Site Search

362 results for where to check completed case

- [pdf] Business Information Form

-

Equitable Insights: Our Large Case Experts

Welcome to the fifth video in our Equitable Insights series. “Our Large Case Experts” features Scott Morrow, Individual Insurance Sales Vice President, MGA East, Equitable Life.

-

Get to know our large case experts

Equitable launches new Ask our Experts video series

At Equitable®, we’re committed to the large case market. Our dedicated team of experts is here to support you from application through to policy placement.

We are thrilled to share the first episode of Ask our Experts. This mini docuseries features key members of our large case team. They talk about their work, their perspectives, and their role in the large case experience.

Watch Ask our Experts Episode 1 featuring Cindy Shirley, Chief Underwriter and Claims Risk Management

Cindy chats with us about:• Her approach to large case underwriting.• The large case underwriting team.• The important relationship between advisors and underwriters.Visit our large case markets webpage to learn more about our team of dedicated experts.

Do you have a large case opportunity? Talk to your wholesaler to learn more.

® and ™ denote trademarks of The Equitable Life Insurance Company of Canada.

- Case Studies

-

Sofie wants to provide for her children long after she’s gone with Equitable Generations Universal L

Sofie knows the future is uncertain. As a mom of two children and in her late forties, Sofie wants to continue to help her kids with their life goals as they get older.

She learns that Universal Life insurance from Equitable® is a great fit for her. It has investment options, choices of death benefit and even flexibility on how she pays for her premiums. With the investment option, she can earn tax-advantaged growth*.

Watch our new Universal Life Insurance from Equitable video to learn more. See it on Vimeo

This video can help you talk with clients about Universal Life insurance. It walks them through what it is, how it works, and the affordability and flexibility it features. It highlights just how Universal Life from Equitable is an insurance solution truly designed to meet the needs of clients today and into tomorrow.

Not sure where to start? Send clients this draft prospecting letter which you can personalize specifically for them.

Plus, check out our Universal Life solution page on EquiNet®, then click on the Marketing Materials tab for the latest Universal Life Marketing Materials.

Want to learn more? Ask your Equitable wholesaler!

View on Vimeo

*Subject to the Income Tax Act of Canada.

-

NEW – Online courses for CE Credits from Individual Insurance

Needing continuing education credits?

Equitable® is excited to introduce two new online courses focusing on Universal Life and Critical Illness insurance that provide immediate CE credits upon completion. The courses allow you to learn at your own pace and earn CE Credits quickly and easily. Both courses are accredited by AIC, ICM, the Institute, and La Chambre*.

New courses:

1) Where UL fits in your product portfolio

2) Building your business with Critical Illness insurance

A few important notes before you get started:

● The programs are hosted on Teachable: https://equitable-life-education.teachable.com/

● Username: Please use your email that you are contracted with.

● Password: Equitable

● Please use Google Chrome to access the courses.

.png)

Check out our new individual insurance online learning centre on EquiNet® to stay up to date on new courses and find out more information on the topics provided. While you’re there, don’t forget to take our Path to Success course!

Questions?

Contact your local wholesaler.

Are you having trouble logging in?

Email equitablelifemarketing@equitable.ca for assistance.

*Please select the course with “QC credits” in the title for La Chambre credits.

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada.

- General Information

- General Information

-

Boost your knowledge and earn CE credits

Need continuing education credits?

Equitable® is happy to offer two new online courses focusing on whole life insurance. The courses allow you to learn at your own pace and earn CE credits quickly and easily. You can earn CE credits right away when you complete these courses. All courses are accredited by Alberta Insurance Council, Insurance Council of Manitoba, The Institute for Advanced Financial Education, and Chambre de la sécurité financière*.

New courses:

1. Introduction to Whole Life Insurance

2. Participating Whole Life for the Children’s Market – A Head Start for Tomorrow

3. Harness the Power of Whole Life Cash Value

Existing courses:

1. Path to Success - Expert Advice on Navigating CI Sales

2. Ensuring a Compliant, Needs-based Insurance Sale

3. Where UL Fits in your Product Portfolio

A few important notes before you get started:

• The programs are hosted on Teachable: https://equitable-life-education.teachable.com/

• Username: Please use your email address that you are contracted with

• Password: Equitable

• Please use Google Chrome to access the courses

Start Earning CE Credits!

Check out the individual insurance online learning centre on EquiNet® to stay up to date on new courses.

Questions?

Contact your local wholesaler.

Are you having trouble logging in or accessing certificates?

Email equitablelifemarketing@equitable.ca for assistance.

*Please select the course with “QC credits” in the title for La Chambre credits.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada. -

New secure encryption process for outstanding Equitable S&R business requirements

The Equitable® Savings and Retirement Operations team is improving how they send secure email messages to advisors. These emails are sent when there are outstanding requirements for an application or missing information for requests.

Previously, advisors had to manually password protect or unlock PDF documents. This caused delays and difficulties for recipients. The new encryption process will remove that confusion and make it easier for advisors to send and receive secure, encrypted messages.

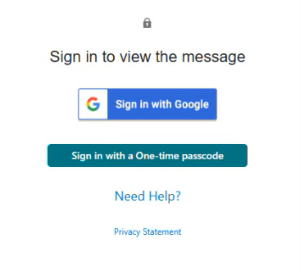

Advisors will now receive secure, encrypted emails from the QA annuity operations mailbox. These emails will use an encrypt option to protect personal client information, such as attachments or requests for personal documents. Recipients will get an email with a subject line saying they have a secure private message. They will need to sign in to view the message or choose to get a one-time passcode (OTP).

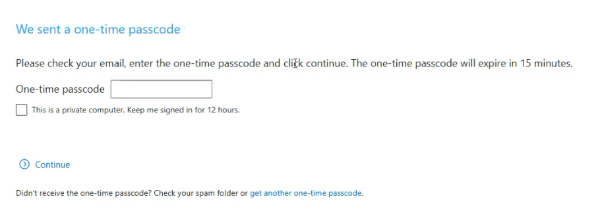

Please ensure to check the SPAM folder for the OTP option as it will expire in 15 minutes. Enter the OTP in the secure message

portal.

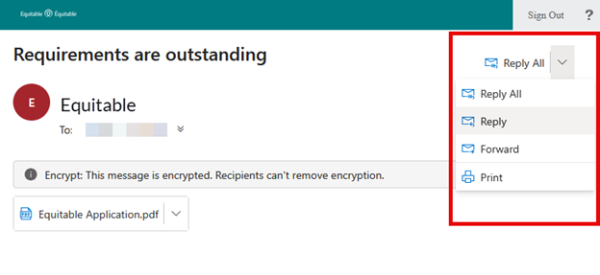

Emails are sent in both English and French, with automatic translation based on browser settings. Recipients must click the view button to access the message in the secure web portal where they can see the encrypted attachment.

Make sure to click Reply in the top right corner of the encrypted message to keep communications within the secure portal.

For more information or assistance, please contact your Director, Investment Sales.

Date posted: May 22, 2025