Site Search

1362 results for if

-

Celebrating our wins – 2023 Individual Insurance Marketing Recap

Equitable® would like to wish everyone a Happy New Year and we are looking forward to doing more business together in 2024!

As we start a brand new year, we would like to share with you some highlights of our 2023 initiatives in Individual Insurance. These projects aimed to make it easier to do business and enrich your experience of working with us.

Digital & Administration Enhancements

Our 2023 digital transformation initiatives ensured smoother processes, streamlined operations, and improved user experiences for advisors and clients:

● Digital Transactions for Universal Life Plans

● Text Notifications Keep You Informed on Your New Business

● New Online Policy Loan Form

● EZcomplete Enhancement for Critical Illness

● New Life & CI Application

Product Updates

Equally pivotal were our efforts in enhancing our individual life insurance solutions to empower you to confidently recommend us to clients:

● A Tune-Up for Equimax

● The Equimax Evolution Continues

● Critical Illness Insurance Update

● New Dividend Scale Interest Rate

To learn more about the above initiatives, kindly reach out to your local wholesaler.

Thank you for entrusting us with your business in 2023!

Continue watching for news from Equitable for more great launches and enhancements in 2024!

® or TM denote trademarks of The Equitable Life Insurance Company of Canada -

Take the helm in 2024 with insights from leading investment experts

Find out what our panel of leading investment experts are saying about the markets and how they are positioning their portfolios. Learn about the themes and forces driving markets and where there are opportunities.

-

• Equitable Asset Management Group - Dave Irwin, AVP, External Fund Management.

-

• Fidelity Investments - Ilan Kolet, Institutional Portfolio Manager, Global Asset Allocation (GAA) Group.

-

• Franklin Bissett (ClearBridge) Investment Management - Les Stelmach, Senior Vice President, Portfolio Manager.

-

• Mackenzie Bluewater Team - Shah Khan, Vice President, Portfolio Manager.

Cam Crosbie, Executive Vice-President, Savings & Retirement will highlight some of the ways Equitable can help make 2024 a great year. We’ve got everything you need and more!

Posted January 3, 2024

Learn more!

Continuing Education Credits

This webcast has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

™ and ® denote trademarks of The Equitable Life Insurance Company of Canada -

-

Equitable’s New Brand – The Power of Together!

On November 1, 2023, we unveiled our new brand and announced the shortening of our brand name to Equitable®. The rebranding includes a fresh new look, and a forward-looking vision for the future – one that honours our 103-year history and our unwavering commitment to clients.

As we start 2024 with a renewed sense of purpose and commitment to clients, together with you, we are more determined than ever to provide more value and impact – to protect today and prepare tomorrow for our clients.

“At Equitable, we champion the power of togetherness. It’s a mindset that drives our behaviours, decisions, and actions to power equitable outcomes for our clients, advisors, and partners,” said Fabien Jeudy, President, and CEO, Equitable.

View the Power of Together video to learn more about Equitable’s renewed purpose and dedication to clients:

View on Vimeo

Questions about our new brand? Please contact your Equitable wholesaler or visit equitable.ca.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada. -

Important Information Regarding FHSA Contributions

Many clients have already taken advantage of Equitable’s First Home Savings Account (FHSA), available on Pivotal Select™ Investment Class (75/75) and Pivotal Select Estate Class (75/100).

Below, we answer questions we have received regarding cut-off dates for 2023 FHSA contribution tax receipts.

1. The client submitted an application with a deposit before 11:59 p.m. ET on December 29, 2023. Will they get a 2023 FHSA contribution tax receipt?

Yes, the client will receive a 2023 FHSA contribution tax receipt.

2. The client submitted an application with a deposit on December 30 or 31, 2023. Will they get a 2023 FHSA contribution tax receipt?

No, the client will not receive a 2023 FHSA contribution receipt. The client’s deposit will be made effective the next business day, January 2, 2024. The client will receive a FHSA contribution tax receipt for the 2024 tax year.

However, since the client signed the application on or before December 31, 2023, they are eligible to take advantage of the 2023 contribution room in 2024 (up to $16,000 total*).

3. The client submitted an application with a deposit after January 1, 2024, but it was signed on or before December 31, 2023. Will they be eligible for the 2023 contribution room?

Yes. Any FHSA application received on or before 4:00 p.m. ET on January 12, 2024 that was signed on or before December 31, 2023 will be eligible to take advantage of the 2023 contribution room in 2024*.

4. The client received a confirmation letter stating their deposit was effective in January, but the application and contribution was submitted on or before December 29, 2023, will they receive a 2023 tax receipt for their contribution?

Yes, if the client received a confirmation letter stating their deposit was effective in January but the application and deposit was received at Equitable® on or before December 29, 2023, they will receive a 2023 tax receipt for their contribution. We are currently updating any impacted FHSA policies to reflect a December trade date. The client will receive a revised confirmation letter reflecting the December trade date.

5. When will 2023 FHSA contribution tax receipts be issued?

FHSA contribution receipts for the 2023 tax year will be mailed to clients by February 29, 2024.

If you have further questions, please contact your Regional Investment Sales Manager or one of our Client Services Representatives at 1.866.884.7427.

*Clients must consider all eligible FHSAs with any other institutions to determine their remaining contribution room.

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted January 2, 2024 -

Harness the Power has been enhanced

The popular marketing piece — Harness the Power of Whole Life Cash Value — has been enhanced.

Newly renamed as Harnessing the Power of Your Policy Cash Value, this piece now includes information on Universal Life in addition to Whole Life cash value.

You can find this piece on EquiNet, now available in English and French. -

GIA Coming to the Equitable FHSA

Many clients have already taken advantage of Equitable’s First Home Savings Account (FHSA), available on Pivotal Select™ Investment Class (75/75) and Pivotal Select Estate Class (75/100).

And now, we’ve got some more great news. We’re working to expand the Equitable® FHSA to include our Guaranteed Interest Account (GIA). But clients don’t need to wait to start earning tax-free income in a FHSA.

If clients want to open a FHSA now but may be interested in an Equitable GIA, simply choose the No-Load Equitable Money Market Fund Select investment option while we work on including the GIA on FHSA. The current yield to maturity is 5.41% gross.1

We will let you know when the GIA is available in FHSA in the coming months. Once it is available, advisors can speak to clients about the GIA options available in the FHSA and select what best suits their needs.

Don’t forget, clients who make a contribution to their FHSA, RRSP or TFSA between January 1 and February 29, 2024, could win $5,000 and you could win $1,000 in Equitable’s New Year’s Resolution, New Year’s Contribution Contest.2

For more information, please contact your Regional Investment Sales Manager.

1 As of January 16, 2024, 4.06% net after deducting the management expense ratio. Yield to Maturity: the market value weighted-average yield to maturity includes the coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

2 Equitable’s New Year’s Resolution, New Year’s Contribution Contest: No purchase necessary. Contest period January 1, 2024, to February 29, 2024. Enter by making a deposit to an Equitable FHSA, TFSA or RRSP during the contest period or by submitting a no-purchase entry. One prize for a total value of $5,000 CAD to be drawn on March 8, 2024, will be awarded. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner and will receive a $1,000 CAD prize. For example, if an Equitable client is a winner of the $5,000 prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see the full contest rules.Posted January 17, 2024

-

FasatWeb Upgrade Implementation

At Equitable, we are making continuous improvements to our advisor services. We are excited to share some upcoming enhancements to FasatWeb—Equitable’s compensation inquiry system.

What’s new?

On January 20, 2024, Equitable is implementing changes to FasatWeb. These changes include:

● Single sign-on has been enabled. Once you log into EquiNet, you won’t have to log in again to access Compensation Inquiry.

● Compensation Inquiry (FasatWeb) can be accessed using MS Edge, Chrome, or Firefox. Compensation Inquiry will no longer run on Internet Explorer.

● Compensation Inquiry screens will now have a new look and feel.

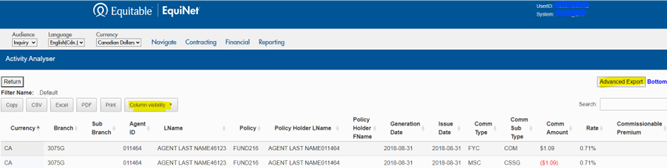

● Two new features have been added to the Activity Analyser, as are highlighted in the image below:

1. Advanced Export—an Advanced Export button has been added to the upper right side of the page, allowing you to export all query results.

2. Column visibility—the new Column visibility tab allows you to choose which columns you’d like to display in your PDF or print request.

-

Sofie wants to provide for her children long after she’s gone with Equitable Generations Universal L

Sofie knows the future is uncertain. As a mom of two children and in her late forties, Sofie wants to continue to help her kids with their life goals as they get older.

She learns that Universal Life insurance from Equitable® is a great fit for her. It has investment options, choices of death benefit and even flexibility on how she pays for her premiums. With the investment option, she can earn tax-advantaged growth*.

Watch our new Universal Life Insurance from Equitable video to learn more. See it on Vimeo

This video can help you talk with clients about Universal Life insurance. It walks them through what it is, how it works, and the affordability and flexibility it features. It highlights just how Universal Life from Equitable is an insurance solution truly designed to meet the needs of clients today and into tomorrow.

Not sure where to start? Send clients this draft prospecting letter which you can personalize specifically for them.

Plus, check out our Universal Life solution page on EquiNet®, then click on the Marketing Materials tab for the latest Universal Life Marketing Materials.

Want to learn more? Ask your Equitable wholesaler!

View on Vimeo

*Subject to the Income Tax Act of Canada.

-

Join us for an Equitable Life Master Class webcast featuring Dr. Ryan Murphy, Morningstar

You’re invited to our next Equitable® Master Class webcast offering compelling topics and unique ideas from leading experts to help you manage and grow your business.

Just asking clients what their goals are may not be enough. Clients may respond in ways that seem reasonable but might not represent the goals that are truly important to them.

In the Behavioural world, this is known as ‘thinking blind spots’ and stems from behavioural biases we all have. The blind spots can prevent clients from expressing their true goals to you and lead to a plan that doesn’t accurately represent their preferences and motivations.

Join us for an informative discussion led by Dr. Ryan Murphy, head of Morningstar’s global Behavioural insights in how you can get clients past their thinking blind spots.

Learn more

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® or ™ denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Posted February 1, 2024 -

January 2024 eNews

In this issue:

- Equitable scores high marks with group advisors*

- REMINDER: Equitable's National Biosimilar Program starts in March*

- 2024 dental fee guide updates*

- Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable scores high marks with group advisors*

Equitable ranked first for operational service among major group insurers in a recent study of Canadian group benefits advisors.

NMG Consulting, a leading global consulting firm, conducted in-depth interviews with 146 Canadian group benefits brokers, consultants, MGAs and third-party administrators between May and August 2023 for its annual Canadian Group Benefits Study. Based on these interviews, NMG ranked group insurers in six categories, ranging from operational management to technology.

Nationally, Equitable ranked among the top three in five of the six main categories, including number one for Operational Management:Category Ranking Operational management 1st Initiatives (including seminars & training) 2nd Technology 3rd Underwriting & claims management 3rd Relationship management 3rd

“Advisors regard us highly in many categories. That’s a testament to our mutual status and ability to focus exclusively on our clients and advisor partnerships,” said Marc Avaria, Executive Vice President, Group Insurance Division. “We are truly working together to build strong, enduring and aligned partnerships with our clients and advisors.”

“We’re delighted with these results and are committed to continuously advancing our delivery of a better benefits experience for our clients and advisors,” added Avaria.More highlights from the latest NMG survey

Nationally, we ranked first in seven subcategories in Operational Management, including:- Overall service to intermediaries,

- Overall service to plan sponsors,

- New quote process,

- Plan implementation,

- Renewal process,

- Accuracy and timeliness of reporting and billing, and

- Administration quality and responsiveness

And we were rated strongly in Technology, finishing in the top three for:- Overall technology for Intermediary (2nd)

- Member experience (3rd)

- Quality of technology for the plan sponsor (2nd)

- Quality of mobile application (2nd)

REMINDER: Equitable's National Biosimilar Program starts in March*

In October 2023 we announced the upcoming launch of our national biosimilar program. Starting March 1, 2024, we are expanding our biosimilar switch initiatives to provide a single, nationwide** program.

Why we’re making the switch

Over the past few years, most provinces have introduced policies to delist some originator biologic drugs. They require most patients to switch to biosimilar versions of those drugs to be eligible for coverage under their public drug plans. Soon, it is expected that all provincial drug plans will cover only biosimilars.

Equitable’s National Biosimilar Program simplifies drug plan coverage by replacing our provincial programs. It also protects clients from additional drug costs while offering access to lower-cost biosimilars deemed equally safe and effective by Health Canada.

How will this affect clients' drug plans?

Because we have already introduced biosimilar switch initiatives in most provinces, the impact of this change will be minimal. It will primarily affect plan members in provinces or territories where we haven’t already required the switch to biosimilars. It will also affect plan members who are taking biosimilars that were not originally included in the switch initiative for their province.

Regardless of where they live, plan members across Canada will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower-cost biosimilar version of the drug. Plan members already taking the originator biologic will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable plan. We will support their transition with education, personalized communication, and resources.

Advance notice for plan members

We contacted affected claimants in early December to give them enough time to change their prescriptions and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Account Executive.

** Excludes plan members in Quebec who participate in a separate provincial program.

2024 dental fee guide updates*

Each year, Provincial and Territorial Dental Associations publish fee guides. Equitable uses these guides to help determine the reimbursement limits for dental procedures.

For your reference, you may wish to refer to the 2024 list of the average dental fee increases for general practitioners.

Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable is proud to congratulate our Employee and Family Assistance Plan (EFAP) partner, Homewood Health®, for winning the Canadian HR Reporter 2023 Reader’s Choice Award in Employee Assistance Plan services. Homewood’s EFAP provides confidential support for a range of health, family, money, and work issues through face-to-face, phone, email, chat, or video counselling. The award recognizes their high standards in counselling and mental health support services.

The annual Reader’s Choice Awards identify organizations that provide outstanding expertise and services for HR professionals and employers across Canada. Those organizations provide valuable information on useful, innovative HR and employee benefits products and programs, in categories such as recruitment, mental health services, employee engagement programs, and more.

Sharing Homewood Health with your clients

Since 2019, we have worked with Homewood to provide mental health services for Equitable benefits plan members.

Your clients can access Homewood Health’s award-winning EFAP for an additional fee by adding it to their benefits plan. Services are available 24/7, 365 days a year.

All Equitable clients also have free access to Homewood Health Online in their benefits plan. Homewood Online provides a variety of helpful wellness resources, including:

- Homeweb, an online and mobile health and wellness portal,

- Health Risk Assessment, a group of assessment tools to help plan members identify and overcome health and wellness barriers, and

- Online Internet-based cognitive behavioural therapy (iCBT) through Sentio to manage symptoms of anxiety and/or depression.

Questions

To learn more about Homewood Health’s services, contact your Group Account Executive or myFlex Account Executive.