Site Search

961 results for life policy 300109556

- [pdf] Dividend Q&A Advisor Educational Series

- [pdf] Participating account executive summary

- [pdf] Equitable Generations Advisor Admin Guide

-

Equitable receives FundGrade A awards for outstanding performance

Equitable® is thrilled to announce that several of our funds have received Fundata FundGrade A awards for their exceptional performance in the first half of 2025.

The FundGrade rating system is a great tool for identifying top-performing funds. This recognition highlights our commitment to providing high-quality investment options to clients.

And the winners are…

The following funds from Equitable's lineup have received a FundGrade A rating this year:

Pivotal Select:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Global Innovators Fund Select

Personal Investment Portfolio/Pivotal Solutions:

• Equitable Life Invesco Global Bond Fund

An enhanced fund performance page

Equitable has also introduced several new features to our fund performance page to enhance user experience. These updates include:- Printable performance reports: Easily accessible and printable reports for detailed fund performance.

- Equity and Fixed Income breakdowns: Detailed breakdowns by fund displayed on the Fund Details tab.

- Fund Category display: Clear display of fund categories on the Fund Details tab.

- Filter enhancements:

- New “Risk Rating” filter.

- New “U.S. Equity” filter.

- Renamed “Domestic Equity” to “Canadian Equity”.

- Moved “Index Funds” and “Portfolio Solutions” out of asset class filters into “Additional filters”.

For more information on these funds and their performance, and to see the latest enhancements, visit our Fund Performance page.

Questions? Contact your Director, Investment Sales.

FundGrade A is used with permission from Fundata Canada Inc., all rights reserved.

Date posted: June 10, 2025 - Submit an application

- [pdf] Term Advisor/Admin Guide

-

Equitable Life Group Benefits Bulletin - July 2021

In this issue:

- Fabien Jeudy takes over as President and CEO*

- Reminder: Equitable Life’s Guide to Accessing Virtual Healthcare*

- Mental health resources for plan members*

- Recall of Philips CPAP machines*

Fabien Jeudy takes over as President and CEO*

In March, we announced that Fabien Jeudy was appointed as Equitable Life’s next President and CEO. Jeudy officially took over on July 5th, succeeding Ronald Beettam, who is retiring after 16 years with the company.

Jeudy is a collaborative leader with more than 30 years of experience in the insurance industry, leading actuarial, finance, risk management, distribution, marketing teams and operational teams in the Life & Health Insurance, Wealth Management and Group Benefits markets in Canada, the US, and Asia.

Reminder: Equitable Life’s Guide to Accessing Virtual Healthcare*

The demand for virtual healthcare services has increased as the pandemic is driving more people to access their health care providers from home.

Thankfully, many virtual healthcare services are available for free to Canadians with provincial health care coverage. We have created a Guide to Accessing Virtual Healthcare for plan members to easily access a variety of virtual healthcare services. Our guide includes information and links to both free and paid virtual medical care options, including video appointments, health advice over the phone, emergency dental services, and more.

You can find the guide on our website. It’s also available on our plan member website at EquitableHealth.ca.Mental health resources for plan members*

Many Canadians have been experiencing increased levels of stress, anxiety, and depression since the beginning of the COVID-19 pandemic. Through our partnership with Homewood Health®, all of our clients and their plan members have access to a number of health and wellness resources designed to provide guidance and support.

Homewood’s Online Cognitive Behavioural Therapy tool, i-Volve, can help plan members identify, challenge and overcome anxious thoughts, behaviours and emotions. Learn more about Online CBT or access i-Volve at Homeweb.ca/Equitable.

As well, Homewood has a number of resources available to help support plan members dealing with increased anxiety during these uncertain times:- Quelling COVID-19 Anxiety

- Managing stress and anxiety

- How to speak to children

- How to stay productive and motivated when working from home

- The COVID-19 Pandemic: Managing the Impact

- Support for First Responders, Front Line Workers and Public Facing Employees

- Financial tips for your financial health

- Increases in Domestic Violence

- Those with family members in long-term care facilities

- COVID-19: Employee Fatigue, Isolation and Loneliness

Recall of Philips CPAP machines*

Last month, electronics company, Philips, issued a recall with Health Canada of some of its Continuous Positive Airway Pressure (CPAP), BiLevel Positive Airway Pressure (BiLevel PAP) devices and Mechanical Ventilators. The recall was issued due to a foam abatement within the machines that can become loose and cause potential health risks.

To qualify for repair or replacement of these devices, users must register their machine on the Philips website.

CPAP, BiLevel PAP devices and Mechanical Ventilators are eligible for coverage under an HCSA and under some Extended Health Care plans. Plan administrators may want to inform plan members of this recall if the devices are eligible for coverage under their plan.

- [pdf] Segregated Fund Annual Report - December 31, 2024

-

EAMG Market Commentary July 2024

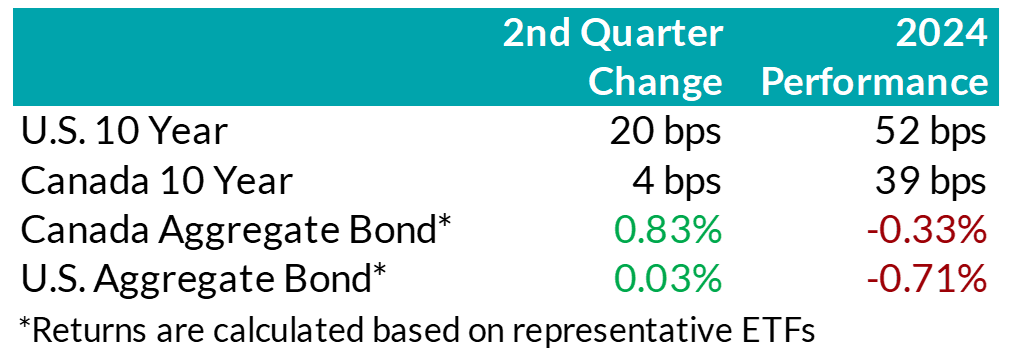

.png) Rates & Credit – In Q2 2024, U.S. inflation and economic growth data was mixed, leading to moderately higher interest rates in the U.S. Meanwhile, in Canada, long-end interest rates were little changed during the quarter, but short-term interest rates fell. That was due to the weaker economic outlook, as well as the Bank of Canada’s decision to reduce its overnight interest rate in June, with anticipation of further monetary policy easing to come. Canadian corporate bonds returned 1.1%, outperforming the 0.8% return of government bonds as well as the 0.9% return for the overall FTSE Canada Universe Bond index. Shorter-dated bonds outperformed longer-dated bonds. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries that have shorter-dated debt (e.g. real estate and financials) outperformed those that tend to have longer-dated debt (e.g. communications and infrastructure).

Rates & Credit – In Q2 2024, U.S. inflation and economic growth data was mixed, leading to moderately higher interest rates in the U.S. Meanwhile, in Canada, long-end interest rates were little changed during the quarter, but short-term interest rates fell. That was due to the weaker economic outlook, as well as the Bank of Canada’s decision to reduce its overnight interest rate in June, with anticipation of further monetary policy easing to come. Canadian corporate bonds returned 1.1%, outperforming the 0.8% return of government bonds as well as the 0.9% return for the overall FTSE Canada Universe Bond index. Shorter-dated bonds outperformed longer-dated bonds. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries that have shorter-dated debt (e.g. real estate and financials) outperformed those that tend to have longer-dated debt (e.g. communications and infrastructure).

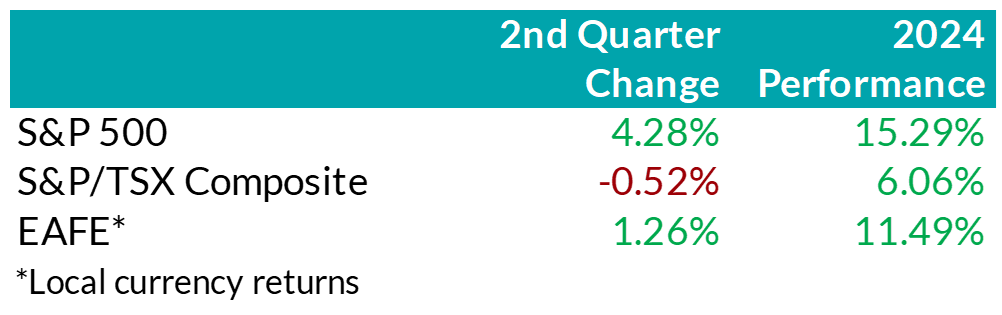

.png) Equity Overview – Against the backdrop of volatile inflation data and a lack of indication from the Federal Reserve that it was prepared to start cutting interest rates yet, U.S. equity markets decoupled from other regions. Crowding into AI-focused, mega-cap names accelerated in Q2. More specifically, investors defaulted toward the Magnificent 7 to navigate the current period, overlooking broadening earnings breadth and less expensive valuations from the remaining S&P 493. Outside the U.S., equity returns were generally mundane in dollar terms. That said, emerging markets proved to be a bright spot for investors seeking value, as the rebound in heavily discounted Chinese equities helped push frontier markets higher.

Equity Overview – Against the backdrop of volatile inflation data and a lack of indication from the Federal Reserve that it was prepared to start cutting interest rates yet, U.S. equity markets decoupled from other regions. Crowding into AI-focused, mega-cap names accelerated in Q2. More specifically, investors defaulted toward the Magnificent 7 to navigate the current period, overlooking broadening earnings breadth and less expensive valuations from the remaining S&P 493. Outside the U.S., equity returns were generally mundane in dollar terms. That said, emerging markets proved to be a bright spot for investors seeking value, as the rebound in heavily discounted Chinese equities helped push frontier markets higher.

U.S. Fundamentals – Corporate earnings continued to surpass expectations last quarter with stable operating margins helping businesses report better-than-expected bottom line results. Investors remain focused on the ability of companies to sustain debt levels ahead of renewing debt obligations, rewarding businesses with a strong ability to generate stable cash flows. Moreover, while prior quarters have witnessed earnings growth that was largely driven by highly profitable mega-cap technology stocks, U.S. markets are witnessing a broadening trend in earnings strength, with previously stunted segments of the market recovering. Our work shows that members of the Russell 1000 index, excluding the Magnificent 7, posted a median earnings growth of about 6% last quarter, with nearly 60% of companies increasing earnings versus the year prior. Furthermore, we observed an increase in the number of major companies that expect improving financial performance to approximately 27%, suggesting that the recovery in earnings breadth may persist.

U.S. Quant Factors – As mentioned, concentration in the equity market drove a surge in valuations as investors continued to chase specific mega-cap technology stocks. In fact, within the Russell 1000 growth factor – which screens for companies whose earnings are expected to grow at an above-average rate relative to the market – the Magnificent 7 totaled nearly 55% of the entire index by quarter-end. In addition, the Nasdaq 100 – which is generally viewed as a technology-biased index – saw the weight of the Magnificent 7 rise to almost 43% of the entire index by the end of the quarter. Furthermore, the equal-weighted S&P 500 underperformed the cap-weighted index by nearly 7% last quarter, bringing the year-to-date divergence to about 10%. With concentration accelerating, the cap-weighted index outperformance has soared past Covid-era levels, a period that saw investors rapidly crowd into profitable technology names due to panic and economic uncertainty. We remain cautious of a severely crowded market that trades near all-time highs as strong performance from 5-7 names distorts the overall stature of market conditions.

Canadian Fundamentals – Although Canadian companies exceeded bleak forecasts, earnings continue to contract on a year-over-year basis. Furthermore, earnings revisions have grinded lower with easing monetary conditions unable to offset concerns of a slowing economic environment. We note the sharp contrast versus the U.S. as the bifurcation of earnings performance widens. The CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges as metals rallied higher despite a stronger U.S. dollar and elevated interest rates. The mining industry benefited from a sustained elevation in prices, helping the materials sector outperform over the quarter. Returns from the heavily-weighted Canadian banks were constrained last quarter with company-specific drivers – including regulatory challenges from TD, and underwhelming U.S. results from BMO – limiting performance. More broadly, the banks continue to build prudent credit provisions to mitigate uncertain economic forecasts and remain well capitalized.

Canadian Quant Factors – With investors remaining attentive to businesses’ ability to create value relative to financing costs, we see value in high quality, dividend-paying companies with strong earnings sustainability and a healthy degree of leverage. Based on our work, investors of the Canadian banks appear well compensated, with the current premium between value creation and current yield remaining compressed. In our opinion, the market has modest expectations regarding prospects for value generation from the banks and, therefore, we believe the industry stands to benefit if the premium reverts closer to historical norms. We also continue to see sources of quality dividend opportunities within certain areas of the energy sector. More specifically, we believe companies that have taken steps to improve their balance sheets through deleveraging efforts, and with improved operating leverage, offer attractive prospects given their stable and high-yielding composition.

Views From the Frontline

Rates – During the first half of the second quarter, interest rates in both Canada and the U.S. increased, continuing the upward momentum from Q1. Higher-than-expected inflation data in the U.S. along with mixed economic growth data caused investors to push out expectations for when the U.S. Federal Reserve would start lowering its interest rate. This trend shifted in the second half of Q2, as positive economic momentum slowed in the U.S. economy and inflation data began to soften. Interest rates in Canada declined more rapidly than in the U.S. due to more benign inflation, a weaker job market, and economic growth remaining below population growth. This economic weakening provided the confidence required for the Bank of Canada to cut rates by 25 basis points in June to 4.75%. The Bank also signaled that if inflation continues to ease and the Bank’s confidence grows that inflation would continue to trend toward its 2% inflation target, it is reasonable to expect further cuts. The second quarter marked a pivotal point for the global policy easing cycle. Sweden, Canada, and the European Central Bank all began lowering their policy rates, and Switzerland made a second rate cut, following one in Q1. The market continues to speculate on the timing of the U.S. Federal Reserve’s first rate cut. Interest rate cut expectations are largely unchanged in Canada since last quarter, with a total of three rate cuts expected throughout 2024. Expectations for the rate cuts by the U.S. Federal Reserve declined slightly, however, to two cuts in 2024.

Credit – The risk premium for corporate bonds (versus government bonds) was largely flat over the quarter, with spreads approaching the tight post-pandemic levels experienced in 2021. Corporate bond supply continues to be very robust, with $41bn in new issuance. Year-to-date, corporate issuance has set a new record, with an impressive $80bn in issuance. On balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward trade-off as being more favourable.

Equity – On the backdrop of a heavily concentrated U.S. market rally, we remain cautious of the distortion to market returns from high-flying technology stocks. As a result, we continue to favour a combination of the Dow Jones Industrial Average and the S&P 500 for our broad U.S. market exposure. The Dow provides a more diversified exposure to 30 prominent large-cap companies and less concentration in technology relative to the S&P. Broadening earnings strength presents an opportunity for previously out-of-favour names to “catch-up”. In our view, companies outside the Magnificent 7 that have demonstrated robust earnings growth, strong cash flow generation, along with decreased debt loads, are well-positioned to benefit from internal market rotations. As such, we gain exposure to these companies through the quality factor – companies with higher return-on-equity, strong operating performance, and healthy leverage levels – and the dividend growth factor – businesses with a lengthy and established history of increasing dividends.

In Canada, we remain attentive to how efficiently corporations are generating profits relative to financing costs. Looking forward, we continue to monitor the ability of businesses to generate profits given a decline in capital spending. More specifically, we are focused on businesses’ ability to grow and sustain dividends amid the lag between easing monetary conditions and consumption. Due to this, we observe value in higher yielding companies that are higher on the spectrum of quality. Geographically, we maintain our overweight U.S. exposure, underpinned by encouraging U.S. inflation data trends, broadening corporate earnings growth, and normalizing consumption. In addition, sluggish Chinese data and the lack of positive earnings revisions from EAFE tilt the risk-adjusted return profile in favour of the U.S. Lastly, as a Canadian investor, fluctuations in the Loonie’s relative value versus other major currencies continues to present tactical trading opportunities within our investment mandate.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

- [pdf] Segregated Fund Semi-annual Report - June 30, 2024