Site Search

119 results for document

- EZ Upload

-

Transaction Authorization Requirements table for Savings & Retirement advisors

Equitable Life® is here to help. When it comes to getting certain transactions authorized in a non face-to-face environment, you might need some direction. We’ve got you covered.

Equitable has created a quick reference table on EquiNet™. The Transaction Authorization Requirements table provides details on how to get certain forms approved and the best way to get them to us. Each form listed gives the authorization type that is accepted. We’ve also provided details when we receive a document that is considered not-in-good-order.

As we navigate through COVID-19, we will continue to update this table. This means you have the most current information available at your fingertips, 24/7.

Have other questions about COVID-19? Check out our Savings & Retirement COVID-19 update page on EquiNet as well. This page provides the latest news and information for Savings & Retirement advisors.

Still have a question? Give our Advisor Services team a call Monday to Friday 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or email savingsretirement@equitable.ca, or your local Regional Investment Sales Manager.

-

Simplified Alternative ID Process is Now Available

We have updated form 1710 to help you validate your client’s identification when you are not face-to-face, or if your client does not have one of the primary sources of ID.

Form 1710, Verification of Identity for Policyowner, will simplify the ID collection process currently in place. This form will help you with the validation of ID and provide you with space to record the details. New with this form is the ability to validate your client’s ID over a video call by documenting the details of the ID, and then having your client hold up the document and read the information for you to validate. You no longer need to obtain and submit copies of the identification documents to Equitable.

If your client requests the use of the Alternate ID process for a paper application, you can use this form to satisfy your identification validation requirements.

For more information, please see Section 2 of Form 1710 entitled “Alternate ID”. As well, you can refer to the “how to complete form 1710” Guide for further details.

Additional resources:

-

Reminder: Review and Manage Key Notifications on EquiNet

Supporting your business as an Equitable Life advisor is our top priority and EquiNet is our top resource to help you manage important policy notifications. You should routinely review policy updates, schedules, statements, and notices and follow up with clients.

Some key notifications you will find on EquiNet include:

- Premium Renewal Notices (including for Term Riders on UL policies)

- Returned PAC (Pre-Authorized Chequing) Letters

- SROs (Special Reinstatement Offer)

- Lapse Notices

- APL Warning Letters

- FGIO Notices

- Tax Exempt Notices

A review of these and other available documents under the Document Lookup tool and following up with clients will help prevent situations of policy lapses and missed renewal notifications. These documents should be managed as part of providing ongoing, superior customer service to our clients. -

THREE new ways to help make your Savings & Retirement business run smoother

As of August 20, 2022, EZcomplete® will include several new features that allow applications to be completed faster and easier:

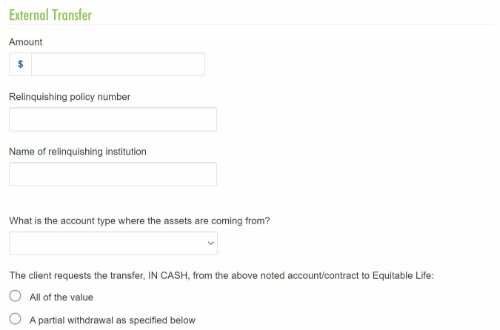

1. Prefilled Fund Transfer Form

The transfer form will be generated with the information from EZcomplete and included in the EZcomplete signing package, saving you time.

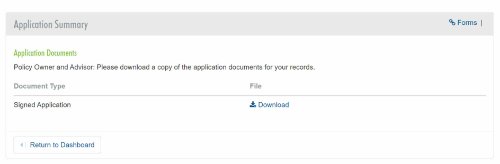

2. Client eSignature Audit History and Document Download

If you choose the e-signature option for the client, you’ll be able to download a copy of the e-signed transfer forms and the signature audit history.

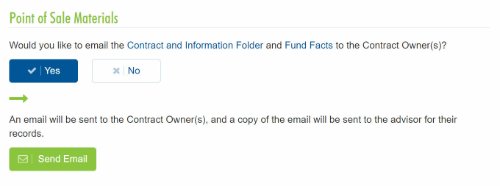

3. Email the Client Contract Info and Fund Facts Before Signing

You'll now be able to email Point of Sale materials (Contract & Info Folder and Fund Facts) to clients before they provide their e-signature.

Log in to EZcomplete today!

Speak to your Regional Investment Sales Manager to learn more!

-

Tax Slips – What you need to know

It is tax time, and clients should be receiving tax slips and deposit receipts by now. Check out the Tax Slips: A Quick Reference Guide for a taxation breakdown by product and Insights into Non-Registered Taxation for a detailed explanation on investment income, and why T3 tax slips are generated on non-registered segregated funds.

Clients who registered for tax slips on Equitable Client Access before December 31, 2022, can download or print tax slips quickly and easily from their Equitable® Client Access Inbox. Advisors can download tax receipts on Document Lookup on EquiNet®.

For questions about contribution limits, Retirement Income Fund minimums and Canada pension maximums check out Equitable Life®’s helpful 2023 Facts & Figures guide.

Equitable's Advisor Services Team is available Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or by email at savingsretirement@equitable.ca. You can also contact your Regional Investment Sales Manager.

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted: February 15, 2023 - [pdf] Levelize the tax on your fixed income investments with participating whole life (individual clients)

- [pdf] S&R Quick Reference Guide

- [pdf] CLHIA MGA Compliance Survey

- [pdf] UL Transfers & Allocations How To