Site Search

406 results for benefits of seg fund

-

Unique solution can help your business grow in the group benefits market

Are you ready to grow your business in the group benefits market? Then the Equitable EZBenefits™ experience should be on your radar.

Join our online session May 22, at 1 p.m. ET and learn why companies with two to 25 employees are choosing this unique solution. Reasons like affordability, sustainability, and how easy managing the plan is for their members and administrators.

We’ll also explore its features:• Plan design options for various needs and budgets• Embedded health and wellness services• Built-in HR support services• ‘EZ’ process for rapid quotes, hassle-free plan implementation and renewals• Dedicated advisor concierge service

A question-and-answer (Q&A) period will follow the presentation.

Register here to attend our session.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

-

Meghan Vallis named head of distribution for myFlex Benefits and other group benefits updates

Meghan Vallis named head of distribution for myFlex Benefits

We are pleased to announce that Meghan Vallis, our Group Sales Vice President for Western Canada, will head national distribution for myFlex Benefits in addition to her existing responsibilities.

As part of her expanded role, Meghan will lead the myFlex Benefits sales team and develop and implement strategies to achieve the growth of this offering. Meghan and the myFlex team will continue to focus on delivering market leading services for our clients and advisors.

Meghan joined Equitable Life in 2020 and brings more than 15 years of experience in the group benefits industry to her expanded role. She is passionate about helping Advisors succeed to transform their clients' employee benefit experience.

myFlex Benefits is one of the most unique and versatile benefits solutions for small businesses in Canada. It is fully pooled, includes a two-year renewal and features a user-friendly portal for plan members to make their benefit selections. And it’s simple to use: Plan sponsors set a budget and choose from a selection of benefit options. Plan members then use flex dollars to select from the options offered by their employer. Any leftover flex dollars are saved in a health care spending account (HCSA).

If you have any questions or are interested in learning more about myFlex Benefits, please contact your Group Account Executive or myFlex Sales Manager.Changes to Short Term Disability (STD) benefit calculations for 2023*

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2023 changes to Maximum Insurable Earnings and premiums for employment insurance.

The following changes to Employment Insurance (EI) will come into effect on Jan. 1, 2023:

How does this affect your clients?

Your clients’ STD benefit will be revised with the updated maximums based on the percentage of EI Maximum Weekly Insurable Earnings shown in their policy if:- Their Equitable Life Group Policy includes an STD benefit that is tied to the EI Maximum Weekly Insurable Earnings, and

- At least one classification of employees has a maximum of less than $650.

If their STD maximum is currently higher than $650 or based on a flat amount instead of a percentage or regular earnings, no change will be made to their plan unless otherwise directed.

If your clients wish to provide direction regarding revising their STD maximum, or if they have questions about the process, they can email Kari Gough, Manager, Group Issue and Special Projects.Coming soon: Survey for Plan Administrators with recent disability claims*

We’ve enhanced our communication processes to help your clients with disability plans manage their workplace absences more effectively. In early December, we will distribute a short survey to plan administrators who may have submitted an approved disability claim in the past six months. The survey will ask recipients about their satisfaction with the frequency and detail of our disability management communications.

The email will come from GBClientFeedback@equitable.ca, and the survey will remain open until the end of the day on December 16, 2022. All responses will be confidential. We plan to use the feedback to help ensure that we’re meeting your clients’ expectations and delivering industry-leading service.

We may also follow up with survey respondents directly, to address any concerns they’ve identified.

* Indicates content that will be shared with your clients. -

Introducing Equitable EZBenefits: A better group benefits solution for your small business clients

If you serve small business owners, chances are they’re looking for a group benefits solution that’s affordable, sustainable and easy to manage. That’s why we introduced Equitable EZBenefits™. It’s a unique group benefits solution designed with you and your small business clients in mind.

Options to fit every need

Available to organizations with between 2 and 25 employees, EZBenefits offers a range of plan design options to match different needs and budgets. * Whether your client owns start-up or a growing company, we’ve got them covered. Plan options include a mix of Life, Health and Dental coverage. ** Clients can also add Long-Term Disability (LTD) coverage or a Health Care Spending Account (HCSA).

Embedded services to support health and wellness

To provide employees with added support for both their physical and mental wellbeing, all our plan design options include:- Anytime, online access to medical professionals through our Virtual Healthcare solution from Dialogue,

- Access to professional counselors – via the telephone, the web or in-person – through our Employee and Family Assistance Program from Homewood Health®, and

- Online resources to help manage health, financial and family challenges through Homeweb, Homewood Health’s online wellness portal.

EZBenefits also comes with built-in HR support through Equitable Life’s partnership with HRdownloads® This takes the heavy lifting out of common human resource tasks with HR support tools and services, including:- HR Technology: An award-winning cloud-based human resource information system to provide help from onboarding to offboarding and everything in between.

- HR Content: Access to a library of over 3,000 HR documents, templates, compliance resources and articles, with 25 free document downloads.

- HR Training: A free Workplace Diversity and Inclusion online training course.

- HR Support: One free Live HR Advice call with a seasoned HR expert.

We know that advising small business clients can be challenging. We’ve created a streamlined benefits process that provides rapid quotes, hassle-free plan implementation, simplified renewals and that is easy to administer. That way, you can spend more time advising your clients and building your business – and less time with administrative back and forth.

Pricing stability for long-term stability

When it comes to attracting and retaining talent, we know your small business clients are competing with larger organizations that have big budgets and lots of resources. That’s why we’ve designed EZBenefits to provide long-term pricing stability for health and dental benefits.

Find out more

Watch this video to learn how EZBenefits can help you and your clients. You can also visit info.equitable.ca/ezbenefits for more details or to request a quote. If you have questions, contact your Equitable Life Group Account Executive. If you don't have an Equitable Life Group Account Executive, email us at EZBenefits@equitable.ca.

* Not available in Quebec.

** Dental coverage is not included with the Bronze plan design option. -

Explore Equitable EZBenefits™

A better group benefits solution for your small business clients

Running a small business isn't easy, especially for companies with smaller budgets and fewer resources. It can be tough to find a competitively priced benefits plan with the features that clients want. That’s why we created Equitable EZBenefits™, a benefits solution designed with the needs of small businesses in mind.

Options to fit every need

Available to organizations with between 2 and 25 employees, EZBenefits offers a range of plan design options to match different needs and budgets. * Whether your client owns start-up or a growing company, we’ve got them covered. Plan options include a mix of Life, Health and Dental coverage. ** Clients can also add Long-Term Disability (LTD) coverage or a Health Care Spending Account (HCSA).

Embedded services to support health and wellness

To provide employees with added support for both their physical and mental wellbeing, all our plan design options include:

● Anytime, online access to medical professionals through our Virtual Healthcare solution from Dialogue,

● Access to professional counselors – via the telephone, the web or in-person – through our Employee and Family Assistance Program from Homewood Health®, and

● Online resources to help manage health, financial and family challenges through Homeweb, Homewood Health’s online wellness portal.

Extra HR support for EZBenefits clients

EZBenefits also comes with built-in HR support through Equitable’s partnership with Citation Canada® (formerly HRdownloads). It takes the heavy lifting out of common human resource tasks with HR support tools and services. Features include:

● an award-winning cloud-based human resource information system (HRIS) to provide help from onboarding to offboarding and everything in between,

● access to a library of over 3,000 HR documents, templates, compliance resources and articles, with 25 free document downloads,

● a free Workplace Diversity and Inclusion online training course, and

● one free Life HR advice call with a seasoned HR expert.

A streamlined process to optimize your time

We know that advising small business clients can be challenging. We’ve created a streamlined benefits process that provides rapid quotes, hassle-free plan implementation, simplified renewals and that is easy to administer. That way, you can spend more time advising your clients and building your business – and less time with administrative back and forth.

Pricing stability for long-term stability

When it comes to attracting and retaining talent, we know your small business clients are competing with larger organizations that have big budgets and lots of resources. That’s why we’ve designed EZBenefits to provide long-term pricing stability for health and dental benefits.

Find out more

To learn more about EZBenefits, watch our video to learn more or view our brochure. You can also visit info.equitable.ca/ezbenefits for more details or to request a quote. If you have questions, contact your Equitable Life Group Account Executive. If you don't have an Equitable Life Group Account Executive, email us at EZBenefits@equitable.ca.

* Not available in Quebec.

** Dental coverage is not included with the Bronze plan design option.

- [pdf] Pivotal Select Application - FHSA

- Advisor Guide

- [pdf] Pivotal Select Estate Class Client Brochure

- About

- About

-

Most employers staying the course on benefits during COVID-19

With businesses suffering hardship due to COVID-19, employers are turning to you for advice on their benefits plans during these difficult times. We’ve received numerous questions from advisors about changes our clients are making to their plans during this crisis.

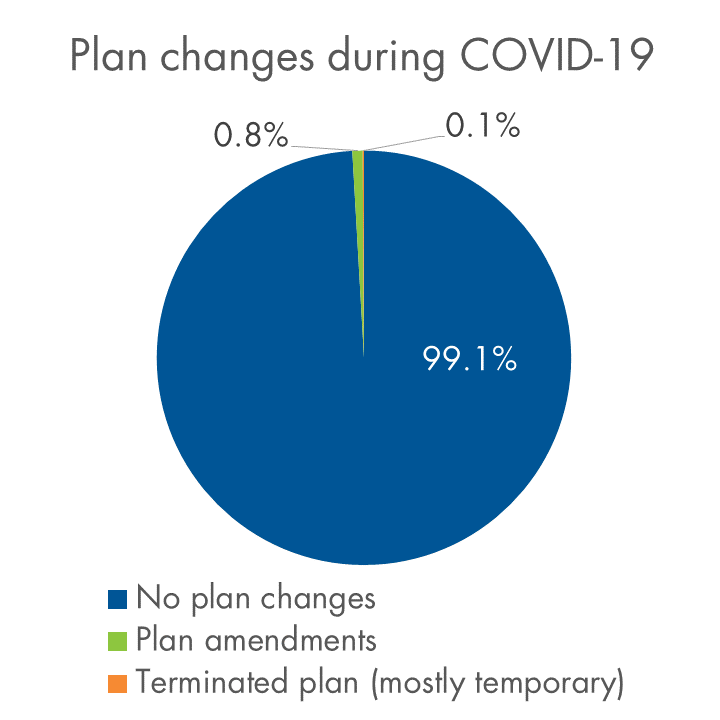

So far, the vast majority of clients are standing pat and taking a wait-and-see approach. Plan amendments have been the exception – fewer than 1% of our clients have made COVID-19-related amendments as of mid-April. Almost all are clients with fewer than 50 lives.

We know that many of our clients have experienced layoffs, but hardly any have cancelled benefits. Fewer than 0.1% have terminated benefits to date.

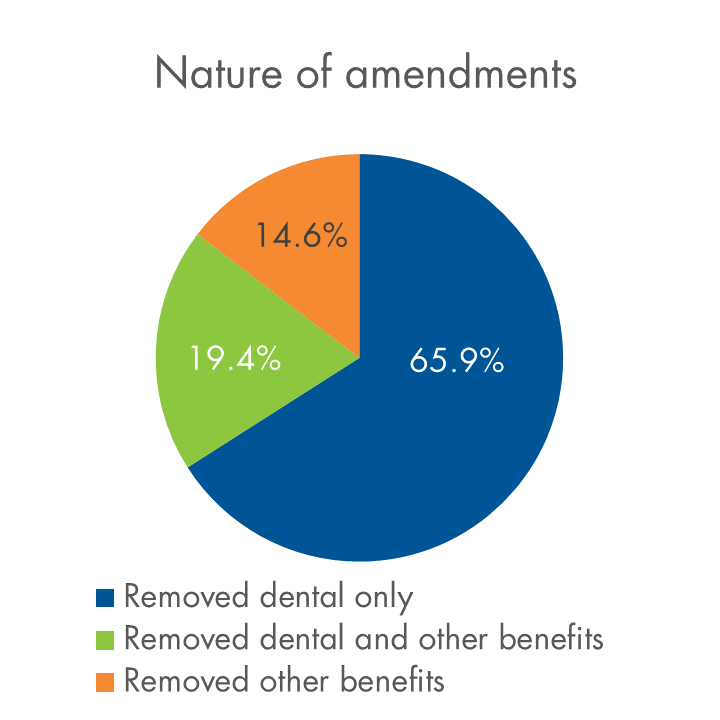

Below is a snapshot of plan amendments and terminations relative to our overall block, and an overview of the types of amendments we’re seeing.

COVID-19-related plan changes on Equitable Life’s block of businessAs of April 15, 2020

Have clients who need to make a change?

We know this is a difficult time for Canadian employers. If you have a client who needs to make a change to their plan, please contact your Group Account Executive or myFlex Sales Manager. We have a range of options to help them manage, and changes can be made quickly. The average turnaround time for COVID-19-related amendments is currently about four days.

We’re happy to work with each employer to understand the options that suit their specific situation best.