Site Search

961 results for life policy 300109556

- About

-

Most employers staying the course on benefits during COVID-19

With businesses suffering hardship due to COVID-19, employers are turning to you for advice on their benefits plans during these difficult times. We’ve received numerous questions from advisors about changes our clients are making to their plans during this crisis.

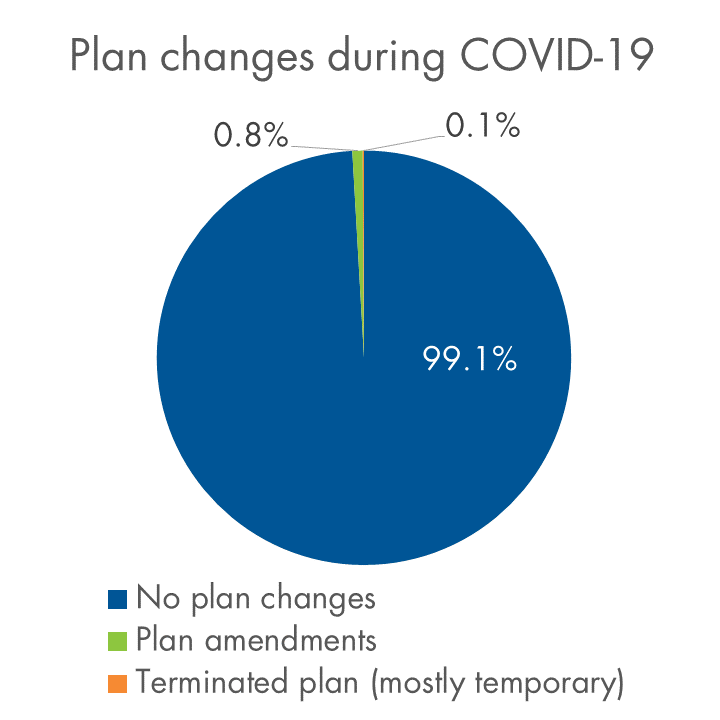

So far, the vast majority of clients are standing pat and taking a wait-and-see approach. Plan amendments have been the exception – fewer than 1% of our clients have made COVID-19-related amendments as of mid-April. Almost all are clients with fewer than 50 lives.

We know that many of our clients have experienced layoffs, but hardly any have cancelled benefits. Fewer than 0.1% have terminated benefits to date.

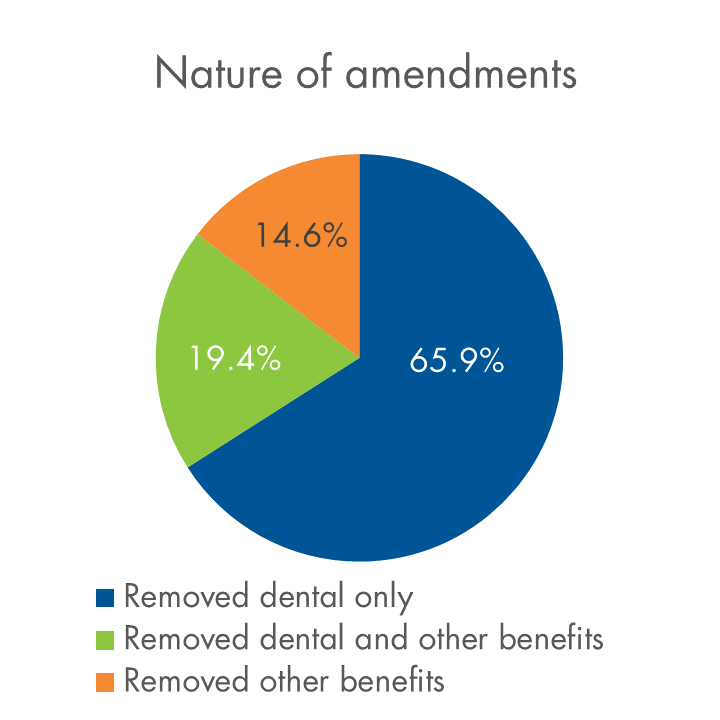

Below is a snapshot of plan amendments and terminations relative to our overall block, and an overview of the types of amendments we’re seeing.

COVID-19-related plan changes on Equitable Life’s block of businessAs of April 15, 2020

Have clients who need to make a change?

We know this is a difficult time for Canadian employers. If you have a client who needs to make a change to their plan, please contact your Group Account Executive or myFlex Sales Manager. We have a range of options to help them manage, and changes can be made quickly. The average turnaround time for COVID-19-related amendments is currently about four days.

We’re happy to work with each employer to understand the options that suit their specific situation best.

-

Update on our service levels during the COVID-19 pandemic

Supporting your clients and their plan members is more important than ever during the ongoing COVID-19 pandemic

So, we’re providing an update on our service levels.

We acted quickly to ensure there were no disruptions in service – most of our staff were working remotely from home and fully functional within a few days. We’ve reallocated resources from functions where volumes are down, such as dental claims, to those experiencing higher volumes. We also created a separate queue for COVID-19-related STD claims.

As a result, we’ve been able to maintain the industry-leading service levels you have come to expect from us, and our turnaround times continue to be well within our targets.

Here’s a summary of what you and your clients can currently expect in terms of average turnaround times:

Service category Average Turnaround Time

(as of April 26th)Customer Care Centre wait times 89% of calls answered within 20 seconds Responses to emails to our Service Team Within 24 hours Health claims 2 days Dental claims 2 days Life claims 1 day STD claims 4 days LTD claims 4 days Plan member updates 2 days New customer implementations 16 days COVID-19-related plan amendments 4 days Other plan amendments 8 days Quotes 2 days ahead of deadline We will closely monitor the situation and continue to adapt to ensure we maintain our service levels. And we will do our best to resolve any service issues that arise as quickly as possible.

Please feel free to contact your Group Account Executive or myFlex Sales Manager and let us know how we’re doing.

-

Take emotions out of investing

Taking the emotion out of investing can be easier said then done. Most of us at one time or another have decided upon something strictly because of how we felt at the time, not because it was logical or made good financial sense. I am sure most of us have a good story to tell.

When it comes to financial planning, you always want to encourage your clients to be a rational investor and accept that market fluctuation is part of the investment journey. Over the last few months, even the hardiest rational investor has been challenged to accept the market fluctuations. History shows us that this too, shall pass and markets will rise once more. The biggest question asked is always, when?

While no one has a crystal ball with that answer, the best we can do is help our clients understand that when building portfolios, risk is always at the forefront of any good investment strategy. The level of risk is just one of the building blocks to constructing a financial portfolio that will see the client through good times and bad.

Need more help? Equitable Life has created an emotional investing brochure to help your clients manage through these extraordinary times. To download a copy, click here. We have also included a template letter that you can personalize and use to reach out to your clients. To download an editable copy, click here.

-

Tools to manage mental health

As we all continue to manage the impacts of the COVID-19 pandemic, it’s important to remind your clients of the valuable supports available to help their plan members cope through this challenging time.

Free trusted information and COVID-19 resources

Our partner FeelingBetterNow® is responding to the pandemic by providing trusted public resources that offer mental health support. They are available to anyone 24 hours a day, seven days a week, and include:

- What to do if you’re anxious or worried about COVID-19;

- Resources for parents and caregivers; and

- National and Provincial Public Health resources.

Access COVID-19 resources from FeelingBetterNow.

FeelingBetterNow Mental Health Assessment

In addition to these public resources, Equitable Life clients with FeelingBetterNow as part of their group benefits plan have access to online mental health resources. FeelingBetterNow can help plan members identify their risk for mental health concerns and work with their doctor on diagnosis and treatment. It’s an anonymous tool developed by mental health experts which provides:

- Emotional and mental health assessments;

- Practical, evidence-based tools employees and their doctor can use to assess, treat, and follow-up on emotional and mental health concerns; and

- Convenient online access to information and effective resources.

FeelingBetterNow is easy to use and completely anonymous. It takes less than 20 minutes to complete the assessment and view your results.

Learn more about FeelingBetterNow, then contact your Group Account Executive or myFlex Sales Manager to discuss how your clients can add this service to their plan.

-

Changes to coverage of Humira in BC

BC Pharmacare recently announced it is adding Humira to the list of drugs included in its ongoing initiative to switch patients to biosimilar versions of high-cost biologics. Patients taking Humira for most conditions will be required to switch to a biosimilar version of the drug by Oct. 7, 2021 to maintain coverage under the public plan.

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is also known as the “originator” biologic. Biosimilars are also biologics. They are highly similar to the originator biologic drugs they are based on, and Health Canada considers them to be equally safe and effective for approved conditions.

How we are responding to protect our clients

To help prevent this change from resulting in additional costs for our clients’ drug plans, while still providing plan members with access to safe and effective medications, we will no longer cover Humira for plan members in BC. Effective Oct. 7, 2021, claimants currently taking Humira will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable Life plan.

We will be communicating this change to plan administrators later this week. And we will be communicating with affected claimants in early August to allow ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Sales Manager.

-

Make It Easy EZtransact Contest

Welcome EZtransactTM, Equitable Life®’s newest online transaction tool that makes managing your client’s policies quick and convenient.

Every EZtransact online transaction submitted between September 13 and November 26, 2021 gives you the chance to WIN! Eligible non-winning Entries will be carried forward to subsequent Draw Dates. So the sooner you start using EZtransact, the more chances you have to win! First draw will be on September 27, 2021.

One $100 winner each week! With a Grand Prize winner of $1000 at the end of the contest! Want to find out more? Please see the contest rules here. You can also contact us at equitablesrmarketing@equitable.ca.

Click here for to start using EZtransact today.

Make It Easy” EZtransactTM Contest: No purchase necessary. Contest period September 13, 2021 to November 26, 2021. Eleven prizes to be awarded, for a total value of $2,100 CAD. Ten weekly prize draws, each for one prize of $100 CAD, to be held every Monday from September 27, 2021 to November 29, 2021. One Grand Prize draw, for one prize of $1,000 CAD, to be held on November 29, 2021. Correct answer to mathematical skill testing question required to win. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will be carried forward to subsequent Entry Periods and will be eligible on subsequent Draw Dates. Maximum one weekly draw prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period.

Click here to see full contest rules, including no purchase method of entry. -

Increased auto approval means more time to focus on your complex cases

As the year draws to a close, we are pleased to reflect back on our many enhancements geared toward improving our auto-approval rates and the notable impact they have made on our service standards.

Throughout 2021, we have invested significantly in our services and technology, including data & analytics to ensure that more of our new business applications are approved automatically without any intervention, leaving our teams available to engage in settling your complex cases. As a result of these enhancements, over the past 3 months we have improved from 8% of our new business flowing straight through to approval, to an impressive 25% of cases requiring no underwriting*.

There are a number of factors that contribute to this straight through approval success in processing applications, such as simpler cases, applicants with no medical history or medical issues, younger applicants and applications for lower face amounts. These factors, alongside our ongoing efforts to fortify our processes, has resulted in positive feedback from the field.

Advisors have mentioned you’ve felt the impact on our speed and service, and we will continue forward into 2022 with this positive momentum, with further enhancements to help make it easier for you to do business with Equitable Life.

*As of December 2021 -

EquiLiving offers more options to clients facing a covered Critical Illness condition

Consider these statistics…1 in 2 Canadians will develop cancer in their lifetimes1. They’re just numbers…until the day someone you know is diagnosed, someone who didn’t see it coming. Then it becomes very real - no longer incidence statistics, but costs. Today more people than ever are surviving and living with not only just the physical, but also the financial effects of their illness.

We’re there to help when illness strikes

NEW! EquiLiving® plans and riders have recently been enhanced including:

● 20 pay options with coverage to age 75 or coverage for life

● Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

● Added Acquired Brain Injury as a covered critical condition

● 30-day survival period removed for all non-cardiovascular covered conditions

● No age restriction to claim for Loss of Independent Existence (LOIE)

● EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

● And so much more …

Learn more

● CI product enhancement video

● Visit our launch event page with product change details and more

● Marketing Materials

Please contact your Regional Sales Manager for more information.

1 www.cancer.ca

-

Our Critical Illness Insurance Path to Success Program

Our Critical Illness Insurance Path to Success program was designed with you, the Advisor, in mind.

Path to Success: Expert Advice on navigating CI Sales provides you with actionable ideas and scripts that you can implement immediately into your critical illness insurance meetings. CE Credits are available if you review the program in its entirety and complete the quizzes at the end of each section.

Learn more about the CI Path to Success Program

Next steps:

If you have any questions or are interested in getting access to this program, please reach out to your Regional Sales Manager directly.

Enhancements to our Critical Illness Insurance product EquiLiving®

The timing couldn’t be better for connecting with your Regional Sales Manager to gain access to this program, as we have made recent enhancements to our Critical Illness product that will help you offer more options to clients. We’ve enhanced our EquiLiving plans and riders with:

• 20 pay options with coverage to age 75 or coverage for life

• Support from Cloud DX to help monitor a client’s well-being from treatment to recovery

• Added Acquired Brain Injury as a covered critical condition

• 30-day survival period removed for all non-cardiovascular covered conditions

• No age restriction to claim for Loss of Independent Existence (LOIE)

• Adult Covered Conditions definitions updated to 2018 CLHIA definitions

• Increased the number of Early Detection Benefit covered conditions from 4 to 8

• And so much more …

Contact your Regional Sales Manager to get set up in the program and learn about other CE accredited presentations happening each week.