)

The MIE will increase from $54,200 to $56,300.

Maximum Weekly Insurable Earnings (MWIE)

The MWIE will increase from $1,042 to $1,083.

EI Benefit (55% of the MWIE, rounded to the nearest dollar)

EI benefit will increase from $573 to $595

Information for Plan sponsors

If your client’s Group Policy with Equitable Life includes a Short Term Disability (STD) benefit which is tied to the EI MWIE, and at least one classification of employees has less than a $595 maximum:

- To comply with the provisions of their policy, their STD benefit will be revised with the maximums updated based on the percentage of EI MEIW shown in their policy.

- The additional premium for any increase from their previous STD amounts and new STD amounts will be show on their January 2021 Group Insurance Billing (as applicable).

If their STD maximum is currently higher than $595 or based on a flat amount (not based on a percentage or regular earnings):

- No change will be made to their plan unless otherwise directed.

If your clients wish to provide direction regarding revising their STD maximum, or have questions about the process, they can email Kari Gough, Manager, Group Quotes and Issue.

*Indicates content that will be shared with your clients

-

Equitable Life Group Benefits Bulletin – December 2021

In this issue:

- Supporting plan members affected by the flooding in Nova Scotia and Newfoundland*

- Update: Changing certificate numbers on EquitableHealth.ca*

- Help plan members take advantage of convenient digital options*

- Ontario optometrists and government to restart negotiations*

- QDIPC updates terms and conditions for 2022*

Supporting plan members affected by the flooding in Nova Scotia and Newfoundland*

The recent flooding in Nova Scotia and Newfoundland is having a devastating impact on the province’s residents.

Here are some of the ways we can help support your clients’ plan members who are affected by the flooding.

Prescription refills

Until Dec. 31, our pharmacy benefit manager, TELUS Health, will allow early refills for plan members who have been evacuated and/or lost their medication due to the flooding.

Replacement of medical or dental equipment and appliances

If plan members in Nova Scotia or Newfoundland need to replace any eligible medical or dental equipment or appliances (e.g. prescription eyeglasses, dentures, etc.) due to the flooding, they can call us at 1.800.265.4556 before incurring additional expenses to see how we can support them.

Disability or other benfit cheques

If plan members affected by the flooding are receiving disability benefits or other benefit reimbursements by cheque, they can visit www.equitable.ca/go/digital for easy instructions on how to sign up for direct deposit. It’s easy and takes just a few minutes. They can call us at 1.800.265.4556 if they need help. We can also arrange for a different mailing address or replacement cheques if necessary.

Mental Health Support

A natural disaster can also take a serious toll on people’s mental health. All of our plan members have access to the Homeweb online portal and mobile app, including numerous articles, tools and resources designed to provide guidance and support in difficult times. Homewood has put together some suggestions on how to help employees affected by a natural disaster.

For your clients with an Employee and Family Assistance Program, remind them that their plan members have 24/7 access to confidential counselling through a national network of mental health professionals. Whether it’s face-to-face, by phone, email, chat or video, plan members will receive the most appropriate, most timely support for the issue they’re dealing with.

If a client wishes to add the EFAP to their plan, we can do this quickly – often in just a few days. Simply contact your Group Account Executive or myFlex Sales Manager.

Plan Administrator support

We realize that the flooding may also be having an impact on the regular business operations of your clients in Nova Scotia and Newfoundland. If any of your clients are unable to carry out day-to-day plan administration, they can call us at 1.800.265.4556 to see how we can support them.

We know this is a challenging time for many of your clients and their plan members. We will continue to monitor the situation and provide additional updates as appropriate.

Update: Changing certificate numbers on EquitableHealth.ca*

Effective Dec. 10th, plan administrators will no longer be able to update or change plan members’ certificate numbers on EquitableHealth.ca. This change will ensure we can manage these changes more effectively to provide a smoother plan member experience.

If your clients need to update a plan member’s certificate number, please have them reach out to Group Benefits Administration for assistance at groupbenefitsadmin@equitable.ca.

Help plan members take advantage of convenient digital options*

We have several digital options available to make it easier for your clients to do business with us and for their plan members to access and use their benefits plan.

To help build awareness among plan members, we’ve created two posters that your clients can post on their intranet sites or in their office. The posters provide easy instructions on how to activate our secure, digital options.

Please click on the links below to download the posters.

EquitableHealth.ca posters: EZClaim mobile app posters:

EquitableHealth.ca English EZClaim mobile app English poster

EquitableHealth.ca French poster EZClaim mobile app French poster

Ontario optometrists and government to restart negotiations*

The Ontario Association of Optometrists (OAO) announced it has paused its job action and will restart negotiations with the Ontario Ministry of Health on funding for optometry services.

In September, Ontario optometrists began withholding services from patients covered by OHIP, including children, senior citizens and other patients with certain medical conditions, after negotiations with the Ministry of Health over compensation broke down.

Residents of Ontario between the ages of 20 to 64 who aren’t eligible for coverage of eye services under OHIP were not affected by the job action. They were able to continue to receive eye exams from their optometrist and submit eligible claims to their benefits plan.

QDIPC updates terms and conditions for 2022*

Every year, the Quebec Drug Insurance Pooling Corporation (QDIPC) reviews the terms and conditions for the high-cost pooling system in the province. Based on its latest review, QDIPC is revising its pooling levels and fees for 2022 to reflect trends in the volume of claims submitted to the pool, particularly catastrophic claims.

Size of group (# of certificates) Threshold per certificate 2022 Annual factor (without dependents Annual factor (with dependents) Fewer than 25 $8,000 $276.00 $771.00 25 – 49 $16,500 $188.00 $527.00 50 – 124 $32,500 $97.00 $328.00 125 – 249 $55,000 $66.00 $223.00 250 – 499 $80,000 $51.00 $173.00 500 – 999 $105,000 $39.00 $153.00 1,000 – 3,999 $130,000 $34.00 $133.00 4,000 – 5,999 $300,000 $18.00 $71.00 6,000 and over Free market – Groups not subject to Quebec Industry Pooling

We will apply the new pooling levels and fees to future renewal calculations that involve Quebec plan members. -

EAMG Market Commentary August 2022

August 2022

The S&P 500 fell into bear market territory over the first half of 2022 with the index down -20.6%. This represented a top 10 ranking amongst the most dismal back-to-back quarterly performances going back to 1928. While comparisons have been made to the inflation driven bear market of 1973-74, the economic backdrop today has some significant differences including greater production capacity (factory utilization rates are running about 20% lower vs the 70’s) and a meaningful decline in raw industrial prices which have fallen -11% over the quarter. While these economic anecdotes are potential positives for the future, it’s important to remain cognizant that prices remain elevated.

As such, the US Federal Reserve seems to be taking every opportunity to telegraph their intentions of raising interest rates at the expense of both market and economic performance, so long as inflation remains a threat. Given this hawkish tone, the market narrative has morphed from fears of inflation to a fed driven recession. As a result, the move in the bond market has been swift with the 10-year treasury yield peaking at approximately 3.5% in June to today’s level of 2.7% (lower rates = higher bond prices). This positive bond performance reflects the consensus view that inflation is temporary (2023 CPI forecasts are approximately 3.6% vs the second quarter’s 8.7% CPI reading) and could allow the Fed to adjust their higher interest rate trajectory downward. The Fed also remains confident that a soft landing is achievable, and a recession avoidable.

Investors seem less convinced however, given the Fed has never been able to engineer a soft landing before, and so it’s no surprise equity markets entered a bear market over the quarter, and currently remain in a technical correction (defined as losses greater than -10%). To better assess future performance, we closely monitor earnings results to understand how companies are navigating these economic trends. With nearly 80% of the S&P 500 reported, the results have been better than expected, but still the EPS beat rate and magnitude of beats (actual vs expectation) remain below 5-year averages. This tells us companies are finding today’s economic conditions more challenging than the recent past. Consumer sectors including marketing, retail, autos and textiles posted the 2nd worst performance vs other sectors while the Financials sector saw the greatest challenges with aggregate EPS falling by -15% year-over-year. Wall Street analysts have started to revise S&P 500 forward growth estimates lower, a trend which we expect will continue for several quarters ahead. The forward (12-month blended) P/E ratio of 17.5 times remains 1.5 multiple points above the long-term average which potentially suggests risks may not be fully priced in.

In terms of the S&P/TSX Composite, after declining nearly -14% in Q2 as recession fears around the world jeopardized the global demand outlook, its’ since rebounded over 4.0%. Still, valuation remains below longer-term averages at 11.8x forward earnings with the heavier weighted Financials and Energy sectors trading at 9.5x and 7.9x, respectively. TSX earnings expectations have stalled as of late but downward revisions are lagging US and European counterparts. Additionally, the domestic labour market remains tight which has allowed the Bank of Canada to continue its aggressive rate hike path to curb soaring inflation. For most of 2022 the TSX has benefitted from surging commodity prices but an economic slowdown in China resulting from its commitment to a zero-Covid policy and a potential global recession could prove to be a challenge for the Canadian market.

Equity markets on average lose 30% of their value in recession led bear markets. If we use this as a potential road map, it suggests the S&P 500 could have further to fall. Using past performance as a forward-looking tool however is an imperfect technique and used in isolation of what’s happening today can often mislead.

Accounting for today’s backdrop, we come up with three scenarios of varying probabilities. The first is the most optimistic and includes an engineered soft landing by the Fed, meaning no recession and inflation cools. A less optimistic view is the fed tames inflation with higher interest rates but tips the economy into a mild-to-moderate recession. The outcome would be consumer spending and corporate hiring slow as a result of tighter financial conditions, and therefore financial results are negatively impacted. The least optimistic scenario is one where stagflationary conditions emerge as inflation continues to accelerate at the expense of growth despite higher interest rates, in other words the Fed loses control. The net result would be similar to our second scenario but with much more dire results in terms of unemployment, household spending and impacts to corporate profitability. While we don’t rule out any of the above scenarios completely, we assign the highest probability to the second one where macro economic issues get resolved at some point in the future, but the full effects of inflation and a possible recession have yet to be priced into the market. Currently, this view translates into a slight underweight equity position versus our benchmark with a tilt towards low volatility and defensive strategies along with an overlay of value and dividend paying securities. In other words, we’ve de-risked the portfolios relative to our benchmark to manage potential downside risks but remain meaningfully invested an on absolute basis. As always, time in the market tends to overcome trying to time the market, and so employing a strategic and diversified strategy is often the most prudent approach.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. - [pdf] Pivotal Select Preferred Pricing

-

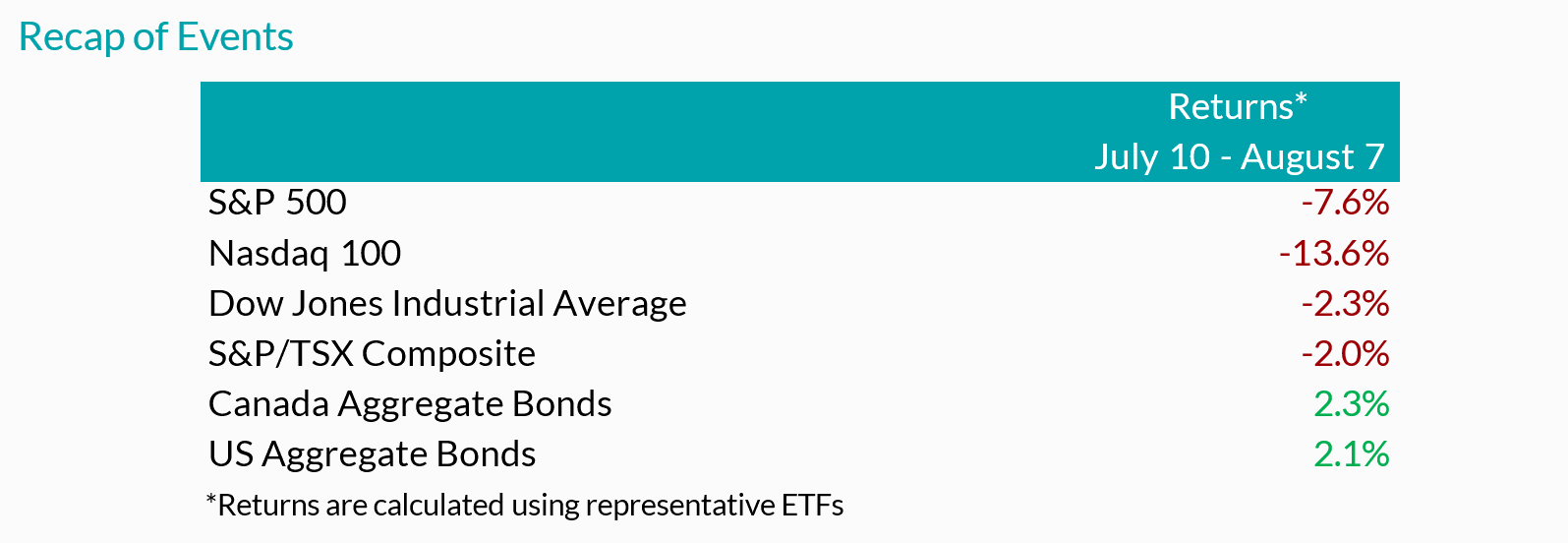

EAMG - Macro Tear Sheet – Recent Market Volatility Summary

By separating the noise from the signals, we believe the rotation away from the mega-cap technology names is likely to continue. Recent market volatility, triggered by a multitude of factors that include the unwind of the carry trade, investor reactions to mixed mega-cap earnings, and U.S. economic data, may present more investment opportunities for long-term outperformance. Recall over the past year that the majority of U.S. stock market performance came from a limited number of mega-cap technology companies and, in our view, moving forward it will be prudent to analyze the source of returns as rapid market rotations may punish overly-concentrated portfolios.

Inflation Slows (July 11) – Headline U.S. inflation readings increased 3.0% year-over-year in June, decelerating from May (3.3%). With prices slowing ahead of forecasts but economic growth remaining strong, investors became more confident regarding the prospects of an economic soft landing.

Outcome: market strength broadened with traders rotating out of highly concentrated areas of the market (“Fabulous 5”) and into more economically sensitive stocks that had been left behind.

• Big Tech Earnings (July 23 – Aug 1) – High profile mega-cap technology companies – including many members of the Magnificent 7 – reported earnings growth that generally surpassed expectations as margins remained healthy. That said, investors were more focused on spending towards AI-initiatives, rewarding businesses with greater success translating their AI investments into higher sales.

Outcome: this trend is evident through the divergence of returns from IBM and Alphabet (Google’s parent company) after releasing their quarterly earnings. The limited number of companies that contributed to the returns of the S&P 500 failed to impress investors, extending the rotation into other areas of the market.

• Caution is Brewing – Following a strong rally of economically sensitive pockets of the market, notably a breakout of returns from U.S. small cap companies, the low volatility factor, which tends to outperform during times of stress, moved in sync with the small caps’ strength.

Outcome: with a lack of fundamental justification supporting small cap performance, markets showed signs of caution.

• Central Bank Decisions (July 31)– The Federal Reserve held interest rates unchanged during its July meeting, in line with market expectations, reiterating committee members’ need for greater confidence that inflation would continue to subside. That said, policymakers signaled a reduction in policy rates could be a possibility in the coming meetings. In contrast, the Bank of Japan (BoJ) increased its key interest rate while also announcing plans to scale back bond purchases – restrictive monetary policy maneuvers aimed at backstopping the depreciating Japanese currency.

Outcome: the bifurcation between the BoJ and most other major central banks sparked a sharp appreciation of the yen and a rapid unwind of the yen carry trade (see below for explanation).

• Growth Scare (August 2)– In early August, a downside surprise in U.S. nonfarm payrolls (114k actual versus 175k expected) and an increase in the unemployment rate to 4.3%, higher than the 4.1% that was expected and up from 3.5% a year ago triggered concerns of a cooling labor market.

Outcome: speculation swelled surrounding the pace of rate cuts with market participants expecting the Federal Reserve to cut rates as much as 125bps over the next 3 policy meetings, up from 50-75bps as of the end of July. Against this backdrop, the ongoing unwind of the yen carry trade accelerated.

Yen Carry Trade Explained

• Simply put, investors have been borrowing Japanese yen – a low yielding currency – to invest in higher-yielding foreign assets. The primary risks in a carry trade can include the uncertainty of foreign exchange rates (if unhedged), as well as changes to expectations of the underlying yields, among other risks. Over the last 2 decades, the BoJ has implemented an ultra-low interest rate monetary policy to combat deflation and stimulate growth. Furthermore, investors were emboldened by the Japanese yen’s ~53% depreciation versus the U.S. dollar over the last 10 years. With the BoJ hiking its key interest rate while also announcing plans to scale back bond purchases, the yen rallied abruptly. Consequently, highly leveraged investors have had to exit their long positions in riskier assets to repay their borrowed yen exposure.

Peak Carry Trade Unwind – Buying Opportunity

• Peak carry trade unwind, which implies heightened panic levels, has historically created an attractive buying environment. That said, we are focused on companies that have demonstrated robust earnings growth and healthy leverage. Given the unprecedented level of market concentration over the last year, we view the unwind of the carry trade as another catalyst for investors to rotate out of the “Fabulous 5”.

Our Findings:

We found that the peak unwind of the carry trade may be a buying opportunity. At present, the current level of the unwind is similar to many notable market bottoms, including the Great Financial Crisis (2008), the European debt crisis (2010), the oil crash (2014), the subsequent emerging market crisis (2015), the Covid-19 crash (2020), and the collapse of Silicon Valley Bank (2023). We assessed the degree of the unwind by looking at the one-month implied volatility between three currency pairs, U.S. Dollar/Yen, Australian Dollar/Yen, and Euro/Yen. Implied volatility is a measure of the expected future volatility of the underlying assets over a given time period. Amid strong earnings growth and steady margins from quality businesses within the U.S. market, the fundamental backdrop suggests that businesses outside the concentrated AI-darlings may drive the next leg of market returns.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. - Continuing Education

- [pdf] EquiNet Quick Tips