Site Search

239 results for fund codes

-

Universal Life Savings and Investment Options Updates

The fund pages for our Universal Life products have been updated.

Full details on the Equitable Generations™ funds available, visit Equitable Generations Savings and Investment Options (2055 pdf).

Full details on the Equation Generation® IV funds available, visit Universal Life Savings and Investment Options (1193 pdf).

We launched our Universal Life product update in September 2022, when an exciting new fund lineup became available.

Learn more about the funds:- Details on funds available

- American Equity Index (ESG)

- Canadian Equity Index (ESG)

- Special Situations fund (Fidelity)

- Sustainable Equity, Balanced, and Bond Funds (Fidelity)

- Target Date funds (Fidelity)

- Get all your ESG questions answered with Margaret Dorn, S&P

- Rates and Performance page

® and ™ denote trademarks of The Equitable Life Insurance Company of Canada. - [pdf] Insights into Non-registered taxation

-

What’s new in EZtransact

We’re excited to introduce the latest enhancement for EZtransact™, our digital self-serve tool. EZtransact now allows you to help clients:

• Easily make segregated fund withdrawals. This functionality is available for all account types, and for the First Home Savings Account, it also eliminates the need to submit additional CRA paper forms.

• Transfer from one fund to another fund digitally, within the same policy and same sales charge options.

These enhancements make it easier than ever to do business with Equitable®. They will help reduce your time spent on paperwork, allowing to you focus on more value-add time and services for clients.

Check out EZtransact. Stay tuned for more exciting digital enhancements coming soon!

If you have any questions, please contact your Director, Investment Sales.

Date posted: July 11, 2024 -

Easier than ever with Equitable and EZtransact

Equitable® keeps improving our digital self-serve tool, EZtransact®. Our latest enhancements make it easier than ever to do business with us.

What's new?

Dollar cost averaging transaction- Advisors can now submit new dollar cost averaging requests through the Fund Switch transaction in EZtransact. A new recurring switch type is available.

- When submitting a new request, you'll need to enter the amount, frequency, date of transfers, and the funds involved.

- If a client has an active request, you can change the amount, frequency, date, and funds.

- After you submit the request, the client will get an email to sign. Once they e-sign, the request goes directly to Equitable.

Other recent enhancements include:- Segregated fund withdrawals and fund transfers

- New dashboard for client search, transaction management enhancements and signing process improvements

Date posted: December 11, 2024 - Advisor Guide

-

Celebrating our most popular Pivotal Select funds

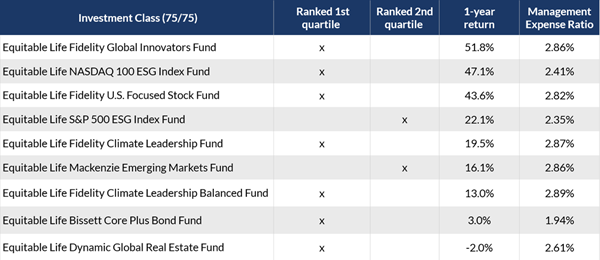

In August 2022, Equitable® launched 12 new segregated funds in Pivotal Select’s Investment Class (75/75). We wanted to bring some new innovative solutions to the product, including six sustainable investment funds. To say the launch of these funds was successful would be an understatement.

The funds are quickly becoming some of the most popular funds in Pivotal Select™, and their performance in 2023 was impressive. Equitable wants to celebrate these funds and encourage clients to consider them for their portfolios.

As of February 29, 2024, nine out of the 12 funds received a 1st quartile ranking for their 1-year return and two more were 2nd quartile. The table below shows the new funds that ranked in the top two quartiles for their 1-year returns.

Access additional fund performance information

If you haven’t looked at these funds yet, now is the time. Speak to clients about their investment options and see if these funds fit within their investment portfolio.

Talk to your Director, Investment Sales today for more information.Disclaimer

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value. Segregated fund values change frequently, and past performance does not guarantee future results. Investors do not purchase an interest in underlying securities or funds, but rather, an individual variable insurance contract issued by The Equitable Life Insurance Company of Canada. There are risks involved with investing in segregated funds. Please read the Contract and Information Folder before investing for a description of risks relevant to each segregated fund and for a complete description of product features and guarantees. Copies of the Contract and Information Folder are available on equitable.ca.

Management Expense Ratios (MERs) are based on figures as of February 29, 2024, and are unaudited. MERs may vary at any time. The MER is the combination of the management fee, insurance fee, operating expenses, HST, and any other applicable non-income tax for the fund and for the underlying fund. For clients with larger contract values, a Management Fee Reduction may be available through the Preferred Pricing Program. For details, please see the Pivotal Select Contract and Information Folder.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

Posted April 18, 2024

- Anti-money Laundering Legislation Requirements Summary

- New Investment Policy

-

Equitable Life awarded FundGrade A+ awards for 2021

Equitable Life® is the proud recipient of the Fundata FundGrade A+® in 2021 for Equitable Life Dynamic Power Global Growth Fund and Equitable Life Accumulative Income Fund. These funds are part of our legacy products and no longer available to purchase for new contracts.

Each year, Fundata looks for Canadian investment funds that uphold an outstanding performance rating over the course of the year. Equitable Life invests for the big picture and offers a complete range of investment and annuity products designed to meet the savings, accumulation and income needs of clients. Our strength as a company along with our many investment guarantees can help your clients achieve their financial goals with confidence.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.® ”Equitable Life” and “Pivotal Select” are trademarks of The Equitable Life Insurance Company of Canada.

- [pdf] Pivotal Solutions Fund Facts