Site Search

961 results for life policy 300109556

-

Important information regarding use of the form 350 Application for Life and/or Critical Illness Ins

As of February 12, 2022 the new version of the form 350 (2022/02/12) was available on EquiNet® (Individual Insurance>Forms), and can be ordered from our Supply department using form 1390 Supply Order Form (Life and Health)

To apply for the new 10 pay premium option on Equimax Estate Builder, or the new EquiLiving plans or riders, the new version of the form 350 (2022/02/12) Application for Life and/or Critical Illness Insurance must be used. The new version of the 350 will include the option to select the new features.

We will not accept the 350 (2021/04/02) version of the application with a hand-written note indicating the new 10 pay premium option, or the new EquiLiving plans or riders.

After March 31, 2022, we will no longer accept the 2021/04/02 or earlier version of the 350 application for any life or critical illness products. -

Crunch the numbers with Equitable Life’s Online Calculators

Whether helping your client determine net worth or reviewing to see if your client’s retirement plan is on track, Equitable Life® is here to help with our online calculators. These number crunching tools can help you answer some of those challenging questions you get asked by your clients. From an RSP loan calculator to home budgeting to even figuring out if your client will be a future millionaire, check out our latest tools.

Each week in March, we will be sharing an online calculator from our list.Share calculators using your Facebook, Twitter or LinkedIn account.

-------------------------------------------------------------------------------------------------------Abbey and Ben enjoy being with friends and family. They are always ready to hit the town and have some fun. Sometimes, they run short on money at the end of each month.

Did you know?

One of the most important aspects of controlling a budget is knowing where the money goes. Check out Equitable Life’s Home Budget Calculator.

-

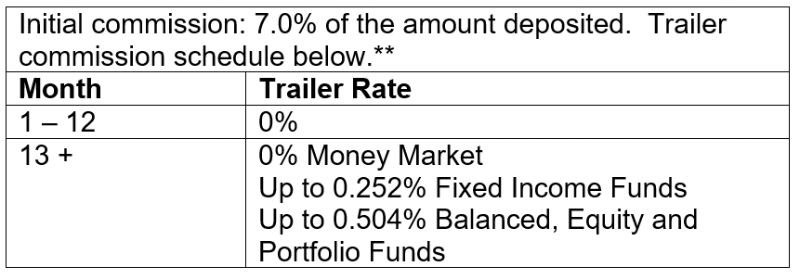

7% No Load CB5 Initial Commission - Limited Time Offer!

For a limited time only, Equitable Life® is pleased to announce an increase to the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Increased initial commission does not apply to pre-existing PADs. Equitable Life reserves the right to end the campaign, at any time and without notice.

** Applies to FundSERV trades occurring between May 20 and August 31, 2022. Initial commission on non-FundSERV trades occurring between May 20 to August 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

Equitable Life Savings & Retirement Webinar Series welcomes Franklin Templeton

In 2021, Equitable Life’s® S&R team will spotlight various aspects of our competitive fund lineup and product offerings. Each webinar in the series will feature a new topic. This series will also give advisors an opportunity to:- learn more about various products and product features,

- hear from industry professionals,

- learn about investment strategies; and so much more.

Join your host Joseph Trozzo, Investment Sales Vice President and Franklin Templeton. Equitable Life is pleased to highlight access to the Bissett Monthly Income and Growth Fund Select, Bissett Canadian Equity Fund and Bissett Dividend Income Fund in the Pivotal Select™ segregated fund line-up.

Learn More

-

Crunch the numbers with Equitable Life of Canada

Whether helping your client determine net worth or reviewing to see if your client’s retirement plan is on track, Equitable Life® is here to help with our online calculators. These number crunching tools can help you answer some of those challenging questions you get asked by your clients. From an RSP loan calculator to home budgeting to even figuring out if your client will be a future millionaire, check out our latest tools.

-------------------------------------------------------------------------------------------------------

Gloria and Nigel just launched their small business and have dreams of becoming millionaires. What will it take for them to join the millionaire’s club?

Did you know?

There are many factors to consider including inflation, taxation and rate of return. Check out Equitable Life’s Cool Million Calculator.

Share calculators using your Facebook, Twitter or LinkedIn account. -

Crunch the numbers with Equitable Life of Canada

Whether helping your client determine net worth or reviewing to see if your client’s retirement plan is on track, Equitable Life® is here to help with our online calculators. These number crunching tools can help you answer some of those challenging questions you get asked by your clients. From an RSP loan calculator to home budgeting to even figuring out if your client will be a future millionaire, check out our latest tools.

-------------------------------------------------------------------------------------------------------Amesh just celebrated his 71st birthday. He is looking for a product that provides continued growth in a tax-sheltered environment. What should he do with his existing Registered Retirement Savings Plan?

Did you know?

It is mandatory that you convert your RRSP to a RRIF by December 31st in the year you turn 71. Check out Equitable Life’s RRIF Payment Calculator.Share calculators using your Facebook, Twitter or LinkedIn account.

-

Stay connected with a NEW Web Illustration tool for Equimax

Equitable Life® is pleased to announce the launch of our web illustration tool starting with Equimax® participating whole life insurance.

This web illustration tool for Equimax is another way that Equitable Life is modernizing your experience and allowing you more flexibility to keep your business going while you’re on the road or meeting clients. This new illustration site is accessible on a web browser, so you can access it from a mobile device such as your phone, tablet, or iPad, and with MAC or Windows-based PCs or laptops.

Access the new web illustration tool for Equimax by logging in to EquiNet® and clicking the button in the ribbon called Sales Illustration that now has a Web Illustrations option. Note that you have the option to continue running Equimax illustrations in the desktop illustration software, as it remains unchanged at this time.

For future enhancements, we plan to integrate with EZcomplete®, to continue to make it easy to do business with Equitable Life.

Visit the New Web illustration tool for Equimax® now.

Questions? Please see our FAQ or contact your Regional Sales Manager.

® denotes a trademark of The Equitable Life Insurance Company of Canada -

Equitable Life presents “Opportunities and risks in the current investment landscape” featuring Davi

If you missed the live webcast, “Opportunities and risks in the current investment landscape” with David Irwin from Equitable Life, catch up On-Demand.

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

Date posted: March 15, 2023

® denote trademarks of The Equitable Life Insurance Company of Canada.

-

Equitable Life Dynamic U.S. Monthly Income Fund Select

As a Global Equity Balanced asset class, investors benefit from long-term capital growth through investments that include a broad range of U.S. equity and debt securities. Check out Equitable Life Dynamic U.S. Monthly Income Fund Select in this issue of Fund Focus. The Fund aims to provide long-term capital appreciation and income by investing primarily in a broad range of U.S. equity and debt securities, focusing on a value investment approach when selecting equity securities.

Key highlights

• Actively manages access to the U.S. (one of the broadest and deepest markets in the world).

• Ability to tactically shift asset allocation to take advantage of changing market conditions.

• Aims to provide stability and growth to investors while providing interest and dividend income.

For more information, check out Equitable Life Dynamic U.S. Monthly Income Fund Select or contact your Regional Investment Sales Manager.

Posted November 2, 2023 -

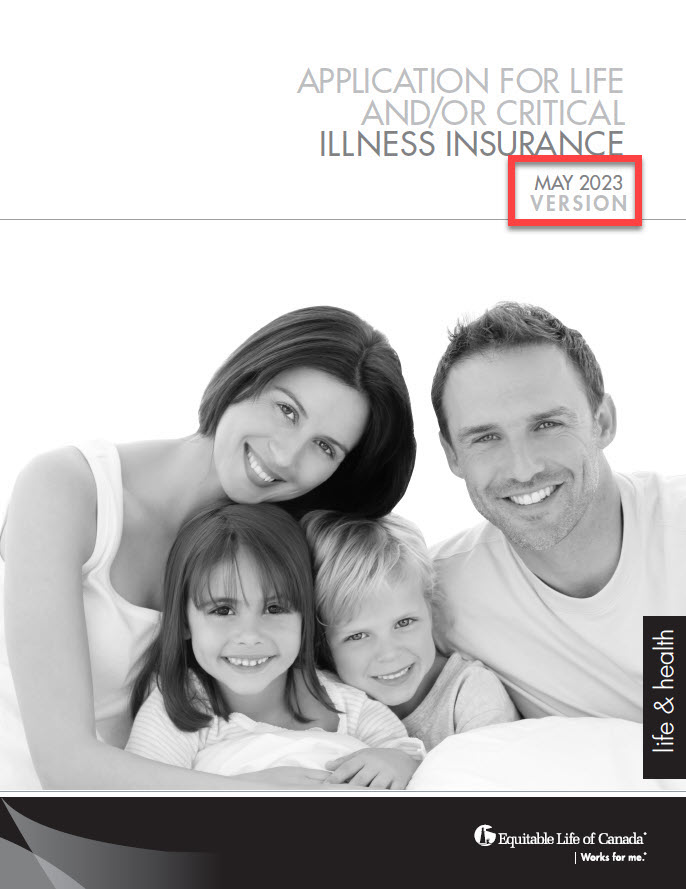

Reminder: New 350 Life and CI Applications

In early August, Equitable® updated the privacy and legal sections on some forms. This included the 350 Paper Application for Life and/or Critical Illness Insurance. This change was also applied on our websites and our online application EZComplete®. These changes are part of Bill 64. The Bill is about the protection of personal and private information in Quebec and took effect on September 1st, 2023.

Due to this change, we ask that all advisors use the latest version, dated May 2023, of the paper application.

For applications in Quebec, the latest version must be used.

For all regions outside Quebec, we are supporting a transition period from ‘old’ to ‘new’ applications until December 31st, 2023. After this date, we will no longer accept older versions of our Life and Critical Illness applications.

To make sure you are using the latest version of the application, check the date on the title page. It should say May 2023. See the image below:

.jpg?width=200&height=259)

To order paper copies, click here.

To learn more about Bill 64, please visit Assemblee nationale du Quebec - Bill 64. You may also contact your wholesaler.

® denote a registered trademark of The Equitable Life Insurance Company of Canada.