Site Search

756 results for form to restart a pac on insurance

- [pdf] What's New July 6 2017

- About

-

EZcomplete Non-Face-to-Face enhancement

An EZ way to conduct your out-of-town businessYou asked for it, we built it: a solution for your non face-to-face business. EZcomplete® allows you to conduct your non face-to-face business easily and quickly with your clients providing their signature remotely on their own device.

How does it work?

EZcomplete walks you through the electronic signature process. EZcomplete allows your clients to sign remotely using their own device for non-face-to-face applications. You only need to enter their email address and provide them with a secret passcode to securely access the documents to review and sign.

Just another reason to do business with Equitable Life®

EZcomplete makes it easy to process your non-face-to-face applications and do business with Equitable Life.

Login to EquiNet® and click on the EZcomplete icon on the menu bar

® denotes a trademark of The Equitable Life Insurance Company of Canada.

-

The Equitable Gives Back Contest – Start spreading the word!

Equitable Life of Canada is celebrating our 100th Anniversary in 2020, and we’re busy planning a year of events and activities so we can celebrate this significant milestone with our employees, clients, wholesalers and advisors across Canada.

A big part of who we are as a company is our commitment to help strengthen the communities where we operate by supporting a variety of charitable initiatives that help to improve the quality of life for the people living there. We are proud to launch the Equitable Gives Back Contest. Our goal is to give $10,000 to five registered charities operating in Canada.

All it takes to enter is an original essay (not less than 100 words, not more than 500) describing the way in which a charitable organization could use $10,000 to help further their charitable purpose and improve life for Canadians.

Reach out to your clients, tell them about the contest, and encourage them to visit www.equitable100.ca to see if they are eligible! All entries must be submitted by March 31, 2020.

-

Policy endorsement: Long Term Disability pre-existing condition period

We are updating our contracts to clarify how we handle the Long Term Disability (LTD) pre-existing condition period for employees returning from maternity or paternity leave.

A new LTD pre-existing condition period will no longer apply when an employee re-enrols in the benefits plan after their maternity or paternity leave ends, provided that they return to work on the date agreed upon with their employer, or in the time period allowed by the Employment Insurance Act, whichever is earlier.

To facilitate this change, we are amending some of the wording in our contracts and booklets, effective March 1, 2020. Below are links to the Endorsement to the Master Policy and the Summary of Master Booklet Wording Changes for this amendment. Please download and save these policy endorsement documents for your files.

In addition, please remind your clients to provide all of their plan members with a copy of the Summary of Master Booklet Wording Changes.

The next time your clients amend their benefits plan, the updated wording will be included in their group benefits plan booklets.

Download Endorsement to the Master Policy

Download Summary of Master Booklet Wording Changes -

November is Financial Literacy Month

During the month of November, financial services organizations throughout Canada will be participating in Financial Literacy month. Created by the Financial Consumer Agency of Canada (Agency), the goal of this initiative is to share information that will help Canadians achieve their financial goals. This can include managing debt, saving for the future, and understanding their rights and responsibilities.To support this initiative, Equitable Life® will be posting articles on Equitable’s® Blog and sharing relevant information on Facebook, Twitter and LinkedIn. Feel free to share our content with your followers.

If you’re interested in learning more about your own financial literacy, take this Self-Assessment Quiz. When you have completed the quiz, you will see a list of suggested topics that you might want to explore further.® and TM denote trademarks of The Equitable Life Insurance Company of Canada

Posted November 1, 2023 -

Equitable Life is making changes to its Pivotal Select Fund lineup

On June 7, 2021, Equitable Life® will be launching new funds to the Pivotal Select™ segregated funds lineup. The new funds include:

1. Mackenzie Global Strategic Income Fund

2. Fidelity® Special Situations Fund

3. Fidelity® Tactical Asset Allocation Income Portfolio

4. Fidelity® Tactical Asset Allocation Balanced Portfolio

5. Fidelity® Tactical Asset Allocation Growth Portfolio

At Equitable Life, we pride ourselves on offering quality products. This means always reviewing our investment fund lineup. The reasons for this change are to create greater focus on investment offerings, and enhanced investment choices for you and your clients.

Watch your email over the next few weeks for more details about Fidelity Investments and Mackenzie Investments, including two upcoming webcasts.

Fidelity and Fidelity Investments are registered trademarks of 483A Bay Street Holdings LP. Used with permission.

Equitable Life and Pivotal Select are trademarks of The Equitable Life Insurance Company of Canada.

-

Welcome Fidelity to Equitable Life’s Pivotal Select segregated funds lineup

Equitable Life® is pleased to welcome Fidelity to its Pivotal Select™ segregated funds lineup.- Equitable Life Fidelity® Special Situations Fund Select

- Equitable Life Fidelity® Tactical Asset Allocation Income Portfolio Select

- Equitable Life Fidelity® Tactical Asset Allocation Balanced Portfolio Select

- Equitable Life Fidelity® Tactical Asset Allocation Growth Portfolio Select

These new funds are available on all the Pivotal Select load types and guarantee classes, providing you and your clients with even more choice and flexibility.

To learn more about Fidelity, click here. To learn more about the funds, click here.

Speak to your Regional Investment Sales Manager today about Equitable’s segregated fund lineup.

Equitable Life and Pivotal Select are trademarks of The Equitable Life Insurance Company of Canada.

Fidelity and Fidelity Investments are registered trademarks of 483A Bay Street Holdings LP. Used with permission.

-

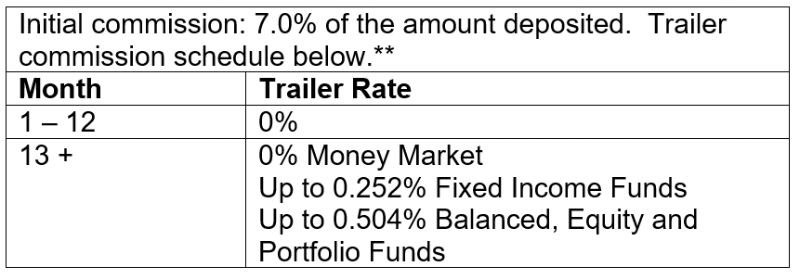

7% No Load CB5 Initial Commission - Limited Time Offer!

For a limited time only, Equitable Life® is pleased to announce an increase to the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Increased initial commission does not apply to pre-existing PADs. Equitable Life reserves the right to end the campaign, at any time and without notice.

** Applies to FundSERV trades occurring between May 20 and August 31, 2022. Initial commission on non-FundSERV trades occurring between May 20 to August 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

WFG KYC and Trade Ticket documents are now part of EZcomplete

Equitable Life® wants to help you get on with your day. Effective June 11, 2022, WFG’s KYC* and Trade Ticket documents will be integrated into the highly rated EZcomplete® online application tool. This means no more completing these documents separately and uploading them to EZcomplete.

By integrating the KYC and Trade Ticket with EZcomplete:-

these documents will automatically populate with information collected in the EZcomplete process,

-

necessary signatures will be captured, and

-

these documents will be sent to WFG’s back office on your behalf.

Once the application has been submitted, signed documents will be available for advisors, clients, and joint clients to download. It is that easy.

Get on with your day with Equitable Life. Log in to EZcomplete today.

Speak to your Regional Investment Sales Manager to learn more.

* KYCs on corporately owned policies are not currently supported

® denotes a trademark of The Equitable Life Insurance Company of Canada. -