Site Search

1362 results for if

-

New publication: CLHIA consumer guide for critical illness

In February, the Canadian Life and Health Insurance Association (CLHIA) published a new consumer guide for critical illness. This guide covers what clients need to know about critical illness.

Some of the topics include:

● What critical illness insurance covers in Canada

● If critical illness insurance is the right choice for a client

● What critical illness insurance policies may or may not include

● Plan types and offerings

● And more!

Equitable is committed to helping clients make informed decisions about their insurance needs. You can find links to the CLHIA critical illness consumer guide on equitable.ca and through EquiNet > Individual Insurance > Critical Illness. You can also find a link to the CLHIA agent guide for critical illness on EquiNet.

Share this with clients in addition to the great resources below!

Critical illness insurance with Equitable video: View on Vimeo.

Critical illness prospective letter template – simply fill it out and send off to your clients!

Want to earn CE credits? Check out our Critical Illness Path to Success program.

Need more information?

Your Equitable Wholesaler is here to help!

® and TM denote trademarks of The Equitable Life Insurance Company of Canada. -

EAMG Market Commentary April 2024

April 2024

Rates & Credit – Interest rates increased in Q1 2024, giving back half of the decline experienced in Q4 2023 amid consistently positive surprises in U.S. economic data. The positive economic news also drove a strong risk-on tone to the market, with the risk premium on corporate bonds tightening as economic prospects improved. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index (FTSE) with a slightly positive 0.07% return, verses a loss of 1.66% in government bonds and a loss of 1.22% for the overall index. More interest rate sensitive long-term bonds experienced the largest decline, which was partially offset in corporate bonds by the risk-on tone to corporate bond spreads. On a 6-month and 1-year basis, the FTSE remained positive at 6.94% and 2.10%, respectively. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less exposure (notably financials and securitization).

.png?width=850&height=303)

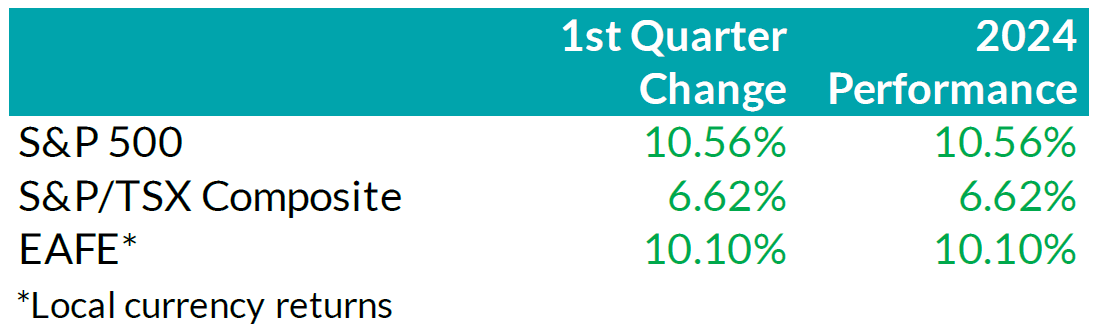

Equity Overview – Throughout Q1 2024, concerns about a recession gradually eased as central bankers adopted a more accommodative outlook on monetary policy. Their growing dovishness reflected confidence that the restrictive monetary measures were effectively curbing inflation as anticipated. Underpinned by prospects of an economic soft-landing, global equity markets rallied to start the year with most major North American indices soaring to new all-time highs during the quarter. U.S. equities continued to outperform other major international markets with the S&P 500 returning 10.6% in USD terms. Major developed economies from Europe, Australasia, and the Far East (EAFE) gained 10.1% in local currency terms, while the TSX added 6.6%. Furthermore, the U.S. economy continued to prove more resilient than most major developed economies, with strong employment and robust output data. As such, foreign investors of U.S. denominated securities achieved enhanced returns, benefitting from a stronger Greenback.

.png?width=850&height=260)

U.S. Fundamentals – Corporate earnings beat expectations in Q4 2023, triggering a wave of upward earnings revision. Stable operating margins, cash flows and debt loads continue to attract investors into equities. Investors appear focused on the company’s ability to sustain debt levels ahead of renewing debt obligations. We observed that the number of major companies that expect improving financial performance shrunk to ~19%. This suggests that concentration risks are likely brewing in the equity market, yet again.

U.S. Quant Factors

Optimistic run-up in equity valuations were mostly driven by the momentum factor. A basket of companies with positive price trends intensified concentration risk in the equity market. We note that momentum factor’ performance sharply contrasted fundamental factors, making us cautious on the market’s complacency. For context, high quality companies, which is typically defined by high Return on Equity (ROE), stable earnings variability, and low financial leverage, placed second in our risk-adjusted performance rankings, and is dwarfed by the ~ 17.9% return observed from the momentum factor.

Canadian Fundamentals – Against the backdrop of underwhelming financial results, ROE – a gauge of how efficiently a corporation generates profits – rebounded in Q4, 2023, after declining throughout most of the year. The improved efficiency metric provided a positive catalyst for dividend investors as the inverse movements of ROE relative to financing costs over 2023 kept investors on the sidelines. In addition, the CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges, providing a tailwind for Canada’s energy and materials sector. Concerns with earnings contraction and macro-economic conditions have subsided.

Canadian Quant Factors – Crude prices soared higher in Q1 2024, with ongoing production cuts from OPEC+ and ramifications of geopolitical conflicts keeping oil markets undersupplied. As such, energy companies benefitted, surging higher and outperforming the broader index, while the low volatility basket – with lower exposure to cyclically sensitive business – underperformed into quarter end. Furthermore, Canadian banks underperformed to start the quarter, giving back some of the sharp outperformance witnessed into the end of Q4 2023. That said, soft inflation data increased expectations of impending rate cuts from the Bank of Canada and, as such, banks performed in line with the broader market throughout most of the quarter. Underpinned by expectations of a dovish switch in monetary policy, investors rewarded dividend payers with a history of increasing dividends, boosting confidence in their ability to support future dividend growth. It is important to note that investors should not let dividend growth’s outperformance overshadow high dividend paying companies’ underperformance; more specifically, investors remain attentive to the businesses’ ability to create value relative to financing costs.

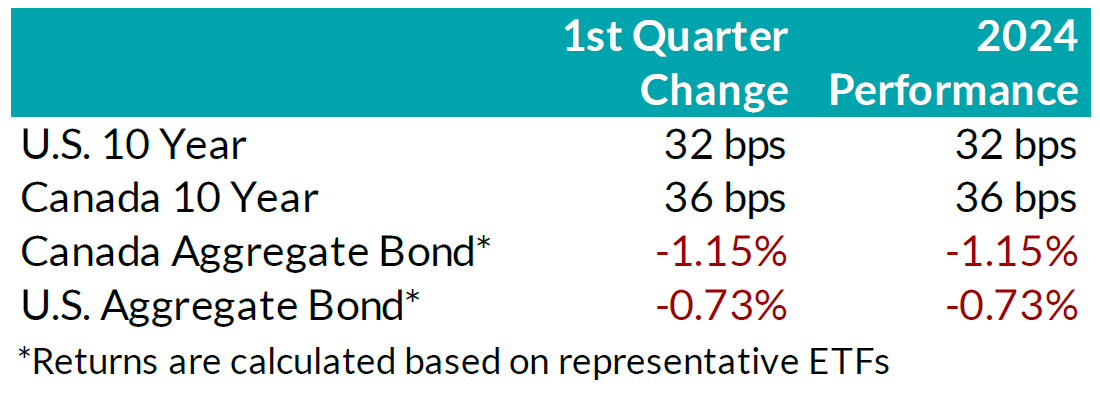

Views From the Frontline

Rates – Interest rates in both Canada and the U.S. increased across all bond tenors in Q1 2024. U.S. inflation data surprised to the upside, remaining stubbornly higher than hoped, while labour market and consumer indicators underscored the economy's continued strength. In Canada, inflation data fell below forecasts, but early 2024 GDP readings exceeded expectations. The market now anticipates a 'soft landing' for the U.S. economy; however, the Canadian economy continues to slow. North American central banks have signaled that we are at the peak for policy rates. The market is currently pricing in approximately two-to-three, 25 basis point interest rate cuts by the U.S. Federal Reserve in the second half of 2024, much fewer than the six-to-seven 25 basis point interest rate cuts that the market had been anticipating even just three months ago. As the Swiss central bank led the way with the first rate cut among developed countries, central banks in major developed economies will closely monitor upcoming data and market developments to determine the timing and pace for rate cuts.

Credit – The risk premium for corporate bonds (versus government bonds) continued to tighten over the quarter, with a strong risk-on tone to the market as investors priced in renewed economic growth in 2024 as compared to previous expectations. Corporate bond supply was robust, with $38.2bn in new issuance, the second strongest first quarter on record. On the balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – We favour a combination of the Dow Jones and the S&P500 for our broad market exposure. The Dow, a price-weighted index, should have some value and low volatility tilt as it tracks mature large companies. As explained above, concentration risks are brewing in the equity market, and during Q1 this risk was exacerbated by investors rushing into a basket of companies with positive price trends, thereby pushing valuation metrics further into the expensive territory. In our view, it is well-suited to use a combination of the Dow Jones Industrial Average and the S&P 500 for broad U.S. market exposure given the heightened concentration risk. Looking forward, we expect companies to exhibit stable operating margins and therefore, we are shifting our focus toward the balance between upcoming corporate debt refinancing requirements and reinvestment in projects intended to drive future growth. In plain words, we are tactically adding to companies with stable cash flows and decreased debt loads outside of the mega-cap group. In Canada, we expect a modest earnings growth and remain attentive to how efficiently a corporation generates profits relative to their financing cost. We caution against the overly optimistic, commodity driven, “catch-up” trade vs. our southern neighbour. Therefore, we tweaked our investment strategy by rotating out of the low volatility factor and adding to higher yielding quality companies in Canada.

Downloadable Copy

Mark Warywoda, CFA VP, Public Portfolio Management Ian Whiteside, CFA, MBA AVP, Public Portfolio Management Johanna Shaw, CFA Director, Portfolio Management Jin Li

Director, Equity Portfolio ManagementTyler Farrow, CFA

Senior Analyst, EquityAndrew Vermeer

Senior Analyst, CreditElizabeth Ayodele

Analyst, CreditFrancie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

Is it time to revisit bonds?

You see the interest rate predictions and talk of inflation in the news every day. What should clients do? Is it time to consider bonds?

Join our webcast with Darcy Briggs, Senior Vice-President, Portfolio Manager, of the Franklin Canadian Core Plus Bond Fund, for insights on the impacts of interest rates and inflation movement on bond portfolios and how to navigate during this time of uncertainty.

Darcy and the team skillfully combine Canadian core bonds with non-core fixed income opportunities to create a solution that is built around a foundation of high-quality Canadian bonds. They opportunistically add “off benchmark” securities for added yield and diversification.

You don’t want to miss it.Learn more

Continuing Education Credits

This webcast has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

Date Posted: April 25, 2024 -

April 2024 eNews

In this issue:

- Competitive – and easy – benefits plans for your small business clients

- Simplifying benefits enrolment for your clients*

- NEW time-off tracking tool from HRdownloads*

- Focus on benefits fraud: Protecting your clients’ plans from abuse*

Competitive – and easy – benefits plans for your small business clients

Supporting your small business clients can be a challenge. It’s tough to find a competitively-priced benefits plan with the features they want. Small business owners may also need more of your time – especially if this is their first benefits plan.

That’s why we created Equitable EZBenefits™, a benefits solution designed with the needs of small businesses in mind. With a range of plan design options and valuable embedded services for plan sponsors and plan members, EZBenefits is available for groups with 2 to 25 employees. And to make things simpler for you, we’ve created an Advisor Concierge Service exclusively for EZBenefits. Whether you have a question about submitting a quote request for a new client or an issue with an in-force client, our Concierge Service is your go-to resource for EZBenefits support.Don’t have any EZBenefits clients yet?

To learn more about EZBenefits, watch our video to learn more or view our brochure.Simplifying benefits enrolment for your clients*

Navigating the benefits enrolment period can be overwhelming – for you, your clients and their employees. It’s difficult to ensure all plan members complete the necessary paperwork before the enrolment deadline.

That’s why we offer our secure Online Plan Member Enrolment tool at no extra cost to plan sponsors. The tool simplifies the onboarding process for your clients and their plan members by eliminating the need for paper enrolment forms.

It also makes enrolment faster and easier for your clients by:- Reducing errors and rework that can occur due to spelling mistakes or missing information on paper forms; and

- Sending automatic enrolment reminders to plan members, resulting in fewer late applicants.

- Enrol in their benefits plan in just minutes from their computer or mobile device;

- Easily enter all their enrolment information, including dependent details, banking information for direct deposit of claim payments and details for coordination of benefits; and

- Designate their beneficiary electronically.

Ready to share our Online Plan Enrolment Tool with your clients? Get them started with these helpful resources:

- Online Plan Member Enrolment Flyer for Plan Administrators

- Online Plan Member Enrolment Quick Reference Guide for Plan Administrators

- Quick Reference Guide for Plan Members

To learn more about how Online Plan Member Enrolment can simplify benefits enrolment for your clients, contact your Group Account Executive or myFlex Account Executive.

NEW time-off tracking tool from HRdownloads*

Through our partnership with HRdownloads®, EZBenefits clients now have complimentary access to Timetastic —a time-off tracking tool that can make it easier to manage employee vacation time, sick days and more.

Timetastic integrates seamlessly with HRdownloads and includes a mobile app to help manage time-off requests from any mobile device.

To see Timetastic in action, check out this demo.

EZBenefits also includes other helpful resources and tools from HRdownloads that can make daily human resources tasks easier, including:- A robust, award-winning HR management platform (HRIS);

- HR documents, templates, compliance resources and articles; and

- A live HR advice helpline.

Learn more about accessing HRdownloads.Focus on benefits fraud: protecting your clients’ plans from abuse*

According to the Canadian Life and Health Insurance Association (CLHIA), benefits fraud costs insurers and plan sponsors millions of dollars each year, which can lead to increased premium costs.

Resources for your clients

Both plan administrators and plan members play a role in preventing benefits abuse. So, we’ve compiled some resources you can share with your clients to help them understand what benefits fraud is and how to prevent it:- CLHIA’s free 15-minute Protect Your Benefits online course for plan administrators and their members

- CLHIA’s Fraud is Fraud program, including their FAQs on benefits fraud

- Our online guide to benefits abuse

- Tips for plan administrators and plan members to protect their plan

How we’re fighting benefits fraud

Our Investigative Claims Unit (ICU) works to detect and eliminate benefits fraud. We use a variety of investigative techniques, including CLHIA-led industry tools to detect and eliminate benefits fraud:- Joint Provider Fraud Investigation Program: A robust program that allows insurers to collaborate on fraud investigations that affect multiple insurers;

- Data Pooling Program: An initiative that pools data between insurers and uses advanced artificial intelligence to further identify and reduce benefits fraud; and

- Provider Alert Registry: A registry that allows insurers to view the results of other insurers’ anti-fraud investigations into specific practitioners.

-

Free Webinar: A better employee health benefits solution for small business clients

Join us on Tuesday, May 28, 2024 at 1 p.m. ET for a free webinar about Equitable EZBenefits™ – our new employee health benefits solution designed for small business clients.

If you serve small business owners, chances are they’re looking for a group benefits solution that’s affordable, sustainable and easy to manage. That’s why we created EZBenefits for businesses with between 2 and 25 employees.

You’ll learn about:

● The range of plan design options we’ve created to fit various needs and budgets;

● The streamlined process we’ve designed to optimize your time and provide you and your clients with rapid quotes, hassle-free plan implementation and easy renewals;

● Our dedicated Advisor Concierge Service – your go-to resource for EZBenefits support;

● The health and wellness services that are embedded with EZBenefits, including Virtual Health and an Employee and Family Assistance Program; and

● The built-in HR support through Equitable’s partnership with HRdownloads®, including access to HR technology, content and training.

Register to attend the EZBenefits webinar

This webinar will be delivered using Microsoft Teams and will include a Q&A component. If you wish to submit a question using the Q&A feature, please follow these instructions when you join the webinar:

● Join using the Microsoft Teams app. If you do not have Microsoft Teams, you can download it for free here.

● If you prefer to join via web browser without installing Microsoft Teams, please use Google Chrome or Microsoft Edge. Other browsers do not support the Q&A feature. -

Clients looking to add a little balance and diversification to their investment mix?

An Equitable® Guaranteed Interest Account (GIA) may be just the right fit for them. With competitive interest rates, Equitable GIAs may be an ideal solution for clients looking to create a well-diversified and balanced portfolio.

A few reasons to consider Equitable for your GIA business:

-

• The GIA advantage – a life insurance contract can provide many estate planning benefits.

-

• Advisor rate discretion – advisors can forego up to 40bps of commission for an equal increase in interest rate, making our great rates even better.

-

• Step Up Your Wealth Sales program1 – 100% of GIA net deposits are used to calculate the 0.75% bonus commission earned on net deposits for 20242.

Bookmark this page to check our current rates.

For more information, please contact your Director, Investment Sales.

1 Equitable reserves the right to alter or terminate this program at any time and without notice.

2 All eligible deposits, sales, and redemptions occurring between January 1 and December 31, 2024, will be used to calculate an advisor’s 2024 net deposits. See full Step Up Your Wealth Sales program details for more information.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Date posted: May 9, 2024 -

-

The power of together

At Equitable, we believe in the power of working together. It's a mindset that drives our behaviours, decisions, and actions to deliver impact and positive outcomes for our clients, advisors, partners, each other, and the communities we cherish.

Together with advisors and partners across Canada, we offer Individual Insurance, Group Insurance and Savings and Retirement solutions. Together we are helping clients protect today and prepare tomorrow.

View on Vimeo

Questions about our new brand? Please contact your Equitable wholesaler or visit equitable.ca.

-

All about the changes to the capital gains inclusion rate

Disclaimer: The following content is provided by and is the opinion of Invesco Canada Ltd. Equitable does not guarantee the adequacy, accuracy, timeliness, or completeness of the information. Equitable shall not be liable for any errors or omissions in the information provided by Invesco.

What has changed?

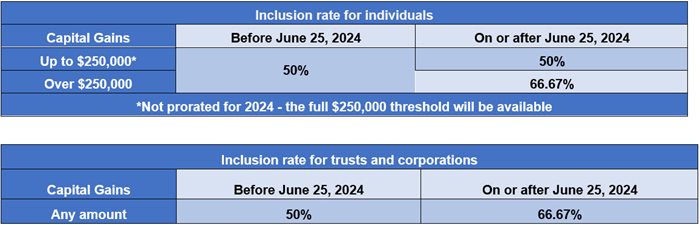

One noteworthy measure to come from Budget 2024 is the proposed change to the capital gains inclusion rate, which was previously held steady at 50% since 2001.

For individuals, capital gains more than $250,000 annually will be subject to an increased 66.67% inclusion rate as of June 25, 2024, while the capital gains up to $250,000 will continue to be subject to the existing 50% inclusion rate. As a transitional measure for 2024, only the capital gains realized by individuals on or after the effective date of June 25 that are above the $250,000 threshold will be subject to the increased inclusion rate.

For trusts and corporations, the inclusion rate on all capital gains will increase from 50% to 66.67% starting on June 25, 2024.

Who is affected?

Impact to individuals

Budget 2024 proposed to add transitional rules which would specifically identify capital gains and losses realized before the effective date (Period 1) and those realized on or after the effective date (Period 2). The effective date is June 25, 2024. Capital gains realized on or after that date will have an inclusion rate of 50% on the amount up to $250,000, and an inclusion rate of 66.67% on the amount above $250,000. All capital gains realized prior to the effective date will have an inclusion rate of 50%.

Take Ontario as an example, the proposed higher inclusion rate on capital gains would effectively increase the average federal-provincial marginal tax rate for Ontario residents on capital gains above $250,000 at the top marginal tax rate from 26.76% to 35.69%. A more detailed analysis on the impact of these changes to an individual’s tax rate is discussed below.

For net capital gains realized in Period 2, the annual $250,000 threshold would be fully available in 2024 (i.e., it would not be prorated) and it would apply only in respect of net capital gains realized in Period 2.

The $250,000 threshold would effectively apply to capital gains realized by an individual, either directly or indirectly via a partnership or trust, net of any: current-year capital losses, capital losses of other years applied to reduce current-year capital gains, and capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed employee Ownership Trust Exemption or the proposed Canadian Entrepreneurs’ Incentive claimed.

Two common scenarios of reaching the $250,000 capital gain threshold are the deemed disposition of capital property at death, and the emigration from Canada (i.e., becoming a non-resident for income tax purposes). We have provided additional details on these topics below.

Deemed disposition upon death

When an individual passes away, they are deemed to have sold their capital property (e.g., units or shares of mutual funds, shares of corporations, and real property) at its fair market value (FMV) immediately before their death. If a capital gain arises because of this deemed disposition, that capital gain is reportable on the deceased’s final (terminal) tax return and the taxes owing as a result, if any, would be payable by the estate of the deceased. However, there are provisions that allow taxes to be deferred when the property is transferred to a spouse. For example, if a capital property is transferred to a surviving spouse or common-law partner, subsection 70(6) of the Income Tax Act (Canada) automatically deems the deceased to have disposed of that property and the spouse or common-law partner immediately acquires the same property at the deceased transferor’s adjusted cost base (ACB). This is commonly referred to as the “spousal rollover”. Another potential strategy to manage potential large capital gains taxes at death is life insurance, since the death benefit is typically paid out tax-free.

Without careful planning, the estate value could be substantially reduced by the changes to the capital gains inclusion rate. Furthermore, it would be prudent to ensure there are liquid assets or cash available in the estate to cover the associated tax liabilities.

Non-resident of Canada – Departure tax

Residency in Canada for income tax purposes is a question of fact, which primarily depends on the individual’s residential and social ties in Canada. When an individual becomes a non-resident of Canada, they are deemed to have disposed of and immediately reacquired certain types of property at FMV. The tax incurred because of this deemed disposition and reacquisition is also known as the departure tax. Some examples of properties subject to departure tax include securities inside a non-registered investment portfolio, shares of Canadian private corporations, and real estate situated outside of Canada. Note that there are some properties that are exempted from the departure tax, including: pensions and similar rights (including registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), and tax-free savings accounts (TFSAs)) and Canadian real property.

The departure tax rules coupled with the increased capital gain inclusion rate above the $250,000 threshold may incur additional tax payable for emigrants. However, there is an option to defer the payment of departure tax on income associated with the deemed disposition upon emigration. By making an election, the individual would pay the tax later, without interest, when the property is disposed of. This election can be done by completing CRA Form T1244, “Election Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property," on or before April 30 of the year following their departure from Canada.

Impact to Entities

Corporations and trusts will also be impacted by the increased inclusion rate as of June 25, 2024. Unlike individuals, corporations and trusts will not have access to the old inclusion rate on the first $250,000 of capital gains: they will be subject to the new 66.67% inclusion rate from the very first dollar.

With the above in mind, there will be options available to shelter corporate and trust capital gains from the new inclusion rate.

For corporations:

The lifetime capital gains exemption (LCGE) can be used to eliminate capital gains taxes on the sale of qualified small business corporation shares (generally, these are shares of a Canadian-controlled private corporation that carries on an active business). The LCGE is also available on the sale of qualified farm or fishing property. The current lifetime limit for the LCGE is $1,016,836. Budget 2024 proposed to increase that limit to $1,250,000 starting on June 25, 2024, so certain business owners will be able to reduce or eliminate their exposure to the new inclusion rate if they are able to make use of the increased LCGE limit.

For trusts:

Budget 2024 suggests that capital gains allocated by a trust to its beneficiaries on or after June 25, 2024, will be included in the beneficiaries’ income at the old 50% rate up to the beneficiaries’ first $250,000 of capital gains for the year. While the specifics are not yet available, this opportunity will likely create further planning considerations surrounding the allocation of capital gains from a trust to its beneficiaries to reduce taxes. Capital gains can generally be allocated to a beneficiary for tax purposes when they are actually paid to the beneficiary, or when they are payable to a beneficiary (i.e., the beneficiary hasn’t received it, but has a right to demand payment of the capital gain). The option of making income paid (or payable) to its beneficiaries and allocating such income to be taxed in their hands will largely depend on the trust terms.

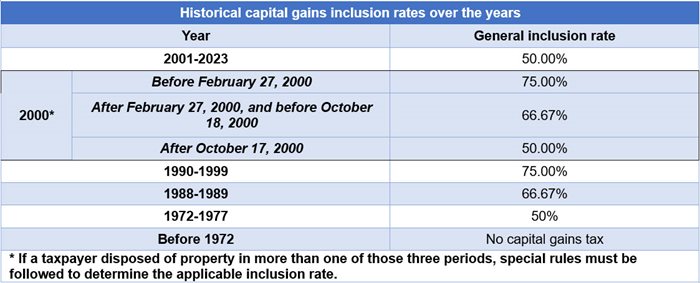

Historical reference: capital gains inclusion rate

Those of us around long enough, understand that this recent change was not the only time the capital gains inclusion rate has deviated from the 50% inclusion rate. Over the years, capital gains tax rate has ranged from nil to as high as 75% as indicated in the table below. In fact, the first instance of capital gain tax was introduced in 1972!

Excluding the 2024 tax year, we have given a rough estimate on the percentage of time spent at each of the various capital gains inclusion rates over the last 42 years. As we can see, for most of the time, the capital gains inclusion rate has remained at the 50 % inclusion rate. In fact, for the last 23 consecutive years, the inclusion rate has remained untouched with the last change being back in tax year 2000 with various changes introduced that year.

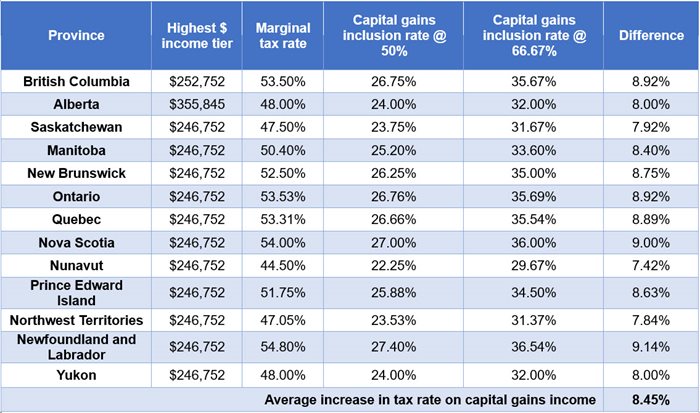

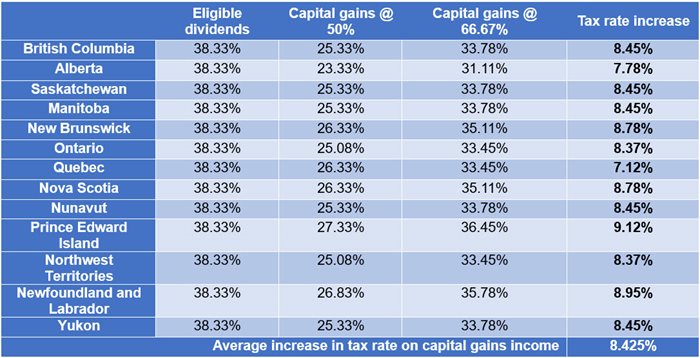

Tax impact by province/jurisdiction

With the increase in the capital gains inclusion rate, we want to demonstrate the potential tax impact of those changes across jurisdictions in Canada. The table below shows the 2024 marginal tax rate for the highest individual income earners in each jurisdiction at both the 50% and 66.67% capital gains inclusion rate, respectively. The average difference is an increase in taxes payable by 8.45%.

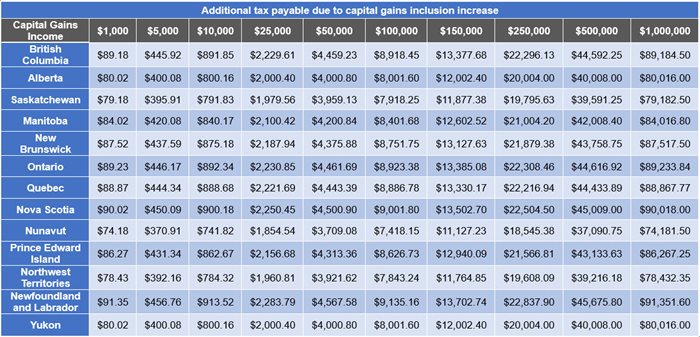

Next, we look at the additional taxes payable because of the inclusion increase, assuming varying capital gains income levels. Of course, this assumes that the capital gains do not otherwise benefit from a reduced inclusion rate or an outright exemption such as eligible in-kind donations of securities to registered charities, or shares that qualify for the lifetime capital gains exemption, to name a few.

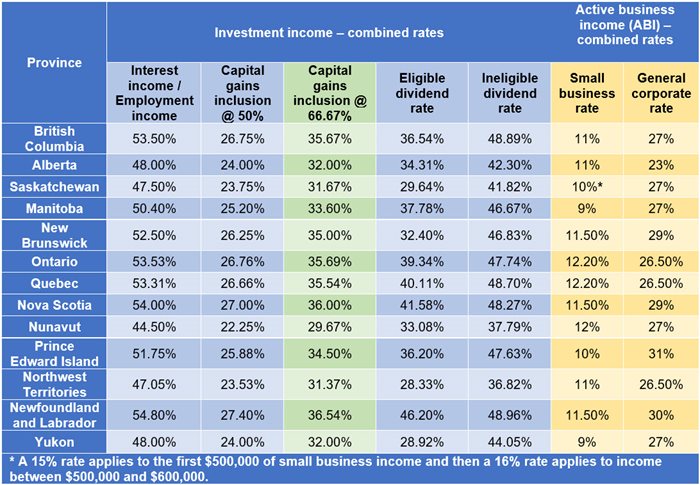

Understanding the tax implications of investing is an essential part of financial planning and reinforces the importance of working with a knowledgeable financial advisor to understand the long-term impact of these changes as it applies to personal situations. No doubt, tax rates influence capital allocation decisions. Canadians who take more inherent risk with their capital have traditionally been afforded preferred taxation rates promoting innovation through capital investment, something the government can do with good tax policy to encourage business growth and spur economic expansion. This is evident in the breakdown of the tax rates depending on the characterization of the income as noted in the table below.

Clearly the tax rates reflect the added capital risk investors and business owners take. We can clearly see the preferred taxation rates afforded on small business income and at the general corporate tax rates on income over the small business limit, compared to the tax rate on interest income or that of employment income. That tax-preference also extends to investors of “riskier” allocations of capital in marketable securities such as stocks, bonds, mutual funds, and exchange traded funds, to name a few. The tax rates of less-risky investments (such as money market instruments) do not benefit from the capital gains tax-preferred inclusion rates. With the latest move, there is not much difference in earning eligible dividend income from Canadian resident corporations and from dispositions resulting in capital gains.

Some pundits have declared the move as a disincentive to capital and business investment and may encourage businesses to move into more tax-favoured jurisdictions outside Canada. The Federal government has promoted the change as impacting a very small overall percentage of investors, estimated at 0.13% of Canadian individuals and 12.6% of corporations. Further, the move has been argued by the Liberals as necessary to work towards “intergenerational fairness”.

How to prepare for the changes?

For now, advisors may want to start educating their clients about the basics of the changes, which starts with comparing the current inclusion rates with the new inclusion rates.

Individual investors with large unrealized capital gains will also likely ask if they should crystallize their capital gains before June 25th to save money on taxes in the long run. The assumption that selling now will result in overall savings will not be correct in all cases, however. There is an opportunity cost to paying taxes upfront, rather than deferring those taxes to a later year.

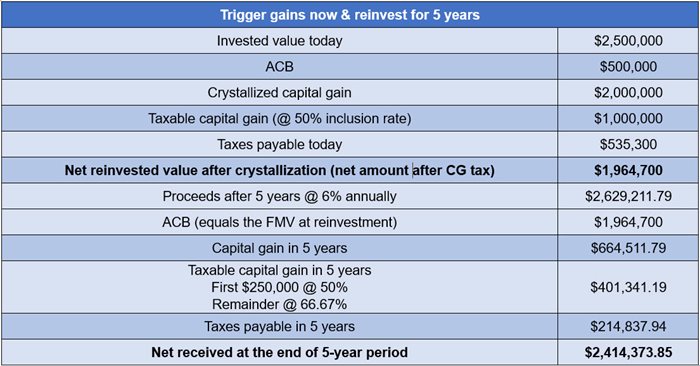

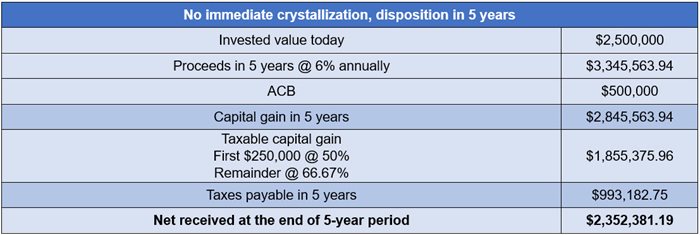

For example, let’s assume an Ontario client owns a $2.5 million non-registered equity portfolio with $2,000,000 in unrealized capital gains. They had no intention of selling those investments for another 5 yeas, but in light of the upcoming changes, they are considering selling immediately, paying the capital gains taxes now, then reinvesting the net amount after taxes back into those same investments for the 5-year investment period. They are currently in the top marginal tax bracket in Ontario (53.53%) and expect to continue to be in 5 years’ time. The assumed average rate of return on their investments is 6% annually over the next 5 years.

As can be seen in this example, at 6% annual compound growth rate, the option to realize much of the capital gains now resulted in a higher overall return in the amount of $61,992.66 over the 5-year period due to the lower inclusion rate. Alternatively stated, if the investor does not crystallize the gains today, the equivalent rate of return needed to have the exact net after tax amount at the end of the 5-year period (the “breakeven return”) would be a 6.60% compound annual return. While this certainly will not be true in all cases, this is the sort of analysis that will have to be conducted when assessing whether it makes sense to realize capital gains in 2024. The rate of return on investment and the investment horizon, among other things, are important determining factors.

Although we used securities investment in our example, a similar analysis can be done for other kinds of property held, such as a vacation property that is unlikely to benefit from the principal residence exemption. In addition, taxes often take a back seat to other planning considerations. These conversations should be had with the primary goals of the client in mind, which may supersede tax planning considerations.

For corporate investors, it will be important to emphasize the impact the capital gains inclusion increase will have on small business owners. As a refresher, a corporation is a separate legal entity from the shareholders who own it and is subject to tax on the income it generates. Income is first taxed within the corporation before it can be passed to the shareholders in the form of dividends out of its retained earnings. To avoid double tax on income that passes through a corporation to shareholders (and to prevent any unintended tax advantages), a dividend gross-up and tax credit model is applied at the individual level, along with a tax refund mechanism to the corporation on passive investment income. This is designed to integrate the tax system between the two entities: individual and corporation. Ideally, perfect integration is achieved when after-tax income is equal, whether it is earned individually or through a corporation. In reality, depending on the province and type of income earned, there could be a tax cost in earning passive investment income through a corporation, including earning passive investment capital gains income. Currently there is a tax cost of earning capital gains income through a corporation across all Canadian provinces/jurisdictions.

The latest change further increases the cost of earning passive investment income inside a corporation, though we do not yet know what changes will be made to the corporate tax refund mechanisms. As noted in the table below, the increase averages approximately 8.43% and closely equates the rate on eligible dividends. This rate reflects the initial tax rate on passive investment income earned within an active business.

For many small businesses, and perhaps to long-term individual investors, this increase in the tax rate will feel unfair as the accumulation of earning a pool of assets for retirement is often done within their small business corporation, and in many cases the sole source of retirement funds.

If an immediate crystallization of accumulated capital gains is not desired, what should investors consider in the longer run? Although many details of the new proposed rules are yet to be clarified, here are some general considerations.

For individuals, it may be helpful to plan the timing of future dispositions to stay below the annual $250,000 threshold. Also, it may seem obvious but maximizing investments within registered plans, including the new first home savings plan (FHSA) where eligible, can reduce exposure to future capital gains tax. Moreover, estate planning becomes even more important as the potential tax payable on the deemed disposition of capital property at death rises. On that front, strategies to reduce capital gains at death could be considered, such as inter-vivos gifting, charitable donation, spousal rollover, and acquiring life insurance to provide sufficient liquidity to the estate.

For business owners, some strategies to limit future capital gain exposure may include contributing to an individual pension plan (IPP), conducting an estate freeze to pass on future capital gains to succession owners, and ensuring the small business shares qualify for the LCGE. The suitable strategies are highly dependent on the business needs and personal situation of the business owner.

Acting too soon or not fast enough?

Finally, there is what many in the industry have been calling a “change of law” risk. That is, within the next year and a half, a federal election is scheduled, and this capital gains inclusion tax policy will surely be a primary election issue. As part of that election platform, parties may promise to repeal it outright or alter its scope and application. Consider also that any changes in the capital gains inclusion rate could be retroactive or simply not apply in all cases.

The information provided is general in nature and may not be relied upon nor considered to be the rendering of tax, legal, accounting or professional advice. Invesco Canada is not providing advice. Readers should consult with their own accountants, lawyers and/or other professionals for advice on their specific circumstances before taking any action. The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the simplified prospectus before investing. Copies are available from your advisor or from Invesco Canada Ltd

Date posted: May 23, 2024 -

Equitable Master Class webcast featuring Susan Silma

You’re invited to our next Equitable® Master Class webcast offering compelling topics and unique ideas from leading experts to help you manage and grow your business.

Navigating regulatory compliance and changes as an advisor can be challenging and overwhelming at times. Just imagine how clients feel. Wouldn’t it be nice to be able to transform regulatory compliance into meaningful client engagement?

Join us for an informative discussion on how to do just that, led by Susan Silma, a lawyer and former regulator with deep experience in the financial services industry. Susan is passionate about humanizing and simplifying the client and advisor experience.

Learn more!

Shannon Labby

Investment Sales Vice President,

Equitable

Susan Silma

Speaker and Author

Continuing Education Credits

This webcast has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

Date posted: May 22, 2024