Site Search

348 results for mode change request

-

Policy endorsement: Contracts and group benefits plan booklet updates related to BC PharmaCare Biosi

As we announced in the June 2019 issue of eNews, BC PharmaCare recently introduced a new Biosimilars Initiative that ends coverage of three biologic drugs, including Remicade, Enbrel, and Lantus. These drugs will no longer be eligible in British Columbia for most conditions for which lower-cost biosimilar versions are available. Patients in the province with these conditions will be required to switch to biosimilar versions of these drugs by Nov. 25, 2019 in order to maintain their coverage under BC PharmaCare.

The following table outlines the affected originator drugs and their biosimilars.

Drug Originator Biosimilar etanercept Enbrel® Brenzys®

Erelzi™infliximab Remicade® Inflectra®

Renflexis®insulin glargine Lantus® Basaglar™

Biologics are drugs that are engineered using living organisms, such as yeast and bacteria. Biosimilars are highly similar to the originator drugs they are based on and most have been shown to have no clinically meaningful differences in safety or efficacy.

To ensure this provincial change doesn’t result in your clients' plans paying additional drug costs, we are aligning our drug eligibility for these three biologic drugs with that of BC PharmaCare.

To facilitate this change, we are amending some of the wording in our contracts and booklets, effective Oct. 1, 2019. Below are links to the Endorsement to the Master Policy and the Summary of Master Booklet Wording Changes for those amendments. Please download and save these policy endorsement documents for your files.

In addition, please remind your clients to provide their plan members with a copy of the Summary of Master Booklet Wording Changes. The next time your clients amend their benefits plans, the updated wording will be included in their group benefits plan bookletsDOWNLOAD ENDORSEMENT TO THE MASTER POLICY

DOWNLOAD SUMMARY OF MASTER BOOKLET WORDING CHANGES

As of Nov. 25, 2019, Remicade and Enbrel will no longer be eligible for BC plan members with conditions for which lower-cost biosimilar versions of the drugs are available. These plan members will be required to switch to the biosimilar versions of these drugs in order to maintain eligibility on the Equitable Life drug plan.

We will be communicating with affected claimants in the coming weeks to allow them ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

We intend to take a similar approach to Lantus. However, we are still investigating the options to implement this change. We will be communicating with you in the coming weeks to confirm our approach for this drug.

If you have any questions about this change, please contact your Group Marketing Manager or myFlex Sales Manager.

® and ™ denote trademarks of their respective owners -

Announcing Equitable Life's National Biosimilar Program

Beginning March 1, 2024, we are expanding our biosimilar switch program nationally** to protect all our clients and to make our coverage consistent across Canada.

Our national biosimilar initiative will simplify drug plan coverage, replacing our provincial programs with one program across the country.

Why now?

Over the past few years, most provinces have introduced policies to delist some originator biologic drugs. They require most patients to switch to biosimilar versions of those drugs to be eligible for coverage under their public drug plans. Soon, it is expected that all provincial drug plans will cover only biosimilars.

In response, we have implemented biosimilar switch initiatives in BC, Alberta, Saskatchewan, Ontario, Quebec, New Brunswick and Nova Scotia to align with these provincial changes. Our initiatives are designed to protect our clients from additional drug costs that may result from these government policies while providing access to equally safe and effective lower cost biosimilars.

How will this affect clients’ drug plans?

Because we have already introduced biosimilar switch initiatives in most provinces, the impact of this change will be minimal. It will primarily affect plan members in provinces or territories where we haven’t already required the switch to biosimilars, and plan members who are taking biosimilars that were not originally included in the switch initiative for their province.

Regardless of where they live, plan members across Canada will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower cost biosimilar version of the drug. Plan members already taking the originator biologic will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable plan. We will support their transition with education, personalized communication, and resources.

Will this change affect clients' rates?

Any cost savings associated with the change will be factored in at renewal.

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is known as the “originator” biologic. Biosimilars are highly similar to the drugs they are based on, and Health Canada considers them to be equally safe and effective for approved conditions.

What is the difference between biologics and biosimilars?

Advance notice

We will be communicating with affected claimants in early December to allow them ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Account Executive.

**Excludes plan members in Quebec who participate in a separate provincial program. - [pdf] Pivotal Select Contract and Information Folder

- Online Annuity Quotation

- Online Annuity Quote

-

Update to DSC Reimbursement for WFG advisors

Equitable Life now accepts WFG’s Commission Rebate Disclosure form instead of Equitable’s Deferred Sales Charge Reimbursement (DSC) Request Form (Form #1605). Allowing the use of WFG’s form will help streamline the process for WFG in submitting DSC reimbursements.

Previously, any DSC reimbursement received from Equitable Life required WFG advisors to submit form #1605 and provide proof of the DSC charge from the relinquishing institution, along with a cheque for the reimbursement. The WFG disclosure form and cheque from WFG is now all that is required for the initial submission. Proof of the DSC charge from the relinquishing institution is not required in all instances, but may be requested by Equitable Life and must be available if requested.

If you have any questions, contact your Regional Investment Sales Manager or Equitable Life’s Advisor Services Team Monday to Friday from 8:30 a.m. to 7:30 p.m. ET at 1.866.884.7427 or email savingsretirement@equitable.ca. -

Backdating of insurance applications – New rule now in effect

Great news! We are making it even easier for you to do business with Equitable Life®. We now allow backdating of life insurance applications by up to 364 days. Previously, the maximum backdating period was six (6) months.

Backdating can result in lower total premiums for the client over the life of a policy based on their younger age at time of application. But clients must pay all the premiums due for the backdated period up front. Thus, backdating is only beneficial when the total premium savings over the life of the policy are greater than the premium due for the backdated period.

To request backdating beyond six (6) months (up to 364 days)

No special approval is needed. Simply add a note to the Advisor Sheet requesting backdating or contact us at any time prior to policy issue. This step is only necessary when backdating beyond six (6) months as the application will automatically prompt to save age within the 6-month period.

Note: The maximum backdating period for critical illness (CI) applications remains unchanged at three (3) months.

Questions? Please contact your Equitable Life Regional Sales Manager for more information.

-

FasatWeb Upgrade Implementation

At Equitable, we are making continuous improvements to our advisor services. We are excited to share some upcoming enhancements to FasatWeb—Equitable’s compensation inquiry system.

What’s new?

On January 20, 2024, Equitable is implementing changes to FasatWeb. These changes include:

● Single sign-on has been enabled. Once you log into EquiNet, you won’t have to log in again to access Compensation Inquiry.

● Compensation Inquiry (FasatWeb) can be accessed using MS Edge, Chrome, or Firefox. Compensation Inquiry will no longer run on Internet Explorer.

● Compensation Inquiry screens will now have a new look and feel.

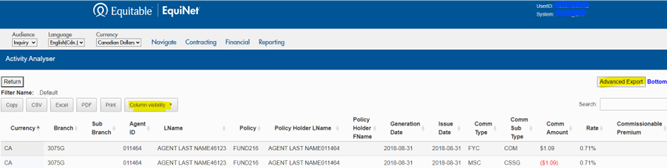

● Two new features have been added to the Activity Analyser, as are highlighted in the image below:

1. Advanced Export—an Advanced Export button has been added to the upper right side of the page, allowing you to export all query results.

2. Column visibility—the new Column visibility tab allows you to choose which columns you’d like to display in your PDF or print request.

- About

- Online Annuity Quotation