Site Search

1362 results for if

-

How to talk to clients about CI when they don’t want to

Does this sound familiar?

You’re having a chat with your client about Critical Illness insurance. They suddenly interject: “Critical illness insurance isn’t for me.”

“Why is that?” you ask.

“Because….

- Critical Illness insurance is expensive!

- I don’t understand what it covers exactly.

- I have money to cover me if I get sick, so I don’t need this.

- I’m healthy enough.

- It’s not life insurance, so I don’t need it right now.

- I already have disability coverage through my work.”

If you’ve heard any of these responses, and didn’t know how to respond, we can help.

Our Path to Success program covers all these objections and more with simple-to-follow PDFs and videos. You’ll learn conversation strategies and tips on how to navigate the sale. Most importantly, you’ll know exactly what to say the next time a client objects to Critical Illness insurance.

Want to learn more? Check out our CI Path to Success modules here!

Need CE credits? Take our Path to Success program here. -

Introducing Equitable EZBenefits: A better group benefits solution for your small business clients

If you serve small business owners, chances are they’re looking for a group benefits solution that’s affordable, sustainable and easy to manage. That’s why we introduced Equitable EZBenefits™. It’s a unique group benefits solution designed with you and your small business clients in mind.

Options to fit every need

Available to organizations with between 2 and 25 employees, EZBenefits offers a range of plan design options to match different needs and budgets. * Whether your client owns start-up or a growing company, we’ve got them covered. Plan options include a mix of Life, Health and Dental coverage. ** Clients can also add Long-Term Disability (LTD) coverage or a Health Care Spending Account (HCSA).

Embedded services to support health and wellness

To provide employees with added support for both their physical and mental wellbeing, all our plan design options include:- Anytime, online access to medical professionals through our Virtual Healthcare solution from Dialogue,

- Access to professional counselors – via the telephone, the web or in-person – through our Employee and Family Assistance Program from Homewood Health®, and

- Online resources to help manage health, financial and family challenges through Homeweb, Homewood Health’s online wellness portal.

EZBenefits also comes with built-in HR support through Equitable Life’s partnership with HRdownloads® This takes the heavy lifting out of common human resource tasks with HR support tools and services, including:- HR Technology: An award-winning cloud-based human resource information system to provide help from onboarding to offboarding and everything in between.

- HR Content: Access to a library of over 3,000 HR documents, templates, compliance resources and articles, with 25 free document downloads.

- HR Training: A free Workplace Diversity and Inclusion online training course.

- HR Support: One free Live HR Advice call with a seasoned HR expert.

We know that advising small business clients can be challenging. We’ve created a streamlined benefits process that provides rapid quotes, hassle-free plan implementation, simplified renewals and that is easy to administer. That way, you can spend more time advising your clients and building your business – and less time with administrative back and forth.

Pricing stability for long-term stability

When it comes to attracting and retaining talent, we know your small business clients are competing with larger organizations that have big budgets and lots of resources. That’s why we’ve designed EZBenefits to provide long-term pricing stability for health and dental benefits.

Find out more

Watch this video to learn how EZBenefits can help you and your clients. You can also visit info.equitable.ca/ezbenefits for more details or to request a quote. If you have questions, contact your Equitable Life Group Account Executive. If you don't have an Equitable Life Group Account Executive, email us at EZBenefits@equitable.ca.

* Not available in Quebec.

** Dental coverage is not included with the Bronze plan design option. -

Join us for an Equitable Life Master Class webcast featuring Daryl Diamond, Dynamic Funds

Building Your Business in the Retirement Income Market featuring Daryl Diamond, Chief Retirement Income Strategist, Dynamic Funds

You’re invited to our next Equitable Life Master Class webcast offering compelling topics and unique ideas from leading experts to help you manage and grow your business.

Daryl Diamond is an author, educator and sought-after speaker on how clients can achieve the greatest security and satisfaction during the retirement years.

In this Master Class, Daryl Diamond will discuss how the last four years have been extremely challenging for retirees, pre-retirees and for the advisors who service them. He will focus on key aspects of retirement income planning from the perspective of:-

delivering and sustaining tax-efficient income,

-

managing high inflation,

-

investing in volatile markets, and

-

navigating high interest rates.

Learn more

Posted October 11, 2023Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® denote a registered trademark of The Equitable Life Insurance Company of Canada -

-

Text Notifications keep you informed in real time on your Equitable individual insurance business

Our text notification program that we launched a year ago has been very successful. Thousands of tech-savvy advisors like yourself are currently taking advantage of text message updates on their Equitable new business application status.

Approximately 70% of new Equitable insurance applications submitted are choosing to receive real-time status updates via text notifications.

Not using Text Notifications yet?

To opt-in, next time you submit an online insurance application, simply check 'Yes' on the Advisor Report when asked “Would you like to receive text notifications (SMS) regarding this application?” You can opt-out at anytime by texting "Stop."

Questions? Contact your wholesaler for more information. -

Lin covers her life, her partner, her home, and business with Equitable’s Term Life insurance

Lin has just opened her new business. Her partner Terri has supported her through it all, managing the bills and the mortgage so Lin can focus on getting her store established. Lin knows they’ve both worked so hard to achieve what they have.

She wants to make sure they’re covered in case anything happens to either of them.

With Equitable Life® Term Insurance, Lin can get affordable life insurance, which covers her and Terri’s current needs but is also flexible enough to change as their needs change.

This video can help you start the conversation with clients about Term insurance. It walks them through the different term options and the value of being able to convert term coverage to a permanent life insurance policy later on. It also details the KINDTM benefits that are currently available with Term insurance.

Not sure where to start? Send clients this prospecting letter, which you can personalize specifically for them.

Plus, check out our Term product page, then click on the Marketing Materials tab for the latest Term marketing materials.

Want to learn more? Reach out to your local wholesaler.

Watch our new Term insurance with Equitable Life of Canada video to learn more. See it on Vimeo or YouTube.

® and ™ denote trademarks of The Equitable Life Insurance Company of Canada. -

Announcing Equitable Life's National Biosimilar Program

Beginning March 1, 2024, we are expanding our biosimilar switch program nationally** to protect all our clients and to make our coverage consistent across Canada.

Our national biosimilar initiative will simplify drug plan coverage, replacing our provincial programs with one program across the country.

Why now?

Over the past few years, most provinces have introduced policies to delist some originator biologic drugs. They require most patients to switch to biosimilar versions of those drugs to be eligible for coverage under their public drug plans. Soon, it is expected that all provincial drug plans will cover only biosimilars.

In response, we have implemented biosimilar switch initiatives in BC, Alberta, Saskatchewan, Ontario, Quebec, New Brunswick and Nova Scotia to align with these provincial changes. Our initiatives are designed to protect our clients from additional drug costs that may result from these government policies while providing access to equally safe and effective lower cost biosimilars.

How will this affect clients’ drug plans?

Because we have already introduced biosimilar switch initiatives in most provinces, the impact of this change will be minimal. It will primarily affect plan members in provinces or territories where we haven’t already required the switch to biosimilars, and plan members who are taking biosimilars that were not originally included in the switch initiative for their province.

Regardless of where they live, plan members across Canada will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower cost biosimilar version of the drug. Plan members already taking the originator biologic will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable plan. We will support their transition with education, personalized communication, and resources.

Will this change affect clients' rates?

Any cost savings associated with the change will be factored in at renewal.

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is known as the “originator” biologic. Biosimilars are highly similar to the drugs they are based on, and Health Canada considers them to be equally safe and effective for approved conditions.

What is the difference between biologics and biosimilars?

Advance notice

We will be communicating with affected claimants in early December to allow them ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Account Executive.

**Excludes plan members in Quebec who participate in a separate provincial program. -

Message from Equitable President and CEO Fabien Jeudy

I’m pleased to share our new brand with you. It’s an expression of our renewed purpose and commitment to work together, with our partners, to focus exclusively on our clients, protecting today and preparing tomorrow.

Our commitment to you

The new Equitable® brand signifies our focus on making it even easier to do business with us. To continuously refresh our products to meet the evolving needs of Canadians. And to strengthen our partnerships that enable growth and positive outcomes. The result is an uncompromising commitment to our clients, our partners, our advisors, and our people.

A year of transitioning to our new brand

Over the next year, we’ll make the transition away from our legacy look as our new look starts to emerge. We’ll invest in building more brand awareness so that together we can help even more Canadians. What you should know is that no matter old or new, our commitment is always focused on our clients, together with our partners.

Join us in the journey

We’ll provide more details on the changes we’re making, and we welcome you to join in the journey. I encourage you to reach out to your Equitable point of contact or visit equitable.ca to learn more.

Why Equitable? The Power of Together.

View video on Vimeo.

Equitable’s New Logo.

View video on Vimeo.

Sincerely,

Fabien Jeudy

President and CEO -

Equitable Life Dynamic U.S. Monthly Income Fund Select

As a Global Equity Balanced asset class, investors benefit from long-term capital growth through investments that include a broad range of U.S. equity and debt securities. Check out Equitable Life Dynamic U.S. Monthly Income Fund Select in this issue of Fund Focus. The Fund aims to provide long-term capital appreciation and income by investing primarily in a broad range of U.S. equity and debt securities, focusing on a value investment approach when selecting equity securities.

Key highlights

• Actively manages access to the U.S. (one of the broadest and deepest markets in the world).

• Ability to tactically shift asset allocation to take advantage of changing market conditions.

• Aims to provide stability and growth to investors while providing interest and dividend income.

For more information, check out Equitable Life Dynamic U.S. Monthly Income Fund Select or contact your Regional Investment Sales Manager.

Posted November 2, 2023 -

EAMG Market Commentary October 2023

October 20, 2023

Rates & Credit - Interest rates increased steadily in Q3 against the backdrop of sticky inflation, strong economic growth, and a tight labour market. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a loss of 2.2%, versus a loss of 4.4% for government bonds and a loss of 3.9% for the overall index. The outperformance was primarily driven by the fact that the corporate bond index is less sensitive to interest rates movements (as compared to the government index), all else being equal. The outperformance was also driven by an improvement in risk-appetite, with lower-rated BBBs slightly outperforming higher-rated A bonds. Industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less (notably financials and securitization), consistent with the overall shift in the yield curve.

Equities Lose Traction – Global equity markets lost momentum last quarter with the TSX declining 2.2% while major developed economies from Europe, Australasia, and the Far East (EAFE) fell 1.3% in local currency terms. U.S. equity markets, while falling approximately 3.3%, were cushioned by a strong greenback, with the index declining only 1% in Canadian dollar terms. With inflation prints continuing to be stubbornly high and employment data remaining strong, central bankers emphasized their commitment to a higher-for-longer approach to monetary policy. The hawkish tones out of the Federal Reserve pushed bond yields higher and consequently, pressured equities lower. Furthermore, mixed economic data out of China rattled investor sentiment over the quarter as global growth forecasts came under scrutiny.

U.S. Fundamentals – Although U.S. earnings continue to contract on a year-over-year basis, companies surpassed expectations with investors remaining highly focused on signs of deteriorating operating margins. After bouncing off Q1 2022 lows, forward earnings guidance continues to improve on a quarterly basis. Based on our analysis, ~35% of major companies revised earnings forecasts higher (+2% versus Q2) while ~33% held expectations constant, with the balance expecting deteriorating financial performance. Overall, improved efficiencies through cost-cutting measures and stronger-than-expected pricing power have contributed to resilience in operating margins, and therefore renewed optimism about forecasted financial performance.

Equal Weight S&P 500 versus S&P 500 – Persistent crowding into mega-cap technology stocks – which has driven the majority of market returns year-to-date in the U.S. – slowed at the beginning of the summer before reaccelerating into quarter end. The persistence of this trend has resulted in the equal-weighted version of the S&P 500 index returning a mere 1.8% over the first three quarters of the year, markedly lower than the 13.1% return observed from the S&P 500. We continue to emphasize that a crowded market surge is not uncommon during late stages of the economic cycle, and we remain focused on delivering optimal risk-adjusted returns with quantitative factors.

U.S. Quant Factors – The quality-growth areas of the market continued to outperform last quarter with market participants seeking large cash-rich companies with innovative product offerings and stable operating margins. That said, the pricing power of these companies has weakened more recently with consumers having depleted pandemic-era savings and stimulus. As such, fundamentals are beginning to appear overvalued. Low volatility stocks (i.e. stocks with lower sensitivity to broad market movement and lower price volatility) performed in-line with the overall market for most of the summer before underperforming into quarter-end when crowding into big-tech returned. While top-line projections are forecasted to post stable growth, the basket’s relatively lower operating margins remain a headwind amid surging interest rates. Dividend growth companies, which include businesses with a lengthy and established history of increasing dividends, performed approximately in-line with the broader index over the quarter. With the market forecasting overly-negative fundamental performance, this factor is positioned as a contrarian opportunity in the market.

Canadian Fundamentals – Unlike those in the U.S., Canadian companies reported shrinking operating margins in general, pressuring equity pricing. Like in the U.S., Canadian corporate earnings were mostly consistent with expectations but continue to contract on a year-over-year basis. The energy sector benefitted from a ~30% increase in oil prices during the quarter, as OPEC’s restrictive oil production schedule pushed crude markets deeper into under-supplied territory. Those higher energy prices buoyed performance of stocks in the energy sector, one of only two sectors with positive performance during the quarter, helping partially offset softer-than-expected results out of the financials and communications sectors. Meanwhile, the Bank of Canada continued with its hawkish monetary policy by raising its overnight interest rate by another 25 basis points, bringing it to 5%. Their efforts to slow economic growth are beginning to cause some deterioration in fundamentals and, with one quarter remaining, analysts are expecting Canadian earnings to contract ~9% for the year.

Canadian Quant Factors – With central banks around the world continuing to hike interest rates and uncertainty surrounding China’s economic health, global growth prospects fluttered over the quarter. The cyclical nature of the Canadian market, and therefore its reliance on global partners, saw equity prices put under pressure by growth concerns. As a result, the quality bucket benefitted from defensive positioning by investors and thus resumed its climb in Canada. Investors continue to prefer mature, large businesses that are better positioned in a restrictive economic environment due to their more stable operating margins. The value factor – which was beaten down in Q2 – rebounded last quarter with supply-driven energy strength helping to propel energy stocks higher. Low volatility initially displayed similar performance to the TSX, but energy’s rapid surge into the end of summer pressured the group lower. Given higher risk-free rates, the dividend factor also underperformed over the quarter, with dividend yields becoming less attractive on risk adjusted basis.

Views From the Frontline

Rates – Both nominal and real – rose sharply in Q3 to levels not seen since the Great Financial Crisis of 2008. A healthy labour market, strong consumer spending, persistent inflation and excess supply concerns drove the interest rate increase. Although the economy is starting to witness a deceleration in consumer spending and tighter credit conditions, central banks remain committed to maintaining a higher policy rate for longer to bring inflation back to the 2% target.

Credit – The risk premium for corporate bonds (versus government bonds) has been range-

bound over the past quarter as investors’ evaluations of a variety of scenarios have evolved: soft-landing versus a recession, geopolitical uncertainty, further central bank increases, among other things. On the balance, we do not think the current risk premium adequately compensates for downside risk, and as such, we remain cautious on corporate bonds and have a bias towards higher-quality, shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equities – Geographically, we began the quarter with a preference for U.S. equities relative to Canada and EAFE. In-line with our expectations, U.S. stocks outperformed the two regions in Canadian dollar terms. That said, weakness in the Euro versus the Canadian dollar was a headwind for our EAFE exposure. With earnings yield – which is the percentage of earnings relative to price – becoming less attractive compared to risk-free rates in the U.S., and the greenback strength becoming overstretched from a technical perspective, we have pared back our overweight U.S. position. Moreover, with Chinese officials focusing efforts on the introduction of new stimulus packages, we believe that more cyclical markets like Canada and EAFE will retrace some of their losses in the near term. Within the U.S., we entered Q3 with a constructive view on high quality growth segments of the market that provide strong operating margins during the current late economic cycle conditions. The factor moved in-line with our expectations, as highlighted in the “U.S. Quant Factor” section, and we are tactically decreasing our exposure amid stretched fundamentals. In Canada, we continue to prefer high-quality companies due to their strong fundamentals, with the group currently displaying momentum versus the broader TSX. Tactically, we are participating in the oil supply shock through the value factor.

Downloadable CopyMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Mohamed Bouhadi, CFA

Senior Analyst, Rates

Tyler Farrow

Analyst, Equity

Andrew Vermeer

Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

Posted November 3, 2023 -

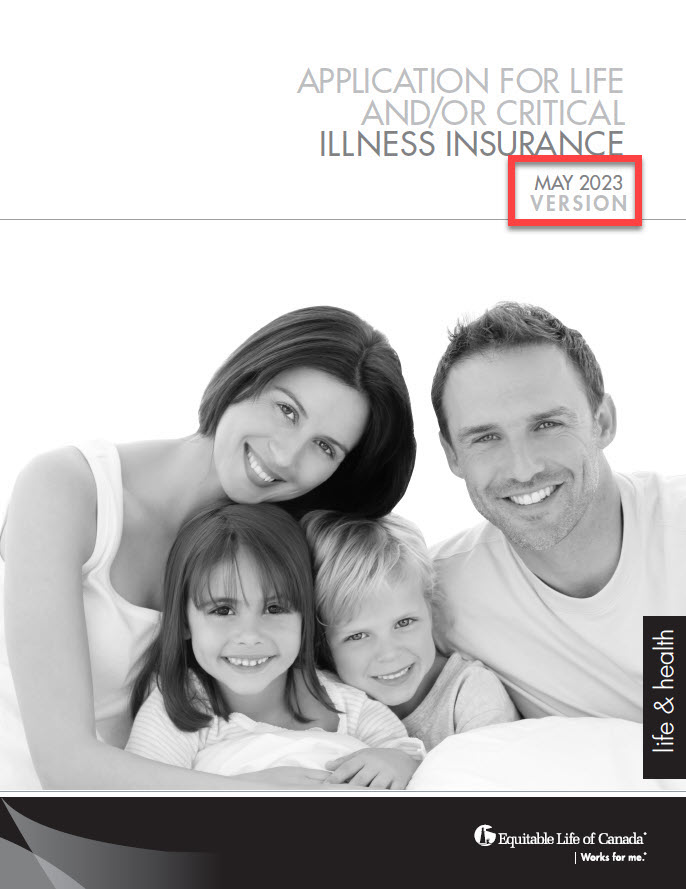

Reminder: New 350 Life and CI Applications

In early August, Equitable® updated the privacy and legal sections on some forms. This included the 350 Paper Application for Life and/or Critical Illness Insurance. This change was also applied on our websites and our online application EZComplete®. These changes are part of Bill 64. The Bill is about the protection of personal and private information in Quebec and took effect on September 1st, 2023.

Due to this change, we ask that all advisors use the latest version, dated May 2023, of the paper application.

For applications in Quebec, the latest version must be used.

For all regions outside Quebec, we are supporting a transition period from ‘old’ to ‘new’ applications until December 31st, 2023. After this date, we will no longer accept older versions of our Life and Critical Illness applications.

To make sure you are using the latest version of the application, check the date on the title page. It should say May 2023. See the image below:

.jpg?width=200&height=259)

To order paper copies, click here.

To learn more about Bill 64, please visit Assemblee nationale du Quebec - Bill 64. You may also contact your wholesaler.

® denote a registered trademark of The Equitable Life Insurance Company of Canada.