Site Search

362 results for where to check completed case

-

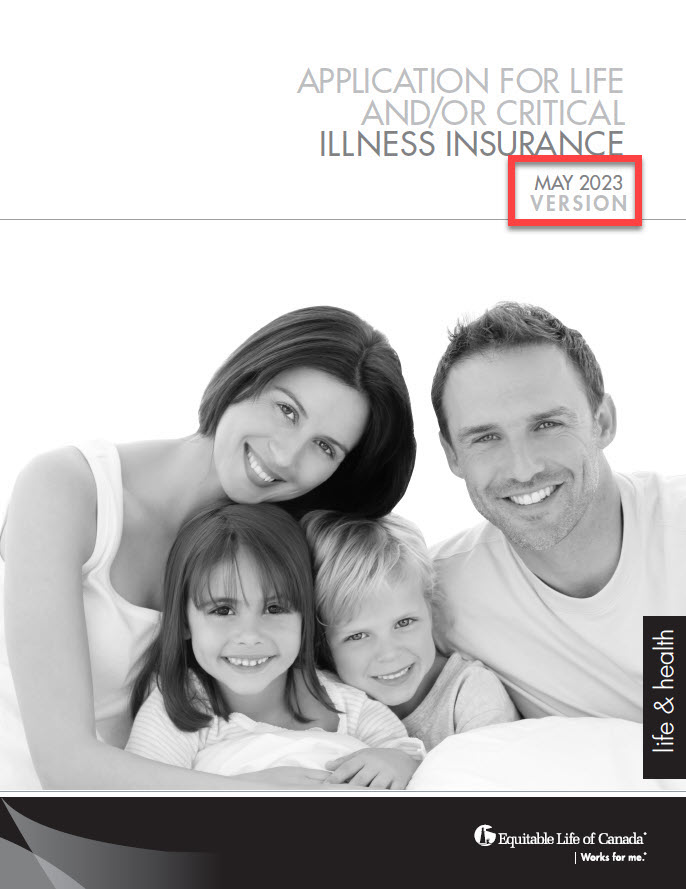

Reminder: New 350 Life and CI Applications

In early August, Equitable® updated the privacy and legal sections on some forms. This included the 350 Paper Application for Life and/or Critical Illness Insurance. This change was also applied on our websites and our online application EZComplete®. These changes are part of Bill 64. The Bill is about the protection of personal and private information in Quebec and took effect on September 1st, 2023.

Due to this change, we ask that all advisors use the latest version, dated May 2023, of the paper application.

For applications in Quebec, the latest version must be used.

For all regions outside Quebec, we are supporting a transition period from ‘old’ to ‘new’ applications until December 31st, 2023. After this date, we will no longer accept older versions of our Life and Critical Illness applications.

To make sure you are using the latest version of the application, check the date on the title page. It should say May 2023. See the image below:

.jpg?width=200&height=259)

To order paper copies, click here.

To learn more about Bill 64, please visit Assemblee nationale du Quebec - Bill 64. You may also contact your wholesaler.

® denote a registered trademark of The Equitable Life Insurance Company of Canada. -

What’s the story behind Equitable’s new brand?

We are excited to share some more insight into the news of Equitable’s new brand.

Our new brand isn’t just a logo change.

Our new brand reflects our deeply rooted dedication to our clients. Over the next year, we will make the transition to our refreshed look. The new brand illustrates our focus on strong partnerships and making it even easier for you to do business with us.

Check out the Beyond the Logo video featuring our executive team sharing how the new brand embodies our commitment to advisors.

We’ll provide more details on the changes we’re making, and we welcome you to join in the journey. Please reach out to your Equitable point of contact or visit equitable.ca to learn more.

Posted December 4, 2023 -

Equitable explains individual life and critical illness insurance with client-focused videos!

In today’s busy world, clients need guidance to help them pick the right solutions for their needs. They need quick, easy-to-understand information. With so many options out there, it can get overwhelming to make the right choice.

The same goes for individual life and critical illness insurance. Which type of insurance is right for the client? Advisors can help provide that support and guidance. But perhaps, to get that conversation started, you just need to give clients a little nudge.

We get it. That’s why Equitable has produced a series of client-focused videos to help advisors start those conversations.

Check out our explainer videos below and share them with clients today!

● Equimax® participating whole life for children

● Dividends

● EquiLiving® critical illness insurance

● Term life insurance

● Equitable Generations™ universal life insurance

Want to learn more?

Contact your Equitable Wholesaler – we’re here to help!

® or ™ denote trademarks of The Equitable Life Insurance Company of Canada.

-

EquiNet email verification starting October 21

Starting October 21, 2023, advisors will be asked to verify or update the email we have on file when logging into EquiNet®. The purpose of verifying your email address is to enable multi-factor authentication in the future and enhance advisor communications based on accurate email addresses.

Instructions:-

Log into EquiNet with your username and password.

-

You will be redirected to the "Verify Email" page. Choose to verify or update your email address.

-

Check your email for the verification link.

-

In the email select "Verify Email" within 24 hours of receiving the email.

-

Once you have verified your email and are logged into EquiNet, you will return to the EquiNet home screen and a success message will display.

-

You will receive a confirmation email that you have verified your email address.

® denote trademarks of The Equitable Life Insurance Company of Canada.

Thank you for your cooperation.

Posted October 4, 2023 -

-

Making it easy to do business with us

Online Term illustration now auto-populates the application

We have added a new online illustration for Equitable® Term life insurance illustrations that automatically populates the fields in your Term application.

We’ve designed the online illustration to be intuitive so you can fill in client details with ease.

● Select term plans and coverages of choice, then get an illustration report in minutes.

● You can save your web illustration progress at any time and view it from the online application dashboard.

● We’ve combined the illustration with our online application to make the process seamless. The illustration details you provide will auto-populate in the fields needed to complete the application.

New: You can create a term illustration without logging in to EquiNet.

We are taking another step in the journey towards enhancing the ways we do business.

Check out this update on the new Illustrations page on EquiNet®!

Learn more

Have further questions? Your Equitable Wholesaler is here to help!

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

-

What’s new in EZtransact

We’re excited to introduce the latest enhancement for EZtransact™, our digital self-serve tool. EZtransact now allows you to help clients:

• Easily make segregated fund withdrawals. This functionality is available for all account types, and for the First Home Savings Account, it also eliminates the need to submit additional CRA paper forms.

• Transfer from one fund to another fund digitally, within the same policy and same sales charge options.

These enhancements make it easier than ever to do business with Equitable®. They will help reduce your time spent on paperwork, allowing to you focus on more value-add time and services for clients.

Check out EZtransact. Stay tuned for more exciting digital enhancements coming soon!

If you have any questions, please contact your Director, Investment Sales.

Date posted: July 11, 2024 -

Elite Advisor Program

At Equitable®, we believe that when we grow together, success is mutual. Our Elite Advisor Program recognizes our top investment advisors and provides unique benefits to support your business.

This year, we have enhanced our Program to offer more valuable resources and opportunities to help you thrive.

• Marketing and event support, and

• invitations to our Business/Advisor Practice Support conferences for Platinum and Diamond production levels.

While maintaining great benefits like:

• Increased bonus rate on our Step Up Your Wealth Sales Program for Elite Advisor re-qualifiers1.

• Enhanced services including access to a priority phone line and a dedicated inside sale representative.

You can check out all the details here.

If you have any questions, you can reach your Director, Investment Sales.1Elite Advisor re-qualifiers are advisors who attained Elite Advisor status in2024 and 2025.

Equitable reserves the right to end or alter the Elite Advisor Program and/or the Step Up Your Wealth sales campaign at any time and without notice.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada -

Fresh new look for Equitable’s Path to Invest

When we grow together, success is mutual. At Equitable, we’re committed to supporting your professional growth. Path to Invest, our self-serve online education and training resource, has been redesigned to deliver a simpler and more streamlined experience for advisors.

You can now register and log in to Path to Invest, complete the modules, download resources, contact us with questions and access your CE certificates all in one place. Plus, our always-on Path to Invest modules offer new engagement tools like Refer a Colleague, Meet the Team and Learn More, an AI feature that allows you to further your content journey using AI suggested content.

Grow your knowledge - and your business - with Equitable. Check out our current selection of investment training modules today and watch for more modules coming later this year.

Date posted: March 12, 2025 -

New Term Rider for Equitable Generations

Affordable, Flexible Protection for Clients

Great news! As of June 7, 2025 you can now offer clients a Term 30/65 Rider on Equitable Generations™ universal life plans. This new rider will help you provide clients more choice in affordable and flexible solutions to align with their financial goals.

What this new rider means for clients:

• Coverage until the later of 30 years or age 65

• Premiums remain level• Coverage convertible to a permanent plan until age 60

The Term 30/65 Rider complements the 10 and 20 Yearly Renewable and Convertible Term Riders already offered on Equitable Generations.

This enhancement reflects Equitable’s commitment to growing and evolving our products, ensuring you have the solutions to meet clients’ changing needs.

Transition Rules

Check out our Transition Rules for new and in-progress life applications, which took effect on June 7, 2025.

Questions? Contact your Equitable® wholesaler. -

Generating client policy information is easy with Equitable

Did you know that Equitable® makes it easy to create a report with client policy information using Policy Inquiry? This tool makes a simple PDF that gives advisors and clients all the policy details they need to talk about investment goals.

Key features of the Policy Inquiry tool:• Exclude “Advisor Only Information” sections: Customize the report by leaving out sections meant only for advisors.Generate the report just before meeting with a client to have the most current information. You can find this tool in the top right corner of the client’s policy page on EquiNet®. It is a great takeaway or follow-up item for client meetings.

• Access active links to fund pages with risk ratings: Quickly go to fund pages and check risk ratings from the report.

• View calendar and compound returns: See a clear picture of a client's investment performance history with detailed return information.

Clients can also access their policy information report anytime through Client Access®. Remind clients that they can view the report online as well.

For more information please contact your Director, Investment Sales.

Date posted: June 17, 2025