Site Search

1360 results for if

-

Equitable Life creates guide to accessing virtual healthcare at no cost

With many health clinics closed and the healthcare system under strain, people are looking to access a doctor and other health providers virtually.

To make it easier for plan members, we’ve created the Guide to Accessing Virtual Health Care Services on the plan member section of EquitableHealth.ca. This online resource provides information about and links to a range of virtual health services they need to take care of their health and the health of their family during these challenging times.

The Guide also indicates which services can be accessed for free. In some provinces, online doctor visits are now covered by the public health plan, so there’s no cost to the patient to access them as long as they provide their valid provincial health card. In other provinces, the nominal fee can be claimed on a Health Care Spending Account.

We will continue to update the Guide as more virtual healthcare providers and services become available.

-

Most employers staying the course on benefits during COVID-19

With businesses suffering hardship due to COVID-19, employers are turning to you for advice on their benefits plans during these difficult times. We’ve received numerous questions from advisors about changes our clients are making to their plans during this crisis.

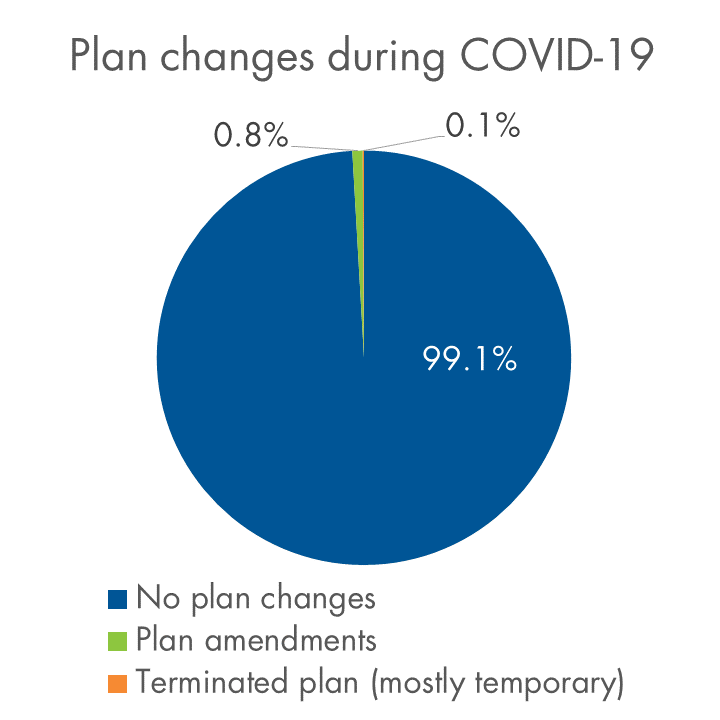

So far, the vast majority of clients are standing pat and taking a wait-and-see approach. Plan amendments have been the exception – fewer than 1% of our clients have made COVID-19-related amendments as of mid-April. Almost all are clients with fewer than 50 lives.

We know that many of our clients have experienced layoffs, but hardly any have cancelled benefits. Fewer than 0.1% have terminated benefits to date.

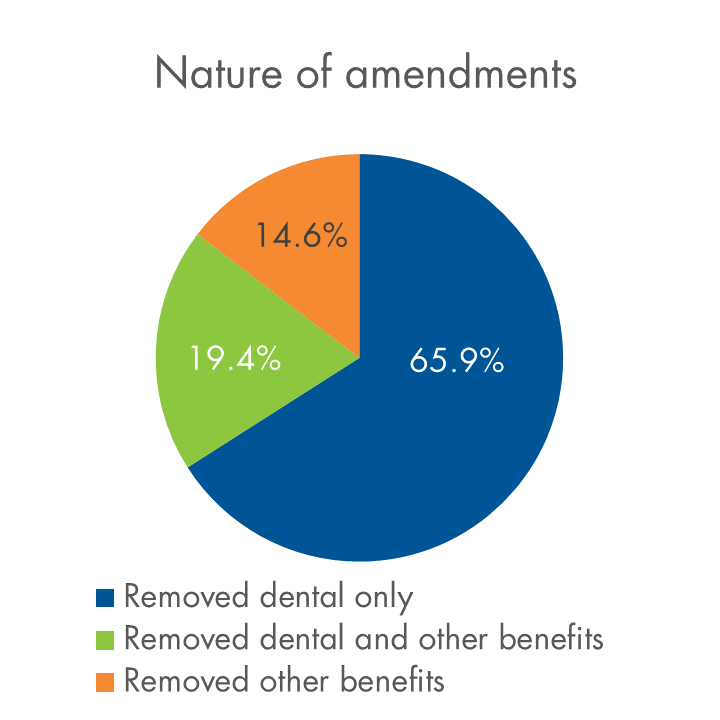

Below is a snapshot of plan amendments and terminations relative to our overall block, and an overview of the types of amendments we’re seeing.

COVID-19-related plan changes on Equitable Life’s block of businessAs of April 15, 2020

Have clients who need to make a change?

We know this is a difficult time for Canadian employers. If you have a client who needs to make a change to their plan, please contact your Group Account Executive or myFlex Sales Manager. We have a range of options to help them manage, and changes can be made quickly. The average turnaround time for COVID-19-related amendments is currently about four days.

We’re happy to work with each employer to understand the options that suit their specific situation best.

-

Group Benefits - Premium relief for Dental and Extended Health Care benefits

We know this is a difficult time for Canadian employers and that many of your clients are facing financial hardship as a result of the COVID-19 pandemic. We continue to look for ways to help employers manage while still supporting their employees.

With many health practitioners closing their offices due to the pandemic restrictions, plan member use of dental benefits and some health benefits has declined.

So, we are pleased to announce that we are offering premium relief for all Traditional and myFlex insured non-refund customers for Health and Dental benefits, as follows:

- A 50% reduction on Dental premiums; and

- A 20% reduction on vision and extended healthcare rates (excluding prescription drugs), which equates to an 8% reduction on Health premiums.

These reductions are retroactive to April 1, 2020 and will appear as a credit against the next available billing. We will assess the situation monthly and expect to continue with monthly refunds for as long as the current crisis period continues.

We expect that claims experience and premiums will return to normal once the current pandemic restrictions are lifted.

In the meantime, plan members will continue to have full access to their benefits coverage throughout the pandemic. In many cases, dental offices remain open for emergency services, and a variety of healthcare providers are available virtually.

Commissions

We know the pandemic has put financial strain on your business as well, so we will continue to pay full compensation. Although your overall commission will be unaffected by these premium reduction adjustments, you may see a temporary reduction in your commission payments if you are on a pay-as-earned basis while we put through mass changes. If so, we will then make an additional top-up payment to cover that shortfall as soon as we are able.

Communication

We will be communicating this premium relief program to your clients April 21st at 8:00am EST.

A PDF of the communication is also available here.Questions?

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. In the meantime, we have provided some Questions and Answers below.

Will the premium reduction on Health and Dental benefits have an impact on the renewals that were deferred?

No. Renewals will proceed as normal, with rate adjustments based only on months where full premium was paid. For most clients, we anticipate “normal” rate adjustments at renewal compared to rates paid prior to refunds taking effect.

Does this adjustment apply equally to clients who have had their renewal deferred?

Yes, these adjustments apply to all Traditional and myFlex insured, non-refund customers for Health and Dental benefits.

How does this affect clients who have terminated or amended a plan?

If a benefit is in-force during the month of April, the adjustment will be credited to the next available billing. For clients who have temporarily terminated all benefits, this will be applied against the first bill once benefits have been reinstated. No cash refunds will be paid.

Will you recover any of the adjustment at a future point in time?

No, we will not recover this adjustment.

Instead of this premium reduction adjustment, can a client cancel or adjust some of the benefits on their plan?

Yes, you and your clients always have the option of changing the coverage on a plan, such as reducing or removing a benefit to help control costs. Please speak to your Group Account Executive or myFlex Sales Manager about the options available.

Are TPAs and self-administered groups eligible for the premium reduction?

Yes. TPAs and self-administered groups are eligible for the premium reduction. However, timing for the credit will be dependent on the billing practices of the TPA or self-administered group. We will apply these credits as soon as we are able. -

RRIF minimum withdrawal changes in response to COVID-19

Responding to the COVID-19 pandemic and retirees concerned about withdrawing from their portfolios during the market sell-off, the federal government recently announced a 25% reduction in the minimum withdrawal rate for Registered Retirement Income Funds (RRIFs) for 2020. This reduction only applies to funds that have not yet been withdrawn.

If your client chooses to leave the payment at the current minimum payment for the 2020 calendar year, no further action is required.

If your client has already received the unreduced payment for the year, your client cannot return the excess amount.

If your client would like to reduce the minimum, you can contact our Advisor Services Team at 1.866.884.7427, Monday to Friday 8:30 a.m. – 7:30 p.m. ET or email savingsretirement@equitable.ca to advise us of the change. Taxes will not be withheld on the payment.

-

Introducing a new Pivotal Select sales charge option from Equitable Life of Canada

Equitable Life® is adding a No Load Chargeback (NL-CB) sales option to its Pivotal Select™ segregated funds lineup. The new option provides an additional choice to the existing Low Load (LL), No Load (NL) and Deferred Sales Charge (DSC) options.

Equitable’s new NL-CB option will provide more choices to both client and advisor. Equitable® offers a competitive initial commission and a 36-month chargeback schedule.

By offering the choice of four sales charge options, as well as the choice between three distinct guarantee classes: Investment Class (75/75), Estate Class (75/100) and Protection Class (100/100), and a diverse selection of investment funds, the Pivotal Select contract provides the flexibility to build an investment solution that meets the needs of your clients.

For more information about Equitable’s NL-CB or any of Equitable’s products, contact your local Regional Investment Sales Manager or our Advisor Services team at 1.866.884.7427 Monday to Friday 8:30 a.m. – 7:30 p.m. ET or email savingsretirement@equitable.ca -

Easy and convenient digital options for your clients and their members

During this time of physical distancing, people are looking for ways to interact with their providers virtually. We have several convenient digital options available to make it easier for Plan Members and for Plan Administrators. Below is an overview to refer to when you're meeting with your clients. Or you can download this PDF version

For Plan Administrators:

Plan Administrator Portal (EquitableHealth.ca)

Our secure portal allows Plan Administrators to easily manage their plan anytime and anywhere. Instead of printing and mailing forms, Plan Administrators can make real-time updates at their convenience. The site also makes it easy to view or upload forms and other important documents, retrieve billing information, estimate monthly premium costs, and view announcements, tips and reminders. Plan Administrators can visit www.equitablehealth.ca to activate their account.

Online Plan Member Enrolment

Our Online Plan Member Enrolment tool simplifies the onboarding process for both Plan Administrators and Plan Members and offers a more secure and efficient alternative to traditional paper enrolment. The user-friendly interface allows Plan Members to easily enrol in their benefits plan in just minutes from their computer or mobile device. That saves work for Plan Administrators by eliminating the need to manage paper forms. And since Plan Members receive automatic reminders, it reduces late applicants and eliminates the need to chase down Plan Members for their paperwork. (This option is currently only available for new clients. It will soon be available for existing clients to add new hires.)

Digital Welcome Kits

Instead of paper kits that can easily get lost or quickly become outdated, Plan Members receive personalized welcome kits via an interactive email, including instructions on how to activate their online group benefits account, download their digital benefits card, submit claims from their computer or mobile device, review their coverage details, and explore their health and wellness resources.

Easy automated payments

Automated payments are a convenient way to avoid missed payments, suspended claims and disruption. Plan Administrators simply need to complete thepre-authorized debit formand send to GroupCollection@equitable.ca. Or contact Group Collections about online banking and electronic funds transfer (EFT).

We can help

For assistance, Plan Administrators can contact their Client Relationship Specialist or our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

For Plan Members:

Plan Member Portal (EquitableHealth.ca)

By logging into EquitableHealth.ca, Plan Members have secure 24/7 access to their personalized Group Benefits account where they can submit claims, view their claims status and history, and review their coverage details from their computer or mobile device. They can also visit Equitable HealthConnector®, our suite of services to help employees stay healthy and productive. They can simply visit www.equitablehealth.ca to activate their Group Benefits account.

Electronic Claim Payments and Notifications

Once Plan Members have activated their Group Benefits account on EquitableHealth.ca, they can easily get set up to receive their claim payments via direct deposit, and their claim notifications via email. Once logged in they simply click “My Information” and enter the required information.

EZClaim Mobile App

Submitting claims is fast, easy and secure with the Equitable EZClaim® mobile app. Plan Members can submit health and dental claims and receive payments directly to their bank account via direct deposit. Most claims are processed within three business days; some are processed in as little as 24 hours. They simply download the EZClaim app for their iPhone®, or Android™ device, fill out the interactive health or dental claim form, attach their receipt and submit.

Digital Benefits Cards

Instead of digging through their wallets, Plan Members can download a digital version of their benefits card on their mobile device via the Equitable EZClaim® Mobile app to easily provide coverage details to health providers.

We can help

We’ve created a video guide to help Plan Members access and use their digital resources. For further assistance, Plan Members can contact our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

-

Update on our service levels during the COVID-19 pandemic

Supporting your clients and their plan members is more important than ever during the ongoing COVID-19 pandemic

So, we’re providing an update on our service levels.

We acted quickly to ensure there were no disruptions in service – most of our staff were working remotely from home and fully functional within a few days. We’ve reallocated resources from functions where volumes are down, such as dental claims, to those experiencing higher volumes. We also created a separate queue for COVID-19-related STD claims.

As a result, we’ve been able to maintain the industry-leading service levels you have come to expect from us, and our turnaround times continue to be well within our targets.

Here’s a summary of what you and your clients can currently expect in terms of average turnaround times:

Service category Average Turnaround Time

(as of April 26th)Customer Care Centre wait times 89% of calls answered within 20 seconds Responses to emails to our Service Team Within 24 hours Health claims 2 days Dental claims 2 days Life claims 1 day STD claims 4 days LTD claims 4 days Plan member updates 2 days New customer implementations 16 days COVID-19-related plan amendments 4 days Other plan amendments 8 days Quotes 2 days ahead of deadline We will closely monitor the situation and continue to adapt to ensure we maintain our service levels. And we will do our best to resolve any service issues that arise as quickly as possible.

Please feel free to contact your Group Account Executive or myFlex Sales Manager and let us know how we’re doing.

-

New Dividend Scale effective July 1, 2021

The Equitable Life Insurance Company of Canada Board of Directors has approved a change to the dividend scale for the period July 1, 2021 to June 30, 2022.

- The dividend scale interest rate* will decrease from 6.2% to 6.05%.

- All series of participating whole life policies issued in the 2012 series and beyond other than the most recent Equimax Estate Builder® series will see an improvement in the mortality component. The most recent Equimax Estate Builder series, for sale as of September 12, 2020, already incorporated better mortality and its mortality component will remain unchanged. Series issued prior to 2012 will see an increase in the overall dividends but results will vary by series and policy.

- Other factors that are used to calculate the dividend scale will remain unchanged.

- The interest rate for dividends left on deposit will decrease from 2.75% to 2.25% for all participating whole life policies.

- The policy loan rate will remain unchanged at 6.2%. This applies to all new and existing policy loans, including automatic premium loans on Equimax® policies that have a 9-digit policy number beginning with a “3” or an “8”. The policy loan rates on some older blocks of policies may increase or decrease because they are tied to the prime interest rate.

*The dividend scale interest rate is not the same as the participating account rate of return in any given calendar year. The dividend scale interest rate smooths out the ups and downs experienced by the participating account.

Policyholder dividends in the next dividend scale year would be approximately $85 million, compared to $67 million in the prior dividend scale year.

The sustained low interest rate environment continues to put downward pressure on the experience in the participating account. If low interest rates continue, investment returns in the participating account will also be lower, and we may need to decrease the dividend scale in the future.

Your participating whole life clients will receive a notice of the dividend scale change with their annual policy statement. The Equitable Sales Illustrations system will be updated to reflect the new dividend scale. Updated illustration software will be available for download after 9 a.m. ET on June 25, 2021.

Find out more -

Two options for supporting plan members during the pandemic

We know these are difficult times. In addition to concerns about their health and the health of their family, working Canadians are worried about their jobs and their finances. Fortunately, through our partnership with Homewood Health®, we have two options for employers to support their employees through this crisis.

Below is an overview to refer to when you're meeting with your clients. Or you can download this PDF version.

Homewood Online (Homeweb)

All Equitable Life® clients and their plan members have access to Homeweb, a personalized online mental health and wellness portal. Accessible via the web or mobile app, Homeweb includes an online library of interactive tools, assessments, e-courses and resources to support plan members through the pandemic.

Homewood Health Employee and Family Assistance Program (EFAP)

Employers can provide additional support by adding the Homewood Health EFAP. In addition to full access to Homeweb, it offers confidential short-term counselling through a national network of mental health professionals, plus other resources and tools.

To make it easier to understand the options, here’s a detailed summary of what’s included with each:

Service Description Homeweb EFAP Homeweb.ca A secure and personalized online portal that includes hundreds of articles and resources, including e-books, toolkits, self-assessments, podcasts and more.

Homeweb Mobile App One of Canada’s newest EFAP mobile apps that allows users to access every one of Homewood’s online tools and resources wherever they are.

i-Volve Cognitive Behavioural Therapy Tool An online self-directed treatment tool that helps coach plan members to identify, challenge and overcome anxious thoughts, behaviours and emotions.

Online Health Risk Assessment An online tool that helps plan members identify and address their health and wellness risks and barriers.

Short-Term Counselling Short-term counselling provided face-to-face, by phone, email, chat or video through a national network of counsellors and clinical professionals.

Life Smart Coaching A suite of telephonic and online services including coaching and resources to help employees manage their life balance, finances, health and career. Online resources only.

Trauma response Prompt, compassionate and effective response to traumatic events, consisting of one three-hour block with one counsellor at one location per year.

Legal Resources One-on-one consultation with a lawyer for guidance on issues such as family law, civil litigation, real estate and immigration. Online resources only.

Key Person Advice Line (KPAL) Designed for HR, managers and supervisors, this service provides Online Management Resources and Workplace Situation Professional Support.

Resource Locator Online childcare and eldercare resources locators.

For more information, please contact your Group Account Executive or myFlex Sales Manager.

-

Equitable Life presents a conversation with Equitable Asset Management Group

Did you miss our recent webcast with Equitable Asset Management Group’s Dave Irwin? Did you want to watch it again? Click here to access the On Demand presentation.

Summary

After a record-breaking descent into bear market territory, equity markets have since undergone an unprecedented recovery despite the continued negative economic impacts of COVID-19. With market performance seemingly at odds with the outlook for corporate profits and recessionary calls from economists, what can possibly explain the optimistic tone of the market and is it justified? Please join us to hear David Irwin, Director, Portfolio Management and Client Relations share some insight into the current environment, key market drivers and policy responses to help put market performance in context.

Don’t miss your opportunity to also hear about Equitable’s Active Portfolios and recent No Load CB sales charge option.

Please note that this webcast is open to advisors only. Be advised this webcast is available in English only. We will not be seeking any Continuing Education credits for this webcast.