Site Search

961 results for life policy 300109556

-

New flexibility with Equitable’s Term Exchange option

Great news! Equitable® has just added our Term 30/65 plan as an option for term exchanges! This gives clients greater flexibility to choose a term plan that can adapt to their specific needs.

Clients can exchange their Equitable 10-year or 20-year term plans to a Term 30/65 plan as their financial needs change – without additional underwriting.

What you need to know:

• A term plan that is a result of an exchange option cannot be exchanged again

• Exchange is available between the 1st and 5th coverage anniversary.

o Only up to the insured’s 65th birthday for exchange to T20

o Only up to the insured’s 55th birthday for exchange to T30/65

• To request a term exchange, use the Term Exchange form.

For additional information, refer to the Term Advisor Admin Guide on EquiNet®, or contact your Equitable wholesaler.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada. - [pdf] Converting Your Savings into Retirement Income

-

Paramedicals are Re-opening Shortly

We are pleased to announce that face-to-face insurance testing paramedical services, including the collection of vitals & fluids, are resuming shortly. Our service providers, Dynacare and ExamOne, have been monitoring the public health standards and have established standards they will operate under to protect the health of both the applicant and health professionals.

Our commitment to your client’s safety

It is Equitable Life's commitment that both clients and advisors will be provided clear and thoughtful communication before initiating any testing. Clients should fully understand the potential risks associated with having a paramedical test taken at this time and are always able to choose not to attend the appointment if they do not feel comfortable or safe.

How will paramedical services be conducted?

Dynacare is conducting appointments at fixed site facilities where clients will travel to the health professional for their appointment. The paramedical questions will be covered by video or telephone to minimize the time spent in the fixed site facility. For more information, see Dynacare’s COVID-19 client guide that will be provided to the client directly.

ExamOne examiners will travel to the client’s home for their appointment and the entire paramedical will be conducted at that time. Information about ExamOne’s COVID-19 processes and their Preparing for my exam client guide will also be provided to the client directy.

When are paramedical services re-opening?

In person paramedical services for Equitable Life cases will begin opening gradually. We have worked closely with our service providers, the CLHIA & provincial governments and believe it is prudent to begin re-opening services in the provinces that have a lower incidence of COVID-19. We will expand the schedule as the incidence of COVID-19 lowers or is expected to lower in specific regions.

Please note if you had an order in process prior to services shutting down, the provider will be looking to re-open and complete those orders. If requirements are no longer needed given the non-med limit changes, the order will remain closed.

Schedule for re-opening paramedical services:Province Start Date Saskatchewan June 1-Dynacare, June 11-ExamOne New Brunswick June 8-Dynacare, June 11-ExamOne PEI and Newfoundland June 15, Dynacare and ExamOne Manitoba June 15, Dynacare and ExamOne Alberta June 18, Dynacare and ExamOne British Columbia June 22, Dynacare and ExamOne Nova Scotia June 22, Dynacare and ExamOne Ontario* By June 30, Dynacare and ExamOne Quebec * By June 30, Dynacare and ExamOne

Note: Start dates are subject to change based on the progress of COVID-19.

*Ontario & Quebec to re-open regionally (starting with areas with lower incidence of COVID-19). Specifics for Ontario and Quebec will be communicated closer to the implementation dates for these provinces. Further details can be found in this communication. -

Supporting plan members affected by the British Columbia and Northwest Territories wildfires

Wildfires across Canada are disrupting the lives of many Canadians. During this difficult time, Equitable Life is providing additional support to help affected clients and plan members.

Prescription refills

Plan members who have been evacuated and/or lost their medication due to the wildfires will be able to make early refills until September 17, 2023, through TELUS Health, our pharmacy benefit manager.

Replacement of medical or dental equipment and appliances

Plan members who need to replace eligible medical or dental equipment or appliances due to the wildfires should first call 1.800.265.4556 to confirm coverage.

Disability or other benefit cheques

Plan members receiving disability benefits or other benefit reimbursements via cheques can visit www.equitable.ca/go/digital for instructions on how to sign up for direct deposit. It just takes a few minutes. Plan members can also call us at 1.800.265.4556 if they need help, a replacement cheque or assistance arranging a different mailing address.

Mental health support

Unpredictable, large-scale natural disasters can cause people to experience intense reactions, putting a lot of pressure on their mental health. Having coping mechanisms to deal with the current crisis can be a huge help. Any Equitable Life plan member who needs mental health support can visit Homeweb.ca/equitable to access online resources or contact Homewood at 1.888.707.2115.

For plan sponsors who have purchased Homewood Health’s Employee and Family Assistance Program (EFAP), their plan members also have access to confidential counselling services. The EFAP provides plan members with 24/7 access to confidential counselling through a national network of mental health professionals. Whether it’s face-to-face, by phone, email, chat or video, plan members will receive the most appropriate, most timely support for the issue they’re dealing with.

Plan Administrator support

We realize that the fires are having a profound impact on regular business operations in B.C. and N.W.T. If you have clients that are unable to carry out day-to-day plan administration, they can call us at 1.800.265.4556. They can also contact their Customer Relationship Specialist for support.

This is a challenging time for advisors, plan sponsors and plan members. We will continue to monitor the situation and provide additional updates as appropriate.Questions?

If you need more information, contact your Group Account Executive or myFlex Sales Manager.

-

2023 Holiday Hours

The Holiday season brings thoughts of gratitude, and there is no better time to express our thanks and sincere appreciation for your dedication and commitment to Equitable Life.

Thank you for your support this past year and for trusting Equitable Life with your Individual Insurance and Savings & Retirement business. Happy Holidays!

Client Care Centre Holiday Hours

Friday December 22, 2023 - 8:30 a.m. – 7:30 p.m. ET

Monday December 25, 2023 – CLOSED

Tuesday December 26, 2023 – CLOSED

December 27, 28 and 29, 2023 - 8:30 a.m. – 7:30 p.m. ET

Monday January 1, 2024 - CLOSED

Savings & Retirement

To settle on December 22, 2023, the transaction must be received that day by 11:00 a.m. ET

To settle on December 29, 2023, the transaction must be received that day by 11:00 a.m. ET

Individual Insurance

Underwriting

● Underwriting must receive all evidence and outstanding Underwriting requirements by December 15th- at the latest. Underwriting will then be able to decision these cases by December 21st. This will give the New Business team December 21st – December 29th to issue and settle policies.

New Business

● New Business will continue to process all issue and settle requirements every business day until the last working day of the year – December 29th. New Business needs to receive ALL final settle documents in Good Order within our posted service standards. We are currently operating at a 3 business day turn around time.

Field Payroll

● Second Last Pay Period for 2023 – December13, 2023 to December 19, 2023 (Transmission/Statement date December 20, 2023)

● Last Pay Period of 2023 – December 20, 2023 to December 29, 2023 (Transmission/Statement date January 2,2024)

● First Pay of 2024 – January 1, 2024 to January 9, 2024 (Transmission/Statement date on January 10,2024)

Daily Pay will run on business days.

Please note that all requirements must be received in Head Office by the above dates to guarantee settlement for year end. -

Celebrating our most popular Pivotal Select funds

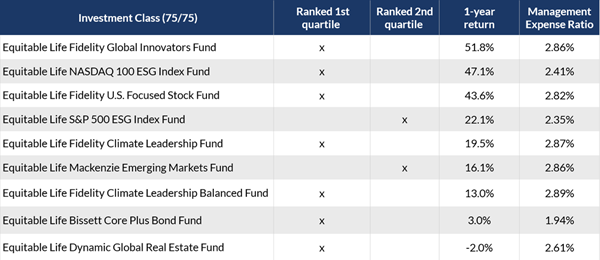

In August 2022, Equitable® launched 12 new segregated funds in Pivotal Select’s Investment Class (75/75). We wanted to bring some new innovative solutions to the product, including six sustainable investment funds. To say the launch of these funds was successful would be an understatement.

The funds are quickly becoming some of the most popular funds in Pivotal Select™, and their performance in 2023 was impressive. Equitable wants to celebrate these funds and encourage clients to consider them for their portfolios.

As of February 29, 2024, nine out of the 12 funds received a 1st quartile ranking for their 1-year return and two more were 2nd quartile. The table below shows the new funds that ranked in the top two quartiles for their 1-year returns.

Access additional fund performance information

If you haven’t looked at these funds yet, now is the time. Speak to clients about their investment options and see if these funds fit within their investment portfolio.

Talk to your Director, Investment Sales today for more information.Disclaimer

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value. Segregated fund values change frequently, and past performance does not guarantee future results. Investors do not purchase an interest in underlying securities or funds, but rather, an individual variable insurance contract issued by The Equitable Life Insurance Company of Canada. There are risks involved with investing in segregated funds. Please read the Contract and Information Folder before investing for a description of risks relevant to each segregated fund and for a complete description of product features and guarantees. Copies of the Contract and Information Folder are available on equitable.ca.

Management Expense Ratios (MERs) are based on figures as of February 29, 2024, and are unaudited. MERs may vary at any time. The MER is the combination of the management fee, insurance fee, operating expenses, HST, and any other applicable non-income tax for the fund and for the underlying fund. For clients with larger contract values, a Management Fee Reduction may be available through the Preferred Pricing Program. For details, please see the Pivotal Select Contract and Information Folder.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

Posted April 18, 2024

-

Advisor Compensation after the DSC/LL ban May 29, 2023

As of May 29, 2023, Pivotal Select segregated fund contracts will not allow new deposits to the Deferred Sales Charge (DSC) and Low Load (LL) sales charge options. This is in response to the ban on deferred sales charges by the Financial Services Regulatory Authority (FSRA). The following sales charge options will continue to be available:

- No Load (NL)

- No Load – 3 year chargeback (NL-CB)

- No Load – 5 year chargeback (NL-CB5)

Advisors may be wondering how compensation compares under various sales charge options.

Here is an example of advisor compensation for a $100,000 segregated fund contract in the Equitable Life Active Balanced Portfolio Select.*

*For illustration purposes, this assumes a 0% return over the period shown.Year No Load DSC Low Load No Load CB No Load CB5 1 $1,008 $5,544 $3,024 $3,500 $5,600 2 $1,008 $504 $504 $504 $504 3 $1,008 $504 $504 $504 $504 4 $1,008 $504 $1,008 $504 $504 5 $1,008 $504 $1,008 $1,008 $504 6 $1,008 $504 $1,008 $1,008 $504 7 $1,008 $504 $1,008 $1,008 $504 8 $1,008 $504 $1,008 $1,008 $504 Contract Value Total Compensation Paid $100,000 $8,064 $9,072 $9,072 $9,044 $9,128

Over an 8-year period, total advisor compensation with the CB5 sales charge option is $9,128 versus $9,072 and $8,064 with DSC and NL respectively.

Below is the chargeback schedule for NL-CB and NL-CB5:

Month (age of units) Commission Chargeback Schedule

NL-CBCommission Chargeback Schedule

NL-CB51 - 12 100% 100% 13 - 24 97.2% - 66.4% 98.3% - 82.0% 25 – 36 63.6% - 32.8% 80.5% - 64.0% 37 – 48 0% 62.5% - 46.0% 49 – 60 0% 44.5% - 28% 61+ 0% 0%

For more information, please contact your Regional Investment Sales Manager.

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Date posted: June 15, 2023

-

Equitable Life Group Benefits Bulletin – May 2020

In this issue:

- Digital options for your clients and their plan members*

- Alberta delaying biosimilar initiative*

- Yukon increasing insurance premium tax*

- Manitoba and New Brunswick relaxing drug limits*

- Free guide to accessing virtual healthcare*

- Homeweb for plan members who are losing coverage*

*Indicates content that will be shared with your clients

Easy and convenient digital resources for your clients and their plan membersDuring this time of physical distancing, people are looking for ways to interact with their providers virtually. We have several convenient digital tools available to make it easier for your clients and their plan members.

For plan administrators:

Plan administrator portal (EquitableHealth.ca)Our secure portal allows plan administrators to easily manage their plan anytime and anywhere. Instead of printing and mailing forms, they can make real-time updates at their convenience. The site also makes it easy to:

- View or upload forms and other important documents;

- Retrieve billing information;

- Estimate monthly premium costs; and

- View announcements, tips and reminders.

Plan administrators can visit www.equitablehealth.ca to activate their account.

Digital Welcome Kits

Instead of paper kits that can easily get lost or quickly become outdated, plan members receive personalized welcome kits via an interactive email, including instructions on how to:

- Activate their online group benefits account;

- Download their digital benefits card;

- Submit claims from their computer or mobile device;

- Review their coverage details; and

- Explore health and wellness resources.

Easy automated payments

Automated payments are a convenient way to avoid missed payments, suspended claims and disruption. Plan administrators simply complete the pre-authorized debit form and send to GroupCollections@equitable.ca. Or contact Group Collections about online banking and electronic funds transfer (EFT).

We can help

For assistance, plan administrators can contact their Client Relationship Specialist or our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

For plan members:

Plan member portal (EquitableHealth.ca)By logging into EquitableHealth.ca, plan members have secure 24/7 access to their personalized Group Benefits account. They can:

- View and submit claims;

- Review their coverage details; and

- Access health and wellness resources.

Electronic claims payment and notifications

Once plan members have activated their Group Benefits account on EquitableHealth.ca, they can easily set up receiving their claim payments via direct deposit, and their claim notifications via email.

EZClaim Mobile App

Submitting claims is fast, easy and secure with the Equitable EZClaim® mobile app for iOS and Android devices. Plan members can view and submit health and dental claims and review their coverage details.

Digital Benefits Cards

Instead of digging through their wallets, plan members can download a digital version of their benefits card to their mobile device.

We can help

We’ve created a video guide to help plan members access and use their digital resources. For further assistance, plan members can contact our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

Alberta government delaying biosimilar initiativeAs we announced in the February 2020 issue of eNews, the Alberta Biosimilar Initiative will require patients using several originator biologic drugs to switch to a biosimilar in order to maintain coverage through their Alberta government sponsored drug plan.

Due to the increased demands the COVID-19 pandemic is placing on healthcare providers, the Alberta government has postponed the switching requirement. Affected patients will now have until January 15, 2021 to switch to the biosimilar version of their drug in order to maintain provincial coverage.

We continue to investigate appropriate options to help ensure this provincial change does not unreasonably impact Equitable Life groups and patients and will keep you informed.

For more information about the Alberta Biosimilars Initiative, consult the Alberta government website.

Yukon increasing Insurance Premium TaxThe Yukon Government has announced that it plans to increase its Insurance Premium Tax rates effective January 1, 2021. The premium tax rates for group life and accident and sickness insurance are expected to increase from 2% to 4%. The new tax rates will be applied to premiums paid on or after January 1, 2021.

Manitoba and New Brunswick relaxing drug limitsIn order to protect the drug supply during the COVID-19 crisis, residents of most provinces were temporarily limited to receiving a 30-day supply of drugs when filling a prescription. Normally, doctors prescribe a 90-day supply for most maintenance-type drugs.

The Government of Manitoba and the Government of New Brunswick are now relaxing this 30-day limit for prescription drugs where shortages do not exist. They will address potential shortages of specific drugs if necessary.

As the situation continues to evolve, there may continue to be changes to provincial legislation and prescription limits. Plan members should speak to their pharmacist for the most up to date information.

Free guide to accessing virtual healthcareWith many health clinics closed and the healthcare system under strain, people are looking to access a doctor and other health providers virtually.

As we announced previously, we’ve made it easier for plan members to find the information they need using our Guide to Accessing Virtual Healthcare. This online resource provides information about and links to a range of virtual health services they need to take care of their health and the health of their family during these challenging times.

The Guide also indicates which services are covered by public health plan, so there’s no cost to the patient to access them if they provide their valid provincial health card.

We will continue to update the Guide as more virtual healthcare providers and services become available.The Guide is available on both EquitableHealth.ca and Equitable.ca.

Homeweb for plan members who are losing coverageWe know these are difficult times for Canadian employers and their employees. As businesses temporarily suspend operations, some employers have had to make the difficult decision to temporarily lay off employees or put their benefits coverage on hold.

That’s why we were pleased to announce that Homewood Health® and Equitable Life will extend access to Homeweb, a personalized online mental health and wellness portal, for up to 120 days for plan members who have temporarily lost their benefits coverage due to COVID-19.

Employees and their family members will continue to have access to the Homeweb website and mobile app, including:

- iVolve, online self-directed Cognitive Behavioural Therapy;

- Resources to support themselves and their family members through the COVID-19 pandemic;

- An interactive online Health Risk Assessment; and

- An online library of tools, assessments and e-courses.

This will allow businesses undergoing financial hardship to provide some support to employees who are temporarily without benefits coverage.

- [pdf] Personalized Brochure - Benefits of segregated funds in a Tax-free Savings Account

- [pdf] Life Quick Reference Guide