Site Search

756 results for form to restart a pac on insurance

-

Crunch the numbers with Equitable Life of Canada

Whether helping your client determine net worth or reviewing to see if your client’s retirement plan is on track, Equitable Life® is here to help with our online calculators. These number crunching tools can help you answer some of those challenging questions you get asked by your clients. From an RSP loan calculator to home budgeting to even figuring out if your client will be a future millionaire, check out our latest tools.

-------------------------------------------------------------------------------------------------------

Elijah welcomed a new baby to his family and needs to reduce the amount of money he is saving for retirement. Is he still going to be able to retire at age 60 like he planned, or will he need to extend his working years until age 65?

Did you know?

Investment returns, unexpected expenses and inflation can all affect your retirement savings. Check out Equitable Life’s How Long How Long Will My Retirement Savings Last Calculator.Share calculators using your Facebook, Twitter or LinkedIn account.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

December 30 Deadline for 7% No Load CB5 Initial Commission for Investment Class (75/75)

As the end of year approaches, so does the temporary increase to our CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ Investment Class (75/75). The 7% initial commission promotion will end on December 30, 2022.*

- Deposits and transfers to CB5 funds for Pivotal Select Investment Class (75/75) must be made by December 30, 2022, at 11:00 a.m. ET. Any deposits received after this date will not receive the promotional rate.

- Applications submitted before the December 30, 2022, deadline will only receive the promotional rate if also funded before December 30, 2022.

- If the client is awaiting a transfer from another financial institution, please follow up with the institution to ensure the transfer arrives by December 30, 2022.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Equitable Life reserves the right to end the campaign, at any time and without notice.

™ or ® denote trademarks of The Equitable Life Insurance Company of Canada.

November 24, 2022 -

Tax Slips – What you need to know

It is tax time, and clients should be receiving tax slips and deposit receipts by now. Check out the Tax Slips: A Quick Reference Guide for a taxation breakdown by product and Insights into Non-Registered Taxation for a detailed explanation on investment income, and why T3 tax slips are generated on non-registered segregated funds.

Clients who registered for tax slips on Equitable Client Access before December 31, 2022, can download or print tax slips quickly and easily from their Equitable® Client Access Inbox. Advisors can download tax receipts on Document Lookup on EquiNet®.

For questions about contribution limits, Retirement Income Fund minimums and Canada pension maximums check out Equitable Life®’s helpful 2023 Facts & Figures guide.

Equitable's Advisor Services Team is available Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or by email at savingsretirement@equitable.ca. You can also contact your Regional Investment Sales Manager.

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted: February 15, 2023 -

Access more fund performance information faster and easier

Welcome to a new and improved Fund Overview & Performance website for Equitable Life® segregated funds.

A central location for:-

fund performance and quartile rankings

-

daily and historical unit prices

-

fund information (available in web and PDF)

-

Fund Facts documents

-

MERs

Highlights:-

Save your favourite funds for easy access.

-

New fund search and filter tools by product, guarantee, asset class and sustainability.

-

Share features allow you to easily share fund information with clients.

-

Ability to compare fund performance of Equitable Life segregated funds.

-

Simulated backcasted returns for funds with less than five years of performance history.

Check out the new Fund Overview & Performance webpage today to see how Equitable Life is making fund information faster and easier to access. Speak to your Regional Investment Sales Manager to learn more!

® denote a trademark of The Equitable Life Insurance Company of Canada.

Posted February 27, 2023

-

-

The Equitable Life FHSA is coming!

We want to help clients save money for their first home. We’re working on offering the Equitable Life® First Home Savings Account!

A First Home Savings Account (FHSA) is a registered plan allowing prospective first-time home buyers to save for their first home tax-free (up to certain limits).

Highlights:- Must be a Canadian resident

- Minimum of 18 years of age

- Annual contribution limit of $8,000 with a lifetime limit of $40,000

- Contributions are tax deductible (like an RRSP)

- Qualifying withdrawals are tax-free (like a TFSA)

- Must be a first-time home buyer (has not owned a home in which they lived during the current or preceding four calendar years)

- Unused FHSA proceeds can be transferred on a tax-deferred basis to an RRSP or RRIF

For more information contact your Regional Investment Sales Representative.

Date posted: April 11, 2023

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada. -

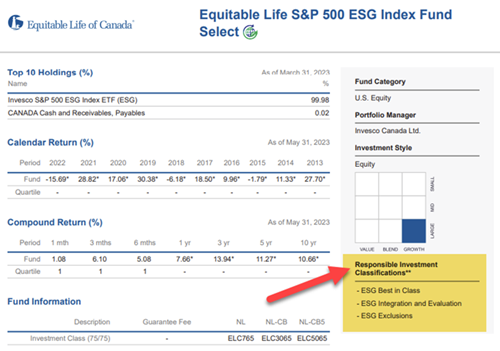

Responsible investing classification on Equitable Life Pivotal Select funds

Recently, the Canadian Investment Funds Standards Committee (CIFSC) classified responsible investing funds under its RI identification framework. The goal of the framework is to help investors and advisors identify and compare responsible investing funds.

We’re pleased to share that the following funds have been assigned multiple responsible investment classifications:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life S&P 500 ESG Index Fund Select

• Equitable Life S&P/TSX Composite ESG Index Fund Select

• Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Climate Leadership Fund Select

You can find the new responsible investment classifications for our funds by visiting our Fund Information webpage. After selecting a fund with the “Sustainable Investment” icon, the classifications can be found on the right side of the webpage or fund profile PDF:

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted: June 26, 2023

-

What’s the story behind Equitable’s new brand?

We are excited to share some more insight into the news of Equitable’s new brand.

Our new brand isn’t just a logo change.

Our new brand reflects our deeply rooted dedication to our clients. Over the next year, we will make the transition to our refreshed look. The new brand illustrates our focus on strong partnerships and making it even easier for you to do business with us.

Check out the Beyond the Logo video featuring our executive team sharing how the new brand embodies our commitment to advisors.

We’ll provide more details on the changes we’re making, and we welcome you to join in the journey. Please reach out to your Equitable point of contact or visit equitable.ca to learn more.

Posted December 4, 2023 -

Equitable’s New Brand – The Power of Together!

On November 1, 2023, we unveiled our new brand and announced the shortening of our brand name to Equitable®. The rebranding includes a fresh new look, and a forward-looking vision for the future – one that honours our 103-year history and our unwavering commitment to clients.

As we start 2024 with a renewed sense of purpose and commitment to clients, together with you, we are more determined than ever to provide more value and impact – to protect today and prepare tomorrow for our clients.

“At Equitable, we champion the power of togetherness. It’s a mindset that drives our behaviours, decisions, and actions to power equitable outcomes for our clients, advisors, and partners,” said Fabien Jeudy, President, and CEO, Equitable.

View the Power of Together video to learn more about Equitable’s renewed purpose and dedication to clients:

View on Vimeo

Questions about our new brand? Please contact your Equitable wholesaler or visit equitable.ca.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada. -

FasatWeb Upgrade Implementation

At Equitable, we are making continuous improvements to our advisor services. We are excited to share some upcoming enhancements to FasatWeb—Equitable’s compensation inquiry system.

What’s new?

On January 20, 2024, Equitable is implementing changes to FasatWeb. These changes include:

● Single sign-on has been enabled. Once you log into EquiNet, you won’t have to log in again to access Compensation Inquiry.

● Compensation Inquiry (FasatWeb) can be accessed using MS Edge, Chrome, or Firefox. Compensation Inquiry will no longer run on Internet Explorer.

● Compensation Inquiry screens will now have a new look and feel.

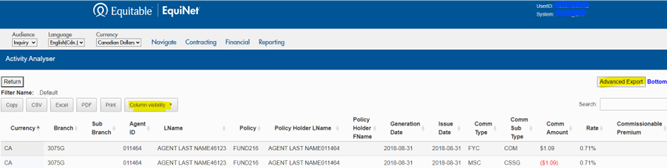

● Two new features have been added to the Activity Analyser, as are highlighted in the image below:

1. Advanced Export—an Advanced Export button has been added to the upper right side of the page, allowing you to export all query results.

2. Column visibility—the new Column visibility tab allows you to choose which columns you’d like to display in your PDF or print request.

-

And the winners of Equitable’s New Year’s Resolution, New Year’s Contribution Contest are…

A big thank you for making Equitable’s New Year’s Resolution, New Year’s Contribution contest a huge success.

Clients who made a contribution between January 1 and February 29, 2024, to their Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA) or First Home Savings Account (FHSA) could win $5,000 and the advisor could win $1,000.

As a special thank you to our clients and wonderful advisor partners we’ve tripled the fun and appreciation to three prizes.

We’ve now completed the draws and are thrilled to announce the following winners:-

Client: Winnie C., Ontario

Advisor: Rebecca M., Ontario -

Client: Eunice D., Alberta

Advisor: Diamond O., Alberta -

Client: Loyda A., Alberta

Advisor: Michael V., Alberta

Congratulations to our winners!

From all of us at Equitable, thank you for your trust and partnership.

Date posted: April 24, 2024

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada. -