Site Search

348 results for mode change request

-

Things keep getting EZer with Equitable and EZtransact!

Equitable® continues to make great strides with our digital self-serve tool, EZtransact®. To keep this momentum, we’ve given EZtransact a fresh new look and feel, with additional transaction management changes and a new dashboard to enhance your online transaction experience! This refresh embraces our new brand, as we continue to focus on making it easier for you to do business with us.

What’s new with this update?

New dashboard for client search- The existing client search screen has been replaced with a new user-friendly dashboard.

- Upon accessing EZtransact, all contracts associated with the user’s EquiNet ID will be displayed.

- Users can refine the results and search by client name or contract number.

- Transactions submitted through EZtransact within the last 12 months are available, including their status.

- Transactions that have received all signatures will now allow the user to download a copy of the signed request and any supporting documents uploaded by the user.

- Transactions that are pending client signatures will allow the user to manage and track the e-signature process:

- Signing packages can be resent to clients who have not completed their e-signature.

- Clients can be unlocked through the dashboard if locked out due to too many invalid attempts.

- Advisor and dealer/MGA stakeholders have been removed from signing information and review screens.

- Users are no longer required to provide an email address for the dealer/MGA to submit a transaction.

Date published: October 3, 2024 - Sales Illustrations

- Online Annuity Quotation

- About

-

Update - Travel Assist Coverage*

Last Friday, we announced that plan members with Travel Assist on their benefits plan will not be eligible for coverage if they departed the country after the Government of Canada issued its Global Travel Advisory.

When the Government issued its advisory late Friday afternoon, we felt an obligation to let prospective travellers know as soon as possible so they could make informed choices about their travel. Since then, we have been made aware of a number of situations where plan members were unable to change their travel plans and need our continued support.

To provide that support, we have revised our position. We will continue to cover plan members for all eligible emergency medical expenses, including those related to COVID-19, for trips outside Canada. Given the global situation is evolving quickly, we will continue to monitor developments and update you accordingly.

In spite of this, we strongly urge your clients to advise their employees not to travel outside of the country at this time. The risk is high and the options for returning to Canada are becoming limited. Further, we urge your clients to advise their employees who are outside the country to return to Canada earlier than scheduled, if possible.

If a plan member is currently travelling abroad and is experiencing symptoms or is hospitalized with suspicion of the coronavirus, they should contact Travel Assist at the numbers listed below for assistance and to confirm their coverage.

- Toll-free Canada/USA: 1.800.321.9998

- Global call collect: 519.742.3287

- Allianz Global Assistance ID #9089

We will continue to update you as the situation develops.

We will update the announcement on our Plan Member website to reflect this change.

We apologize for any confusion or inconvenience our earlier announcement may have caused.

*Indicates content that will be shared with your clients

-

Most employers staying the course on benefits during COVID-19

With businesses suffering hardship due to COVID-19, employers are turning to you for advice on their benefits plans during these difficult times. We’ve received numerous questions from advisors about changes our clients are making to their plans during this crisis.

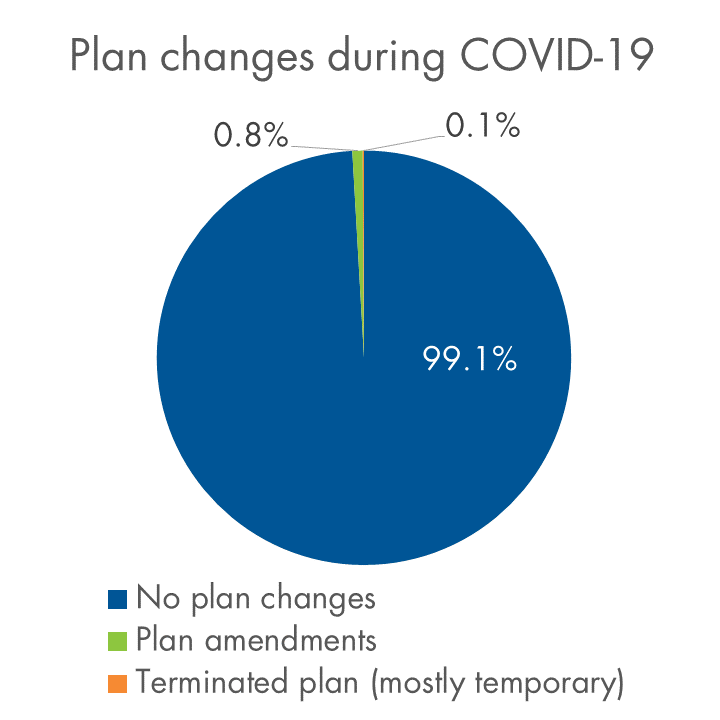

So far, the vast majority of clients are standing pat and taking a wait-and-see approach. Plan amendments have been the exception – fewer than 1% of our clients have made COVID-19-related amendments as of mid-April. Almost all are clients with fewer than 50 lives.

We know that many of our clients have experienced layoffs, but hardly any have cancelled benefits. Fewer than 0.1% have terminated benefits to date.

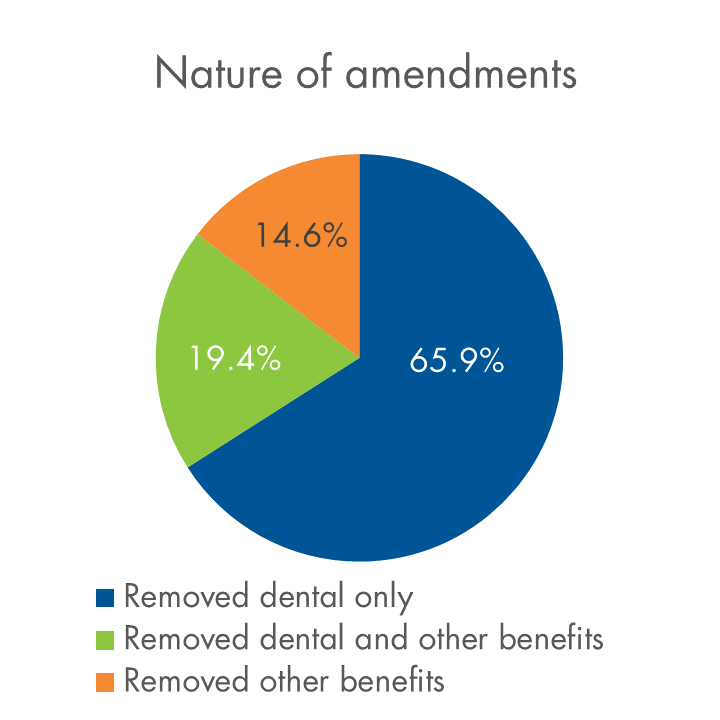

Below is a snapshot of plan amendments and terminations relative to our overall block, and an overview of the types of amendments we’re seeing.

COVID-19-related plan changes on Equitable Life’s block of businessAs of April 15, 2020

Have clients who need to make a change?

We know this is a difficult time for Canadian employers. If you have a client who needs to make a change to their plan, please contact your Group Account Executive or myFlex Sales Manager. We have a range of options to help them manage, and changes can be made quickly. The average turnaround time for COVID-19-related amendments is currently about four days.

We’re happy to work with each employer to understand the options that suit their specific situation best.

-

New Dividend Scale Effective July 1, 2023!

Equitable Life’s Board of Directors has approved a change to the dividend scale* for the period July 1, 2023, to June 30, 2024.

- The interest rate we use for the dividend scale will go from 6.05% to 6.25% on July 1, 2023.

- Other factors used to decide the dividend scale will stay the same.

- The interest rate for participating whole life policies with dividends on deposit will stay the same at 2.25%.

- The policy loan interest rate** will go from 6.20% to 6.50% on June 30, 2023

More good news!

Once the next dividend scale year starts, we expect policyholder dividends to be close to $105 million until the end of June 2024.

Learn more

- Advisor Dividend Scale Notice

- Client Dividend Scale Notice

- Dividend Information Page

Did you miss our virtual Spring Update & 2023 Dividend Scale Announcement? Watch it now:

(*The French and Chinese events will be partially in English, with sub-titles on screen).

TOGETHER – Protecting Today – Preparing Tomorrow™

As a MUTUAL we provide financial security DIFFERENTLY by focusing exclusively on our CLIENTS.

*Dividends are not guaranteed and are paid at the sole discretion of the Board of Directors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the Participating Account as well as mortality, expense, lapse, claims experience, taxes, and other experience of the participating block of policies. Changes in the dividend scale do not affect the guaranteed premium, guaranteed cash values, or guaranteed death benefit amount. A copy of Equitable Life’s Dividend Policy and Participating Account Management Policy can be found on our website at www.equitable.ca.

** This applies to all new and active policy loans, including automatic premium loans. This change is for Equimax® policies that have a 9-digit policy number beginning with a “3” or an “8”. Some older policies may have other loan rates as they are based on the prime interest rate. -

New 350 Life and CI Applications

On August 2nd, 2023, Equitable Life® will be updating the privacy and legal sections on some forms. This includes the form 350 Paper Application for Life and/or Critical Illness Insurance. This change will also be applied on our websites and our online application EZComplete®. These changes are part of Bill 64. The Bill is about the protection of personal and private information in Quebec. This will take effect on September 1st, 2023.

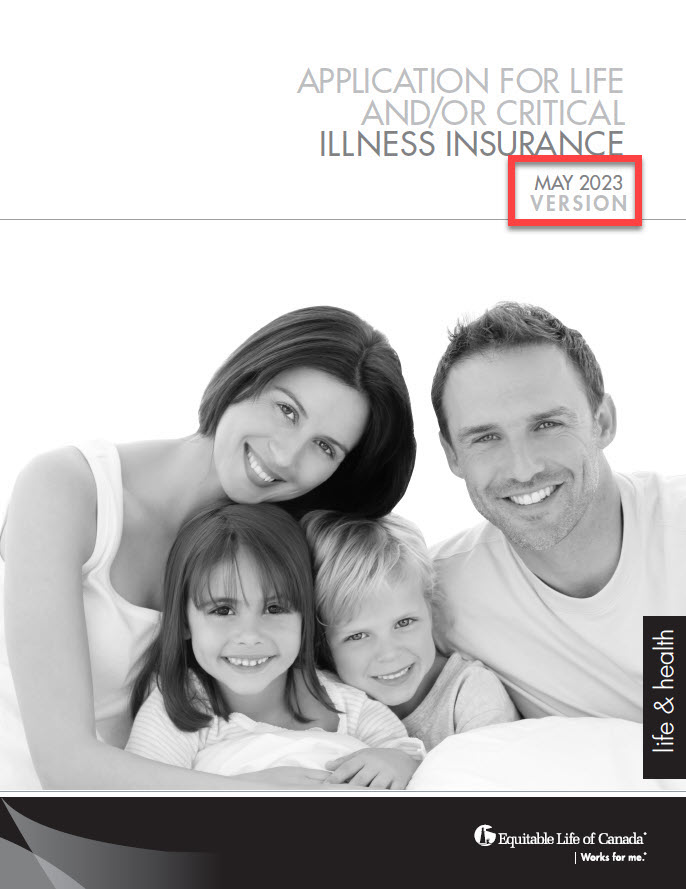

Due to this change, we ask all advisors to use the latest version dated May 2023 of the paper application after August 2nd. Applications in Quebec must use the lastest version from September 1, 2023 onwards.

For all regions outside Quebec, we will support a transition period from ‘old’ to ‘new’ applications until December 31st, 2023. After this date, we will no longer accept older versions of our Life and Critical Illness application.

To make sure you are using the latest version of the application, check the date on the title page. It should say May 2023. See the image below:

.jpg?width=200&height=259)

To order paper copies, click here.

Email completed applications to supply@equitable.ca.

To learn more about Bill 64, please visit Assemblee nationale du Quebec - Bill 64. You may also contact your wholesaler.

® denote a registered trademark of The Equitable Life Insurance Company of Canada. -

Making it easier to claim for Loss of Independent Existence for EquiLiving Critical Illness insuranc

We have recently changed the definition of Loss of Independent Existence (LOIE). As a result, the Critical Illness claim criteria has also changed. Before, EquiLiving® Critical Illness insurance coverage was issued with a definition of LOIE that required clients to have the total inability to do 3 of 6 Activities of Daily Living (ADLs). Now, clients will only need to give us proof of the total inability to do 2 of 6 Activities of Daily Living (ADLs) to submit a claim for LOIE.

This change makes it easier for clients to claim for this covered critical illness. This change is retroactive to February 2022.

Clients will be sent a notice from us with a personalized endorsement from Equitable Life. This applies to their policy and forms part of their contract. We will approve claims for LOIE as outlined in the endorsement.

LOIE is one of the 26 conditions named as a covered critical illness in an EquiLiving policy or Critical Illness insurance rider on an Equitable Life insurance policy. With a loss of independent existence, some activities of daily living can no longer be done on one’s own. This can happen because of a disease or an injury.

Want to learn more? See the marketing piece: Understanding the Covered Conditions (1248).

For more information, reach out to your local wholesaler.

® denotes a trademark of The Equitable Life Insurance Company of Canada. -

Lin covers her life, her partner, her home, and business with Equitable’s Term Life insurance

Lin has just opened her new business. Her partner Terri has supported her through it all, managing the bills and the mortgage so Lin can focus on getting her store established. Lin knows they’ve both worked so hard to achieve what they have.

She wants to make sure they’re covered in case anything happens to either of them.

With Equitable Life® Term Insurance, Lin can get affordable life insurance, which covers her and Terri’s current needs but is also flexible enough to change as their needs change.

This video can help you start the conversation with clients about Term insurance. It walks them through the different term options and the value of being able to convert term coverage to a permanent life insurance policy later on. It also details the KINDTM benefits that are currently available with Term insurance.

Not sure where to start? Send clients this prospecting letter, which you can personalize specifically for them.

Plus, check out our Term product page, then click on the Marketing Materials tab for the latest Term marketing materials.

Want to learn more? Reach out to your local wholesaler.

Watch our new Term insurance with Equitable Life of Canada video to learn more. See it on Vimeo or YouTube.

® and ™ denote trademarks of The Equitable Life Insurance Company of Canada.