Site Search

756 results for form to restart a pac on insurance

-

April 2023 eNews

Vision care discounts from Bailey Nelson for Equitable Life plan members*

We are pleased to announce we are partnering with Bailey Nelson to provide Equitable Life plan members with discounts on prescription and non-prescription eyewear. Bailey Nelson is a leading provider of prescription glasses, contact lenses and sunglasses with locations across Canada, as well as an online store.

All Equitable Life plan members will have access to the following discounts from Bailey Nelson:

*Includes anti-reflection and anti-scratch treatment. Glasses offers are based on 2 pairs of single vision or 1 pair of premium progressive lenses. Lens add-ons, such as high-index lenses and prescription tinted lens tints may involve additional costs.

**Non-prescription glasses only. Cannot be combined with 2 for $200 discount.

Plan members can provide their Equitable Life discount code in-store or at online checkout. Your clients may wish to distribute this convenient flyer with an overview of the available discounts to their plan members.

Plan members can bring their prescription to a Bailey Nelson location or provide it online to order glasses and contact lenses. Bailey Nelson also provides eye exams in-store for $99.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

Equitable Life helps tackle benefits fraud through Joint Provider Fraud Investigation (JPFI) initiative*

Protecting your clients’ plans is important to us. That’s why Equitable Life is working with other Canadian life and health insurers to conduct joint investigations into health service providers that are suspected of fraudulent activities through the Canadian Life and Health Insurance Association’s (CLHIA’s) Joint Provider Fraud Investigation (JPFI) initiative. This collaborative initiative between major Canadian life and health insurers through the CLHIA is a major step toward reducing benefits fraud in the life and health benefits insurance industry.How the JPFI works

The JPFI builds on the 2022 launch of a CLHIA-supported industry program. The program uses advanced artificial intelligence to help identify fraudulent activity across an industry pool of anonymized claims data. Joint investigations will examine suspicious patterns across this data.

Through this project, Equitable Life can initiate a request to begin a joint fraud investigation when we:- See suspected provider fraud in our own data or the pooled data, or

- Receive a substantiated tip about potential provider fraud

How Equitable Life protects your clients’ benefits plans from fraud

Benefits fraud is a crime that affects insurers, employers and employees and puts the sustainability of workplace benefits at risk. CLHIA estimates that employers and insurers lose millions each year to benefits fraud and abuse.

Our Investigative Claims Unit (ICU) consists of security and fraud experts who use data analytics and artificial intelligence to proactively identify and investigate suspicious billing patterns or claims activity to open investigations. We de-list healthcare providers who are engaged in questionable or fraudulent practices, pursue the recovery of improperly obtained funds, and report practitioners to regulatory bodies and law enforcement where appropriate.

Learn more about benefits fraud, or contact your Group Account Executive or myFlex Sales Manager for more information.Second phase of TELUS eClaims transition*

In June 2022, we switched to TELUS Health eClaims as our digital billing provider to give our plan members a faster and more convenient option for submitting paramedical and vision claims. The switch has allowed our plan members to take advantage of TELUS’s extensive network of over 70,000 paramedical and vision providers.

We’ve now begun the second phase of our TELUS Health eClaims implementation. This phase will focus on improving the experience for paramedical and vision providers. We will begin issuing reconciliation statements for the claims they submit on behalf of their patients. These statements will make it easier for them to use the TELUS Health eClaims portal and provide incentive for even more providers to sign up.

Please encourage your clients to remind their plan members about this convenient option. We have created a helpful one-pager that plan members can bring with them next time they have an appointment with their healthcare provider.

If you have any questions about TELUS Health eClaims, please contact your Group Account Executive or myFlex Sales Manager.

Changes to STD application process for COVID-19 cases*

As the COVID-19 situation evolves, we continue to adjust our disability management practices to ensure ongoing support and a fair experience for all our plan members.

As of May 1, 2023, we will begin managing COVID-19-related short-term disability (STD) claims the same way that we manage disability claims for any other illness or condition. If a plan member is unable to work due to COVID-19 symptoms or a positive COVID-19 test, they must now use the standard STD application, including the Attending Physician Statement portion.

Once we receive the claim, we will adjudicate it according to our standard process.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

* Indicates content that will be shared with your clients.

- [pdf] Retirement Income Fund Understanding minimum withdrawal percentages

- [pdf] The Right Time To Buy And Sell

-

This year’s RSP contribution deadline is March 1, 2022

Does your client want to contribute or open a new policy this Retirement Savings Plan (RSP) season? Whether using paper or our recent EZtransact online platform, here are some important things to remember.

Issuing New Policy with EZcomplete®

-

All online applications must be digitally signed and submitted and have a date stamp no later than March 1, 2022.

Issuing New Policy using Paper Application-

For contributions to qualify for the first 60 days, all paperwork must be completed and signed by March 1, 2022. Equitable Life must receive all paperwork by March 7, 2022.

Deposits to Existing Policy

-

Advisors can setup a one-time or recurring deposit or edit an existing pre-authorized debit already in place using EZtransact. Online deposits must be made and have a date stamp by March 1, 2022, to qualify for a 2021 tax receipt. New to EZtransact? Try our EZtransact Practice Site to see how EZ it is to use.

-

Clients can make online deposits to Equitable Life® through their financial institution’s online banking service. Online deposits must be made and have a date stamp by March 1, 2022, to qualify for a 2021 tax receipt.

-

Clients can also make a new deposit to an existing policy by cheque. The cheque must be dated and signed by March 1, 2022. Equitable Life must receive the cheque no later than March 7, 2022.

If online banking is being used to fund the policy – either topping up an existing policy or opening a new policy – the online banking transaction must be completed by March 1, 2022, to receive a 2021 tax receipt.

Do not miss your opportunity to have your contributions count for 2021!

Please note that cheques and other paperwork cannot be backdated. They must be completed and signed by March 1, 2022, to qualify for a 2021 tax receipt.

® denotes a trademark of The Equitable Life Insurance Company of Canada.

-

-

Equitable Life awarded seven Fundata FundGrade A+ awards

.png?width=400&height=79)

Equitable Life® has won seven Fundata FundGrade A+® awards for 2020. The first four funds are currently available on Equitable Life’s Pivotal Select™ fund lineup.- Equitable Life Invesco International Companies Fund

- Equitable Life Dynamic American Fund

- Equitable Life Dynamic Equity Income Fund

- Equitable Life Dynamic Global Discovery Fund

- Equitable Life Dynamic Power Global Growth Fund

- Equitable Life Accumulative Income Fund

- Equitable Life Common Stock Fund

The annual awards are presented by Fundata Canada Inc. to investment funds that have shown consistent, outstanding, risk-adjusted performance throughout the previous calendar year.

Equitable Life invests for the big picture and offers a complete range of investment and annuity products designed to meet the savings, accumulation and income needs of clients. Our strength as a company along with our many investment guarantees can help your clients achieve their financial goals with confidence.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.® ”Equitable Life” and “Pivotal Select” are trademarks of The Equitable Life Insurance Company of Canada.

-

Equitable Life awarded FundGrade A+ awards for 2021

Equitable Life® is the proud recipient of the Fundata FundGrade A+® in 2021 for Equitable Life Dynamic Power Global Growth Fund and Equitable Life Accumulative Income Fund. These funds are part of our legacy products and no longer available to purchase for new contracts.

Each year, Fundata looks for Canadian investment funds that uphold an outstanding performance rating over the course of the year. Equitable Life invests for the big picture and offers a complete range of investment and annuity products designed to meet the savings, accumulation and income needs of clients. Our strength as a company along with our many investment guarantees can help your clients achieve their financial goals with confidence.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.® ”Equitable Life” and “Pivotal Select” are trademarks of The Equitable Life Insurance Company of Canada.

-

Calming client fears about inflation and market volatility

Watch any news report or read any social media feed and you will see stories about inflation and market volatility. Inflation is one of the reasons that investing in equities is important - they can help to provide long-term returns that offset the effects of inflation. Help your clients stay on track during periods of market volatility and elevated inflation by following a few key investment strategies.

Time diversification through dollar-cost averaging

Volatile markets can provide opportunities. While your client may be skeptical, remind them about the benefits of dollar-cost averaging. Dollar-cost averaging adds time diversification, meaning your client buys into the market at different points in time. Regular investing can even allow your client to see growth during times of volatility. To learn more, click here.

It is time in the markets, not timing the markets that works long-term

Investing for the long-term allows your client to ride the waves of the investment market. The S&P/TSX Composite Index, for example, has had a compound annual return of approximately 7.8% over the past 25 years.[1] These returns account for the most recent financial crisis and the dot-com bubble. Previous market declines have offered buying opportunities for clients who have funds to invest. To learn more, click here.

Keep your clients invested with segregated funds

Segregated funds, like Equitable Life’s® Pivotal Select™, offer additional benefits beyond those offered by mutual funds and Exchange Traded Funds. Segregated fund guarantees (maturity and death) can protect your clients’ money during periods of market stress. A segregated fund guarantee will provide your client with the better of the guaranteed amount or the market value at the maturity date or date of death. A Pivotal Select segregated fund guarantee can give your client the confidence to stay invested during market uncertainty. To learn more about using Equitable Life’s segregated funds to keep your client invested, click here.

To learn more about the advantages of investing with Equitable Life, click here.

® Denotes a trademark of The Equitable Life Insurance Company of Canada.

[1] Annualized S&P/TSX Composite total return from January 3, 1995, to February 28, 2020. -

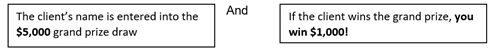

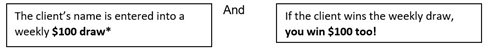

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy

See full contest details. Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

* Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Grow Your Future RSP Contestt: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 20232, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules. -

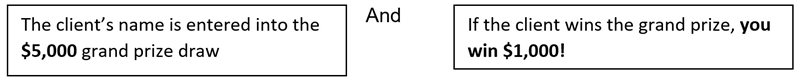

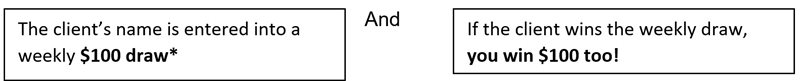

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy*

Full contest details.

Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

*Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Equitable Life® 2023 RRSP Season Contest: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 2023, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules.

Posted December 1, 2022

-

Digital tools for your clients and their plan members

In this issue:

- Digital tools for your clients and their plan members*

- QDIPC updates terms and conditions for 2024*

Digital tools for your clients and their plan members*

Do your clients know how to use all the available digital tools in their Equitable® benefits plans? With useful features for both plan administrators and their members, it’s even easier for your clients to access their plans online.Tools for plan administrators

- Our online plan member enrolment tool lets groups and administrators add new plan members online without completing paper forms

- The EquitableHealth.ca plan administrator portal makes it easy for plan administrators to manage their plan anytime and anywhere. Helpful features include:

- A premium calculator to calculate monthly costs for plan members

- A simple process for updating plan member information

- Digital welcome kits provide personalized information directly to plan members through email

- Easy, automated payment options help plan administrators avoid missed payments by offering pre-authorized debit or electronic funds transfer

Tools for plan members

- Our plan member portal at EquitableHealth.ca provides secure, 24/7 access to claims history and coverage details. It also lets members submit claims, and includes health and wellness resources

- Electronic notifications and claims payments give plan members claim updates via email and deposit payments directly into their bank account

- The Equitable EZClaim® mobile app lets plan members submit claims quickly and securely on-the-go from their mobile device

- Digital benefits cards give plan members the convenience to access their benefits cards easily from a mobile device

Help with digital benefits tools

We’ve created a brochure and video guide to help plan members use digital tools for a smoother, more convenient benefits experience.

Plan members can contact us at 1.800.265.4556 and select the option for Web Support if they need further assistance.

QDIPC updates terms and conditions for 2024*

Every year, the Quebec Drug Insurance Pooling Corporation (QDIPC) reviews the terms and conditions for the high-cost pooling system in the province.

Based on its latest review, QDIPC is revising its pooling levels and fees for 2024 to reflect trends in the volume of claims submitted to the pool, particularly catastrophic claims. These updates take effect January 1, 2024. You can view the updates here.

We will apply the new pooling levels and fees to future renewal calculations that involve Quebec plan members.

If you have any questions, please contact your Group Account Executive or myFlex Account Executive.