Site Search

78 results for beneficiary

- Administration Reference Guide for Savings & Retirement

- About

- Termination

- General Information

- General Information

-

Manage your business virtually with Equitable Life

As an advisor, we know that physical distancing and self-isolation are proving to challenge the business as usual practise. The good news is that Equitable Life® is here to help. Our self-serve and online tools and resources for Savings and Retirement advisors can assist in maintaining a certain degree of daily activity.

Online Banking

Help your clients during this time of isolation and self-distancing by letting them know about banking online. Online banking is an easy and convenient way for your clients to make additional contributions to non-registered savings plans, Tax-Free Savings Accounts or even last-minute contributions to a Retirement Savings Plan.

Deposits will be made according to the instructions on file. Advisors will receive the regular commissions for any deposits made. Please note that all deposits must originate from the policy owner's bank account.

For more information on using online banking including financial institutions currently registered for direct deposit with Equitable Life, click here.

EZcomplete for non face to face

We know that business still needs to happen, even in times of uncertainty. EZcomplete® can help with that. With our non face-to-face functionality, EZcomplete allows you to remotely connect with your clients. Once the online application is complete, EZcomplete sends your client a passcode that gives secure access to review documents and allows your client to provide an electronic signature. You only need to provide your client’s email address.

EZcomplete makes the process of completing non face-to-face applications more convenient and doing business with Equitable Life EZ. For more information on EZcomplete, click here.

Limited Trading Authorization

Need to make some fund adjustments for your client? Limited Trading Authorization (LTA) is built into the Pivotal SelectTM and Guaranteed Interest Account applications to simplify the process of submitting client requests. Alternatively, the Limited Trading Authorization Form # 14 can be completed. Discretionary trading is not permitted. The advisor must have documented the client’s instructions in the client file. To learn more, click here.

Client Access

Does your client need to make changes to a pre-authorized deposit or beneficiary information, address or banking information? Does your client have a Client Access® account? Client Access is Equitable’s secure online client site that connects clients to tools and policy information. To create a new Equitable Client Access account, your client will need to reference the policy number(s). By registering for Equitable Client Access, policyholders and annuitants can make changes and view information such as:

Details of investment holdings including:-

Up-to-date market value of investments;

-

Guaranteed Interest Account (GIA) maturity dates and values;

-

Premium amounts, death and maturity guarantees and beneficiary information; and

-

Recent account activity.

Details of Payout Annuities including:

-

Next payment date;

-

Annual income and payment guarantee details; and

-

Beneficiary and Annuitant information.

There is also a secure inbox where copies of statements and other correspondence are available. To learn more, click here.

Need help with any of these resources? Contact our Advisor Services team Monday to Friday 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or email savingsretirement@equitable.ca, or your local Regional Investment Sales Manager. -

-

Anytime. Anywhere! Equitable Client Access

At Equitable Life®, we know that managing your clients’ requests can keep you busy. We also know providing the opportunity for your clients to self-serve can allow you to focus on their future. That’s why our online client site, Equitable Client Access ensures your clients have all the information about their individual investment and insurance policy information that they need, right at their fingertips.

Our secure client site gives your clients access to:

- Tax Slips *NEW*

- Coverage and guarantees

- Investment allocation, performance, and market values

- Pre-authorized payment information

- Transaction history

- Beneficiary information

- Statements and letters

- Advisor’s contact information

- Banking or payment information

Sign up by December 31, 2021.

Encourage your clients to login or register today!

client.equitable.ca

If you have any questions about Equitable Client Access, we are here to help. Contact us Monday to Friday from 8:30 a.m. to 7:30 p.m. at 1.866.884.7427.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada -

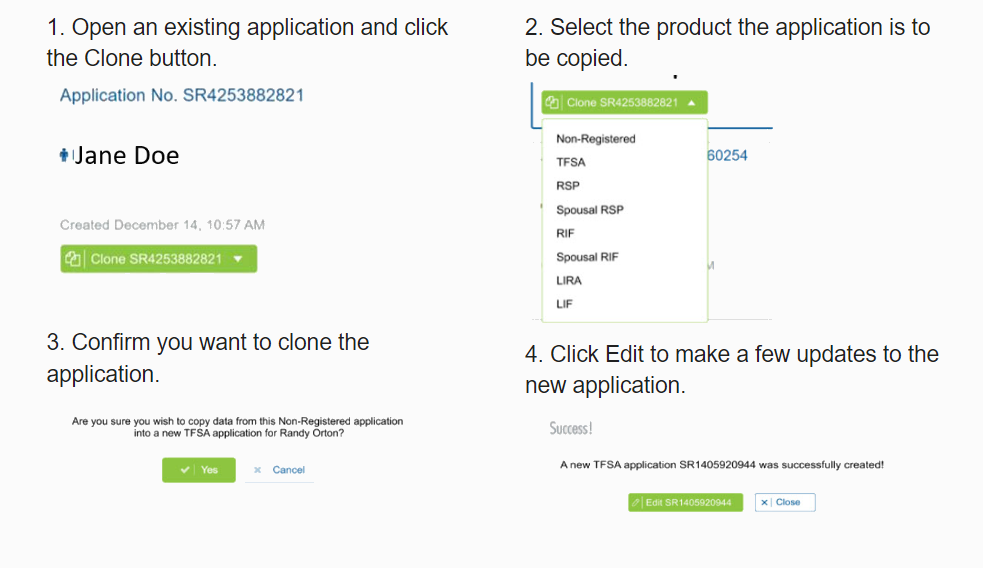

The new segregated fund EZcomplete cloning feature will save time and errors.

The new cloning feature for Savings & Retirement EZcomplete® applications means that advisors don’t need to enter the same client information when completing multiple applications for the same client.

Here's how easy it is to use.

.png)

Best of all, you can clone in progress and submitted applications.

This is just some of the information that will be automatically copied:-

Name

-

Date of birth

-

Gender

-

Occupation

-

Address

-

Phone numbers

-

Email address

-

Social Insurance Number

-

All beneficiary information

The new EZcomplete cloning feature will save advisors time and reduce errors.If you have any questions, contact your Regional Investment Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted April 6, 2023 -

- About

- Dividend Withdrawals and Change and Premium Offset

.png?width=500&height=92)

.png?width=500&height=92)

.png?width=300&height=82)

.png?width=300&height=39)