Site Search

1362 results for if

-

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

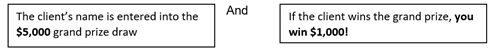

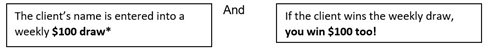

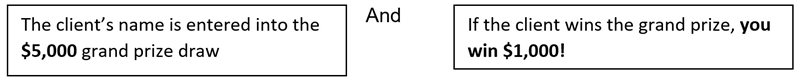

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

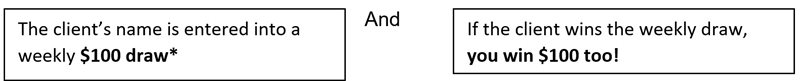

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy

See full contest details. Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

* Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Grow Your Future RSP Contestt: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 20232, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules. -

Equitable Life Group Benefits Bulletin - November 2022

The importance of timely plan member eligibility updates*

Effective Dec. 1, 2022, we are implementing a revised process for managing plan member and dependent health and dental claims that have been incurred and paid after coverage has been terminated. This new process is consistent with industry practices.

If health or dental claims have been incurred and paid after a plan member’s termination date but before we received notice of the termination, we will align the plan member’s or dependent’s termination date with the service date of the last paid claim, retaining premiums up until that date.

If no claims have been incurred and paid after the termination date, Equitable Life will process the termination as requested and refund any excess premium, subject to a maximum premium refund credit of three months.

Currently, we process the termination as requested and attempt to recover any claim overpayments directly from the plan member. We then refund any excess premiums that have been paid, subject to the maximum refund credit amount.

To avoid claims being incurred and paid after a plan member’s termination date, it is important for your clients to update plan member and dependent eligibility dates on or before the effective date of the change.

If you have any questions about the process your clients should follow for updating plan member eligibility, please contact your Group Account Executive or myFlex Sales Manager.QuickAssess®: Absence and accommodation request review services*

It can be difficult to navigate chronic or complex cases of absenteeism or accommodation requests. That’s where QuickAssess® can help.

QuickAssess is an optional, fee-per-use service that can provide your clients with an unbiased, timely assessment of complex plan member absences and workplace accommodation requests. Our disability experts can provide recommendations to help your clients manage:- Workplace absences

- Chronic or patterned absenteeism

- Requests to modify workplaces or duties

- Return-to-work coordination

- Employee Insurance sick leaves

For more information on using QuickAssess, including eligibility requirements, please contact your Group Account Executive or myFlex Sales Manager.

**Within two business days of receiving a completed QuickAssess Absence and Accommodation Review Referral Form and all required information. For more complex referrals, more time will be required.Finding a health care provider with TELUS eClaims direct billing*

By visiting TELUS’s Find a Provider page, your clients’ plan members can now easily search for paramedical and vision providers who are registered on the TELUS Health eClaims network and who can submit claims directly to us on behalf of their patients. Searches can be filtered by postal code to help plan members find the most convenient provider options.

As our direct billing provider for pharmacy, vision and paramedical claims, TELUS Health has an extensive network of 70,000 health care providers that provide direct billing to streamline the claims process.

Please note, plan members should always check Equitable Life’s list of de-listed providers before selecting a health care provider. The list is available for your clients and their plan members on EquitableHealth.ca, and is updated regularly.

For more information about TELUS eClaims, please contact your Group Account Executive or myFlex Sales Manager.First phase of the Canada Dental Benefit proposed for Dec. 1, 2022*

The federal government’s new Canada Dental Benefit is proposed to take effect on Dec. 1, 2022, subject to Parliamentary approval. The program will cover eligible expenses retroactive to Oct. 1, 2022, and this first phase would apply to Canadians under 12 years of age.

If implemented, the Canada Dental Benefit will provide dental care to Canadian families with under $90,000 adjusted net income annually. By 2025, the federal government expects to extend the benefit to children under 18, senior citizens and Canadians with disabilities.

Parents or guardians will be required to apply for this coverage through the Canada Revenue Agency (CRA) and must not have private dental coverage for the child(ren).

This new program will have no impact on your clients’ dental coverage and no action is required on their part.

* Indicates content that will be shared with your clients.

-

NEW Jump Around feature available on EZcomplete

One of the most requested features is available on EZcomplete® effective November 19, 2022. We like to call it “jump around”. It’s the ability to jump from one part of the application to another and back again. You no longer have to complete the application one section after another in order. This will allow a lot more flexibility when submitting a policy application.

This functionality is helpful as you can input basic client information ahead of a meeting to review with the client later. After completing the Owner’s step (step 1), you could jump to step five (Subsequent Payment) or step six (Third Party). This allows you the opportunity to easily jump back and add a second owner once you have all their details from the client. You can also return to your dashboard, and when you go back into the application, you will be returned to the owner’s section.

Hitting the Save button will save the information you have inputted already, so after jumping ahead to a different section, you can return to complete those questions knowing your progress will be saved. When you have completed all the necessary fields, hitting the Done button will validate all the information and the step will be complete. A check mark will appear beside each completed and validated step.

Please note, if you go back to a previously validated step and change information you will have to go through all subsequent steps and complete and validate them again by clicking next if nothing has changed or making any necessary changes.

To Equitable Life®, the term EZ really means something! Learn more about how doing business with Equitable Life continues to be easy.

Questions: Please contact your Regional Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

-

Expanding Online Annuity Quotation Eligibility

Equitable Life® is pleased to announce the following three enhancements to our Online Annuity Quotation eligibility, effective November 1, 2022:

● Single Premium Quotes increased to $2million

● Increased Allowed Annual Amount for Income Annuities

● Alberta Locked-In Funds Available from Age 50 reduced from age 55

Increasing income limits for our Online Annuity Quotation provides advisors with more flexibility to serve the various needs of clients. To learn more, visit Equitable’s Online Annuity Quotation

For more information contact your Regional Investment Sales Manager or our Advisor Services team Monday to Friday from 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427.

® denotes a trademark of The Equitable Life Insurance Company of Canada.

November 24, 2022 -

December 30 Deadline for 7% No Load CB5 Initial Commission for Investment Class (75/75)

As the end of year approaches, so does the temporary increase to our CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ Investment Class (75/75). The 7% initial commission promotion will end on December 30, 2022.*

- Deposits and transfers to CB5 funds for Pivotal Select Investment Class (75/75) must be made by December 30, 2022, at 11:00 a.m. ET. Any deposits received after this date will not receive the promotional rate.

- Applications submitted before the December 30, 2022, deadline will only receive the promotional rate if also funded before December 30, 2022.

- If the client is awaiting a transfer from another financial institution, please follow up with the institution to ensure the transfer arrives by December 30, 2022.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Equitable Life reserves the right to end the campaign, at any time and without notice.

™ or ® denote trademarks of The Equitable Life Insurance Company of Canada.

November 24, 2022 -

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy*

Full contest details.

Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

*Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Equitable Life® 2023 RRSP Season Contest: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 2023, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules.

Posted December 1, 2022

-

An important announcement about our Travel Assist provider

Allianz Global Assistance, our Travel Assist emergency medical assistance provider, has informed us that it is exiting the Canadian group travel insurance market.

Allianz will continue to accept and support new claims up to June 30, 2023, and they will support ongoing claims until Dec. 31, 2023.

We are already meeting with potential new Travel Assist partners and plan to have a provider in place before June 30, 2023.

In the meantime, we are working closely with Allianz to help ensure a smooth and seamless transition for your clients and their plan members. Allianz is committed to maintaining its staff to meet and exceed service levels throughout the transition, as follows:

Before July 1, 2023:

Allianz will continue to accept calls and open new claims up to June 30, 2023. Any claims opened on or prior to June 30, 2023, will continue to be processed by Allianz until Dec. 31, 2023.

After July 1, 2023:

New cases will be directed to our new service provider. Allianz will work alongside us and our new provider to make this transition as simple as possible.

After Dec. 31, 2023:

For any cases still open as of Dec. 31, 2023, Allianz will work with our new service provider to responsibly transfer these cases while ensuring a seamless client experience.

We will communicate this news next week to your clients who have Travel Assist coverage on their plan. And we will continue to communicate more details to you about this transition in the coming weeks.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. -

Stay connected with a NEW Web Illustration tool for Equimax

Equitable Life® is pleased to announce the launch of our web illustration tool starting with Equimax® participating whole life insurance.

This web illustration tool for Equimax is another way that Equitable Life is modernizing your experience and allowing you more flexibility to keep your business going while you’re on the road or meeting clients. This new illustration site is accessible on a web browser, so you can access it from a mobile device such as your phone, tablet, or iPad, and with MAC or Windows-based PCs or laptops.

Access the new web illustration tool for Equimax by logging in to EquiNet® and clicking the button in the ribbon called Sales Illustration that now has a Web Illustrations option. Note that you have the option to continue running Equimax illustrations in the desktop illustration software, as it remains unchanged at this time.

For future enhancements, we plan to integrate with EZcomplete®, to continue to make it easy to do business with Equitable Life.

Visit the New Web illustration tool for Equimax® now.

Questions? Please see our FAQ or contact your Regional Sales Manager.

® denotes a trademark of The Equitable Life Insurance Company of Canada -

Meghan Vallis named head of distribution for myFlex Benefits and other group benefits updates

Meghan Vallis named head of distribution for myFlex Benefits

We are pleased to announce that Meghan Vallis, our Group Sales Vice President for Western Canada, will head national distribution for myFlex Benefits in addition to her existing responsibilities.

As part of her expanded role, Meghan will lead the myFlex Benefits sales team and develop and implement strategies to achieve the growth of this offering. Meghan and the myFlex team will continue to focus on delivering market leading services for our clients and advisors.

Meghan joined Equitable Life in 2020 and brings more than 15 years of experience in the group benefits industry to her expanded role. She is passionate about helping Advisors succeed to transform their clients' employee benefit experience.

myFlex Benefits is one of the most unique and versatile benefits solutions for small businesses in Canada. It is fully pooled, includes a two-year renewal and features a user-friendly portal for plan members to make their benefit selections. And it’s simple to use: Plan sponsors set a budget and choose from a selection of benefit options. Plan members then use flex dollars to select from the options offered by their employer. Any leftover flex dollars are saved in a health care spending account (HCSA).

If you have any questions or are interested in learning more about myFlex Benefits, please contact your Group Account Executive or myFlex Sales Manager.Changes to Short Term Disability (STD) benefit calculations for 2023*

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2023 changes to Maximum Insurable Earnings and premiums for employment insurance.

The following changes to Employment Insurance (EI) will come into effect on Jan. 1, 2023:

How does this affect your clients?

Your clients’ STD benefit will be revised with the updated maximums based on the percentage of EI Maximum Weekly Insurable Earnings shown in their policy if:- Their Equitable Life Group Policy includes an STD benefit that is tied to the EI Maximum Weekly Insurable Earnings, and

- At least one classification of employees has a maximum of less than $650.

If their STD maximum is currently higher than $650 or based on a flat amount instead of a percentage or regular earnings, no change will be made to their plan unless otherwise directed.

If your clients wish to provide direction regarding revising their STD maximum, or if they have questions about the process, they can email Kari Gough, Manager, Group Issue and Special Projects.Coming soon: Survey for Plan Administrators with recent disability claims*

We’ve enhanced our communication processes to help your clients with disability plans manage their workplace absences more effectively. In early December, we will distribute a short survey to plan administrators who may have submitted an approved disability claim in the past six months. The survey will ask recipients about their satisfaction with the frequency and detail of our disability management communications.

The email will come from GBClientFeedback@equitable.ca, and the survey will remain open until the end of the day on December 16, 2022. All responses will be confidential. We plan to use the feedback to help ensure that we’re meeting your clients’ expectations and delivering industry-leading service.

We may also follow up with survey respondents directly, to address any concerns they’ve identified.

* Indicates content that will be shared with your clients. -

Submit transfer forms automatically with EZcomplete!

Save time, effort and the hassles of transfer forms with EZcomplete®!

With EZcomplete you can now automatically submit transfer forms to the relinquishing institution online quickly and easily.*

1. Pick the name of the relinquishing institution

2. Choose the e-signature option

3. Save the transfer form for your records

Easy as 1-2-3!

Want to take EZcomplete for a test drive?

Play around in the sandbox with a demo client account.Ready to start with the real thing?

Submit your transfer form request today.

Take me to the sandbox Take me to EZcomplete

* Available for e-signatures only

® denotes a trademark of The Equitable Life Insurance Company of Canada.

December 6, 2022