Site Search

66 results for dividend scale

- [pdf] Advanced market insurance solutions

-

EAMG - Macro Tear Sheet – Recent Market Volatility Summary

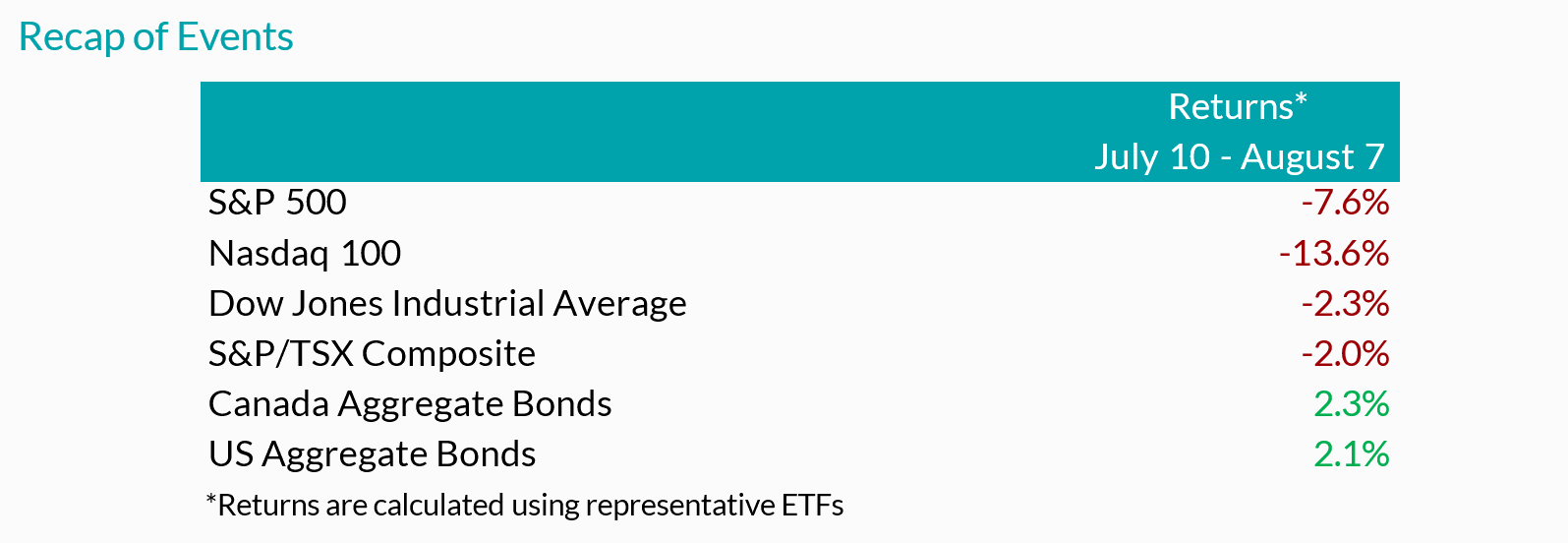

By separating the noise from the signals, we believe the rotation away from the mega-cap technology names is likely to continue. Recent market volatility, triggered by a multitude of factors that include the unwind of the carry trade, investor reactions to mixed mega-cap earnings, and U.S. economic data, may present more investment opportunities for long-term outperformance. Recall over the past year that the majority of U.S. stock market performance came from a limited number of mega-cap technology companies and, in our view, moving forward it will be prudent to analyze the source of returns as rapid market rotations may punish overly-concentrated portfolios.

Inflation Slows (July 11) – Headline U.S. inflation readings increased 3.0% year-over-year in June, decelerating from May (3.3%). With prices slowing ahead of forecasts but economic growth remaining strong, investors became more confident regarding the prospects of an economic soft landing.

Outcome: market strength broadened with traders rotating out of highly concentrated areas of the market (“Fabulous 5”) and into more economically sensitive stocks that had been left behind.

• Big Tech Earnings (July 23 – Aug 1) – High profile mega-cap technology companies – including many members of the Magnificent 7 – reported earnings growth that generally surpassed expectations as margins remained healthy. That said, investors were more focused on spending towards AI-initiatives, rewarding businesses with greater success translating their AI investments into higher sales.

Outcome: this trend is evident through the divergence of returns from IBM and Alphabet (Google’s parent company) after releasing their quarterly earnings. The limited number of companies that contributed to the returns of the S&P 500 failed to impress investors, extending the rotation into other areas of the market.

• Caution is Brewing – Following a strong rally of economically sensitive pockets of the market, notably a breakout of returns from U.S. small cap companies, the low volatility factor, which tends to outperform during times of stress, moved in sync with the small caps’ strength.

Outcome: with a lack of fundamental justification supporting small cap performance, markets showed signs of caution.

• Central Bank Decisions (July 31)– The Federal Reserve held interest rates unchanged during its July meeting, in line with market expectations, reiterating committee members’ need for greater confidence that inflation would continue to subside. That said, policymakers signaled a reduction in policy rates could be a possibility in the coming meetings. In contrast, the Bank of Japan (BoJ) increased its key interest rate while also announcing plans to scale back bond purchases – restrictive monetary policy maneuvers aimed at backstopping the depreciating Japanese currency.

Outcome: the bifurcation between the BoJ and most other major central banks sparked a sharp appreciation of the yen and a rapid unwind of the yen carry trade (see below for explanation).

• Growth Scare (August 2)– In early August, a downside surprise in U.S. nonfarm payrolls (114k actual versus 175k expected) and an increase in the unemployment rate to 4.3%, higher than the 4.1% that was expected and up from 3.5% a year ago triggered concerns of a cooling labor market.

Outcome: speculation swelled surrounding the pace of rate cuts with market participants expecting the Federal Reserve to cut rates as much as 125bps over the next 3 policy meetings, up from 50-75bps as of the end of July. Against this backdrop, the ongoing unwind of the yen carry trade accelerated.

Yen Carry Trade Explained

• Simply put, investors have been borrowing Japanese yen – a low yielding currency – to invest in higher-yielding foreign assets. The primary risks in a carry trade can include the uncertainty of foreign exchange rates (if unhedged), as well as changes to expectations of the underlying yields, among other risks. Over the last 2 decades, the BoJ has implemented an ultra-low interest rate monetary policy to combat deflation and stimulate growth. Furthermore, investors were emboldened by the Japanese yen’s ~53% depreciation versus the U.S. dollar over the last 10 years. With the BoJ hiking its key interest rate while also announcing plans to scale back bond purchases, the yen rallied abruptly. Consequently, highly leveraged investors have had to exit their long positions in riskier assets to repay their borrowed yen exposure.

Peak Carry Trade Unwind – Buying Opportunity

• Peak carry trade unwind, which implies heightened panic levels, has historically created an attractive buying environment. That said, we are focused on companies that have demonstrated robust earnings growth and healthy leverage. Given the unprecedented level of market concentration over the last year, we view the unwind of the carry trade as another catalyst for investors to rotate out of the “Fabulous 5”.

Our Findings:

We found that the peak unwind of the carry trade may be a buying opportunity. At present, the current level of the unwind is similar to many notable market bottoms, including the Great Financial Crisis (2008), the European debt crisis (2010), the oil crash (2014), the subsequent emerging market crisis (2015), the Covid-19 crash (2020), and the collapse of Silicon Valley Bank (2023). We assessed the degree of the unwind by looking at the one-month implied volatility between three currency pairs, U.S. Dollar/Yen, Australian Dollar/Yen, and Euro/Yen. Implied volatility is a measure of the expected future volatility of the underlying assets over a given time period. Amid strong earnings growth and steady margins from quality businesses within the U.S. market, the fundamental backdrop suggests that businesses outside the concentrated AI-darlings may drive the next leg of market returns.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. - Give the Gift of a Head Start

-

EAMG Market Commentary April 2024

April 2024

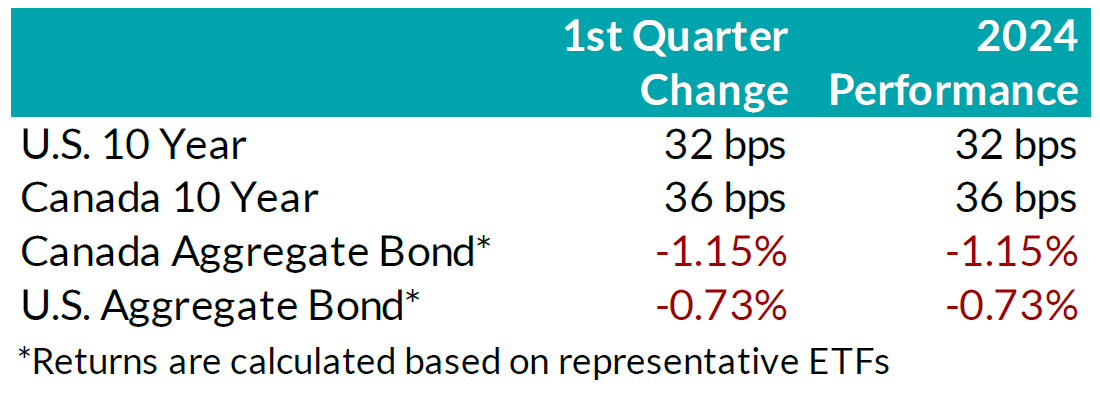

Rates & Credit – Interest rates increased in Q1 2024, giving back half of the decline experienced in Q4 2023 amid consistently positive surprises in U.S. economic data. The positive economic news also drove a strong risk-on tone to the market, with the risk premium on corporate bonds tightening as economic prospects improved. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index (FTSE) with a slightly positive 0.07% return, verses a loss of 1.66% in government bonds and a loss of 1.22% for the overall index. More interest rate sensitive long-term bonds experienced the largest decline, which was partially offset in corporate bonds by the risk-on tone to corporate bond spreads. On a 6-month and 1-year basis, the FTSE remained positive at 6.94% and 2.10%, respectively. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less exposure (notably financials and securitization).

.png?width=850&height=303)

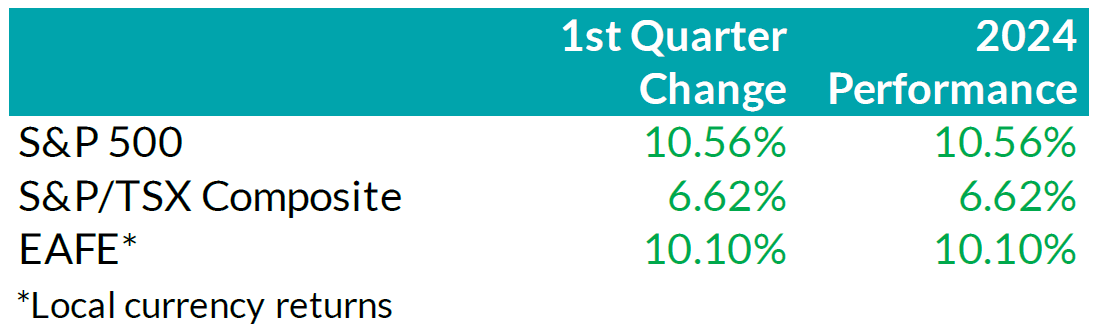

Equity Overview – Throughout Q1 2024, concerns about a recession gradually eased as central bankers adopted a more accommodative outlook on monetary policy. Their growing dovishness reflected confidence that the restrictive monetary measures were effectively curbing inflation as anticipated. Underpinned by prospects of an economic soft-landing, global equity markets rallied to start the year with most major North American indices soaring to new all-time highs during the quarter. U.S. equities continued to outperform other major international markets with the S&P 500 returning 10.6% in USD terms. Major developed economies from Europe, Australasia, and the Far East (EAFE) gained 10.1% in local currency terms, while the TSX added 6.6%. Furthermore, the U.S. economy continued to prove more resilient than most major developed economies, with strong employment and robust output data. As such, foreign investors of U.S. denominated securities achieved enhanced returns, benefitting from a stronger Greenback.

.png?width=850&height=260)

U.S. Fundamentals – Corporate earnings beat expectations in Q4 2023, triggering a wave of upward earnings revision. Stable operating margins, cash flows and debt loads continue to attract investors into equities. Investors appear focused on the company’s ability to sustain debt levels ahead of renewing debt obligations. We observed that the number of major companies that expect improving financial performance shrunk to ~19%. This suggests that concentration risks are likely brewing in the equity market, yet again.

U.S. Quant Factors

Optimistic run-up in equity valuations were mostly driven by the momentum factor. A basket of companies with positive price trends intensified concentration risk in the equity market. We note that momentum factor’ performance sharply contrasted fundamental factors, making us cautious on the market’s complacency. For context, high quality companies, which is typically defined by high Return on Equity (ROE), stable earnings variability, and low financial leverage, placed second in our risk-adjusted performance rankings, and is dwarfed by the ~ 17.9% return observed from the momentum factor.

Canadian Fundamentals – Against the backdrop of underwhelming financial results, ROE – a gauge of how efficiently a corporation generates profits – rebounded in Q4, 2023, after declining throughout most of the year. The improved efficiency metric provided a positive catalyst for dividend investors as the inverse movements of ROE relative to financing costs over 2023 kept investors on the sidelines. In addition, the CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges, providing a tailwind for Canada’s energy and materials sector. Concerns with earnings contraction and macro-economic conditions have subsided.

Canadian Quant Factors – Crude prices soared higher in Q1 2024, with ongoing production cuts from OPEC+ and ramifications of geopolitical conflicts keeping oil markets undersupplied. As such, energy companies benefitted, surging higher and outperforming the broader index, while the low volatility basket – with lower exposure to cyclically sensitive business – underperformed into quarter end. Furthermore, Canadian banks underperformed to start the quarter, giving back some of the sharp outperformance witnessed into the end of Q4 2023. That said, soft inflation data increased expectations of impending rate cuts from the Bank of Canada and, as such, banks performed in line with the broader market throughout most of the quarter. Underpinned by expectations of a dovish switch in monetary policy, investors rewarded dividend payers with a history of increasing dividends, boosting confidence in their ability to support future dividend growth. It is important to note that investors should not let dividend growth’s outperformance overshadow high dividend paying companies’ underperformance; more specifically, investors remain attentive to the businesses’ ability to create value relative to financing costs.

Views From the Frontline

Rates – Interest rates in both Canada and the U.S. increased across all bond tenors in Q1 2024. U.S. inflation data surprised to the upside, remaining stubbornly higher than hoped, while labour market and consumer indicators underscored the economy's continued strength. In Canada, inflation data fell below forecasts, but early 2024 GDP readings exceeded expectations. The market now anticipates a 'soft landing' for the U.S. economy; however, the Canadian economy continues to slow. North American central banks have signaled that we are at the peak for policy rates. The market is currently pricing in approximately two-to-three, 25 basis point interest rate cuts by the U.S. Federal Reserve in the second half of 2024, much fewer than the six-to-seven 25 basis point interest rate cuts that the market had been anticipating even just three months ago. As the Swiss central bank led the way with the first rate cut among developed countries, central banks in major developed economies will closely monitor upcoming data and market developments to determine the timing and pace for rate cuts.

Credit – The risk premium for corporate bonds (versus government bonds) continued to tighten over the quarter, with a strong risk-on tone to the market as investors priced in renewed economic growth in 2024 as compared to previous expectations. Corporate bond supply was robust, with $38.2bn in new issuance, the second strongest first quarter on record. On the balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – We favour a combination of the Dow Jones and the S&P500 for our broad market exposure. The Dow, a price-weighted index, should have some value and low volatility tilt as it tracks mature large companies. As explained above, concentration risks are brewing in the equity market, and during Q1 this risk was exacerbated by investors rushing into a basket of companies with positive price trends, thereby pushing valuation metrics further into the expensive territory. In our view, it is well-suited to use a combination of the Dow Jones Industrial Average and the S&P 500 for broad U.S. market exposure given the heightened concentration risk. Looking forward, we expect companies to exhibit stable operating margins and therefore, we are shifting our focus toward the balance between upcoming corporate debt refinancing requirements and reinvestment in projects intended to drive future growth. In plain words, we are tactically adding to companies with stable cash flows and decreased debt loads outside of the mega-cap group. In Canada, we expect a modest earnings growth and remain attentive to how efficiently a corporation generates profits relative to their financing cost. We caution against the overly optimistic, commodity driven, “catch-up” trade vs. our southern neighbour. Therefore, we tweaked our investment strategy by rotating out of the low volatility factor and adding to higher yielding quality companies in Canada.

Downloadable Copy

Mark Warywoda, CFA VP, Public Portfolio Management Ian Whiteside, CFA, MBA AVP, Public Portfolio Management Johanna Shaw, CFA Director, Portfolio Management Jin Li

Director, Equity Portfolio ManagementTyler Farrow, CFA

Senior Analyst, EquityAndrew Vermeer

Senior Analyst, CreditElizabeth Ayodele

Analyst, CreditFrancie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

Market Comments - October 2024

Key Takeaways for Q3· Central banks eased monetary policy by reducing their target interest rates.

· Bond markets performed very well during the quarter as interest rates fell.

· Risk markets experienced some volatility, but stock markets had robust returns.

· Canadian stocks outperformed U.S. stocks in Q3, while the sources of returns in the U.S. market were more balanced and diversified than in the first half of the year.

Views From the Frontline

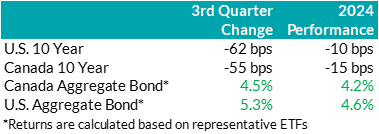

Bond Markets: During the third quarter, interest rates in both Canada and the U.S. moved significantly lower as markets anticipated that the Bank of Canada would continue – and the Federal Reserve would start – cutting rates. Additionally, the expectation became that the central banks would end up lowering rates more aggressively than previously assumed. That’s because inflation data has softened sufficiently to give the central banks the scope to ease policy, and other economic data, especially from the labour market, indicated the need for them to ease policy in order to prevent economic activity from cooling too much. For instance, in Canada, inflation slowed to the Bank of Canada’s 2% target, while the labour market showed warning signs with the unemployment rate rising to 6.6%. The Bank of Canada cut its target interest rate by 0.25% at each of its July and September meetings. Governor Macklem indicated that if growth does not materialize as expected, “it could be appropriate to move faster on interest rates”. In the U.S., the Federal Reserve kicked off its easing cycle by cutting its target rate by 0.50% in September. The growing signs of a cooling labour market amidst slowing inflation motivated the larger-than-typical move. That said, consumer spending in the U.S. continued to be strong, and GDP is still tracking a healthy growth rate.

While interest rates fell, bonds returns were also boosted by solid behaviour of corporate bonds. Credit spreads (i.e. the risk premium for corporate bonds versus government bonds) continued to grind lower over the quarter. Tightening credit spreads reflected the generally positive risk-on tone to the market, despite some volatility. Lower-rated BBB bonds performed better than higher-quality A-rated bonds. Credit spreads have now generally fallen back to levels that are largely consistent with the tight post-pandemic levels experienced in 2021. The on-going appetite of investors for the extra yield offered by corporate bonds over government bonds is indicated not just by falling credit spreads, but also by investors’ enthusiasm to support the primary issuance market. Corporate bond supply continues to be very robust, with $29B (billion) in new issuance during the quarter, resulting in an impressive $119B issued year-to-date, a new record. Nonetheless, on balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward trade-off as being more favourable.

Stock Markets: In the U.S., we continue to caution against heavily concentrated sources of market returns and emphasize a diversified portfolio. Last quarter, diversification proved essential as a multitude of factors heightened market volatility. These factors – which included the unwind of the yen carry trade, investor reactions to mixed mega-cap earnings, and concerns of a slowing labour market – drove investors away from mega-cap technology names and into defensive areas of the market. Following the Federal Reserve’s decision to reduce interest rates by 0.5%, sources of investment returns continued to broaden as investors rotated into economically-sensitive baskets. Underpinned by decelerating inflation and easing monetary policy, we believe the rotation away from the mega-cap tech names is likely to persist and we continue to emphasize portfolio diversification. In Canada, high-quality, high-yielding businesses – composed of the financial sector and non-financial dividend payers – outperformed over the quarter as investors rewarded companies that demonstrated a strong ability to sustain dividends, as well as greater efficiency generating profits. While we continue to favour these businesses, we have taken profit on our financial sector dividend exposure after a sharp reversion in the premium between value creation and current yield. In addition, Chinese officials introduced a wave of stimulus to revitalize growth, bringing life back to the metals and luxury goods sectors. Accordingly, Canadian and European equities have benefitted recently.

Market Update

Rates & Credit: In Q3, interest rates in both Canada and the U.S. decreased significantly, with front-end interest rates declining faster than long-end interest rates amid cooling inflation and a weakening labour market. As a result, the FTSE Canada Universe Index posted a positive return of 4.7%. Coincidentally, Canadian corporate bonds and government bonds each also generated returns of 4.7%, totally in-line with the Universe index. On the other hand, despite short-term interest rates falling much more than long-term interest rates, the higher price sensitivity of long-dated bonds had them outperform shorter-dated bonds, with the Long-Term bond index up 5.8% while the Short-Term bond index gained 3.4%. Similarly, within corporate bonds, industries that have longer-dated debt (e.g. energy and infrastructure) outperformed those that tend to have shorter-dated debt (e.g. real estate and financials).

Rates & Credit: In Q3, interest rates in both Canada and the U.S. decreased significantly, with front-end interest rates declining faster than long-end interest rates amid cooling inflation and a weakening labour market. As a result, the FTSE Canada Universe Index posted a positive return of 4.7%. Coincidentally, Canadian corporate bonds and government bonds each also generated returns of 4.7%, totally in-line with the Universe index. On the other hand, despite short-term interest rates falling much more than long-term interest rates, the higher price sensitivity of long-dated bonds had them outperform shorter-dated bonds, with the Long-Term bond index up 5.8% while the Short-Term bond index gained 3.4%. Similarly, within corporate bonds, industries that have longer-dated debt (e.g. energy and infrastructure) outperformed those that tend to have shorter-dated debt (e.g. real estate and financials).

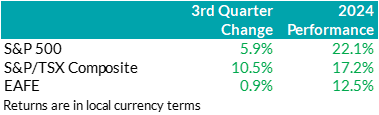

Equity Overview: Underpinned by decelerating inflation data and easing monetary policy – including the outsize 50-basis cut from the Federal Reserve – prospects for an economic soft landing increased over the quarter. That favourable outlook spurred global equity markets to all-time highs, with previously lagging areas of the market narrowing the performance gap compared to the U.S. mega-cap technology names that had led returns in the first half of the year. Canadian equities outperformed their U.S. counterpart last quarter, rising 10.5% as strength in the banking and materials sectors pushed the index higher. Major developed markets from Europe, Australasia, and the Far East (EAFE) were more subdued, gaining 0.9% (in local currency terms) last quarter. That said, grand expectations for further interest rate cuts in the U.S. pushed the greenback to its lowest level in over a year, boosting EAFE returns to over 7% in U.S. dollar terms. Within the U.S., sources of market returns broadened as well, with investors rotating out of concentrated AI companies and into more economically sensitive businesses.

Equity Overview: Underpinned by decelerating inflation data and easing monetary policy – including the outsize 50-basis cut from the Federal Reserve – prospects for an economic soft landing increased over the quarter. That favourable outlook spurred global equity markets to all-time highs, with previously lagging areas of the market narrowing the performance gap compared to the U.S. mega-cap technology names that had led returns in the first half of the year. Canadian equities outperformed their U.S. counterpart last quarter, rising 10.5% as strength in the banking and materials sectors pushed the index higher. Major developed markets from Europe, Australasia, and the Far East (EAFE) were more subdued, gaining 0.9% (in local currency terms) last quarter. That said, grand expectations for further interest rate cuts in the U.S. pushed the greenback to its lowest level in over a year, boosting EAFE returns to over 7% in U.S. dollar terms. Within the U.S., sources of market returns broadened as well, with investors rotating out of concentrated AI companies and into more economically sensitive businesses.

U.S. Fundamentals: Outside of the Magnificent 7, investors are interpreting downside earnings surprises as a normalization of financial performance rather than a deterioration. For example, McDonald’s share price rallied over 17% into quarter-end following its earnings release despite announcing declining sales and contracting earnings per share. Within the AI-ecosystem, investors are beginning to look for opportunities beyond chip manufacturers, such as nuclear energy providers. At an index level, our work shows that members of the Russell 1000 index, excluding the Mag-7, posted a median earnings growth of nearly 9% year-over-year, expanding from the ~6% witnessed in Q2. Furthermore, the number of companies from this group reporting positive earnings growth grew to approximately 67%, up from 60% in the prior quarter. In our view, the ongoing broadening of earnings strength outside of the Mag-7 can provide tailwinds to current market rotations into previously left-behind companies. Within the mega-cap tech space, investors have become more discriminant than in prior quarters, rewarding businesses with greater success monetizing their AI-investments. This trend was evident through the divergence of returns from IBM and Alphabet (Google’s parent company) following their quarterly earnings.

U.S. Quant Factors: Decelerating U.S. inflation data prompted a rotation out of highly concentrated areas of the market (growth) and into more economically-sensitive companies (value). Then, concerns of a slowing U.S. labour market and the unwind of the yen carry trade increased market volatility, leading investors to shelter their positions by reallocating to low volatility. As the quarter progressed, expectations of easing monetary policy and stabilizing employment data helped calm return to the market and the rotation from mega-cap tech sector resumed, albeit at a lesser pace. Notably, this “catch-up” trade also benefitted dividend-paying companies, particularly those with a lengthy and established history of increasing dividends, as investors favoured those more mature operations.

Canadian Fundamentals: Investors returned to the Canadian market after Canadian companies showed signs of recovery last quarter with earnings expanding by more than expected. With inflation showing clearer signs of deceleration and the outlook regarding the path of monetary policy increasingly implying lower interest rates going forward, investors are allocating toward high-quality, dividend-paying companies. From a sector level, surging gold prices provided a tailwind for Canadian miners, helping the materials sector outperform over the quarter. More recently, the materials sector has benefitted from elevated base metal prices following the arrival of Chinese stimulus. In contrast, oil prices declined over 16% last quarter as fears of an oversupplied market swelled following speculation that OPEC+ would look to dial back production cuts. As a result, investors looked past lingering geopolitical risks and the energy sector underperformed.

Canadian Quant Factors: Amid an improving Canadian macroeconomic backdrop and clearer outlook on the trajectory of monetary policy, dividend-yielding businesses became sought after. More specifically, investors continued to emphasize dividend sustainability last quarter, rewarding dividend-paying businesses that demonstrated strong financial performance and the ability to support future payouts. For example, the major Canadian banks sharply outperformed in Q3 after reporting earnings growth that mostly exceeded expectations. In essence, investors have become more constructive on this high-yielding group as their ability to create value relative to financing costs improves.

Downloadable Copy

ADVISOR USE ONLYMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

Tax impacts of the Canadian Dental Care Plan for your clients

Tax impacts of the Canadian Dental Care Plan for your clients*

Earlier this year, the government shared its progress on the Canadian Dental Care Plan (CDCP).

The CDCP will be available to Canadians with an annual family income of less than $90,000 who do not have dental benefits. Co-pays will be waived for eligible Canadians with a family income of less than $70,000.

Canadians who have access to private dental coverage are not eligible for the CDCP. This means that your clients must now report on T4s/T4As if dental coverage** was available on December 31 of the reporting tax year for:- Employees,

- Employees’ spouses and/or dependents,

- Former employees, and

- Spouses of deceased employees.

This new tax reporting requirement is mandatory starting with the 2023 tax year. Employee tax slips will include new boxes for employers to complete:- Box 45 (T4): Employer Offered Dental Benefits. This new box will be mandatory.

- Box 015 (T4A): Payer Offered Dental Benefits. This new box will be mandatory if plan sponsors report in Box 016, Pension or Superannuation. The box will otherwise be optional.

- Code 1: The plan member has no access to dental care insurance or coverage of dental services of any kind.

- Code 2: Only the plan member has access to any dental care insurance, or coverage of dental services of any kind.

- Code 3: The plan member, their spouse and their dependents have access to any dental care insurance, or coverage of dental services of any kind.

- Code 4: Only the plan member and their spouse have access to any dental care insurance, or coverage of dental services of any kind.

- Code 5: Only the plan member and their dependents have access to any dental care insurance, or coverage of dental services of any kind.

Reports for dependents

We have a report available for plan members who have enrolled their dependents in benefits coverage. Your clients can contact their local service team representative to receive a copy of the report. We are working to make it available on our Advisor and PA websites.

Questions

For guidance on your tax slips and reporting obligations, please encourage your clients to contact their accountant, payroll provider or tax advisor.

Supporting plan members affected by the Israeli-Palestinian conflict*

Traumatic events continue to unfold in the Middle East. Enduring ongoing news of conflict and suffering could challenge many Canadians. During this difficult time, Equitable encourages affected clients and plan members to access the mental health support they need.

Large-scale traumatic news events can cause people to experience intense reactions. This puts a lot of strain on their mental health. Having coping mechanisms to deal with the current crisis can be a huge help. Any Equitable Life plan member who needs mental health support can visit Homeweb.ca/equitable to access online resources or contact Homewood at 1.888.707.2115.

Support available to all Equitable plan members

Support available to plan members with the Homewood Health EFAP

For your clients that have purchased Homewood Health’s Employee and Family Assistance Program (EFAP), remind them that their plan members also have access to confidential counselling services. The EFAP provides plan members with 24/7 access to confidential counselling through a national network of mental health professionals. Whether it’s face-to-face, by phone, email, chat or video, plan members and their dependent family members will receive appropriate, timely support for the issue they’re dealing with.

Questions?

If you need more information, contact your Group Account Executive or myFlex account executive.

*Indicates content that will be shared with your clients. - Equitable and Cloud DX

-

EAMG Market Commentary July 2023

Posted July 27, 2023

July 17, 2023

Rates & Credit - The rates market was volatile in Q2 as investors focused on inflation, central bank interest rate decisions, and recession probabilities. Persistent strength in U.S. consumer spending and labour markets have surprised investors and prompted further interest rate tightening from central banks. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a total return of 0.2%, versus a loss of 1.0% for government bonds and 0.7% for the overall Index. The corporate bond outperformance was driven by a broad risk-on tone to the market, most notably in April as the market recovered from the banking sector liquidity crisis that developed during March. That said, the market tone remained cautious, with the improved risk premium on corporate bonds tempered by lingering concerns around sticky inflation, high interest rates, and the potential for slower economic growth into the latter half of the year.

Dominance of U.S. Equities – U.S. equity markets posted another strong quarter with the S&P 500 returning 8.7%, outperforming Canada and other major international equity markets. The S&P/TSX Composite, returned 1.2% in CAD. Major developed economies from Europe, Australasia, and Far East (EAFE) returned 3.2% in local currency terms. The highly anticipated re-opening of the Chinese economy has failed to materialize with economic data indicating less strength than previously forecasted. Amid sluggish Chinese growth, closely interconnected economic partners such as the European Union, as well as commodity-driven markets like Canada, have all underperformed the U.S. on a relative basis.

U.S. Fundamentals – Earnings continued to contract versus prior year, albeit at a slower pace than forecasted. Forward earnings guidance improved quarter-over-quarter with corporate sentiment returning to neutral levels. Based on our analysis, we observed that 31% of major companies expect deteriorating financial performance, while 33% expect improved performance, with the remaining expecting no material change. Overall, major U.S. companies remain well capitalized with strong operating margins. However, company guidance indicates a prioritization of cost controls amid increased consumer indebtedness and concerns about the health of the consumer.

Artificial Intelligence (AI) Mania – Despite concerns that the U.S. economy is at a late stage in its economic cycle, that monetary tightening by central banks could go too far, and the fact that earnings contracted on a year-over-year basis, equity markets became more expensive during the quarter with price-to-earnings multiples expanding. This expansion was driven by investors crowding into AI focused technology companies, with the seven largest AI/technology themed companies averaging a 26% return while the other 493 members gained only 3%. Investors rewarded businesses with contributions to AI development (hardware and software components), as well as those with the ability to implement synergies from leveraging the technology. A crowded market surge is not uncommon at this point in the economic cycle, where positive economic surprises, in this instance, strong employment and consumer spending can lead to an upswelling in investor confidence.

U.S. Quant Factors – Using our investment framework, we currently favour exposures to large cash-rich companies with innovative product offerings, which we believe offer the strongest risk-adjusted returns in the current market environment. While the valuation of AI companies seems to defy traditional rationales, the momentum has continued to push the group higher. Consequently, the Quality factor (companies with higher return-on-equity, strong operating performance, and healthy leverage levels) participated in the AI trend and consistently outperformed throughout the quarter. The Low Volatility factor (stocks with lower sensitivity to broad market movement, and lower price volatility) underperformed through the quarter. While the Low Volatility factor typically performs well at this stage of the economic cycle, the fact that a small number of stocks were responsible for much of the market’s return hurt this factor. Lastly, the Momentum factor (stocks with a recent history of price appreciation) initially underperformed during the quarter before rebounding in June. This factor’s recent outperformance suggests that the market is becoming complacent and possibly signals that rotations within the market are slowing as current trends remain in favour.

Canadian Fundamentals – Top line revenue missed forecasts while bottom line earnings were consistent with expectations. Softer-than-expected results out of Canadian financials, as well as underwhelming results from the materials sector, dragged on the aggregate index performance. Earnings forecasts for the rest of the year have been revised downward with analyst expecting index aggregate earnings to detract 2% to 3%. Meanwhile, the Bank of Canada raised its overnight interest rate by 25 basis points, bringing it to 4.75% on the backdrop of robust economic data releases including Q1 GDP and April CPI.

Canadian Quant Factors – The most notable dislocation in Canada was the convergence of the dividend yield of High-Dividend ETFs and Equal-Weight Bank ETFs. We believe that the drag from Canadian banks following the U.S. regional banking concerns in March resulted in a discount of the Quality factor as the performance of the group is sensitive to the movements of banks. While banks did recover around 35% of their SVB-induced underperformance, the nature of banking has attracted investor scrutiny given the view that we are in the late-stage of the economic cycle. That said, this environment is an attractive environment to add variants of the Quality factor, which would gain exposure to a rebounding industry that offers a similar dividend yield to the high dividend stocks.

Views From the Frontline

Rates – On an outright basis, bond yields across the curve continue to look attractive. Economic data remains strong however we are beginning to see the first signs of weakness in spending, jobs and inflation. Slower growth, a more balanced labour market, declining inflation, and tighter credit conditions will likely drive interest rates lower throughout 2023. Market participants remain focused on the extent of interest rate hikes and the duration of a pause required to bring inflation back to the 2% target. With inflation remaining more persistent than previously expected forecasts around the timing, pace and extent of the removal of monetary policy have been pushed into 2024.

Credit – The uncertain economic outlook and risks around slower economic growth later this year merit caution about corporate bonds and a bias towards higher-quality, shorter-dated credit where we think the risk / reward dynamic are more favourable. That said, the “soft-landing” narrative, now more pervasive in the market, could continue to provide support to risk assets, which we view as an opportunity to further pare down higher beta exposure.

Equities – Given the direction of the current economic and company fundamental data, we continue to favour high quality growth segments of the market with strong operating margins. As such, the late cycle conditions in the market reinforce our preference for large cap stocks over smaller, more U.S. domestically focused businesses. The U.S. Low Volatility factor’s underperformance is unlikely to reverse in the short term given the resilience of the U.S. economy. Furthermore, after a steep decline last quarter, we expect that cyclical value will find support in the near term, echoing the increased chance of slowing inflation without stalling economic growth. In Canada, equities are typically more cyclical in nature, which coupled with the potential for an earnings contraction, makes us view the Low Volatility factor as more likely to outperform. Like the U.S., we prefer Canadian high-quality companies to navigate through the late cycle environment. On the heels of poor Chinese economic data and underwhelming stimulus, we are maintaining our overweight to the U.S. relative to Canada and EAFE.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. -

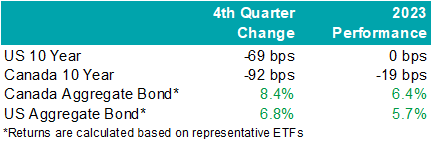

EAMG Market Commentary January 2024

Rates & Credit – Interest rates decreased sharply in Q4 as the market priced in aggressive interest rate cuts by central banks in 2024. The prospect of lower interest rates also drove a strong risk-on tone to the market, with the risk premium on corporate bonds grinding tighter as prospects for a “soft landing” improved. The rally in interest rates resulted in the best quarter for bonds over the past 15 years, with the FTSE Canada Universe Index returning 8.3%. Corporate bonds modestly underperformed the Universe Index with a return of 7.3%. The lower return for corporate bonds was primarily driven by the fact that the corporate bond index is less sensitive to interest rate movements (as compared to the government index), partially offset by the risk-on tone to the market. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds. Industries with higher interest rate exposure such as infrastructure, energy, and communications outperformed those with less exposure (notably financials and securitization), consistent with the overall shift in the yield curve.

.png)

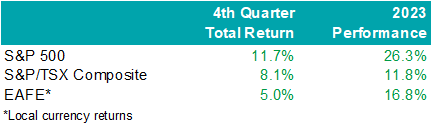

Santa Came to Town – Moving in sync with bonds, global equities jolted higher into the end of the year with cooling inflation data and dovish comments from central bankers. The U.S. market outperformed most regions last quarter with the S&P 500 returning 11.7% in USD terms, bringing the total return in 2023 to 26.3%. The TSX added 8.1% in Q4, boosting the total annual return to 11.8%. Meanwhile, major developed economies from Europe, Australasia, and the Far East (EAFE) gained 5.0% in local currency terms over the quarter, helping the region produce a 16.8% return from the year prior. Prospects of interest rate cuts by the Federal Reserve saw the Loonie rally into year-end and resultantly, investors of Canadian dollar securities witnessed enhanced returns. Strong domestic U.S. economic data helped value pockets of the market outperform. That said, this was not a synchronized trend as China’s economic disappointment weighed on the performance of EAFE.

U.S. Fundamentals – Our work shows that investors are shifting their focus away from operating margins and towards the ability to sustain debt levels ahead of renewing debt obligations. Corporate earnings beat modest expectations last quarter, contracting by less-than-expected on a year-over-year basis. Resilient operating margins continue to attract investors into equities. After three consecutive quarters of improving forward earnings guidance, we observed that the number of major companies expecting deteriorating financial performance grew to ~35%. We note that this is a sharp contrast relative to the optimistic run-up in equity valuations. In general, corporate pessimism has been underpinned by concerns for the health of the consumer, increasing wage pressures, and inflation.

U.S. Quant Factors – While mega-cap technology stocks gave back some ground in the second half, crowding into the magnificent 7 remains noticeable with the cap weighted S&P 500 outperforming the equal weighted index by 12.5% last year. That said, value areas of the market – which underperformed through the first three quarters of the year – were top performing companies last quarter as the prospects for an economic “soft-landing” improved with U.S. inflation continuing to ease without substantial deteriorations of employment or output data. Quality-growth businesses initially outperformed as the higher-for-longer narrative continued to drive investors toward large cash-rich companies with stable margins. That said, this basket of companies gave back relative returns into quarter-end as weakness in operating margins persisted, making fundamentals appear stretched. Low volatility stocks (i.e. stocks with lower sensitivity to broad market movement and lower price volatility) rallied to start the quarter before dovish comments from central bankers improved risk-sentiment and ultimately pushed this basket lower on a relative basis. Lastly, dividend growth companies, which include businesses with a lengthy and established history of increasing dividends, underperformed the broader index as market participants punished businesses that slowed capital growth projects during the rising interest rate environment. While operating margins have declined, the basket’s strong cash flow and low debt burden may be advantageous if the market’s anticipation of impending interest rate cuts proves to be incorrect or mistimed.

Canadian Fundamentals – Although Canadian companies exceeded bleak forecasts last quarter, earnings continue to contract on a year-over-year basis. Return on equity (ROE) – a gauge of how efficiently a corporation generates profits – continued to decline last quarter while corporate costs of capital remain elevated. In essence, Canadian companies are generating less value relative to their financing cost. Value creation underpins the sustainability of dividend payments, which are a unique and desirable attribute of the Canadian market. Meanwhile, the Bank of Canada held its overnight interest rate unchanged with market participants forecasting a higher probability of interest rate cuts in 2024. On the expectations of easing monetary conditions, dividend yields compressed while earnings forecasts improved with analysts predicting that index aggregate earnings will grow 6% to 8% in 2024. At a sector level, the energy industry’s financial performance normalized – in line with expectations – as weakening oil demand expectations overshadowed geopolitical conflict in the Middle East, ultimately pushing crude prices ~21% lower last quarter. The industrials and financials sectors beat expectations, helping offset softer-than-expected results from the consumer staples and technology sectors.

Canadian Quant Factors – The Canadian banks underperformed for most of the year as they reported increasing provisions for nonperforming loans, reflecting forecasts of worsening economic conditions. That said, expectations of interest rate cuts in 2024 helped tame recession fears and eased concerns of slowing loan growth, propelling banks higher in the fourth quarter as they appeared more stable and therefore favourable than prior estimates. The high-quality basket underperformed last quarter as improving risk sentiment in the market reduced the attractiveness of secure companies with lower earnings variability. Furthermore, high dividend payers with solid growth prospects outperformed in the fourth quarter as market participants rewarded companies that demonstrated a strong ability to support future dividends and punished high yielding businesses with less certain financial capabilities.

Views From the Frontline Rates – Interest rates declined sharply in Q4 as inflation continued to trend lower, fears of excess bond supply declined, and the Federal Open Market Committee signaled that the next change to their overnight policy interest rate would likely be lower. Labour market and consumer spending data remain resilient however businesses have indicated slowing across industries, more price-sensitive consumers, rising delinquencies, and concerns about the high cost of debt. Central banks remain committed to achieving their 2% inflation target and most acknowledge that interest rates have likely peaked.

Credit – The risk premium for corporate bonds (versus government bonds) tightened materially over the quarter, with a strong risk on tone to the market as investors priced in lower interest rates in 2024 and a “soft-landing” to economic concerns. Corporate bond supply was well received by the market. On the balance, we do not think the current risk premium adequately compensates for downside risk, and as such, we remain cautious on corporate bonds and have a bias towards higher-quality, shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – In the U.S., we allocated exposure to value names which outperformed over the quarter as the macroeconomic outlook improved on the backdrop of rate cut expectations. Looking forward, we expect that margins will continue to normalize as Covid-induced pent up demand fades. While we do not forecast margins to compress at an alarming rate, we believe sticky wage and input costs will continue to pressure businesses while consumers exhibit further exhaustion. As such, we are shifting our focus toward the balance between company reinvestment in capital projects and upcoming debt refinancing requirements. In line with this view, we favour businesses with stable cash flows and decreased debt loads as we believe they present an attractive contrarian opportunity if soft-landing projections prove to be overstated. Within Canada, we remain attentive to the inverse movements of ROE relative to financing costs over 2023. With the excess between ROE and financing costs compressing, businesses’ ability to create value appears more stretched than earlier in 2023. Therefore, we continue to favour high quality companies in Canada, which is typically defined by high ROE, stable earnings variability, and low financial leverage. Geographically, the U.S. economy appears to be in healthier condition with inflation easing while employment and output data remain stable and hence, our focus will be on capital expenditures. EAFE – which is generally more economically linked to China than North America – contains a large bucket of stable, high-quality businesses that may benefit from any upside economic surprises out of China. Lastly, through the lens of a Canadian investor, the Loonie’s relative value versus other major currencies presents another resource in our investment mandate to derive excess return.Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

EAMG Market Commentary October 2023

October 20, 2023

Rates & Credit - Interest rates increased steadily in Q3 against the backdrop of sticky inflation, strong economic growth, and a tight labour market. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a loss of 2.2%, versus a loss of 4.4% for government bonds and a loss of 3.9% for the overall index. The outperformance was primarily driven by the fact that the corporate bond index is less sensitive to interest rates movements (as compared to the government index), all else being equal. The outperformance was also driven by an improvement in risk-appetite, with lower-rated BBBs slightly outperforming higher-rated A bonds. Industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less (notably financials and securitization), consistent with the overall shift in the yield curve.

Equities Lose Traction – Global equity markets lost momentum last quarter with the TSX declining 2.2% while major developed economies from Europe, Australasia, and the Far East (EAFE) fell 1.3% in local currency terms. U.S. equity markets, while falling approximately 3.3%, were cushioned by a strong greenback, with the index declining only 1% in Canadian dollar terms. With inflation prints continuing to be stubbornly high and employment data remaining strong, central bankers emphasized their commitment to a higher-for-longer approach to monetary policy. The hawkish tones out of the Federal Reserve pushed bond yields higher and consequently, pressured equities lower. Furthermore, mixed economic data out of China rattled investor sentiment over the quarter as global growth forecasts came under scrutiny.

U.S. Fundamentals – Although U.S. earnings continue to contract on a year-over-year basis, companies surpassed expectations with investors remaining highly focused on signs of deteriorating operating margins. After bouncing off Q1 2022 lows, forward earnings guidance continues to improve on a quarterly basis. Based on our analysis, ~35% of major companies revised earnings forecasts higher (+2% versus Q2) while ~33% held expectations constant, with the balance expecting deteriorating financial performance. Overall, improved efficiencies through cost-cutting measures and stronger-than-expected pricing power have contributed to resilience in operating margins, and therefore renewed optimism about forecasted financial performance.

Equal Weight S&P 500 versus S&P 500 – Persistent crowding into mega-cap technology stocks – which has driven the majority of market returns year-to-date in the U.S. – slowed at the beginning of the summer before reaccelerating into quarter end. The persistence of this trend has resulted in the equal-weighted version of the S&P 500 index returning a mere 1.8% over the first three quarters of the year, markedly lower than the 13.1% return observed from the S&P 500. We continue to emphasize that a crowded market surge is not uncommon during late stages of the economic cycle, and we remain focused on delivering optimal risk-adjusted returns with quantitative factors.

U.S. Quant Factors – The quality-growth areas of the market continued to outperform last quarter with market participants seeking large cash-rich companies with innovative product offerings and stable operating margins. That said, the pricing power of these companies has weakened more recently with consumers having depleted pandemic-era savings and stimulus. As such, fundamentals are beginning to appear overvalued. Low volatility stocks (i.e. stocks with lower sensitivity to broad market movement and lower price volatility) performed in-line with the overall market for most of the summer before underperforming into quarter-end when crowding into big-tech returned. While top-line projections are forecasted to post stable growth, the basket’s relatively lower operating margins remain a headwind amid surging interest rates. Dividend growth companies, which include businesses with a lengthy and established history of increasing dividends, performed approximately in-line with the broader index over the quarter. With the market forecasting overly-negative fundamental performance, this factor is positioned as a contrarian opportunity in the market.

Canadian Fundamentals – Unlike those in the U.S., Canadian companies reported shrinking operating margins in general, pressuring equity pricing. Like in the U.S., Canadian corporate earnings were mostly consistent with expectations but continue to contract on a year-over-year basis. The energy sector benefitted from a ~30% increase in oil prices during the quarter, as OPEC’s restrictive oil production schedule pushed crude markets deeper into under-supplied territory. Those higher energy prices buoyed performance of stocks in the energy sector, one of only two sectors with positive performance during the quarter, helping partially offset softer-than-expected results out of the financials and communications sectors. Meanwhile, the Bank of Canada continued with its hawkish monetary policy by raising its overnight interest rate by another 25 basis points, bringing it to 5%. Their efforts to slow economic growth are beginning to cause some deterioration in fundamentals and, with one quarter remaining, analysts are expecting Canadian earnings to contract ~9% for the year.

Canadian Quant Factors – With central banks around the world continuing to hike interest rates and uncertainty surrounding China’s economic health, global growth prospects fluttered over the quarter. The cyclical nature of the Canadian market, and therefore its reliance on global partners, saw equity prices put under pressure by growth concerns. As a result, the quality bucket benefitted from defensive positioning by investors and thus resumed its climb in Canada. Investors continue to prefer mature, large businesses that are better positioned in a restrictive economic environment due to their more stable operating margins. The value factor – which was beaten down in Q2 – rebounded last quarter with supply-driven energy strength helping to propel energy stocks higher. Low volatility initially displayed similar performance to the TSX, but energy’s rapid surge into the end of summer pressured the group lower. Given higher risk-free rates, the dividend factor also underperformed over the quarter, with dividend yields becoming less attractive on risk adjusted basis.

Views From the Frontline

Rates – Both nominal and real – rose sharply in Q3 to levels not seen since the Great Financial Crisis of 2008. A healthy labour market, strong consumer spending, persistent inflation and excess supply concerns drove the interest rate increase. Although the economy is starting to witness a deceleration in consumer spending and tighter credit conditions, central banks remain committed to maintaining a higher policy rate for longer to bring inflation back to the 2% target.

Credit – The risk premium for corporate bonds (versus government bonds) has been range-

bound over the past quarter as investors’ evaluations of a variety of scenarios have evolved: soft-landing versus a recession, geopolitical uncertainty, further central bank increases, among other things. On the balance, we do not think the current risk premium adequately compensates for downside risk, and as such, we remain cautious on corporate bonds and have a bias towards higher-quality, shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equities – Geographically, we began the quarter with a preference for U.S. equities relative to Canada and EAFE. In-line with our expectations, U.S. stocks outperformed the two regions in Canadian dollar terms. That said, weakness in the Euro versus the Canadian dollar was a headwind for our EAFE exposure. With earnings yield – which is the percentage of earnings relative to price – becoming less attractive compared to risk-free rates in the U.S., and the greenback strength becoming overstretched from a technical perspective, we have pared back our overweight U.S. position. Moreover, with Chinese officials focusing efforts on the introduction of new stimulus packages, we believe that more cyclical markets like Canada and EAFE will retrace some of their losses in the near term. Within the U.S., we entered Q3 with a constructive view on high quality growth segments of the market that provide strong operating margins during the current late economic cycle conditions. The factor moved in-line with our expectations, as highlighted in the “U.S. Quant Factor” section, and we are tactically decreasing our exposure amid stretched fundamentals. In Canada, we continue to prefer high-quality companies due to their strong fundamentals, with the group currently displaying momentum versus the broader TSX. Tactically, we are participating in the oil supply shock through the value factor.

Downloadable CopyMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Mohamed Bouhadi, CFA

Senior Analyst, Rates

Tyler Farrow

Analyst, Equity

Andrew Vermeer

Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

Posted November 3, 2023