Site Search

103 results for 31

-

When we grow together, success is mutual

Equitable® announces the return of its popular Step Up Your Wealth sales campaign! Again, this year, we are rewarding advisors who promote Equitable’s Savings & Retirement products to both existing and new clients, as part of a comprehensive investment strategy.

At Equitable, we offer a complete range of investment products designed to meet the savings, accumulation, and income needs of Canadians. Our strength as a mutual company, combined with our diverse lineup of competitive solutions, can help clients achieve their financial goals with confidence.

*The bonus amount will be calculated at the end of 2025 based on net deposits. The bonus will be paid within 90 days following December 31, 2025. Maximum bonus payable is $100,000 for re-qualifying Elite advisors; $75,000 otherwise. 1 Re-qualifying Elite advisors are advisors who attained Elite status at the end of 2024 and maintain Elite status at the end of 2025. To attain Elite advisor status, an advisor must have $1,250,000 in gross deposits in at least five policies or $10,000,000 in assets. For re-qualifying Elite advisors that reach $10,000,000 or more in net deposits in both 2024 and 2025, the maximum payment is $200,000. Equitable reserves the right to end or after the Step Up Your Wealth sales campaign at any time and without notice.

.png)

Join us and take advantage of the opportunity to grow clients’ wealth while being rewarded for your efforts. Together, we can help Canadians achieve their financial dreams. For more information, visit our website or speak to your Director, Investment Sales today.

Date posted: January 6, 2025

-

Savings & Retirement - Updated Application Forms

There are some important updates to share with you. The applications listed below have been updated for content and formatting. The changes also include the removal of maximums for Quebec Life Income Funds.Equitable will accept the previous versions until March 31, 2025, but on April 1, 2025, only the new versions will be accepted.

Form # Application New Version Previous Version 1383 Pivotal Select TFSA Application 2024/11/01 2023/05/29 1384 Pivotal Select Registered/Non-Registered Application 2025/01/01 2023/05/29 2086 Pivotal Select FHSA Application 2024/11/01 2023/08/01 796 Daily/Guaranteed Interest Account TFSA Application 2024/11/01 2024/07/01 799 Daily/Guaranteed Interest Account Registered/Non-Registered Application 2025/01/01 2024/07/01 2087 Daily/Guaranteed Interest Account FHSA Application 2024/11/01 2024/07/01

Updated Form Names

Equitable has updated the names of the Special Quote Request forms for the DIA/GIA and Payout Annuity.New Name Previous Name When to use Custom Quote – DIA/GIA

(Form # 686)GIA Special Quote Request form Any deposit to the Daily Interest Account or Guaranteed Interest Account that is equal to or greater than $1 million. Payout Annuity - Custom Quote

(Form #687)Payout Annuity Special Quote Request form Any non-standard annuity quote (i.e., exceeds maximum deposit or age, pension matching, etc.)

Simplified Conversion Process for Legacy Products

The simplified conversion process should make things easier for advisors. By using the RRSP to RRIF Conversion Form #1673, you can convert legacy products, like RRSP to RRIF and LIRA to LIF, without the need to complete an application.

If you have any questions, reach out to your Director, Investment Sales.

Posted January 27, 2025 - Investment Savings and Distributions Calculator

- Tax Free Savings Account (TFSA) Comparison Calculator

-

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

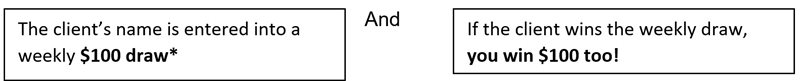

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy

See full contest details. Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

* Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

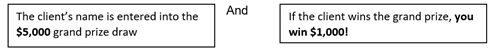

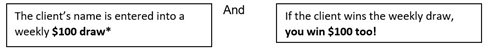

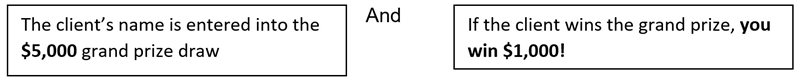

Grow Your Future RSP Contestt: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 20232, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules. -

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy*

Full contest details.

Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

*Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Equitable Life® 2023 RRSP Season Contest: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 2023, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules.

Posted December 1, 2022

-

Responding to Ontario’s biosimilar switch initiative

We are changing coverage for some biologic drugs in Ontario in response to the province’s biosimilar initiative. These changes will help protect your clients’ plans from additional drug costs that may result from this government policy while providing access to equally safe and effective lower-cost biosimilars.

Ontario’s provincial biosimilar initiative

Announced in December 2022, Ontario’s biosimilar switch program ends coverage of eight biologic drugs for Ontario residents covered by the Ontario Drug Benefit (ODB). The transition to biosimilar versions of these drugs began on March 31, 2023. ODB recipients using these drugs will be required to switch to biosimilar versions of these drugs by December 29, 2023, to maintain their provincial coverageEquitable Life’s response

To ensure this provincial change doesn’t result in your clients paying additional and avoidable drug costs, we are changing coverage in Ontario for most biologic drugs included in the provincial initiative.

Beginning October 1, 2023, plan members in Ontario will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower cost biosimilar version of the drug.** These plan members will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable Life plan.Communicating this change to plan members

We will inform any affected plan members in early August of the need to switch their medications so that they have ample time to change their prescriptions and avoid any interruptions in treatment or coverage.Will this change impact my clients’ rates?

Any cost savings associated with the change will be factored in at renewal.What is the difference between biologics and biosimilars?

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is known as the “originator” biologic. Biosimilars are highly similar to the drugs they are based on and Health Canada considers them to be equally safe and effective for approved conditionsQuestions?

** The list of affected drugs is dynamic and will change as Ontario includes more biologic drugs in its biosimilar initiative, as new biosimilars come onto the market, and as we make changes in drug eligibility.

If you have any questions about this change, please contact your Group Account Executive or myFlex Sales Manager. -

This year’s Registered Retirement Savings Plan deadline is March 3, 2025.

Have you talked to clients about their Registered Retirement Savings Plan (RRSP) contributions yet? Equitable® offers RRSP products to meet clients’ needs including:

• Daily/Guaranteed Interest Account

• Pivotal Select™ Segregated Funds

• Investment Class (75/75)

• Estate Class (75/100)

• Protection Class (100/100)

These products offer protection and flexibility that clients need, with the tax savings and benefits of a RRSP. Encourage clients to contribute to their RRSP early. And make RRSP contributions a financial priority each year!

What’s new

The Home Buyer’s Plan is offering temporary repayment relief for qualifying withdrawals from their RRSP. This means that clients can defer the start of the repayment period by an additional three years when they make a first qualifying withdrawal between January 1, 2022 and December 31, 2025. This means the 15-year repayment period would start in the fifth year after the year in which a first withdrawal was made. For example, if you made your first qualifying withdrawal in 2022, your first year of repayment will be 2027.1

Tools and materials to help you start the conversation

Often clients have good intentions about saving for retirement. However, even the best intentions need an action plan. As a trusted advisor, you can help clients see the value in making a RRSP a financial priority. We have tools and marketing materials to help you start the conversation. Show clients why an Equitable RRSP can help them to achieve their financial goals in retirement.

Equitable’s advisor toolbox, available on EquiNet®, includes Product News, Prospecting Letters, Forms, Marketing Materials, Case Studies, Articles and Investment Calculators.

1 www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/what-home-buyers-plan/repay-funds-withdrawn-rrsp-s-under-home-buyers-plan.html

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted February 7, 2025

- Accepted Payment Methods

- Conversions