Site Search

406 results for benefits of seg fund

- [pdf] Pivotal Select segregated fund codes and fees

-

Equitable Life Savings & Retirement Webinar Series features Global Equity Investing Using a First Pr

In 2022, Equitable Life’s® S&R team will continue to spotlight various aspects of our competitive fund lineup and product offerings. Each webinar in the series features a new topic. This series gives advisors an opportunity to:

• learn more about various products and product features,

• hear from industry professionals,

• learn about investment strategies; and so much more.

This month, Equitable Life welcomes Michael Hatcher, CFA, Head of Global Equities and Director of Research for the Invesco Canada Equity team. Join your host Taylor Stavenjord, Regional Vice President and Invesco Canada.

Equitable Life is pleased to highlight access to Invesco Global Companies Fund, Invesco International Companies Fund, and Invesco Europlus Fund in the Pivotal Select™ segregated fund lineup.

Learn more

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only. -

Equitable Life Webcast Series featuring Equitable Life Dynamic Asia Pacific Equity Fund Select

Benjamin Zhan and Bruce Zhang will discuss the Equitable Life Dynamic Asia Pacific Equity Fund Select along with the fund's people, philosophy, process and performance.

Equitable Life® continues to spotlight various aspects of our competitive fund lineup and product offerings. This series gives advisors an opportunity to:

• learn more about products and product features,

• hear from industry professionals,

• learn about investment strategies; and so much more.

Join your host, Joseph Trozzo, Investment Sales Vice President, MGA, Equitable Life of Canada along with Dynamic Funds.Learn More

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® denote a registered trademark of The Equitable Life Insurance Company of Canada

Posted May 31, 2023 -

Short-term disability coverage for plan members in quarantine or self-isolation*

Please note: This announcement applies only to groups with short-term disability coverage through Equitable Life

With the spread of COVID-19, many people have been instructed to self-isolate or quarantine themselves or are doing so voluntarily. We realize this is a stressful situation for people and they may be wondering if they are eligible for disability benefits. Short-term disability is designed to replace a plan member’s earnings if they are unable to work due to illness and injury. As a result, only plan members who meet the following criteria are eligible for benefits:

- Plan members who have tested positive for COVID-19 and are unable to work from home are eligible for coverage from Day 1 of their self-isolation period.

- Plan members who have not been tested but have symptoms consistent with COVID-19 and are unable to work from home, are eligible for coverage. Claims will be assessed according to the terms of the plan.

Plan members who are in quarantine for any other reason, but do not have symptoms consistent with COVID-19, are not eligible for coverage. These plan members should consider applying for Employment Insurance (EI) benefits, if they do not have an option to work from home.

Submitting COVID-19-related STD claims

To make things easier for plan members who need to submit claims related to COVID-19, we will not require a physician’s statement. Instead plan members should submit our simplified Short Term Disability Plan Member COVID-19 Claim Form.

Plan Administrators need to complete their portion of the regular Short Term Disability Form (Form #421).

This is a temporary process that will remain in effect through the current coronavirus situation. We will update on changes and share them on EquitableHealth.ca.

Applying for the Employment Insurance sickness benefit

Canadians quarantined due to COVID-19, who are not receiving Short Term Disability benefits, can apply for Employment Insurance (EI) sickness benefits. The one-week waiting period for EI sickness benefits has been waived. Service Canada’s dedicated toll-free support number is 1-833-381-2725 or (TTY) 1-800-529-3742.

*Indicates content that will be shared with your clients

- [pdf] B2B Investment Loan Application Process

-

Do you have clients looking for growth but are concerned about taking on too much risk?

Please join us to hear Dina DeGeer, Senior Vice President, Portfolio Manager, Head of the Mackenzie Bluewater Team and David Arpin, Senior Vice President and Portfolio Manager, Mackenzie Investments, discuss how the Mackenzie Bluewater Team is positioning the Mackenzie Canadian Growth Balanced Fund for future success

Learn about the value of investing in high-quality businesses and how taking a broader approach to fixed income investing can deliver the balanced solution your clients are looking for

Equitable Life is pleased to offer the Mackenzie Canadian Growth Balanced fund as one of six different Mackenzie funds in Pivotal Select™ segregated fund lineup.

Learn More

-

Equitable Life presents Dynamic Funds featuring David L. Fingold

With the upcoming U.S. election, and the ongoing coronavirus pandemic, the challenges and uncertainty of today’s global market can create doubt for investors. Please join us to hear guest speaker David L. Fingold from Dynamic Funds discuss a look at global markets; insights on the current positioning of Dynamic American Fund and Dynamic Global Discovery Fund; and review of investment process

Do not miss the opportunity to hear about some of the key holdings of David’s portfolios!

Equitable Life is pleased to offer access to five different Dynamic Funds in the Pivotal Select™ segregated fund line-up, including the Equitable Life Dynamic American Value Select and Equitable Life Dynamic Global Discovery (the underlying funds of which are managed by David).

Learn more

-

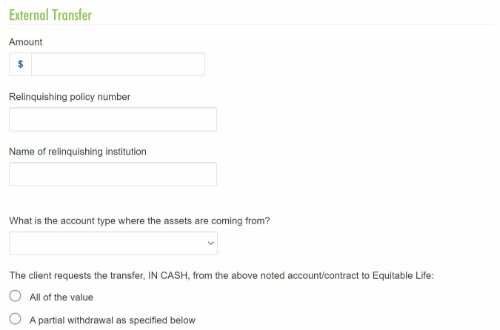

THREE new ways to help make your Savings & Retirement business run smoother

As of August 20, 2022, EZcomplete® will include several new features that allow applications to be completed faster and easier:

1. Prefilled Fund Transfer Form

The transfer form will be generated with the information from EZcomplete and included in the EZcomplete signing package, saving you time.

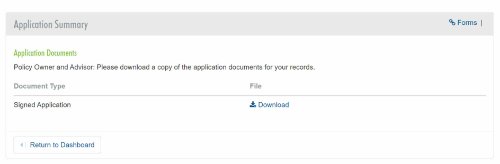

2. Client eSignature Audit History and Document Download

If you choose the e-signature option for the client, you’ll be able to download a copy of the e-signed transfer forms and the signature audit history.

3. Email the Client Contract Info and Fund Facts Before Signing

You'll now be able to email Point of Sale materials (Contract & Info Folder and Fund Facts) to clients before they provide their e-signature.

Log in to EZcomplete today!

Speak to your Regional Investment Sales Manager to learn more!

-

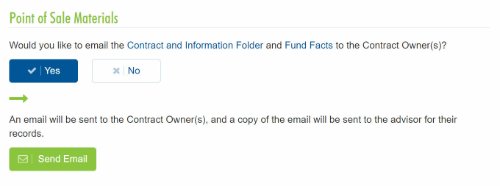

The new segregated fund EZcomplete cloning feature will save time and errors.

The new cloning feature for Savings & Retirement EZcomplete® applications means that advisors don’t need to enter the same client information when completing multiple applications for the same client.

Here's how easy it is to use.

.png)

Best of all, you can clone in progress and submitted applications.

This is just some of the information that will be automatically copied:-

Name

-

Date of birth

-

Gender

-

Occupation

-

Address

-

Phone numbers

-

Email address

-

Social Insurance Number

-

All beneficiary information

The new EZcomplete cloning feature will save advisors time and reduce errors.If you have any questions, contact your Regional Investment Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted April 6, 2023 -

-

Universal Life Savings and Investment Options Updates

The fund pages for our Universal Life products have been updated.

Full details on the Equitable Generations™ funds available, visit Equitable Generations Savings and Investment Options (2055 pdf).

Full details on the Equation Generation® IV funds available, visit Universal Life Savings and Investment Options (1193 pdf).

We launched our Universal Life product update in September 2022, when an exciting new fund lineup became available.

Learn more about the funds:- Details on funds available

- American Equity Index (ESG)

- Canadian Equity Index (ESG)

- Special Situations fund (Fidelity)

- Sustainable Equity, Balanced, and Bond Funds (Fidelity)

- Target Date funds (Fidelity)

- Get all your ESG questions answered with Margaret Dorn, S&P

- Rates and Performance page

® and ™ denote trademarks of The Equitable Life Insurance Company of Canada.

.png?width=500&height=92)

.png?width=500&height=92)

.png?width=300&height=82)

.png?width=300&height=39)