Site Search

406 results for benefits of seg fund

- [pdf] Insights into Non-registered taxation

-

What’s new in EZtransact

We’re excited to introduce the latest enhancement for EZtransact™, our digital self-serve tool. EZtransact now allows you to help clients:

• Easily make segregated fund withdrawals. This functionality is available for all account types, and for the First Home Savings Account, it also eliminates the need to submit additional CRA paper forms.

• Transfer from one fund to another fund digitally, within the same policy and same sales charge options.

These enhancements make it easier than ever to do business with Equitable®. They will help reduce your time spent on paperwork, allowing to you focus on more value-add time and services for clients.

Check out EZtransact. Stay tuned for more exciting digital enhancements coming soon!

If you have any questions, please contact your Director, Investment Sales.

Date posted: July 11, 2024 -

Easier than ever with Equitable and EZtransact

Equitable® keeps improving our digital self-serve tool, EZtransact®. Our latest enhancements make it easier than ever to do business with us.

What's new?

Dollar cost averaging transaction- Advisors can now submit new dollar cost averaging requests through the Fund Switch transaction in EZtransact. A new recurring switch type is available.

- When submitting a new request, you'll need to enter the amount, frequency, date of transfers, and the funds involved.

- If a client has an active request, you can change the amount, frequency, date, and funds.

- After you submit the request, the client will get an email to sign. Once they e-sign, the request goes directly to Equitable.

Other recent enhancements include:- Segregated fund withdrawals and fund transfers

- New dashboard for client search, transaction management enhancements and signing process improvements

Date posted: December 11, 2024 - [pdf] Facts & Figures

-

Celebrating our most popular Pivotal Select funds

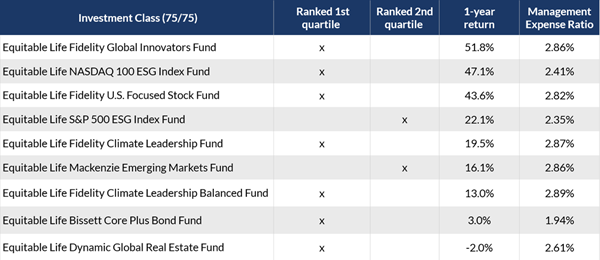

In August 2022, Equitable® launched 12 new segregated funds in Pivotal Select’s Investment Class (75/75). We wanted to bring some new innovative solutions to the product, including six sustainable investment funds. To say the launch of these funds was successful would be an understatement.

The funds are quickly becoming some of the most popular funds in Pivotal Select™, and their performance in 2023 was impressive. Equitable wants to celebrate these funds and encourage clients to consider them for their portfolios.

As of February 29, 2024, nine out of the 12 funds received a 1st quartile ranking for their 1-year return and two more were 2nd quartile. The table below shows the new funds that ranked in the top two quartiles for their 1-year returns.

Access additional fund performance information

If you haven’t looked at these funds yet, now is the time. Speak to clients about their investment options and see if these funds fit within their investment portfolio.

Talk to your Director, Investment Sales today for more information.Disclaimer

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value. Segregated fund values change frequently, and past performance does not guarantee future results. Investors do not purchase an interest in underlying securities or funds, but rather, an individual variable insurance contract issued by The Equitable Life Insurance Company of Canada. There are risks involved with investing in segregated funds. Please read the Contract and Information Folder before investing for a description of risks relevant to each segregated fund and for a complete description of product features and guarantees. Copies of the Contract and Information Folder are available on equitable.ca.

Management Expense Ratios (MERs) are based on figures as of February 29, 2024, and are unaudited. MERs may vary at any time. The MER is the combination of the management fee, insurance fee, operating expenses, HST, and any other applicable non-income tax for the fund and for the underlying fund. For clients with larger contract values, a Management Fee Reduction may be available through the Preferred Pricing Program. For details, please see the Pivotal Select Contract and Information Folder.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

Posted April 18, 2024

- [pdf] Equitable Life Dynamic US Monthly Income Fund Select

- [pdf] EQUITABLE LIFE: Stability you can count on

- Compensation

-

Extending premium relief for Dental and Extended Health Care benefits

We know this is a challenging time for Canadian employers and we continue to look for ways to help your clients manage while still supporting their employees.

As many health practitioners continue to keep their offices closed due to the pandemic restrictions, plan member use of dental benefits and some health benefits remains lower than normal.

So, we are pleased to announce that we are extending premium relief for all Traditional and myFlex insured non-refund customers for Health and Dental benefits for the month of May, as follows:

- A 50% reduction on Dental premiums in all provinces except Saskatchewan, where a 25% reduction will apply due to the re-opening of dental clinics in early-May; and

- A 20% reduction on vision and extended healthcare rates (excluding prescription drugs) in all provinces, which equates to an 8% reduction on Health premiums.

These reductions are effective for May 2020 and will appear as a credit against the next available billing. We will assess the situation monthly and expect to continue with monthly refunds for as long as the current crisis period continues. The size of the credit may change over time as dentists and other health practitioners gradually reopen their offices. We will confirm premium credits for June (if any) at a later date. Credits for subsequent months will be communicated on a month-by-month basis.

In order to be eligible for the monthly credit calculation and payout, a policy must be in force on the first of the month and remain in force thereafter. The monthly credit calculation is based on employees in force on the May bill. If employees experienced layoffs during the month, that would not affect eligibility for a premium credit as long as the benefit itself is not terminated.

We expect that claims experience and premiums will return to normal once the current pandemic restrictions are lifted.

In the meantime, plan members will continue to have full access to their benefits coverage throughout the pandemic. In many cases, dental offices remain open for emergency services, and a variety of healthcare providers are available virtually.

Commissions

We know the pandemic has put financial strain on your business as well, so we will continue to pay full compensation. Although your overall commission will be unaffected by these premium reduction adjustments, you may see a temporary reduction in your commission payments if you are on a pay-as-earned basis. We will begin to process the commission top-up payments in mid-June and will reflect both April and May premium credits.

Communication

We will be communicating this premium relief program to your clients later this week.

Questions?

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. In the meantime, we have provided some Questions and Answers below. You can also refer to our online COVID-19 Group Benefits FAQ.

-

Equitable Life Group Benefits Bulletin – January 2022

Short-term disability coverage for plan members with COVID-19*

Please note: This announcement applies only to groups with short-term disability coverage through Equitable Life

As the COVID-19 pandemic continues, and the situation evolves, we continue to adjust our practices to ensure ongoing support for our plan members.

PCR tests no longer required for COVID-related STD claims

Some provinces have recently restricted access to COVID-19 PCR testing to only high-risk individuals. To ensure your clients' eligible plan members receive their short-term disability benefits in a timely manner, we no longer require a positive PCR test for plan members submitting COVID-19-related STD claims.

Plan members who are experiencing symptoms of COVID-19 or who have tested positive for the virus (either with a PCR test or with an at-home rapid test) and are unable to work from home should complete the Short Term Disability Plan Member COVID-19 Claim Form (#421A).

They should indicate the date of the onset of symptoms or date of their positive test result. Where applicable, they should also indicate the date they have been cleared by public health to end their self-isolation. The form includes an attestation that the information they have provided is accurate.

The employer needs to complete the Short Term Disability Employer COVID-19 Claim Form (#421B). They should indicate the expected return-to-work date according to their provincial health guidelines, or using the date provided by a public health official.

Waiting periods for COVID-related STD claims

To support your clients' plan members during the initial stages of the pandemic, we waived the STD waiting period if a plan member’s absence was due to symptoms or a diagnosis of COVID-19. Now that COVID-19 has become the “new normal,” we are returning to our standard practices and treating the virus as we would any other illness.

Effective Jan. 1, 2022, standard waiting periods will apply for COVID-related STD claims, according to the terms of the Group policy. This ensures that all plan members submitting a STD claim are treated fairly, no matter what the cause of the claim.

Eligible plan members will receive STD benefits up to a maximum of 10 days from the date of the onset of symptoms or a positive COVID-19 test result, minus the waiting period.

For example, if the plan has a five-day waiting period, and the plan member returns to work nine days after a positive test result, they would be eligible for four days of benefits payments.

If the claimant is still unwell after 10 days, then the standard Short Term Disability Claim Form (#421) needs to be completed.

If a plan member is admitted to hospital, benefits will be paid following the waiting period applicable to hospital claims.