Site Search

422 results for beneficiary change form

-

Temporary change for certain Savings & Retirement withdrawal requests

We’re making improvements to Equitable’s EZtransact® automation system. Unfortunately, withdrawal requests under the Home Buyer’s Plan or Lifelong Learning Plan are currently being processed incorrectly as taxable withdrawals, with taxes withheld in error. We are working hard to fix this issue.

What to do:

Please submit these specific withdrawal requests using paper forms for manual processing until further notice.

We appreciate your understanding and support as we enhance the system. If you have any questions, feel free to reach out to your Director, Investment Sales.

Date posted: June 26, 2025 - Accepted Payment Methods

-

Anytime. Anywhere! Equitable Client Access

At Equitable Life®, we know that managing your clients’ requests can keep you busy. We also know providing the opportunity for your clients to self-serve can allow you to focus on their future. That’s why our online client site, Equitable Client Access ensures your clients have all the information about their individual investment and insurance policy information that they need, right at their fingertips.

Our secure client site gives your clients access to:

- Tax Slips *NEW*

- Coverage and guarantees

- Investment allocation, performance, and market values

- Pre-authorized payment information

- Transaction history

- Beneficiary information

- Statements and letters

- Advisor’s contact information

- Banking or payment information

Sign up by December 31, 2021.

Encourage your clients to login or register today!

client.equitable.ca

If you have any questions about Equitable Client Access, we are here to help. Contact us Monday to Friday from 8:30 a.m. to 7:30 p.m. at 1.866.884.7427.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada -

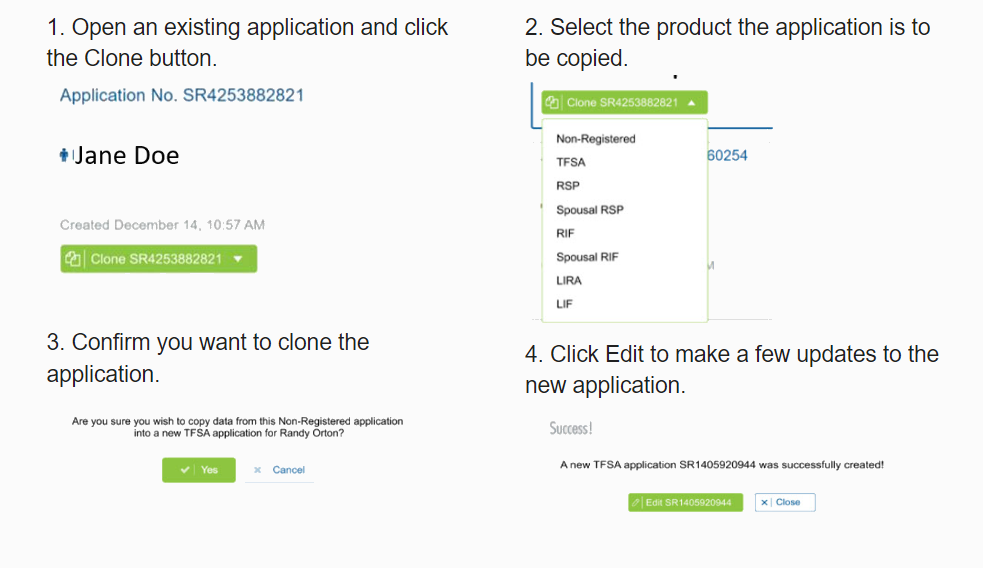

The new segregated fund EZcomplete cloning feature will save time and errors.

The new cloning feature for Savings & Retirement EZcomplete® applications means that advisors don’t need to enter the same client information when completing multiple applications for the same client.

Here's how easy it is to use.

.png)

Best of all, you can clone in progress and submitted applications.

This is just some of the information that will be automatically copied:-

Name

-

Date of birth

-

Gender

-

Occupation

-

Address

-

Phone numbers

-

Email address

-

Social Insurance Number

-

All beneficiary information

The new EZcomplete cloning feature will save advisors time and reduce errors.If you have any questions, contact your Regional Investment Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted April 6, 2023 -

- About

- [pdf] Corporately Owned Segregated Funds

- Contracting and Compensation

- [pdf] Policy Owner Request for New Advisor

- [pdf] Daily/Guaranteed Interest Account Advisor Guide

- [pdf] Equitable's Competitive Advantage

.png?width=500&height=92)

.png?width=500&height=92)

.png?width=300&height=82)

.png?width=300&height=39)