Site Search

756 results for form to restart a pac on insurance

-

Give clients guaranteed retirement income with Payout Annuities

With increased market volatility and interest rates higher than we have seen for much of the past decade, now is a great time to consider payout annuities. Payout annuities can provide regular guaranteed income regardless of how markets perform.

Clients using only a Systematic Withdrawal Plan (SWP) for retirement income are potentially vulnerable during times of market volatility due to the sequence-of-returns risk.1 When markets are down, more units are redeemed to cover income needs. When markets later rise, clients are not able to participate fully in the recovery because more units were redeemed to provide income. That is why having a guaranteed income component, like a payout annuity, as part of an overall retirement strategy is so important.

Three great reasons to consider Equitable Life® for your payout annuity business:

1. Choose from a variety of payout annuity options including:

A. Life Annuity – guaranteed income for one life

B. Joint Life Annuity – guaranteed income for two lives

C. Term Certain – guaranteed income for a specific period of time (5 to 30 years)

D. Term Certain to Age 90 – guaranteed income until age 90

2. Attractive rates, particularly in Registered and Term Certain Annuities

3. Step Up Your Wealth Sales program - 25% of payout annuity net sales qualify for the 0.75% bonus commission earned on net deposits for 20222

.png)

For more information, please contact your Equitable Life Regional Investment Sales Manager.

1Sequence-of-returns risk, or sequence risk, is the risk that an investor will experience negative portfolio returns very late in their working life and/or early in retirement.

2All eligible deposits, sales, and redemptions occurring between January 1 and December 31, 2022, will be used to calculate an advisor’s 2022 net deposits.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada. -

Give clients guaranteed retirement income with Payout Annuities

With increased market volatility and interest rates higher than we have seen for much of the past decade, now is a great time to consider payout annuities. Payout annuities can provide regular guaranteed income regardless of how markets perform.

Clients using only a Systematic Withdrawal Plan (SWP) for retirement income are potentially vulnerable during times of market volatility due to the sequence-of-returns risk.1 When markets are down, more units are redeemed to cover income needs. When markets later rise, clients are not able to participate fully in the recovery because more units were redeemed to provide income. That is why having a guaranteed income component, like a payout annuity, as part of an overall retirement strategy is so important.

Two great reasons to consider Equitable Life® for your payout annuity business:

1. Choose from a variety of payout annuity options including:

A. Life Annuity – guaranteed income for one life

B. Joint Life Annuity – guaranteed income for two lives

C. Term Certain – guaranteed income for a specific period of time (5 to 30 years)

D. Term Certain to Age 90 – guaranteed income until age 90

2. Attractive rates, particularly in Registered and Term Certain Annuities

For more information, please contact your Equitable Life Regional Investment Sales Manager.

1Sequence-of-returns risk, or sequence risk, is the risk that an investor will experience negative portfolio returns very late in their working life and/or early in retirement.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada. -

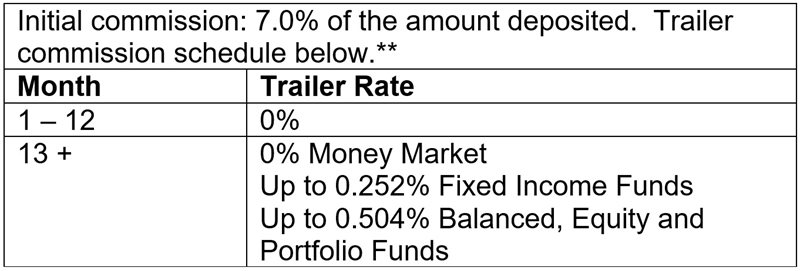

7% No Load CB5 Initial Commission – Limited time offer extended to December 31, 2022 for Investment

We are pleased to announce the temporary increase to the CB5 sales option initial commission from 5.6% to 7.0% has been extended to December 31, 2022 on Pivotal Select™ Investment Class (75/75) only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Equitable Life reserves the right to end the campaign, at any time and without notice. Prior temporary increase to CB5 sales option initial commission for Pivotal Select Protection Class 100/100 and Pivotal Select Estate Class 75/100 ends August 31, 2022.

** Applies to FundSERV trades occurring between September 1 and December 31, 2022. Initial commission on non-FundSERV trades occurring between September 1 to December 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™ or ® denote trademarks of The Equitable Life Insurance Company of Canada. -

An important announcement about our Travel Assist provider

Allianz Global Assistance, our Travel Assist emergency medical assistance provider, has informed us that it is exiting the Canadian group travel insurance market.

Allianz will continue to accept and support new claims up to June 30, 2023, and they will support ongoing claims until Dec. 31, 2023.

We are already meeting with potential new Travel Assist partners and plan to have a provider in place before June 30, 2023.

In the meantime, we are working closely with Allianz to help ensure a smooth and seamless transition for your clients and their plan members. Allianz is committed to maintaining its staff to meet and exceed service levels throughout the transition, as follows:

Before July 1, 2023:

Allianz will continue to accept calls and open new claims up to June 30, 2023. Any claims opened on or prior to June 30, 2023, will continue to be processed by Allianz until Dec. 31, 2023.

After July 1, 2023:

New cases will be directed to our new service provider. Allianz will work alongside us and our new provider to make this transition as simple as possible.

After Dec. 31, 2023:

For any cases still open as of Dec. 31, 2023, Allianz will work with our new service provider to responsibly transfer these cases while ensuring a seamless client experience.

We will communicate this news next week to your clients who have Travel Assist coverage on their plan. And we will continue to communicate more details to you about this transition in the coming weeks.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. -

Step Up Your Wealth Sales with Equitable Life!

Welcome to the Step Up Your Wealth Sales program with Equitable Life® . You will be rewarded with a growth bonus for doing more business with Equitable Life in 2023!

The program rewards advisors who promote Equitable Life’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account (GIA) contracts

+ 25% of payout annuity sales

- Segregated fund redemptions

- GIA redemptions

= 2023 Net Deposits

All deposits, sales, and redemptions occurring between January 1 and December 31, 2023, will be used to calculate an advisor’s 2023 net deposits.

Tier 2023 Net Deposits Bonus Rate* 1 Less than $250,000 $0 2 $250,000 - 499,999 .25% 3 $500,000 – 749,999 .50% 4 $750,000+ .75% 5 Elite Advisor re-qualifiers1 1.00%

* The bonus amount will be calculated at the end of 2023 based on net deposits. The bonus will be paid within 90 days following December 31, 2023. Maximum bonus payable is $100,000 for Elite Advisor re-qualifiers; $75,000 otherwise.

For more information, download our flyer or contact your Equitable Life Regional Investment Sales Manager.

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with clients’ unique needs.Posted:June 26, 2023

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

1 Elite Advisor re-qualifiers are advisors who attained Elite status as of end of 2022 and maintain Elite status at the end of 2023. To attain 2023 Elite Advisor status, an advisor must have $1,250,000 in gross deposits in at least 5 policies or $10,000,000 in assets. -

This year’s RSP contribution deadline is March 1, 2023

The RSP deadline is fast approaching so whether you are using paper or EZtransact™ here are some important things to remember.

Issuing New Policy with EZcomplete®-

All online applications must be digitally signed and submitted and have a date stamp no later than March 1, 2023.

Issuing New Policy using Paper Application-

For contributions to qualify for the first 60 days, all paperwork must be completed and signed by March 1, 2023. Equitable Life must receive all paperwork by March 7, 2023.

Deposits to Existing Policy-

Advisors can setup a one-time or recurring deposit or edit an existing pre-authorized debit already in place using EZtransact. Online deposits must be made and have a date stamp by March 1, 2023, to qualify for a 2022 tax receipt.

-

New to EZtransact? Try our EZtransact Practice Site to see how EZ it is to use.

-

-

Clients can make online deposits to Equitable Life® through their financial institution’s online banking service. Online deposits must be made and have a date stamp by March 1, 2023, to qualify for a 2022 tax receipt.

-

Clients can also make a new deposit to an existing policy by cheque. The cheque must be dated and signed by March 1, 2023. Equitable Life must receive the cheque no later than March 7, 2023.

If online banking is being used to fund the policy – either topping up an existing policy or opening a new policy – the online banking transaction must be completed by March 1, 2023, to receive a 2022 tax receipt.

Please note that cheques and other paperwork cannot be backdated. They must be completed and signed by March 1, 2023, to qualify for a 2023 tax receipt.

Don’t forget about the Equitable Life RSP Grow Your Future Contest. We hope you have a great RSP season!

® denotes a trademark of The Equitable Life Insurance Company of Canada. -

-

Equitable Life Dynamic Global Real Estate Fund Select: More than an inflation hedge

Some clients may be missing out on the benefits of real estate investments. In addition to providing an inflation hedge, investing in real estate can help to diversify an investment portfolio and manage overall risk.

Check out Equitable Life Dynamic Global Real Estate Fund Select in this issue of Fund Focus.

The fund aims to achieve long-term capital appreciation and income by investing in publicly listed real estate companies across a spectrum of property types and geographies.

Reasons to Invest:- Access to high-quality and diversified real estate assets through public companies from around the world

- Real estate is an asset class highly sought after by pension funds and institutional investors

- The underlying Dynamic Global Real Estate Fund is the oldest real estate mutual fund in Canada (1996)

- A key pillar is protecting capital – manager focus is on providing downside protection

- Competitive MER of 2.64%*

Date posted: April 14, 2023

* effective December 31, 2022

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada. -

New Dividend Scale Effective July 1, 2023!

Equitable Life’s Board of Directors has approved a change to the dividend scale* for the period July 1, 2023, to June 30, 2024.

- The interest rate we use for the dividend scale will go from 6.05% to 6.25% on July 1, 2023.

- Other factors used to decide the dividend scale will stay the same.

- The interest rate for participating whole life policies with dividends on deposit will stay the same at 2.25%.

- The policy loan interest rate** will go from 6.20% to 6.50% on June 30, 2023

More good news!

Once the next dividend scale year starts, we expect policyholder dividends to be close to $105 million until the end of June 2024.

Learn more

- Advisor Dividend Scale Notice

- Client Dividend Scale Notice

- Dividend Information Page

Did you miss our virtual Spring Update & 2023 Dividend Scale Announcement? Watch it now:

(*The French and Chinese events will be partially in English, with sub-titles on screen).

TOGETHER – Protecting Today – Preparing Tomorrow™

As a MUTUAL we provide financial security DIFFERENTLY by focusing exclusively on our CLIENTS.

*Dividends are not guaranteed and are paid at the sole discretion of the Board of Directors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the Participating Account as well as mortality, expense, lapse, claims experience, taxes, and other experience of the participating block of policies. Changes in the dividend scale do not affect the guaranteed premium, guaranteed cash values, or guaranteed death benefit amount. A copy of Equitable Life’s Dividend Policy and Participating Account Management Policy can be found on our website at www.equitable.ca.

** This applies to all new and active policy loans, including automatic premium loans. This change is for Equimax® policies that have a 9-digit policy number beginning with a “3” or an “8”. Some older policies may have other loan rates as they are based on the prime interest rate. -

Introducing Path to Invest for learning and earning CE credits

Equitable Life is pleased to introduce Path to Invest, our self-serve Continuing Education accredited presentation platform for advisors.

Whether you want to learn more about the financial services industry or how responsible investment solutions can fit into a client’s overall financial well-being, Path to Invest has what you are looking for.

It’s a one stop shop with 15 accredited presentations on a variety of topics. All with a video tutorial, short quiz and resource links for more information.

A few important notes before you get started.

PLEASE USE CHROME to get the best online experience as elements of the platform may not display correctly in other browsers.

To get started on your Path to Invest:- • Click Equitable Life Education site

- • Use the email address that you received this email to login.

- • Your password is Equitable

- • This link is specifically for your use only. Please do not share this link.

- Select a module.

- Watch the entire video presentation.

- Complete the quiz and receive a passing grade.

Check out Path to Invest and start learning and earning CE credits today.

Questions? Contact your Regional Investment Sales Manager to get started on your Path to Invest today!

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted June 14, 2023 -

Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select: Stability and diver

Although an often-overlooked asset class, infrastructure assets are physical assets that provide an essential service to society. Investing in infrastructure can offer stability and diversification in a well-balanced portfolio.

Check out Equitable Life® ClearBridge Sustainable Global Infrastructure Income Fund Select in this issue of Fund Focus. The fund aims to achieve long-term capital appreciation and income by investing in publicly listed real estate companies across a spectrum of property types and geographies.

Reasons to Invest:- ClearBridge has 50+ years as a leader in active management, with a focus on sustainable investing.

- An ESG (Environmental, Social and Governance) driven investment process: ESG factors are part of fundamental research and a bottom-up security selection process, and risks and opportunities are viewed through an ESG lens.

- Predictable income generation throughout the cycle: Invests in income-generating infrastructure assets, with cash flows underpinned by regulation or long-term contracts.

- Participation in global infrastructure renewal: Both developed and emerging economies are growing their infrastructure assets, producing new investment opportunities.

- Lots of flexibility - broad ranges for sector allocation and geographical allocation

For more information, check out the Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select or contact your Regional Investment Sales Manager.

Date posted: July 20, 2023

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.